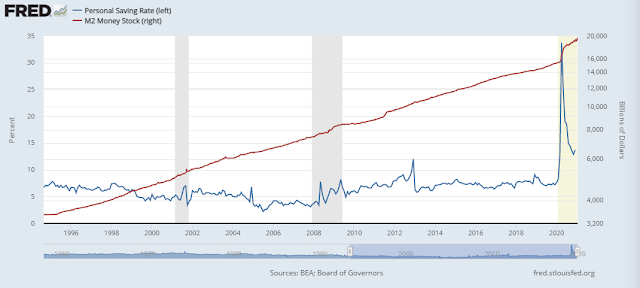

After last week’s wild market swings, it’s time to have a sober discussion about risk control. I know that risk control isn’t a sexy topic, but better portfolio risk control can lead to better overall returns.

The framework of analysis will not be the conventional description of risk as it is stylistically shown above. Instead, I offer some “outside the box” thinking and focus on the following:

- Mis-specifying investment objectives and risk preferences

- How to take advantage of volatility

- Regime change risk in the form of:

- Unexpected tail-risk

- Changes in market environment (conventional regime change);

- Slow changing regimes that investors may be unaware of;

- Changes in modeling assumptions.

The discussion range from practical suggestions for individual investors to big picture issues more relevant to professional portfolio managers.

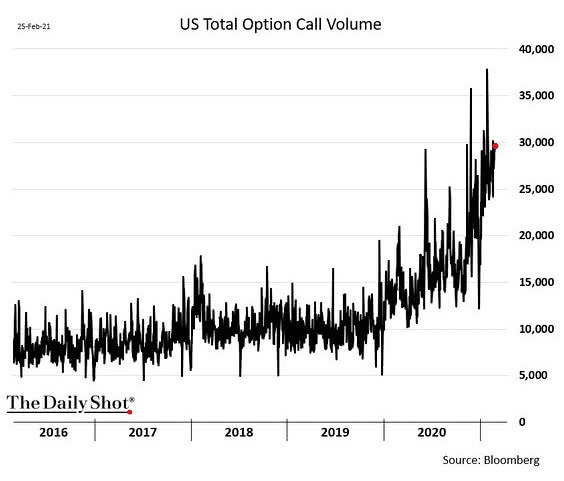

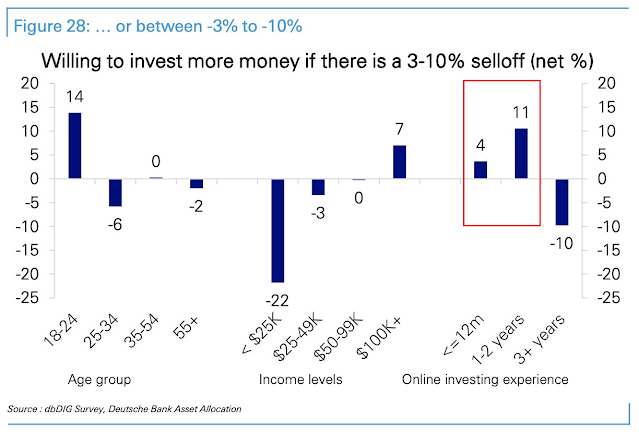

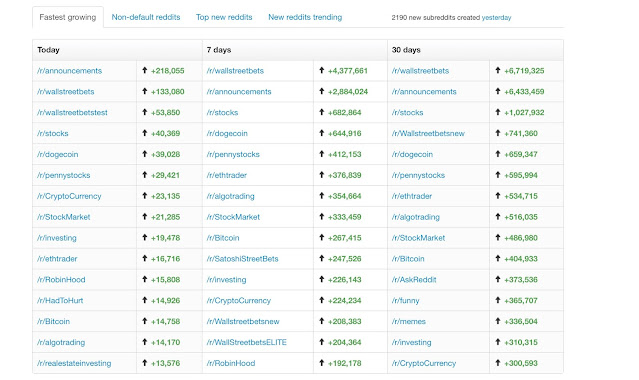

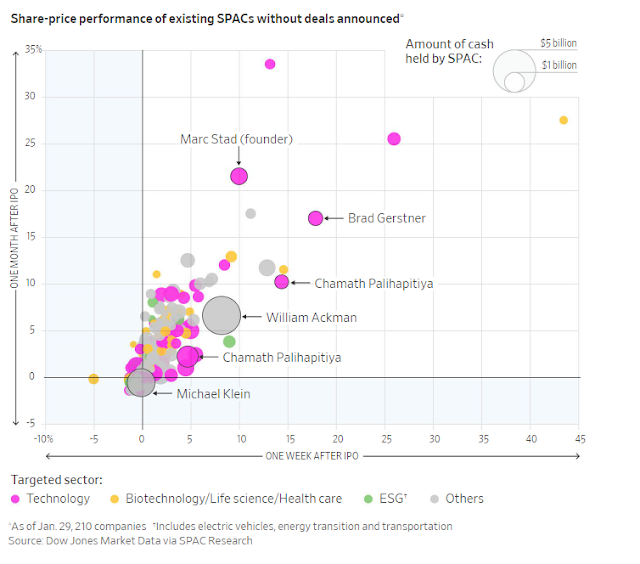

The right and wrongs reasons for trading

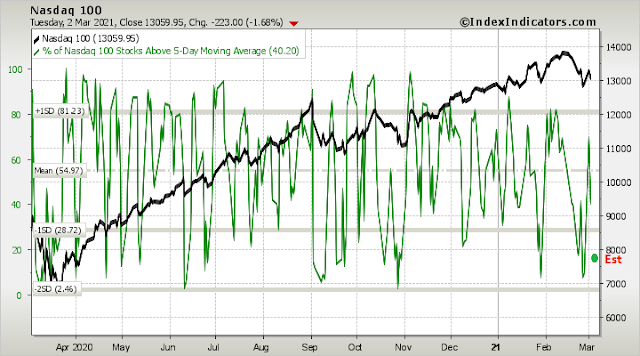

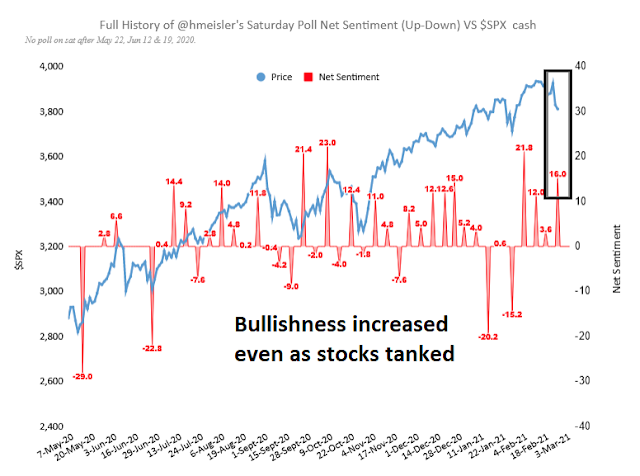

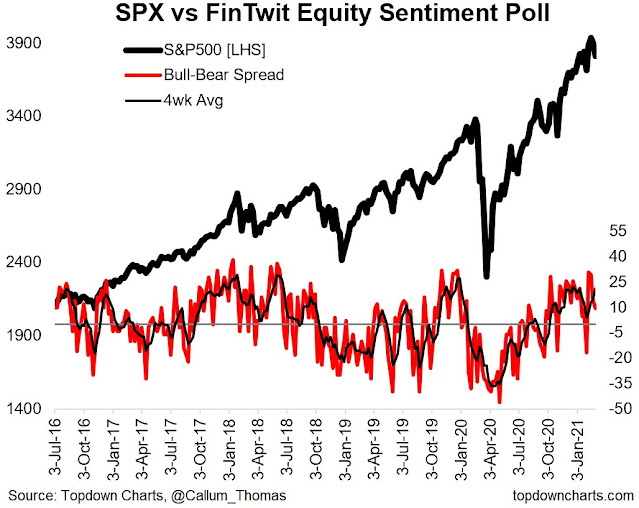

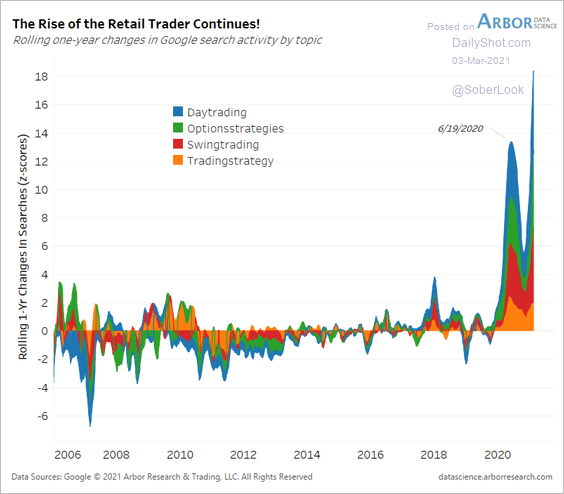

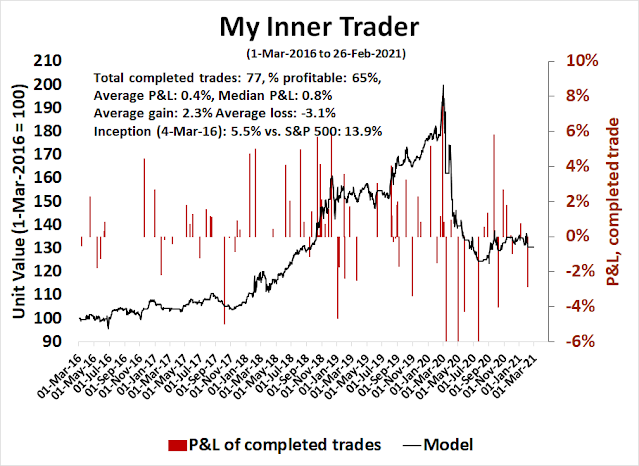

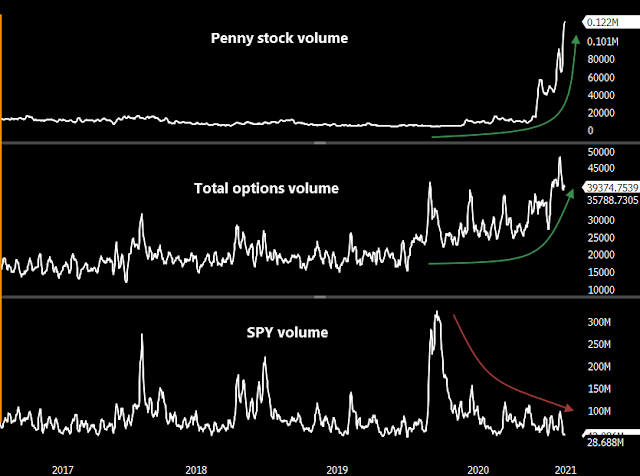

Let’s begin with the individual investor. In light of last week’s r/WSB related volatility, a key question that individual investors should ask themselves is why they are trading. Despite the zero commission rates offered by Robinhood and other online brokers, there are costs to trading. Robinhood sells their order flow as a substitute for commission. Their customers’ trading costs, as measured by the impact cost of crossing the bid-ask spread, acts as an implicit cost that is just as relevant as commission.

Ben Carlson at

A Wealth of Common Sense wrote a timely article, “10 Signs You Are Not a YOLO Trader”. (For the uninitiated, YOLO stands for “You Only Live Once”).

- It’s money you can’t afford to lose.

- You have no idea what you’re investing in or why.

- You’re buying purely based on emotion.

- You have no idea what tendies are.

- You have a family or other financial responsibilities that are more important than putting on a YOLO trade.

- You’re buying a stock because you saw someone talking about it on social media.

- You’re buying a stock because one of your friends owns it.

- You have no idea when you will sell it.

- You’re revenge trading.

- You don’t understand the risk involved in the stock market.

The entire article is well worth reading. Some of the reasons relate to investment knowledge, others relate to a lack of understanding of investment objectives and pain tolerance. All of them relate to the misspecification of investment policy.

In my many years, I have seen far too many people speculate in the financial markets without regard to their risk tolerance and return objectives. These people are gambling, not investing. Almost without exception, gamblers get hurt. YOLO traders should keep that in mind. In Vegas, gamblers get comp’ed free drinks and other goodies.

