Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Asset Allocation Model is an asset allocation model which applies trend following principles based on the inputs of global stock and commodity price. This model has a shorter time horizon and tends to turn over about 4-6 times a year. In essence, it seeks to answer the question, “Is the trend in the global economy expansion (bullish) or contraction (bearish)?”

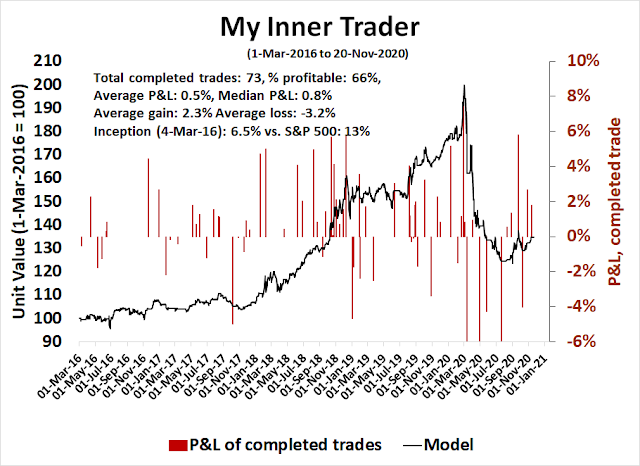

My inner trader uses a trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don’t buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts are updated weekly here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities

- Trend Model signal: Bullish

- Trading model: Neutral

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real-time here.

Rainbows and unicorns?

It is said that it’s a recession is when your neighbor loses his job, and it’s a Depression if you lose your job. In other words, economic weakness is only academic until it hits home. The denizens of New York City and Wall Street were jolted last week when the MTA, which operates the NYC subway and commuter services Metro-North and Long Island Rail Road, announced that it may need to dramatically cut services in the absence of fiscal support. The MTA proposed laying off 9,000 employees and cuts to transit services of 40-50%.

The bad news is hitting home, and Wall Street is suddenly realizing that the recovery is not all rainbows and unicorns. In addition, the decision by the US Treasury to end a series of emergency CARES Act support programs raises the risk to state and local organizations like the MTA.

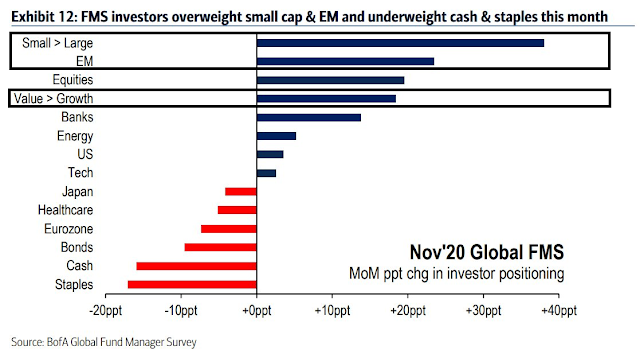

As well, the latest BoA Global Fund Manager Survey revealed that fund managers were stampeding into equities and the reflation trade.

Cash levels have dropped dramatically. To be sure, low cash levels have acted only as a warning, and have not been actionable sell signals in the past [annotations in blue are mine].

Has the rally gone too far, too fast? Is the Great Rotation trade of growth to value and large-caps to small-caps just a mirage?

Time for a pause?

Is it time for the market rally to pause? The pandemic caseload has been rising dramatically in the US. Different states have responded by entering partial lockdowns, which acts as a brake on economic growth and employment. The slowdown isn’t just restricted to the US, the

IMF warned that “the most recent data for contact-intensive service industries point to a slowing momentum in economies where the pandemic is resurging”.

The jobs recovery is showing some signs of stalling. Last week’s print of initial jobless claims missed expectations. The trend of the last few weeks has seen initial claims flatten out and may be edging up again, which raises the specter of a double-dip recession.

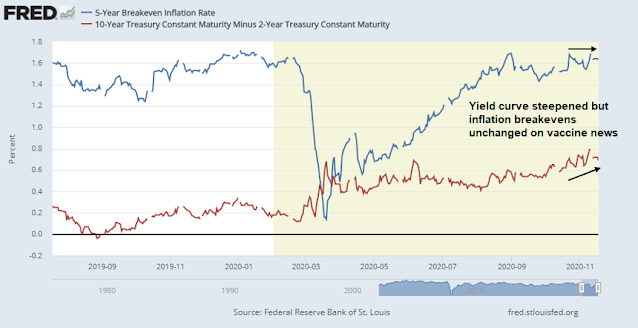

More worrisome is the bond market’s reaction, which is not buying into the equity market’s reflation thesis. The yield curve steepened in response to the upbeat vaccine news. However, inflation breakeven yields were flat during the same period. This is an indication that the bond market expects growth and inflation will be sluggish.

The most alarming development is Treasury Secretary Mnuchin’s refusal to extend CARES Act emergency lending programs beyond December 31, as reported by the

WSJWSJ.

Treasury Secretary Steven Mnuchin declined to extend several emergency loan programs established jointly with the Federal Reserve that are set to expire on Dec. 31.

The Fed’s corporate credit, municipal lending and Main Street Lending programs won’t be renewed, Mr. Mnuchin said Thursday.

The central bank signaled disappointment in his decision. “The Federal Reserve would prefer that the full suite of emergency facilities established during the coronavirus pandemic continue to serve their important role as a backstop for our still-strained and vulnerable economy,” the Fed said in a statement.

These programs are the Municipal Liquidity Facility, Main Street Lending Program, and Primary and Secondary Market Corporate Credit Facilities. More importantly, Treasury has asked the Fed to return unused stimulus funds. This is a potentially contractionary fiscal development and a possible preview of the spending tug-of-war between a Biden White House and a Republican-controlled Senate.

Industry analysts have warned that Mr. Mnuchin’s decision would risk unsettling markets—which for various reasons have been volatile around the end of the recent years—by weakening a key source of insurance that fueled investors’ optimism, especially as the pace of the economic rebound that began in May slows amid rising coronavirus cases.

Shutting down the programs could also deprive some businesses and governments of access to low-cost credit if market conditions worsen.

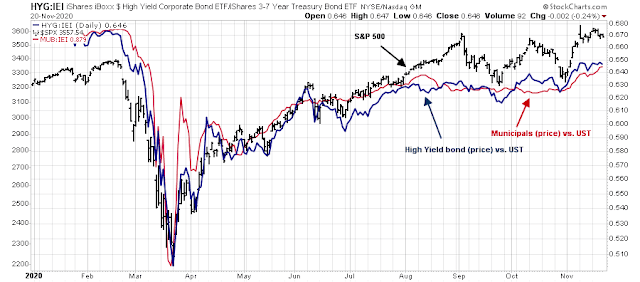

Since the March low, risky corporate and municipal credit has rallied on Fed buying and signals that it is prepared to support the market. What happens now when that backstop becomes shaky? How will changes in credit market risk appetite affect equities?

Some cause for optimism

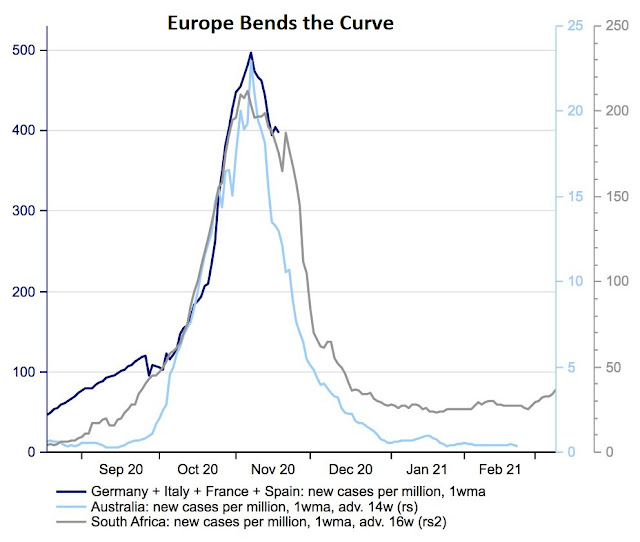

Before the bears get overly excited, there are reasons for optimism. First, the pandemic can be controlled. Europe’s restrictive measures are working. Nordea pointed out that the eurozone Big Four is following the same winter seasonal patterns of Australia and South Africa, which also went into tight lockdowns. With the right policies, the pandemic can be controlled, and any growth slowdown will be temporary.

In addition, any concerns that market participants have stampeded into a crowded long are misplaced. The BoA Global Fund Manager Survey shows that equity weights have surged, but levels are not excessive by historical standards.