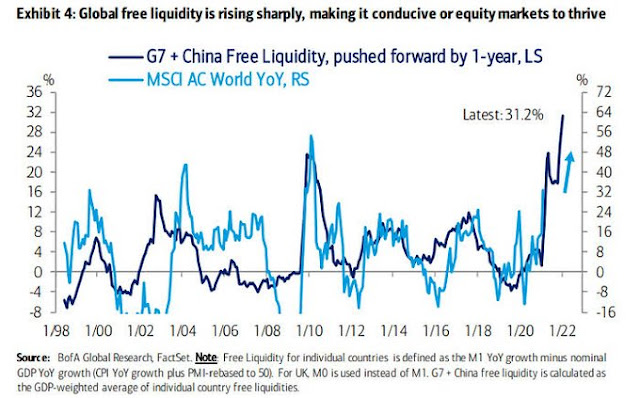

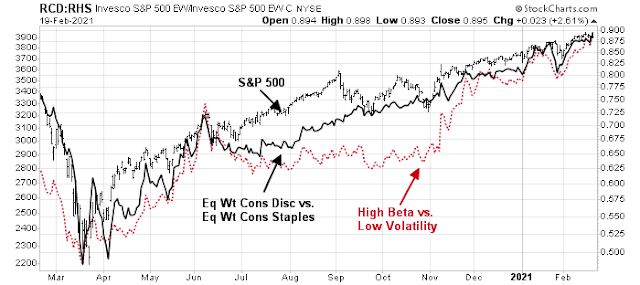

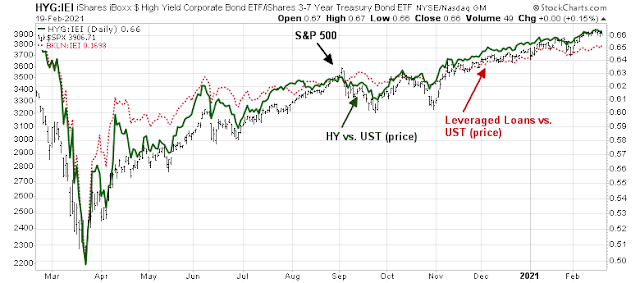

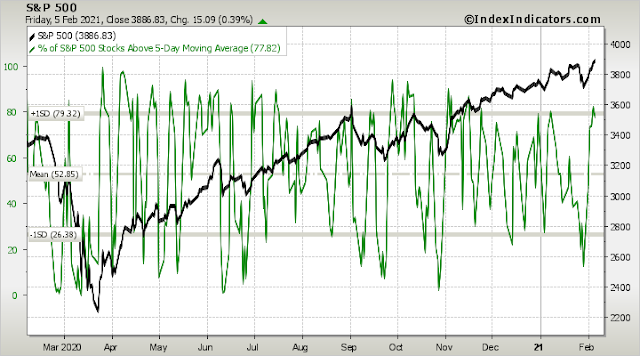

Take advantage of volatility

For a more thoughtful and nuanced look at portfolio management, the

Financial Analysts Journal offered an article “Should Mutual Fund Investors Time Volatility?”. Here is the abstract.

Increasing (decreasing) investment in an actively managed mutual fund when fund volatility has recently been low (high) leads to a significant improvement in investment performance. Specifically, volatility-scaled fund returns exhibit significantly higher alphas and Sharpe ratios than the original (unscaled) fund returns. Scaling by past downside volatility leads to even greater performance improvement than scaling by total volatility. The superior performance of volatility-managed mutual fund trading strategies is attributable to both volatility timing and return timing. Fund flows are negatively related to past fund volatility, suggesting that fund investors are aware of the benefit of volatility management.

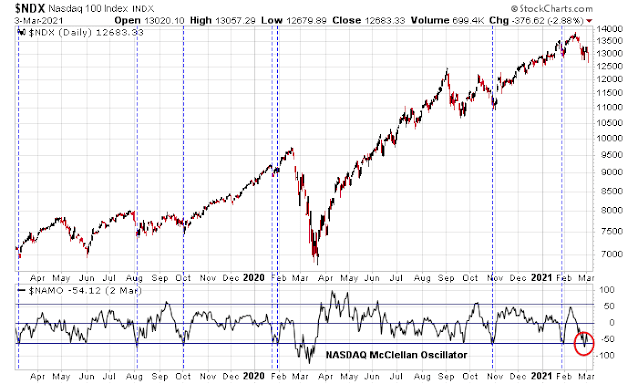

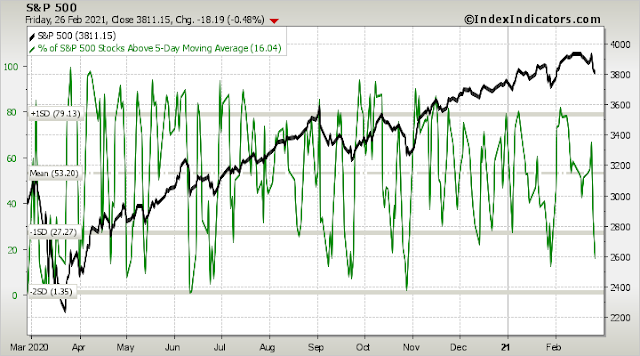

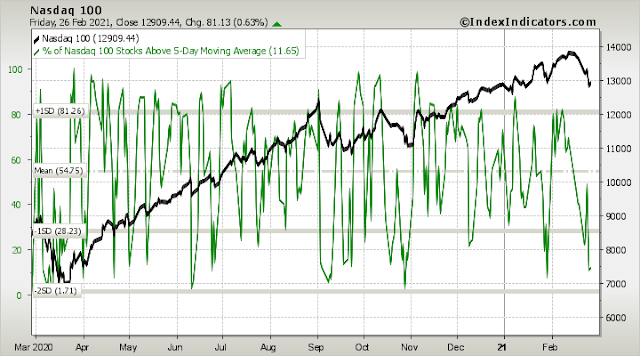

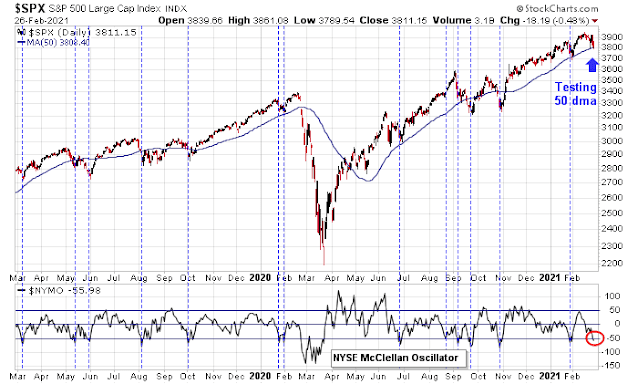

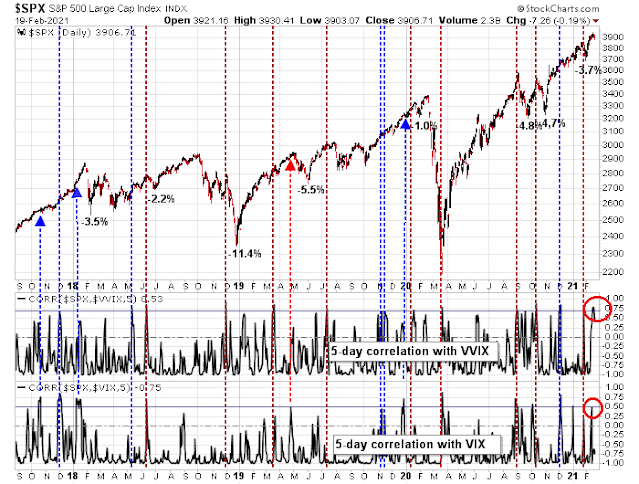

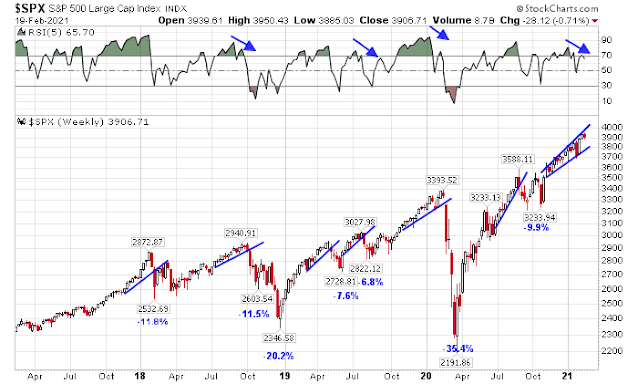

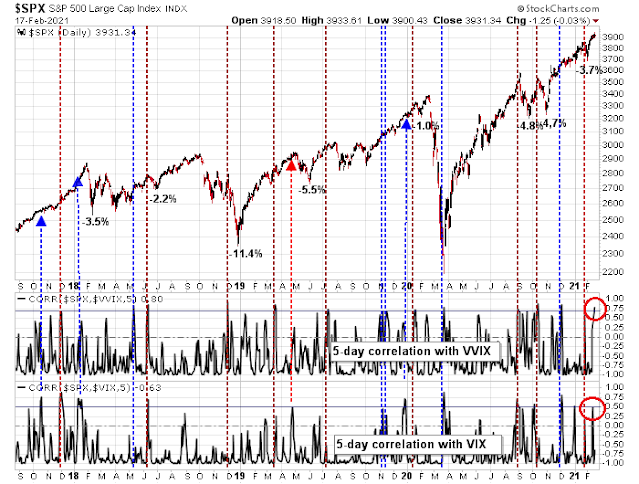

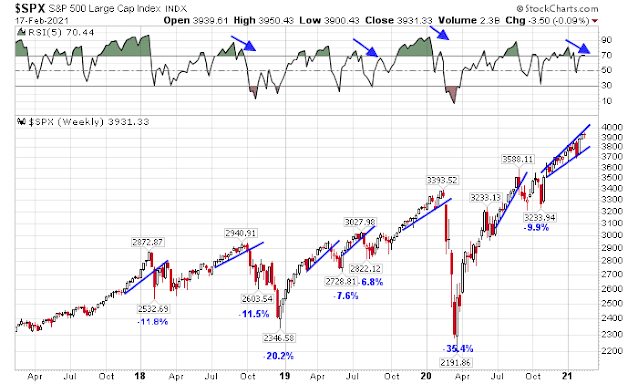

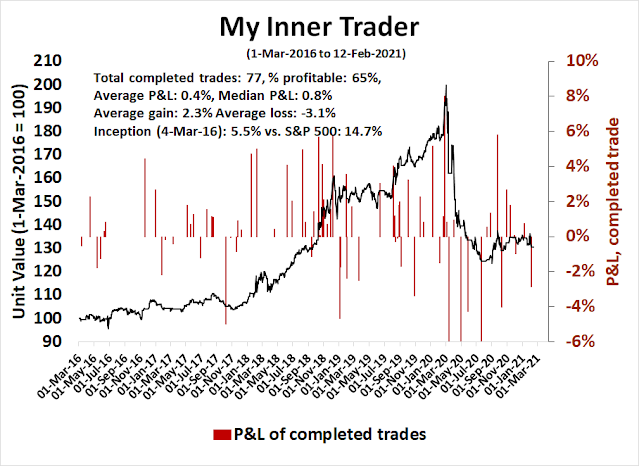

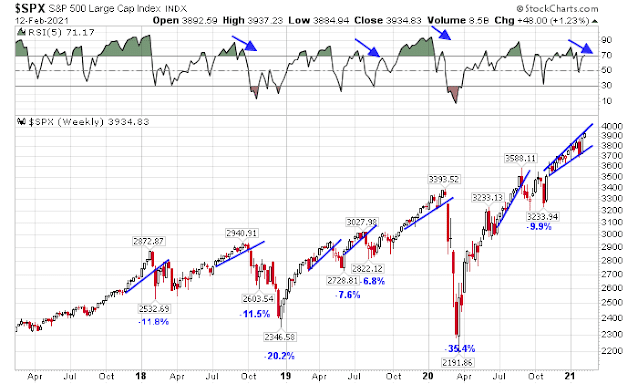

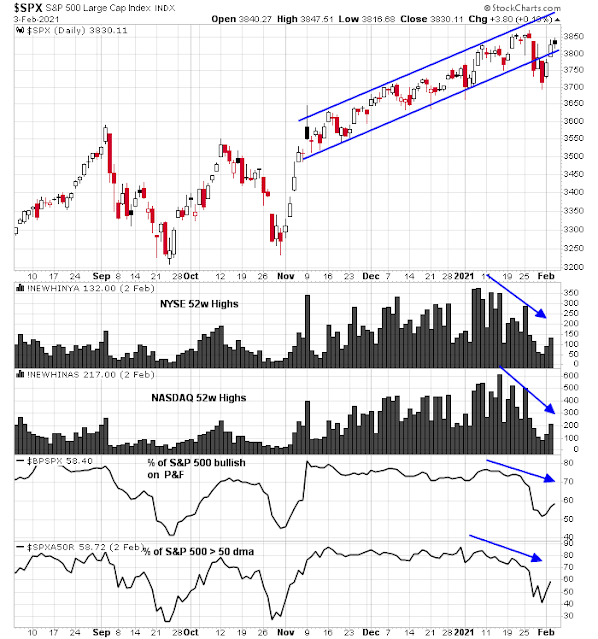

Specifically, the authors found that raising cash when volatility is high and buying when volatility is low leads to better risk-adjusted returns.