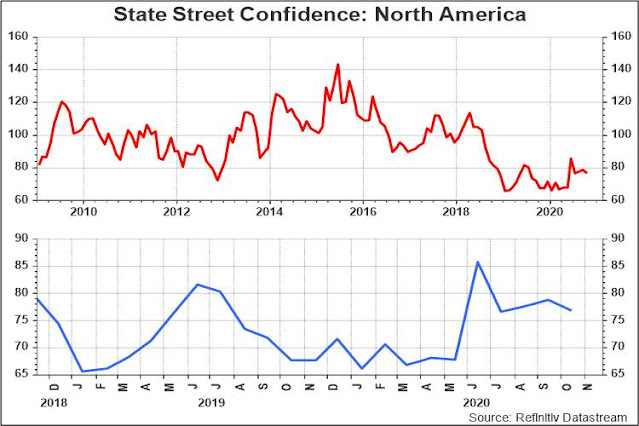

While the BoA survey is a survey of manager’s attitudes, readings can be volatile because they do not necessarily measure what they are actually doing with their portfolios. State Street conducts an aggregated survey of managers, based on custodial data. The latest update of State Street Confidence of North American equity positions indicates that managers are underweight risk (below 100) in their positioning. This is can hardly be called a crowded long condition.

Possible consolidation ahead

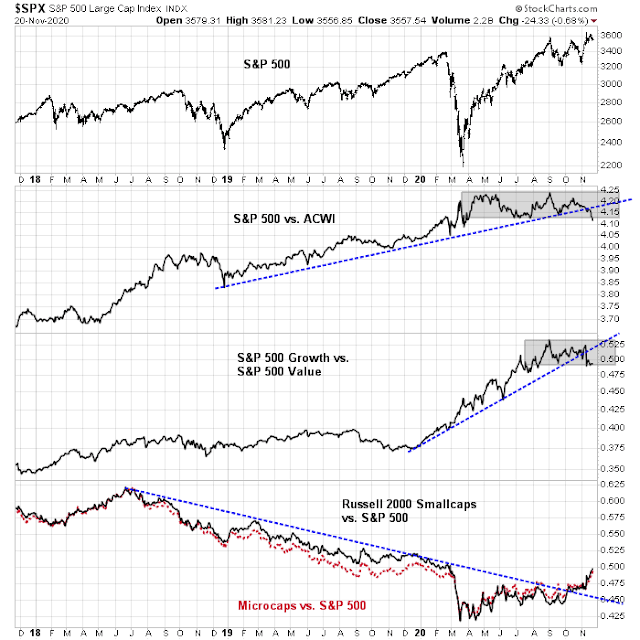

In resolving the bull and bear cases, investors need to put the Great Rotation into context (see

Everything you need to know about the Great Rotation but were afraid to ask). The market is undergoing a leadership change, from US to non-US, growth to value, and large-caps to small-caps. Such transitions are rarely smooth. We may have to undergo a period of choppiness and consolidation before the cyclical reflationary bull market reasserts itself.

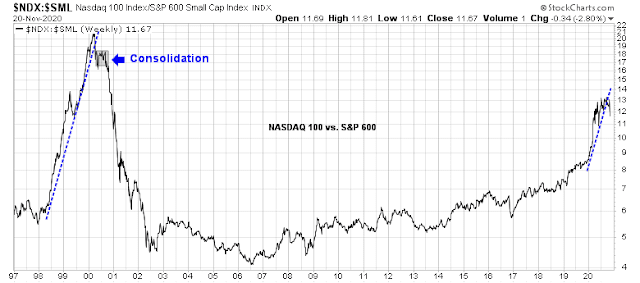

Major trend breaches tell us that the crowd is probably right, but market action can stabilize and consolidate after a break. As the history of the ratio of NASDAQ 100 to small-cap S&P 600 after the dot-com bubble shows, the ratio staged a brief counter-trend rally and consolidated for a few months before falling. That experience may be a useful template for the market today.

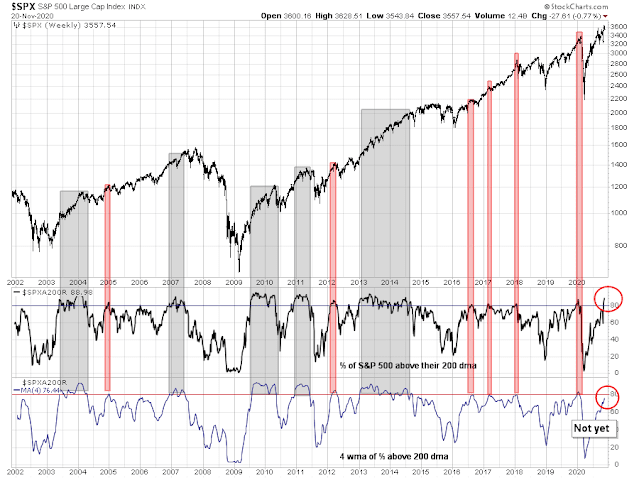

I have highlighted in the past that the percentage of S&P 500 stocks above their 200 dma has risen past 80%, reaching almost 90%. Past instances have either resolved themselves in “good overbought” advances (in grey) or market stalls (in pink). The current episode is unusual inasmuch as the 4-week moving average has not exceeded 80% yet, indicating that perhaps breadth and momentum is not all it’s made out to be. This may be supportive of the consolidation and pullback scenario.