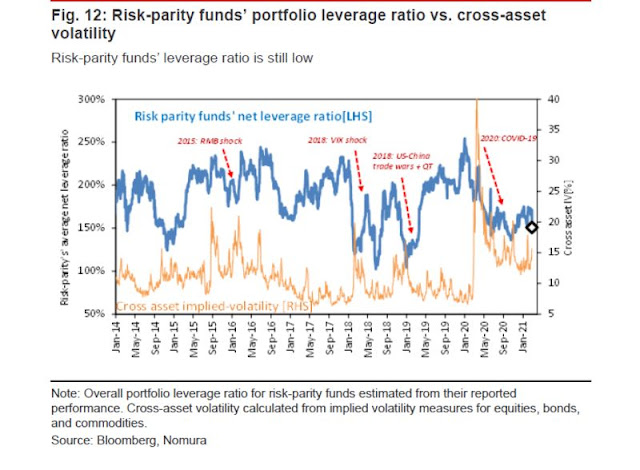

Conceptually, this is a variation of the VaR (Value At Risk) school of risk control. Traders adjust the size of their books based on forecasted volatility. Much depends on the estimation of VaR. Too often, this approach can lead to a pro-cyclical effect of taking on too much risk when the markets are calm and forcing traders to liquidate when markets are volatile.

The authors of the study used longer-term horizons to estimate volatility and found useful results.

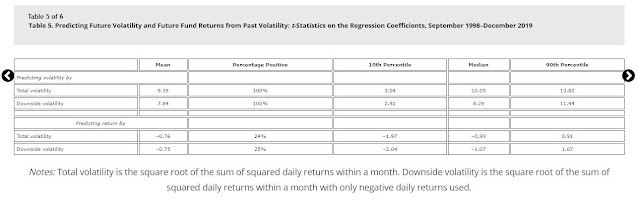

We estimated a similar regression of one-month-ahead fund returns on past fund volatility. For the predictor variable, we used both past total volatility and past downside volatility. We estimated the regressions fund by fund and report in Table 5 the distribution of Newey–West t-statistics of the regression coefficients.

When predicting future volatility with past total volatility, we found that the regression coefficient is positive and statistically significant for all sample funds. The results for downside volatility are similar, with all regression coefficients being positive and statistically significant. The above results are not surprising because volatility persistence is one of the most important stylized facts in the volatility literature. What may be a little surprising is that the relationship is statistically significant for each of the 1,817 sample funds.

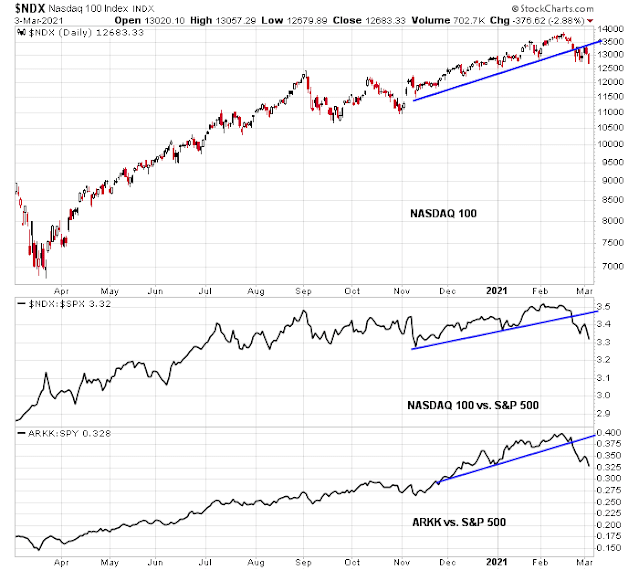

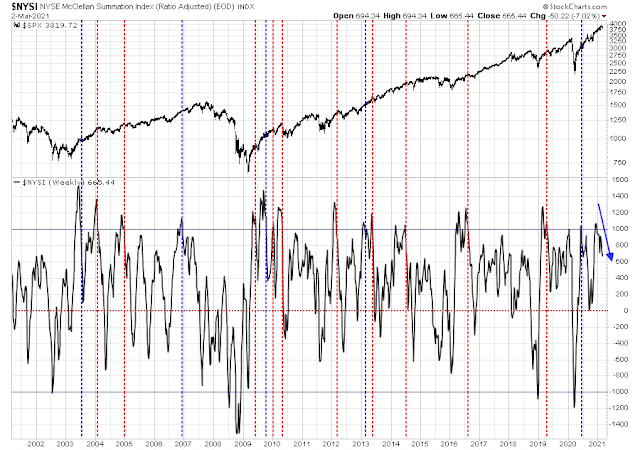

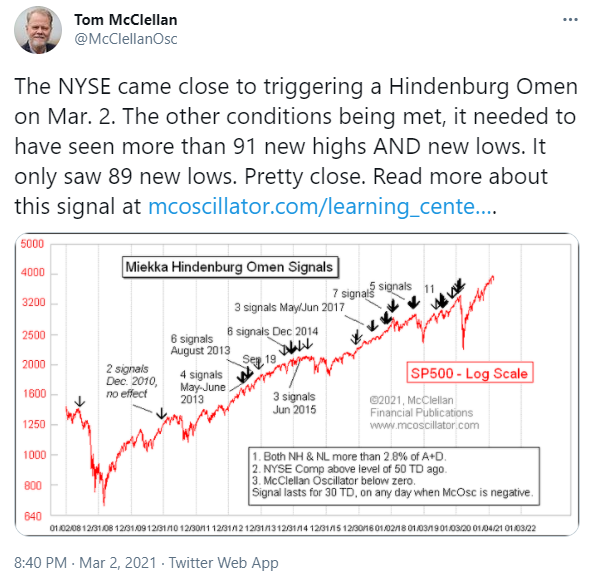

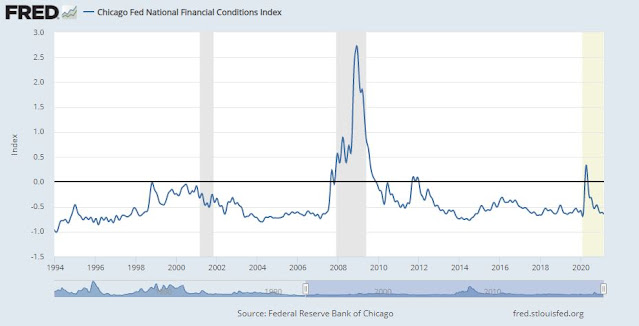

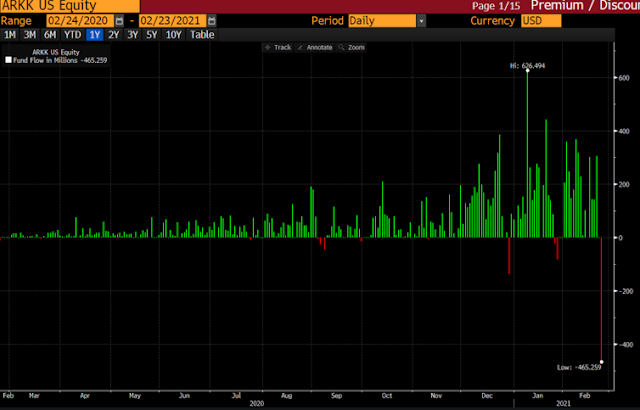

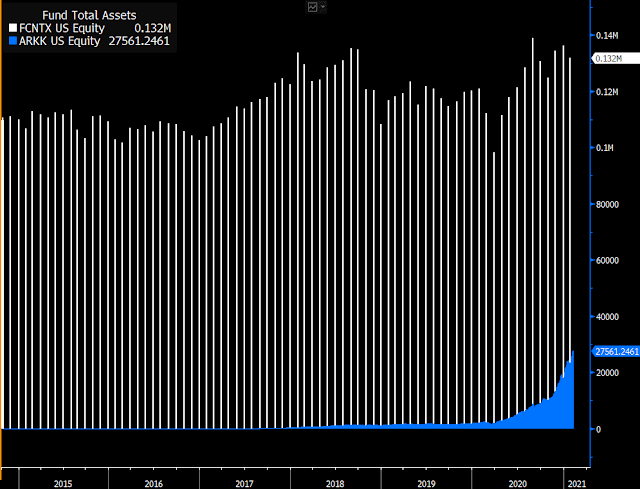

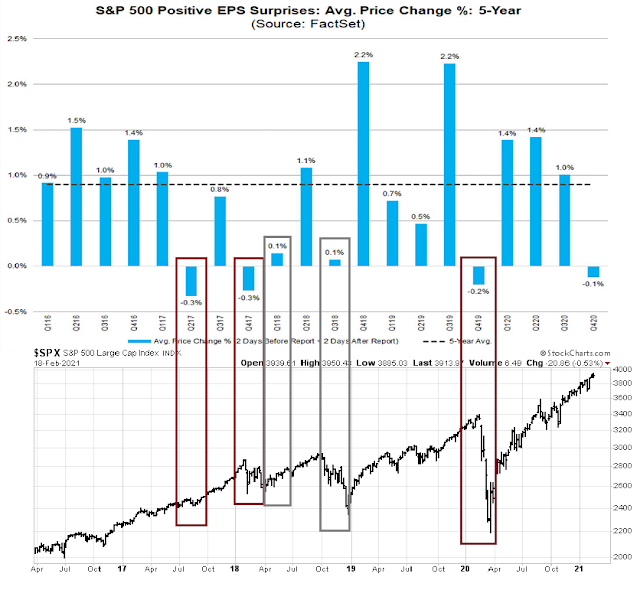

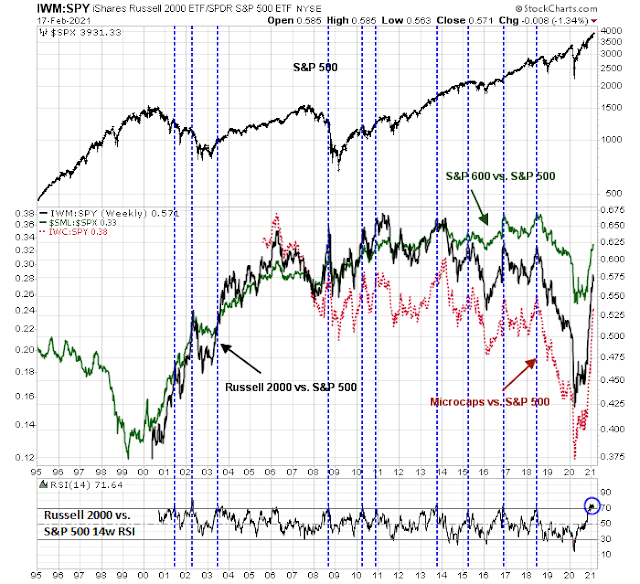

Beware of regime changes

One of risk that investors face is a change in the investment environment. In particular, quantitative modelers are especially vulnerable to being blindsided by market regime changes largely because they are trained to think in a linear and technical fashion. Quantitative modeler Dan diBartolomeo of Northfield Information Systems wrote an important

paper addressing this topic, “The Four Horsemen of the Investment Apocalypse: Pandemic, War, Corruption, and Climate Change”.

In the paper, diBartolomeo addresses two kinds of regime change. The quick ones, war and pandemic, can be thought of as tail-risks, and the slow ones, corruption and climate change, are equally insidious but affect the market environment and returns in a slower fashion.

Tail-risk of widespread deaths

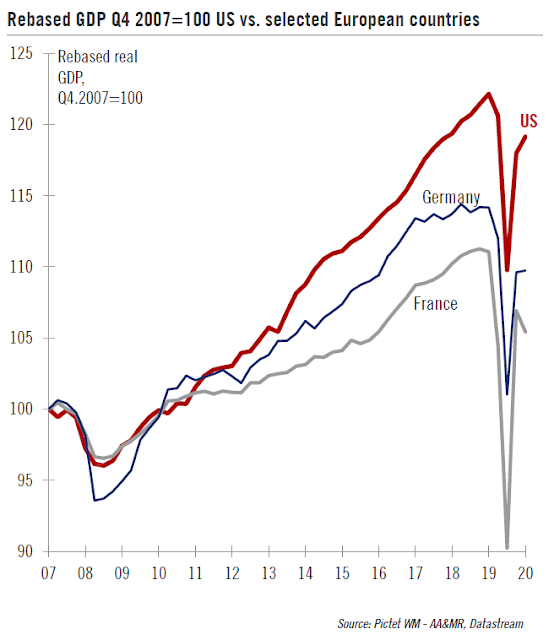

The paper pointed out that “pandemics and wars share the common theme of widespread death”. The study went on to run an ordinary least squares regression on market returns to mortality for the period starting from 1900, the relationship was negative (wars and conflicts mean lower returns).

We start the analysis with a simple Ordinary Least Squares regression model where market returns are the dependent variable and our mortality metric is the independent variable. Depending on whether you use the “high,” “median” or “low” estimate for conflict, the correlation to the global equity market is between negative 30% and negative 38%, but not statistically significant with only 11 data points. For global bond markets the simple correlation ranges from negative 63 to 71%, which is statistically significant despite the small sample of eleven data points. For a typical 60% equity /40% fixed income institutional portfolio, the correlation averaged around negative 45% which is significant at the 95% confidence interval.

Changing the dependent variable in the regression to the log of mortality produced a much higher fit.

The “best fit” is between bond market returns and the “maximum” conflict time series with a correlation of negative 86% (r-squared = .74). This is statistically significant at a greater than 99.9% level. We chose not to control for other effects (inflation, changes in rate of GDP growth) as they may also be outcomes of the real world events, not independent effects. A second benefit of considering the log relationship is to shed light on the possibility that the OLS results are being driven by two large events where casualty rates spiked, World War I and World War II. The small differences in the regression coefficients suggest that the World War decades are not dominant.

The tail-risk with wars and rebellions is the permanent loss of capital. The diBartolomeo study was made on a data set of global market returns without survivorship bias inasmuch as the markets that went to zero were taken out, the following examples of country returns underline the need for global diversification and the risks of permanent loss of capital. Here is the German stock market starting in 1930 and ending just after World War II. Risk happens fast and in a discontinuous manner.

Here is a comparison of the US and Russian markets leading up to the 1917 Revolution when everything went to zero. Markets are forward-looking, but up to a point.

Despite these tail-risks, the study concluded that bond market returns are far more impacted by widespread deaths than equity returns.

Given these empirical results, we can reject the null of our hypothesis that financial market returns will be negatively correlated to conflict mortality for both fixed income markets and the blended 60/40 portfolio. For equities alone, the result has the correct sign but is not significant on eleven observations. We can also confirm that fixed income markets are more acutely impacted.

Turning to the present day, there are two risks that I don’t believe that market is paying attention to. The first is the risk of growing tension in the South China Sea. I outlined the possibility of a Chinese invasion of Taiwan (see

Emerging tail-risk: An invasion of Taiwan). While that remains just a tail-risk and not my base case scenario, there have been reports of large Chinese warplane incursions that the Taiwanese have to scramble fighters to intercept. This may be in response to growing American assertiveness in the region in the form of a Freedom of Navigation passage of a carrier task force, and a growing anti-China alliance in Asia.

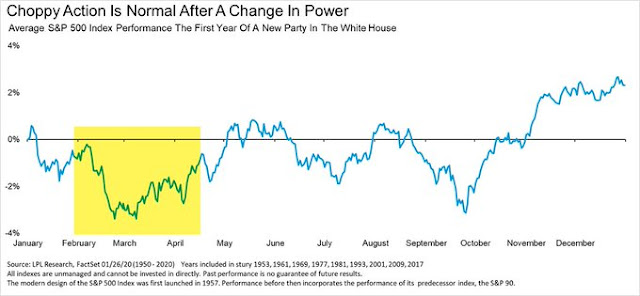

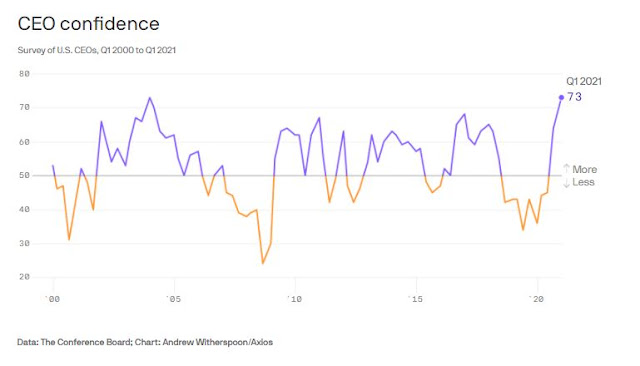

The second unknown is the future path of the Republican Party. My base case scenario had been a Red Wave in 2022 leading to a Republican takeover of the Senate and probably the House. We have experienced these negative partisanship cycles in the past. In 2020, disaffected Democrats turned out in numbers to defeat Trump. In 2016, disaffected Republicans turned out to eject the Democrats from the White House, and Obama had lost his control of the House and Senate well before that. Even going back to 1994, Gingrich engineered a takeover of the House under his “Contract with America” banner. Under normal circumstances, 2022 should be the same.

However, the latest schism between the Establishment wing and the Trump wing of the party as exemplified by the division over Marjorie Taylor Greene and Liz Cheney threatens that narrative. A recent poll shows that Trump Republicans are far less likely to favor a compromise with Biden over legislation than Party Republicans, or those who consider themselves more supporters of the Party.

Should the disagreements within GOP become a widening schism in the weeks and months ahead, retaking control of the Senate and House will more of an uphill battle. Moreover, the Republican Party could bifurcate into an Establishment wing focused on tax cuts and deregulation and a populist MAGA wing that causes disruptions to the body politic. At a minimum, this will change the path for fiscal policy in the third and fourth years of Biden’s term. At worse, it could throw the country into chaos and raise the risk premium of owning USD assets.

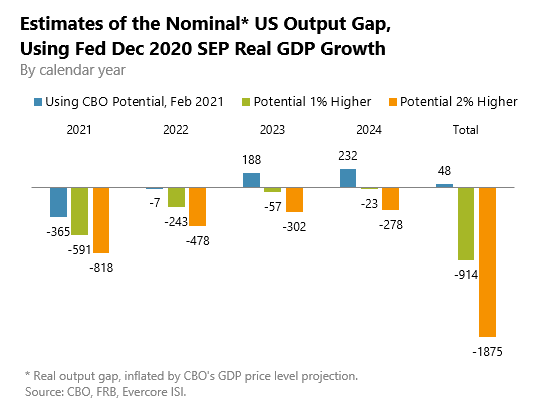

A pandemic under and over-reaction

Turning to pandemics, diBartolomeo assumed the worst case of 60 million worldwide deaths. Assuming that investors have a 10 year time horizon and the death rate effects are similar to war “the expectation of the cumulative return of their [60/40] portfolio would decline by -1.85%”. In other words, the effects are negative but not catastrophic.

A recent

Ezra Klein podcast with sociologist and social media researcher Zeynep Tufekci yielded a good news and bad news story about the consensus reaction to the COVID-19 pandemic. Tufekci, who describes herself as a “systems thinker”, suggested the following frameworks that she found helpful.

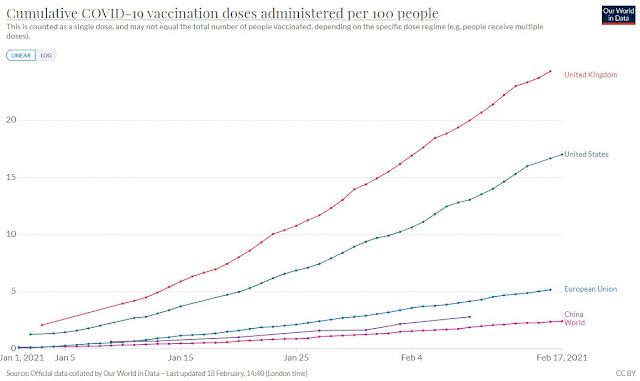

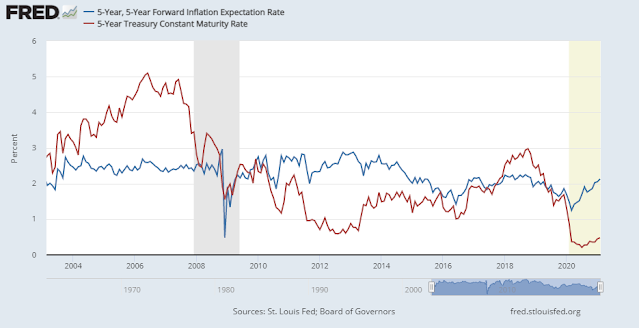

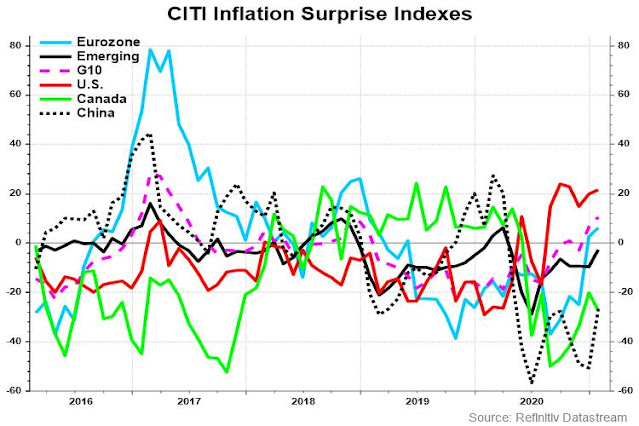

- Herding effects. The West first under-reacted to the bad news about the virus and it is now over-reacting. When China first downplayed the effects of the pandemic but shut down a city of 11 million, Tufekci realized that the problem is serious. Today, the press is full of stories about the shortcomings of different vaccines, but the fact is Operation Warp Speed was a resounding success. Even the “failures” of the vaccines as specified in research papers meant that patients usually didn’t die and only experienced very mild COVID-19 symptoms. Moreover, the world has reached a milestone of more vaccinations than reported cases despite the uneven manner of vaccination programs around the world. That’s good news that the market consensus is ignoring.

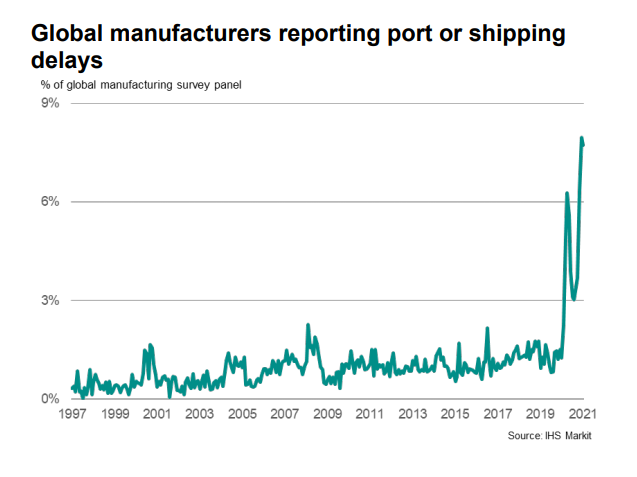

- Thinking in exponents. The above chart shows a shortcoming of the human brain. We are simply not hardwired to think in terms of exponential growth outside of a few venture capitalists who are trained to think in that framework when funding startups. Case growth has been growing exponentially. Hence the initial under-reaction to the virus. Vaccinations are now catching up, but the consensus is not thinking in those terms. On the other hand, the growing dominance of the UK strain, which has a higher transmission rate, poses a threat to the global pandemic fight (think in growth rate exponents).