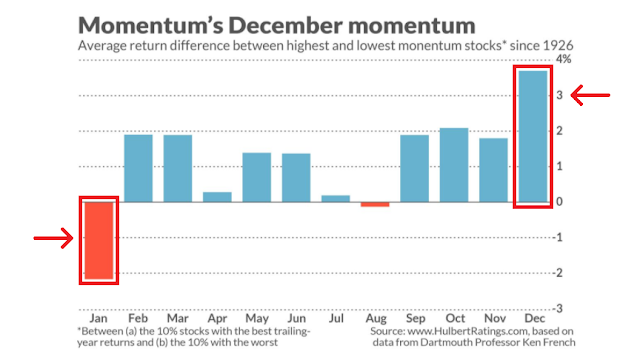

Mark Hulbert has argued that momentum stocks (read: FANG+) are on track to see a strong December, followed by a reversal in January. Since these large-cap growth stocks have taken on defensive characteristics that would imply a corrective phase into year-end.

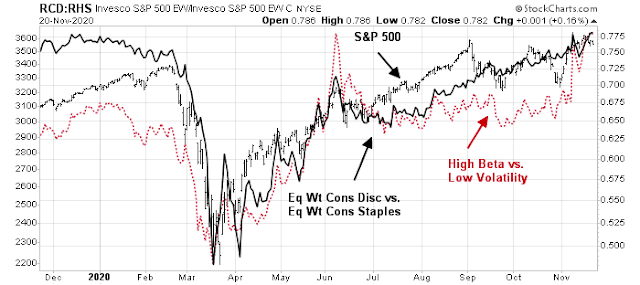

However, don’t get hung up too much on the correction and consolidation scenario. Equity risk appetite indicators, such as the equal-weighted consumer discretionary to consumer staples ratio (equal-weighted to minimize the Amazon weight effect on discretionary stocks), and the high beta to low volatility factor performance ratio, are all behaving in constructive manners.

It’s possible that most of the correction has already played out.

Macro Charts observed that equity futures traders have already dramatically cut exposure. The bulls will contend that there may not be much selling left to do. On the other hand, the bears can argue that the market struggled to maintain positive momentum on vaccine news, which is indicative of a poor sentiment backdrop.

In conclusion, the long and intermediate-term trends for stocks are still up, and the Great Rotation themes remain intact. However, we may be undergoing a brief period of sideways consolidation before launching the next upleg. My inner trader is leaning bullish, but he is staying on the sidelines because of the high risk of sudden reversals. My inner investor believes that any dips should be regarded as buying opportunities.

1918 – 1919.

The Spanish flu tailed off in July 1919 (started effectively beginning 18 or as now – some before)

The graph I have seen indicate we are on the same course in terms of time frame.

Enough die today but not as many as 18-19 due to what we know and preventive action we can choose to follow.

Cam might like to tell us what to expect (markets) if it lasts as then.

Good summary of the bull/ bear cases right now, Cam.

For those who missed it, Ken also posted an excellent big picture view of his Grand Reshuffle thesis yesterday.

One thing I’ve struggled with over my entire trading history (and will probably continue to struggle with) is the impulse to capitalize immediately on each set up – it’s almost always unnecessary. It’s difficult to remain patient, but the usual pattern is one of action-reaction-trigger. In other words, as the initial move unfolds, traders chase (panic buying). Inevitably, a countermove develops (a back test, if you will), which shakes the tree (panic selling). The most successful trades will be initiated at that point.

Over a longer time horizon, what Cam/Ken refer to as the Great Rotation/ Grand Reshuffle may set up in the same way. We’ve seen the initial move. We’ve probably seen at least the beginning of the counter-reaction. The challenge will be how/when we scale into sectors poised to outperform.

My entries last into a suite of potentially outperforming sectors last Wednesday was a perfect example of how not to do it. I was forced to exit all trades the following day for an overall loss of ~0.5%. Had I waited for the end-of-day counter-move, I would probably still be in all positions.

(I was able to repair much of the damage on Friday, but only due to sheer luck. Exiting on Thursday allowed me to sidestep the selloff following Mnuchin’s after-hours annoucement later in the day. Then a series of trades in small-cap momentum stocks on Friday.)