Corrosive corruption

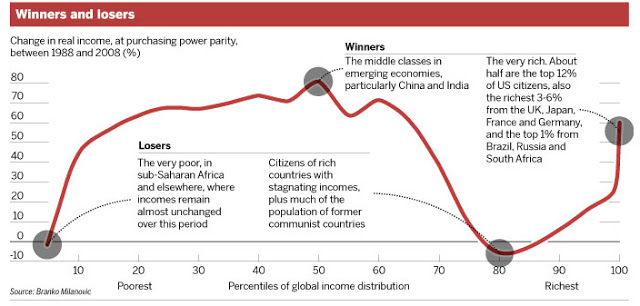

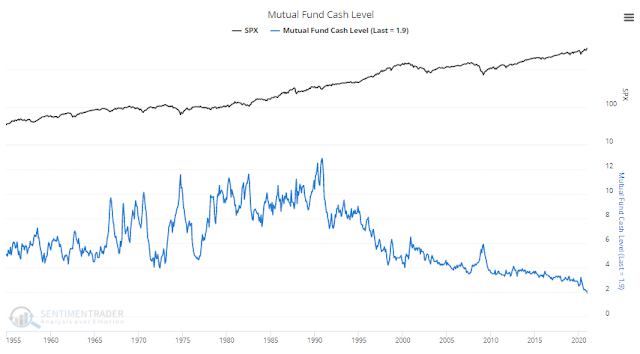

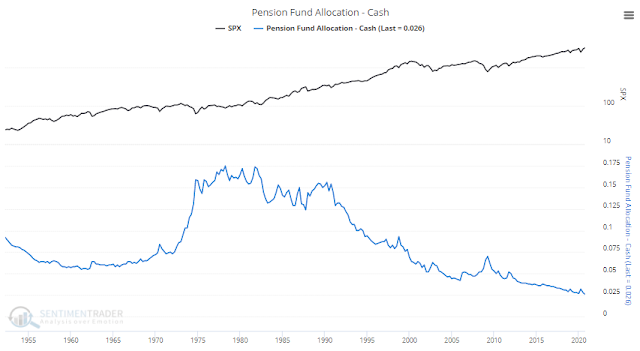

The diBartolomeo paper went on to explore the corrosive effects of corruption on market returns which “may be imperceptible on a short term basis”.

Our empirical investigation began by calculating the ratio of equity market cap to GDP for a sample of about 100 countries for 2012. The correlation of market cap/GDP to the corruption index was negative 45% (r-squared = .21) which is highly statistically significant (T > 5). We repeated the analysis annually starting with 2002. In this case, the number of countries with functional equity markets was only 82, but the correlation of the market cap/GDP ratio was even higher at [negative] 48% (r-squared = .23) which is also highly significant (T > 5).

Keep that in mind when the

Corruption Perceptions Index rating of the US fell to 67 in 2020 (rank 25) from 69 in 2019 (rank 23) and 81 (rank 10) in 2016. The top six countries in the index were New Zealand, Denmark, Finland, Switzerland, Singapore, and Sweden.

Climate change risk

The last topic of the diBartolomeo paper addresses climate change. Unlike other kinds of risks, climate change risk is asymmetric to the downside.

In some ways, the phrasing of “climate change risk” is a misnomer. In financial markets, the word risk is often used as a proxy for uncertainty. There is little uncertainty about the direction of what is happening in climate. The “risk” is in what the economic effects will be. Against a background of natural variation in temperatures over centuries, the increasing existence of greenhouse gases in the atmosphere has biased the process of global temperature variation toward increases rather than decreases. The world is being made hotter by some amount, and the increased energy levels associated with this greater heat is manifesting in various ways including higher intensity and frequency of extreme weather events. While it will take hundreds or thousands of years to prove to a statistical certainty that the recent changes in average temperatures are the result of human activity, the increasing concern of investors with respect to the environment is clear.

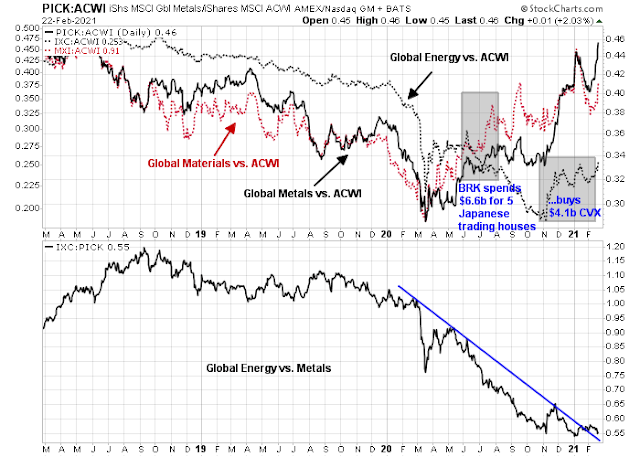

The initial reaction is ESG investing at a company level, with a particular focus on the E (environmental) part of ESG.

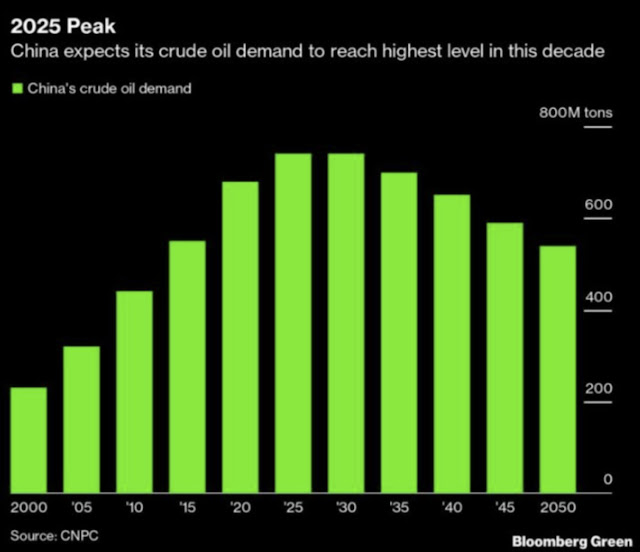

The most obvious question facing investors is the future of fossil fuel production and consumption which is widely accepted as the single largest cause of global warming. The most basic question is whether to reduce or eliminate investment in oil, coal, natural gas, and other fossil fuel related enterprises. The first research on this point was published nearly a quarter-century ago. In diBartolomeo and Kurtz (1996) a detailed analysis is done to attribute performance differences in an equity index which had been “screened” for environmental effects against a similar but unscreened equity index (the S&P 500). At the time, approximately 80% the variation in relative performance could be attributed to the inclusion or exclusion of fossil fuel related firms. This study was subsequently updated in diBartolomeo and Kurtz (2011) with similar conclusions. Both papers also illustrate how investors could change company level weights in their portfolios so as to minimize the variations in relative performance over time.

However, investors need to focus on geography too.

Many asset owners are large investors in geographically bound assets such as real estate and the financing of public infrastructure. Baldwin, Belev, diBartolomeo and Gold (2005) provides a detailed approach to evaluating the risk of real estate and similar assets. A key fact is knowing exactly where that asset is located, down to a specific neighborhood or even street address. A major part of climate change risk is the expectation that sea levels and weather patterns will be changing and these changes will naturally impact some locations more than others (e.g. waterfront cities).

In addition, ESG risks can be aggregated up to the country or local regional level. Investors should also focus on the credit-worthiness of countries and regions with high levels of climate change exposure, whether because of fossil fuel production, changes in agricultural production from warming temperatures, or cities at risk of flooding from rising sea levels. While the first iteration of ESG investing has been at the company level, expect the next one to focus on ESG sovereign risk.

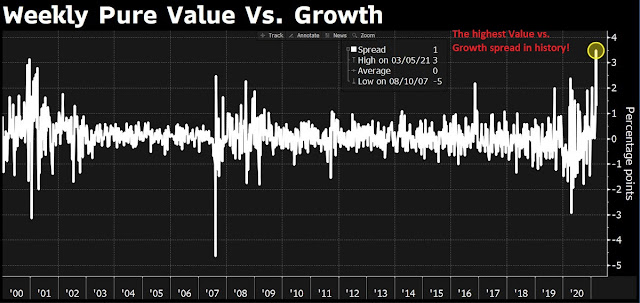

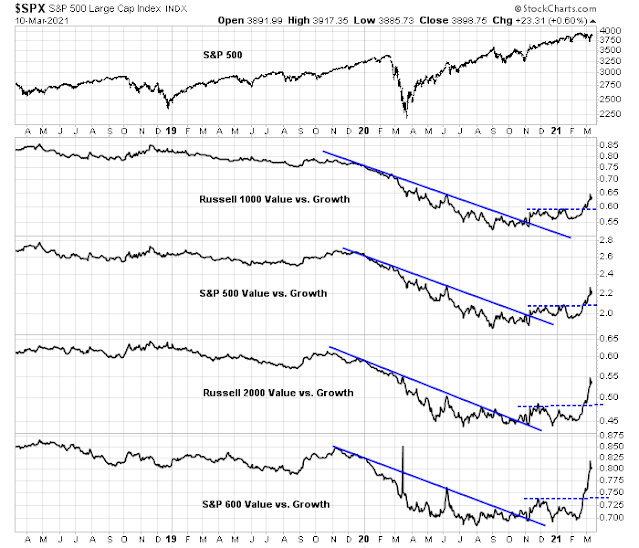

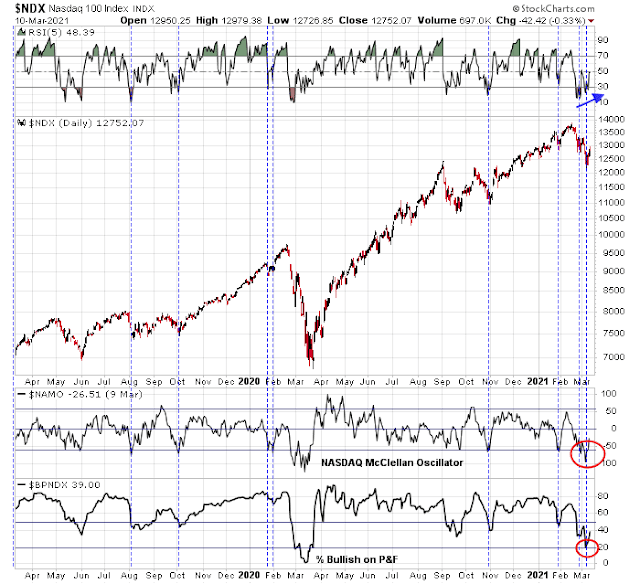

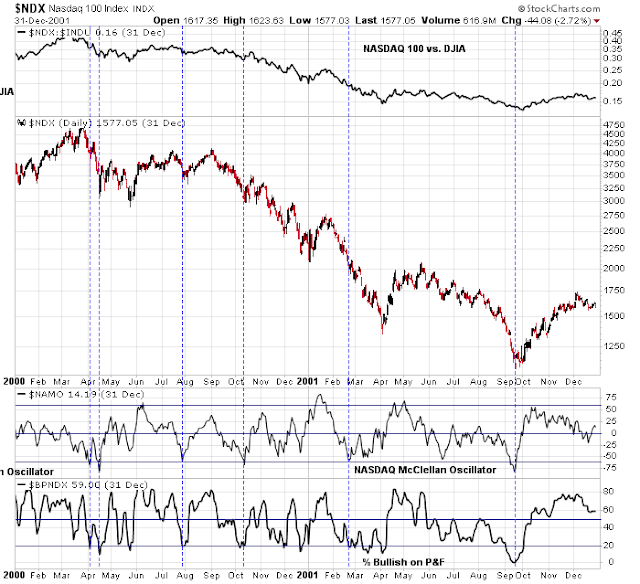

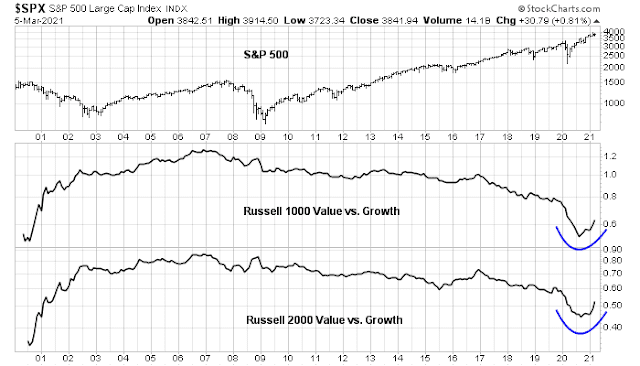

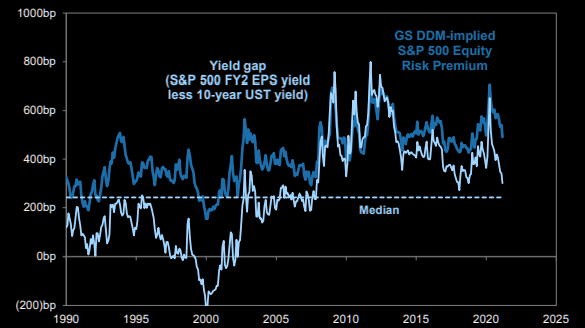

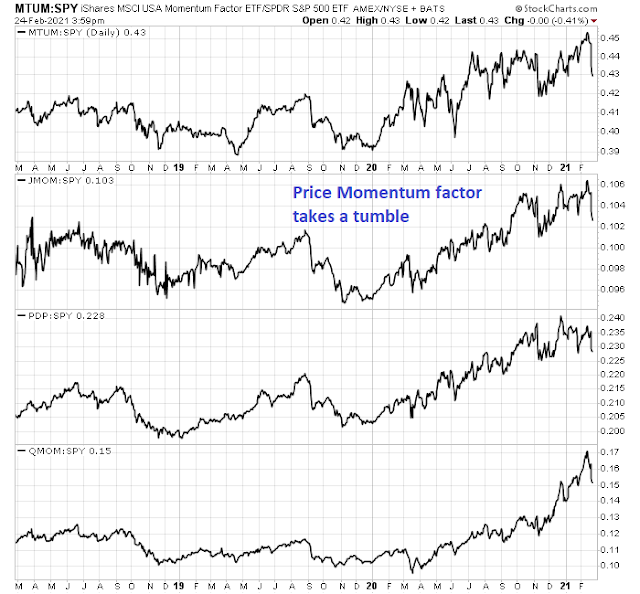

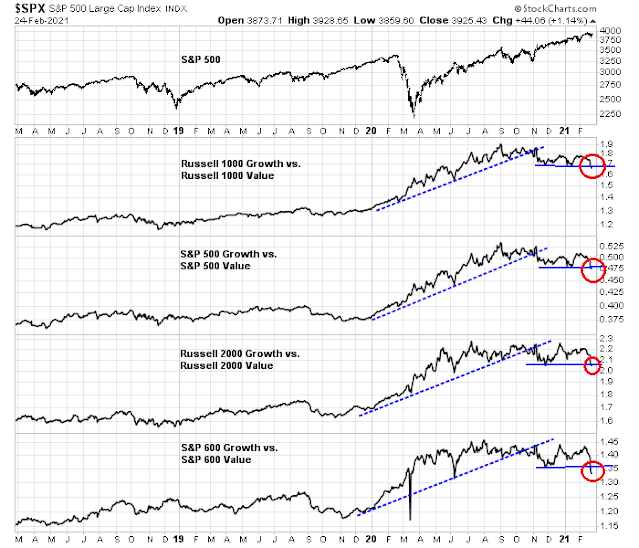

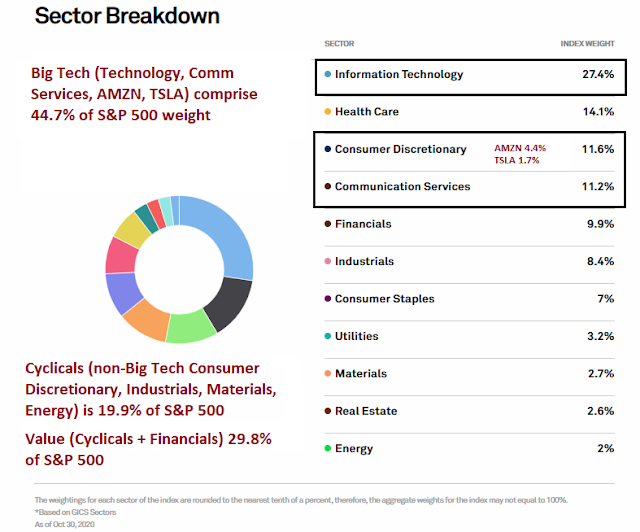

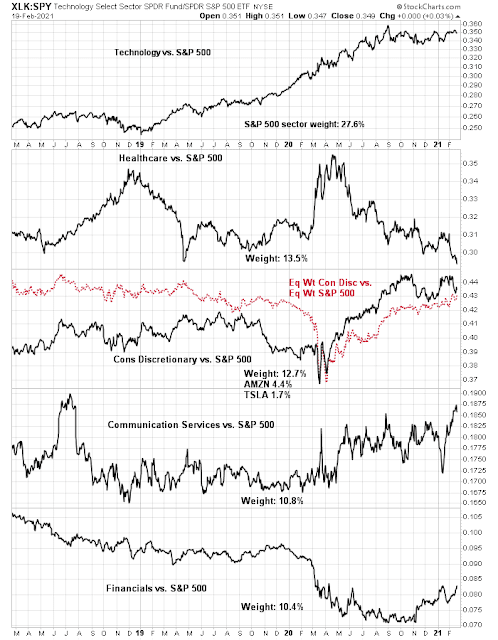

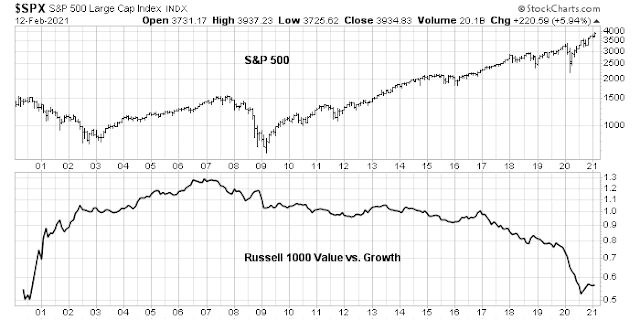

Modeling regime change

The last big picture risk that investors should bear in mind is a shift in modeling regime. A

paper by Rob Arnott et al, “Reports of Value’s Death May Be Greatly Exaggerated”, is an example of how modeling perspectives can change.

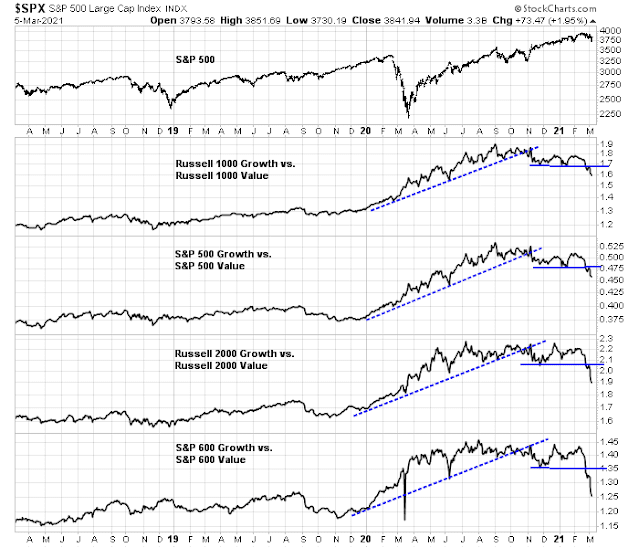

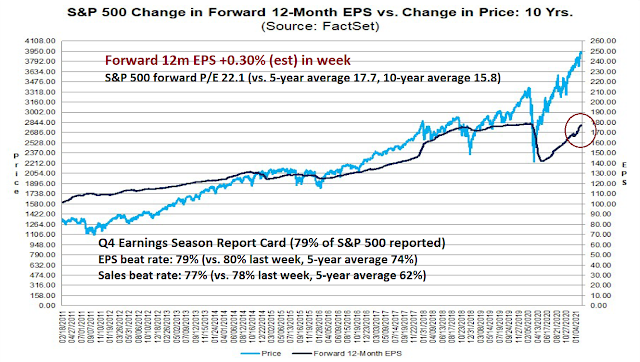

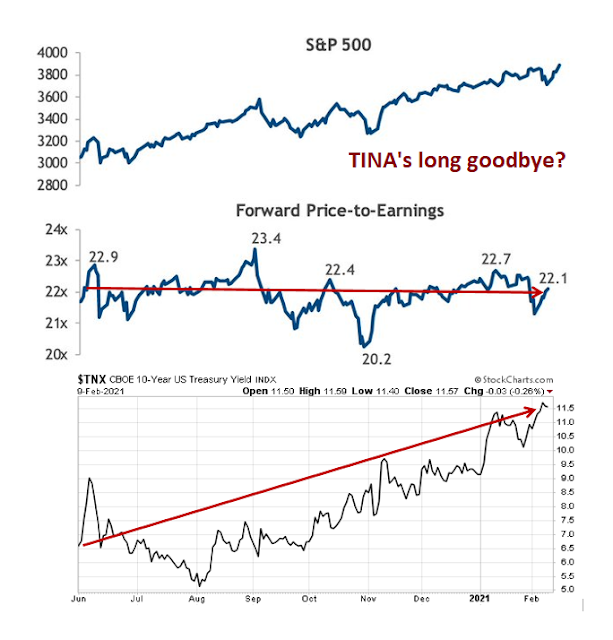

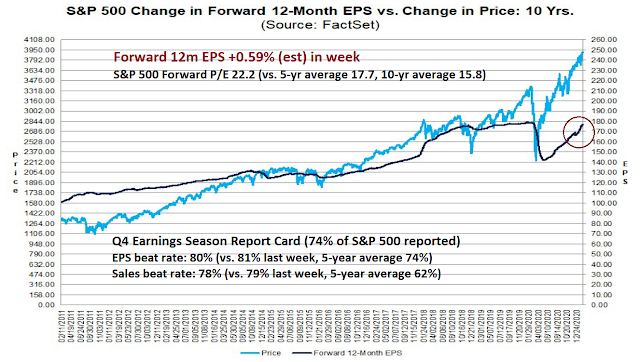

Conventional value and growth indexes often define value stocks based on their P/B ratio. Put simply, any stocks trading at a low P/B is a value stock, anything else is a growth stock. However, the P/B metric is becoming outdated.

We start our analysis with an examination of the question of the adequacy of the P/B measure to capture the value effect in today’s economic environment. The economy has rapidly moved from agriculture to manufacturing to a service and knowledge economy. Therefore, we have economic reasons to believe that simple measures of value, such as B/P, are problematic. For example, a company presumably undertakes the creation of intangibles (e.g., research and development, patents, and intellectual property) because the managers expect these investments to enhance shareholder value. These investments are typically treated as an expense, however, and are not accounted for as amortizable assets on the balance sheet, which effectively lowers—we would argue understates—book value by the amount invested in the intangibles…Many of these stocks would have been classified as neutral or value stocks if the value of the internally generated intangible investments had been capitalized, thus increasing book value.

In other words, value investing, as measured by P/B, is misspecified. Arnott et al found that adding back intangibles improves the performance of value stocks (where HML stands for book-to-market minus low book-to-market).

Using alternative measures of value, the authors of the study found that other metrics performed better than the book-to-price ratio.