I’ll be taking a more deliberate approach to the next round.

Thank you all for your comments because it helps me think things through, so that’s a Vote for “Keep it coming”.

Ken, I was on your website yesterday, gleaming for nuggets. Thanks for that.

RxChen, thank you for keeping it honest with your losses and being the Public Voice to our Inner voice, in dealing with decisions about making money in the Markets. The struggle between ID and Ego and SuperEgo within all of us. Thanks.

So, I know now is not the time to buy Bitcoin, but what do you guys think about it becoming a 2nd value hold in today’s world? Other than Gold. Due to all the issues with Covid-19 fragility in the real world, and also Because of the Shenanigans going on in the current White house. It has gone from 5K to 18K, again, I am not saying buy it now, but what about the next time if it’s on sale for 50% or whatever.

Do you guys think it should become part of a diversified portfolios for both Trading and Investing?

Thanks again to all of you, especially Cam for doing all the hard work and sharing it with all of us. Keep it coming!!!

Mohit, I posted a new Factor Observation report just now that I think is very interesting. Check it out.

There was an interesting Odd Lots podcast about Bitcoin this week. I’m adjusting my attitude from “it’s a currency/medium of exchange and one wouldn’t buy Euros Yen or Canadian $ as an investment” to “it may also have store of value characteristics like gold and therefore could be a hedge against certain scenarios.” I’m not ready to buy quite yet.”

I don’t have a great deal of trust in the opening rally.

No index trades so far.

Solid base hit opening PEIX on early decline (sorry, neglected to post). Also opened a position in EXPI on the morning pullback – still attractive here IMO.

All positions in PEIX/ EXPI closed here.

Reopening PEIX.

I know where EXPI is now.

Building positions in FXI/ BABA.

Adding a little QQQ.

Still holding XLE, will see if it gets sold down from here.

Not this week, IMO. Any positions opened today and/or tomorrow – I will try my best to hold through Friday.

To clarify – I don’t own XLE nor am I planning to open on strength. Instead, I’m doing my best to build positions in sectors showing relative weakness today. The play is to try catching a holiday rally without overpaying for exposure.

Taking a measured swing at RYSPX/ RYOCX end of day.

The rotation into value feels real – but today is not the time to be opening positions. I’ll wait for a better pitch.

Any thoughts on Yellen at Treasury?

Beats the **** out of Warren at Treasury.

bullish

I’m starting to lean towards a Tuesday gap up that forces everyone waiting for a pullback that never materializes to chase stocks into Friday. Alternatively, the right move may be to sell into a Tuesday rally – and buy back into an unexpected decline on Friday.

Building positions premarket in a few names. DBVT on a -12% pullback. BLDP on a pullback (offering news). A little AMZN. A little HYLN on strength. Back in GME.

Added a little AMD/ JKS.

I think we rally harder than most traders can imagine right now – and I’ll be the first to admit I may be way off base on that call. That’s just my sentiment take @ 445 am. I also think we sell off hard at some point – out of the blue and when least expected.

good call.

Trimming BABA on the premarket +2.56% spike.

Adding to HYLN.

Opening a position in SNAP.

Adding to GME.

Out of JKS.

Opening OSTK.

Reopening NIO.

Basically, opened or added to positions on the opening sell wave. And as always, I’m not necessarily saying it was the right move.

Looking for an impulse buy wave in the FAANG names – that would really catalyze an upside breakout.

I’m swinging at RIG ~2.2x. Probably a death wish.

Out of NIO.

What’s performing well today are QQQ/ SPY/ BABA.

NDX 100 still hasn’t broken out of its range from the last few days trading.

Crude is up 4% today.

Reopening FCEL ~7.2x.

Stopped out of HYLN and BLDP.

Closing positions in DBVT and MBIO.

All remaining positions – with the exception of QQQ/ FXI/ BABA – off here. Looks like a minor loss overall on the flyers despite good gains in a few.

Unless things change in the last ninety minutes, gains in RYSPX/ RYOCX/ QQQ/ FXI/ BABA should take me well above the previous all-time high. That’s reason enough to step out here.

The usual indicators (sentiment/ technical) seem to be vacationing somewhere, because they don’t seem to be working this year. Another reason to doubt that the usual post-Thanksgiving rally materializes.

I opted in the final minutes to hold.

Just a hunch, but I think more than a few fund managers will be forced to chase tomorrow. Monday is end of month, and how many of them are positioned to outperform?

Which is the site of Ken ? How can it be finded ? Thanks