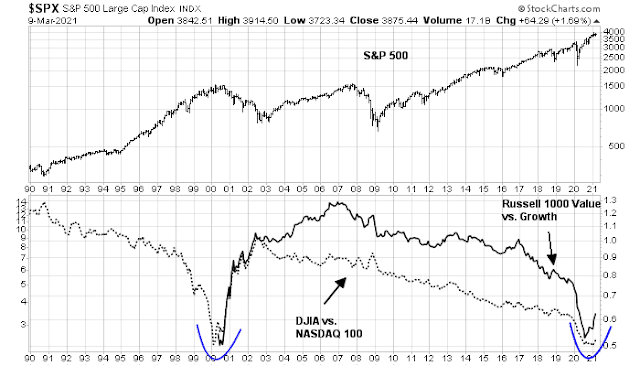

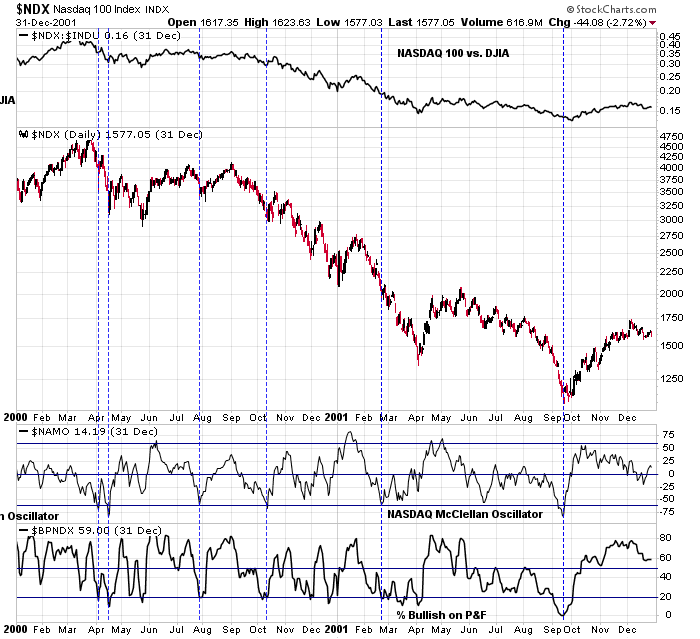

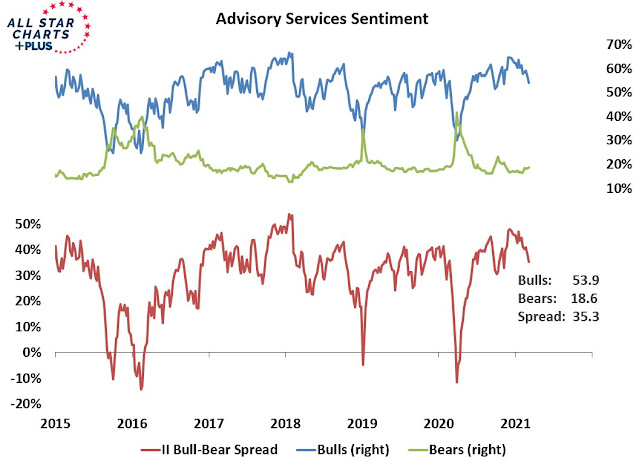

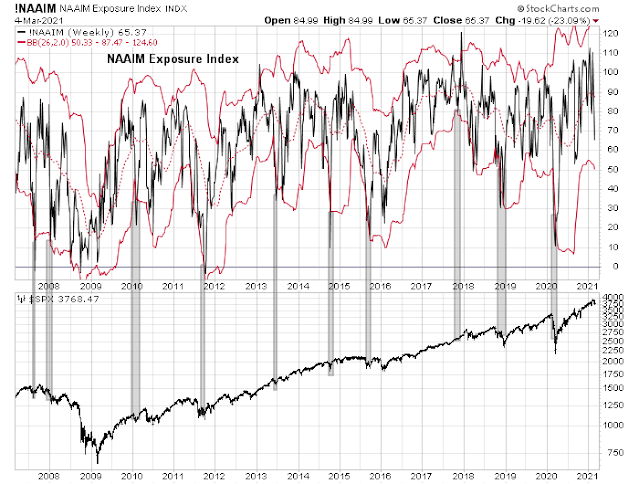

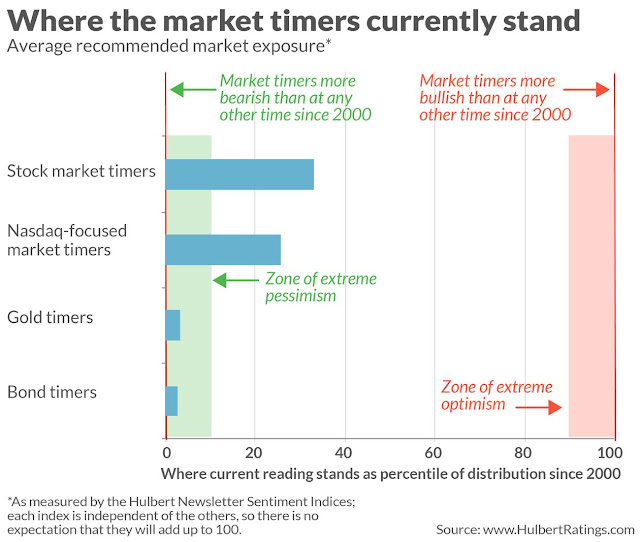

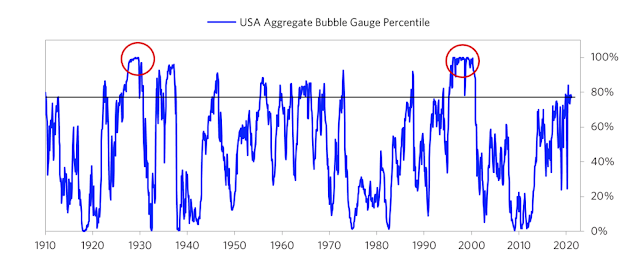

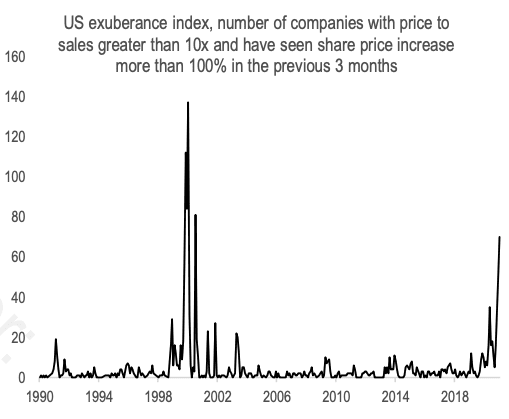

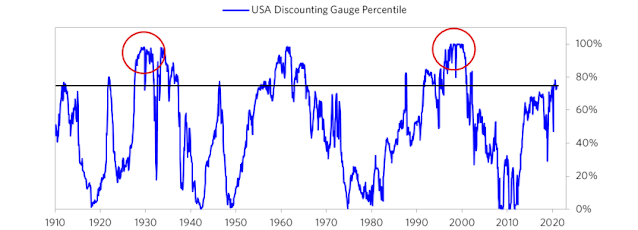

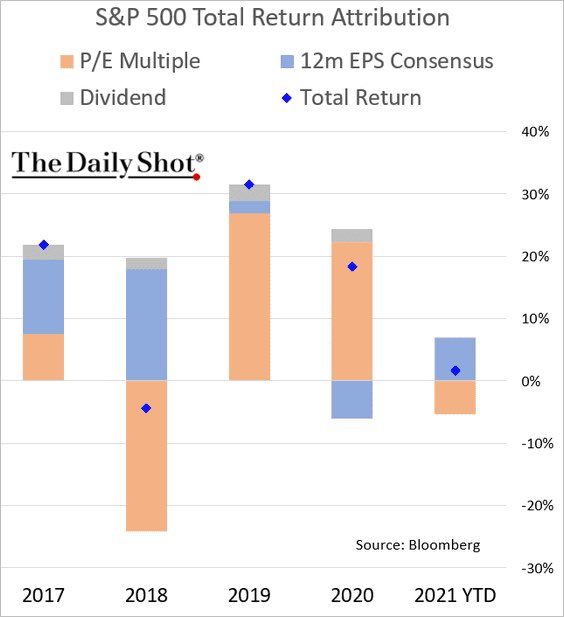

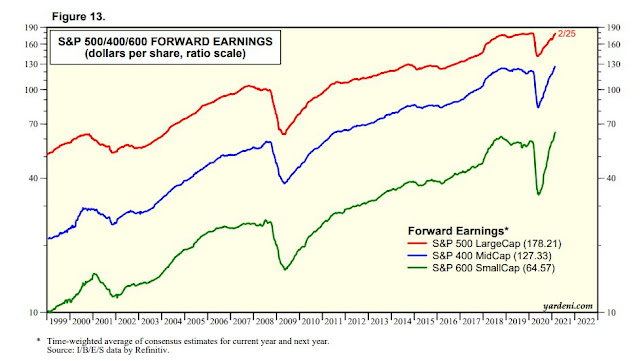

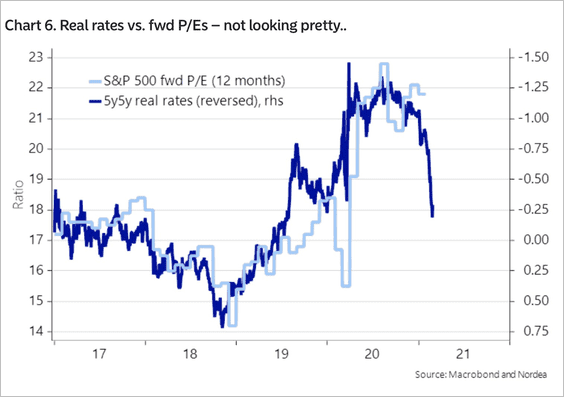

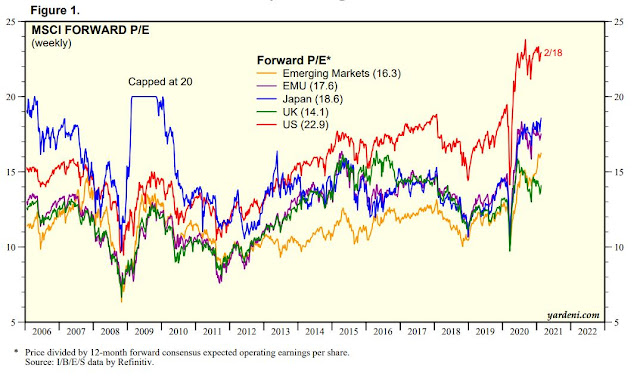

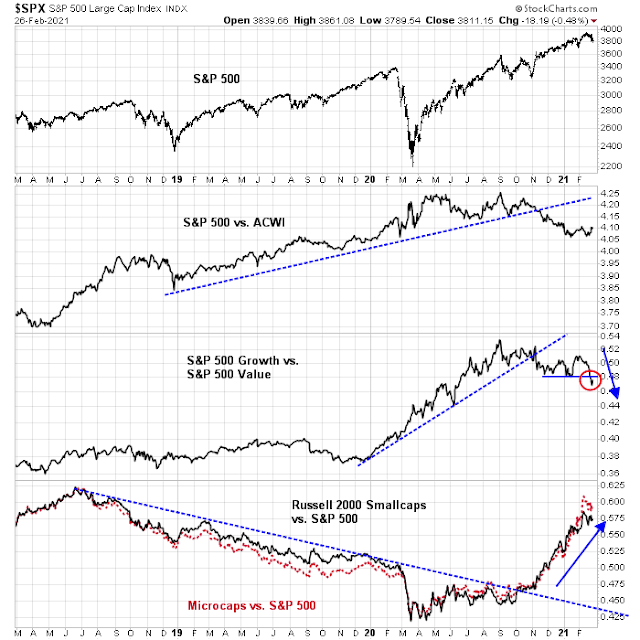

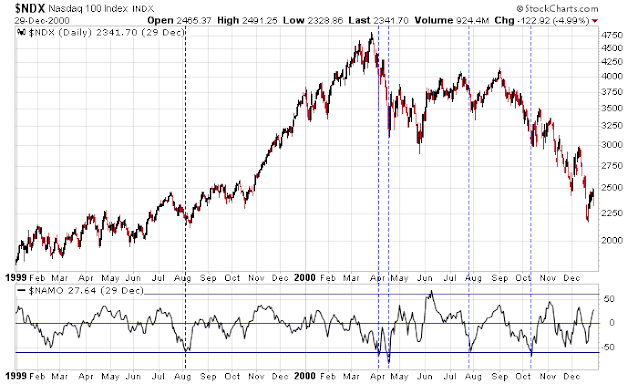

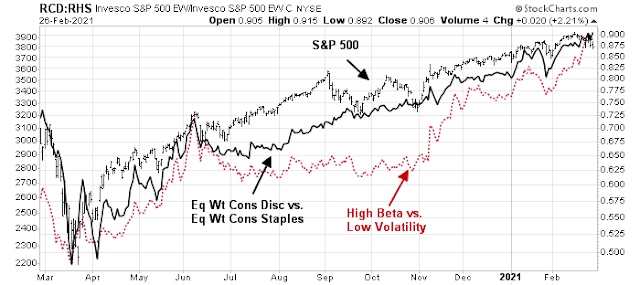

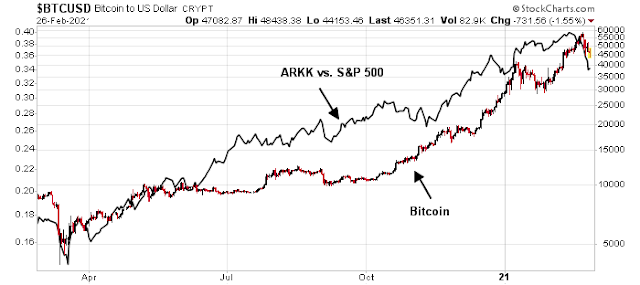

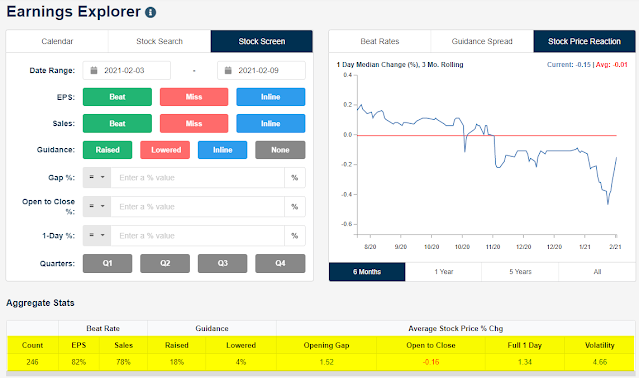

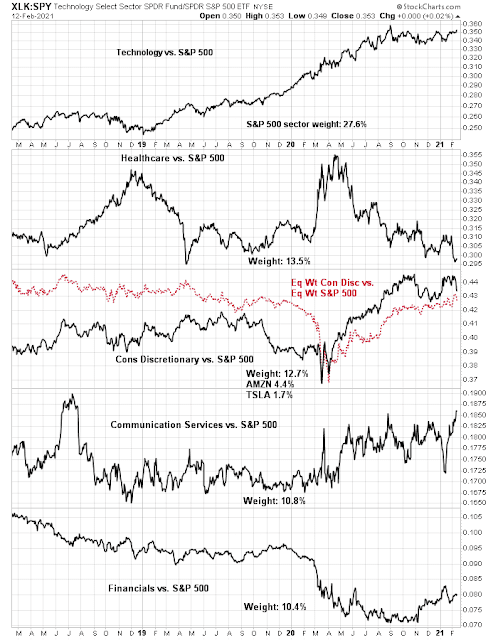

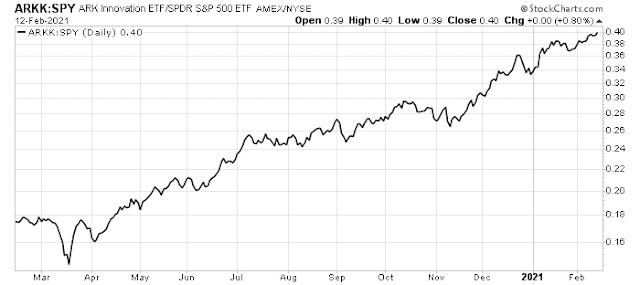

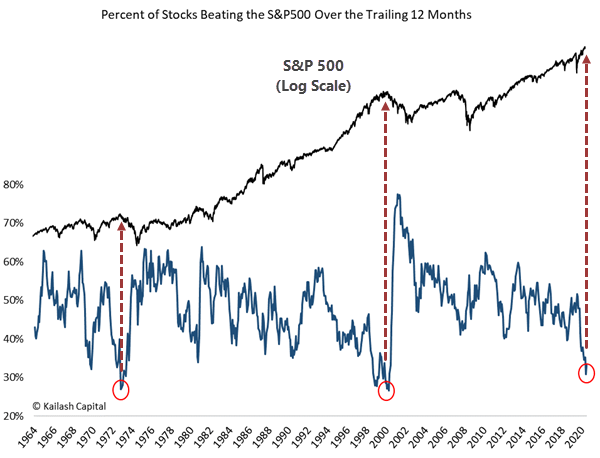

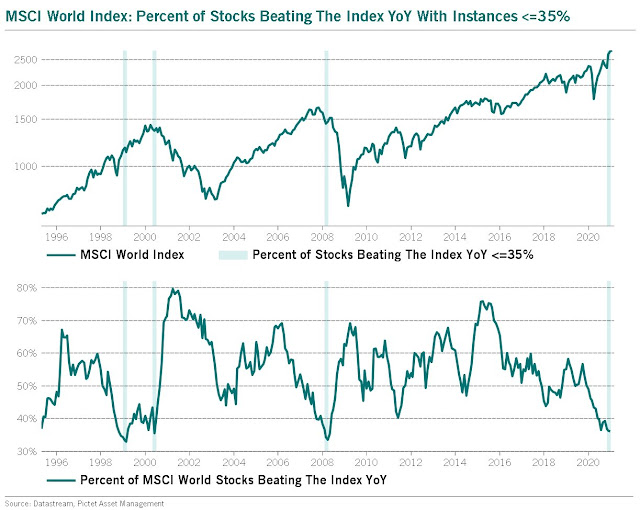

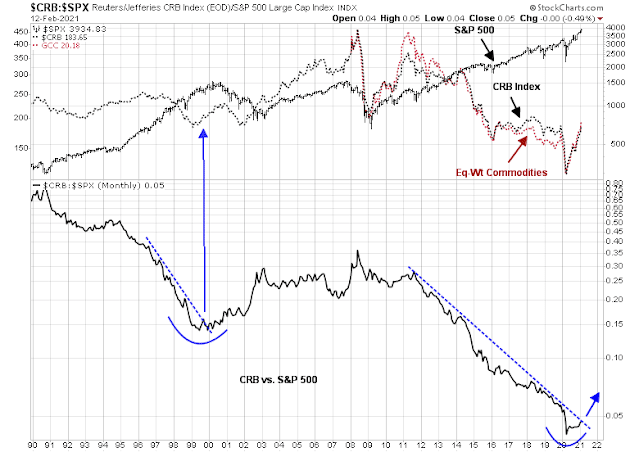

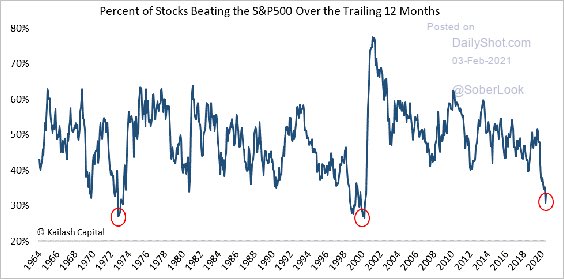

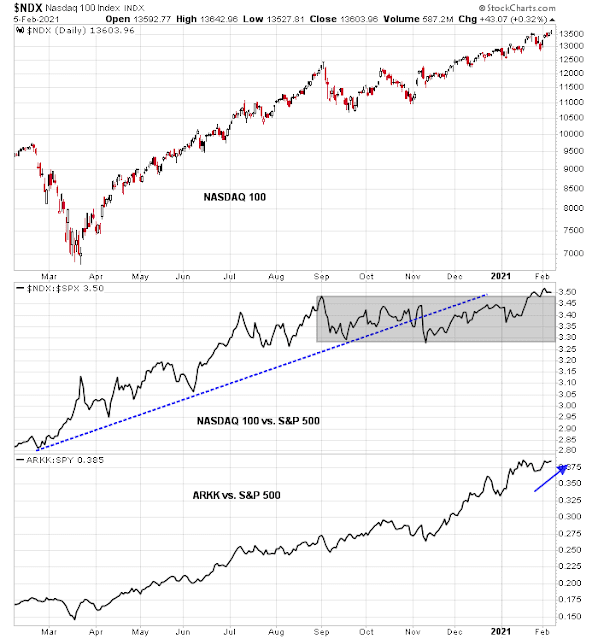

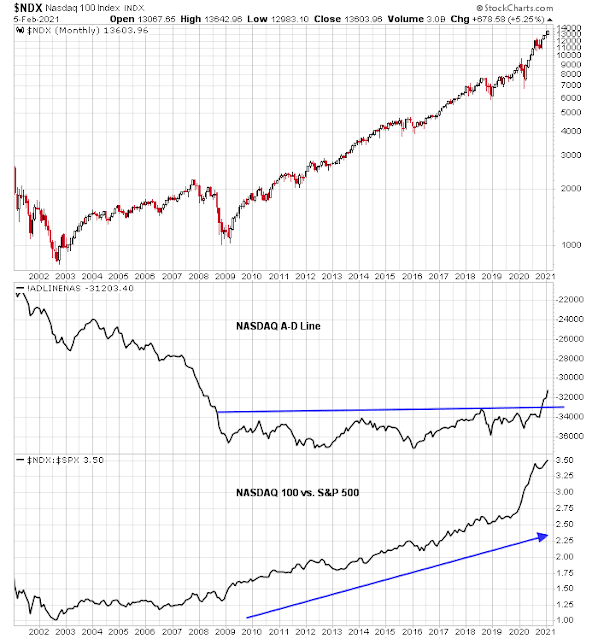

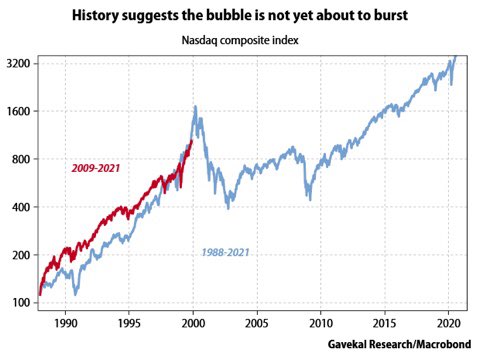

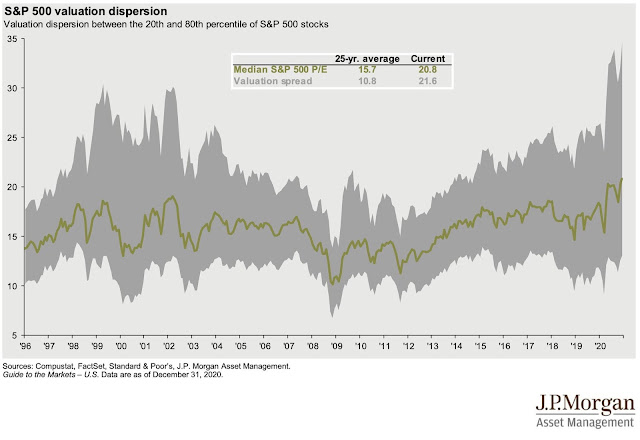

My conclusion from this to means that value investing isn’t dead. The dispersion of low and high P/E stocks is highly elevated, indicating that there are opportunities in value investing. The last time the market saw such a high level of P/E dispersion was at the end of the dot-com bubble and shortly thereafter. Growth stocks tanked, and value stock soared then.

In conclusion, instead of focusing on sources of alpha from stock, sector, or country selection, investors can also add value through better risk control by some “outside the box” analysis of the risk framework. In particular, investors can think about the following:

- Mis-specification of investment objectives and risk preferences

- How to take advantage of volatility

- Regime change risk in the form of:

- Unexpected tail-risk

- Changes in market environment (conventional regime change);

- Slow changing regimes that investors may be unaware of;

- Changes in modeling assumptions.