I hope that I haven’t offended the market gods. Just after my bullish call for a cyclical recovery (see Everything you need to know about the Great Rotation but were afraid to ask), a number of contrary data points have appeared to cast doubt on the reflation thesis.

The markets were jolted by the news on Thursday that Secretary Treasury Mnuchin has declined to extend CARES Act emergency lending facilities established with the Federal Reserve. In addition, Treasury has asked the Fed to return any unused funds. This is a potentially contractionary fiscal development and a possible preview of the spending tug-of-war between a Biden White House and a Republican-controlled Senate.

As well, the ongoing risk posed by a second wave of COVID-19 in Europe, and a third wave in the US derail the cyclical bull? The resurgence of the virus is quite clear in the US, as evidenced by rising policy stringency. In Europe, things have become so bad that even the Swedes have abandoned the Swedish model and announced shutdowns.

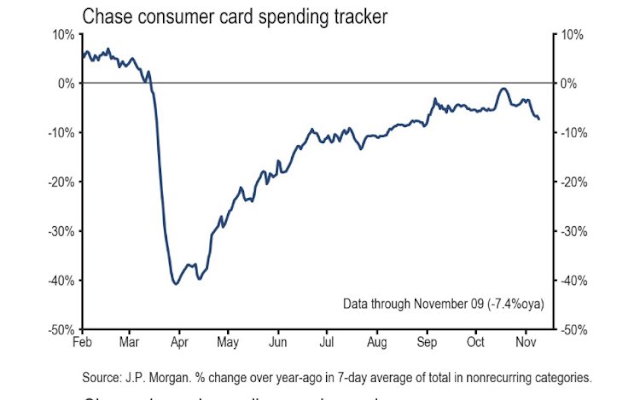

High-frequency data, such as Chase card spending, is turning down.

Are these sufficient negative surprises for equity investors to be worried about? Let’s consider the bull and bear cases.

A sudden downturn

The bear case has two components, a sudden and unexpected slowdown in growth, and excessively bullish psychology. The slowdown is evident in the Economic Surprise Index, which measures whether economic indicators are beating or missing expectations.

One example is the October retail sales report, which missed expectations and rose at the slowest pace in six months. As well, the September figure was revised downwards. The retail sales report was the story of a K-shaped recovery. Affluent households that had the means to spend did so. Demand for eCommerce and home renovations to support the work-from-home trend, and luxury goods like cars and electronics, rose. All other categories were weak. Even food sales were negative, which explains the long lines at some food banks.

Other high-frequency economic data are also pointing to a plateau and possible rollover in employment in the near future.

If corporate credit support is removed, will spreads start to widen, and the loss of risk appetite leak into other asset prices?

Are expectations too high?

Despite the recent softness in high-frequency data, the Street revised S&P 500 quarterly earnings upwards across the board. Are expectations too high?

The magazine cover indicator is also flashing double contrarian warnings. Could the cover of the Economist is setting the bar too high for a vaccine-driven recovery in 2021?

Just as I made the bull case for the Great Rotation from US to non-US, growth to value, and large-cap to small caps, Barron’s embraced small-cap stocks as the next profit opportunity.

The latest BoA Global Fund Manager Survey (FMS) shows that respondents have piled into the risk-on and Great Rotation trade.

The bull case

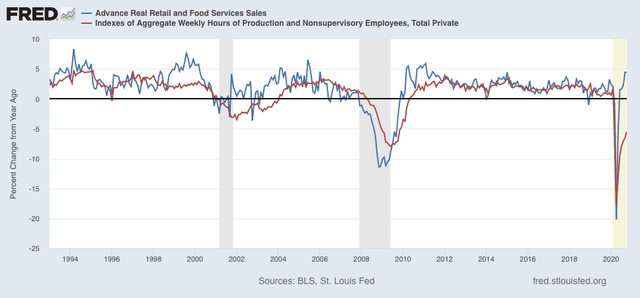

Before you batten down the hatches and turn defensive, here is the bull case for equities. First, any “valley” in the near-term growth path isn’t very deep. New Deal democrat observed that even though the tame retail disappointed, real growth remains positive and leads industrial production by a few months.

Historically consumption has slightly led employment by several months, albeit with a lot of noise. It has almost universally done so for the entire 70+ year history that both measures have been kept. Basically, demand for goods and services drives hiring to fulfill that demand (or at least to an increase in hours employed) typically within a few months later.

From a big picture perspective, the recovery in retail sales is remarkable compared to the GFC. The concerns over the October retail sales miss represents only a blip in the recovery.

Analysis of savings patterns indicates the spending downturn is not expected to be very bad. Bloomberg reported that American household balance sheets are flush with cash as fiscal support raised the savings rate. There is plenty of savings to hold up spending. To be sure, the lack of an additional rescue program will exacerbate inequality and the K-shaped recovery, but the market has ignored the weak leg of the K so far. Why should it be any different now? That’s a problem for policymakers in the future. The additional level of household cash can also be deployed into investing, which would create additional demand for equities.

If you are expecting a Retail Apocalypse, you can forget about it. Walmart and Target reported strong results last week, aided by eCommerce sales. Just listen to Walmart CEO Doug McMillon in his earnings call (via Yahoo Finance):

A big part of this new behavior is the consolidation of trips, whether these are to Walmart stores or any other. Average ticket sizes at Walmart rose 24% in the quarter while the number of transactions fell 14%.

And so the rise of online and hybrid orders is serving as a boost to the company’s top line and creates the impetus for a further investment in keeping these sorts of behaviors in place. McMillon says the company is convinced many of these new shopping habits will last past the pandemic. But it’s also in the company’s interest to make this habit as attractive as possible for customers.

“When a customer shops [in-store] and online, they spend about twice as much, and they spend more in-store,” McMillon said on the call. “Those are pre-pandemic stats, we’re not updating those at this moment. But it is important to remember, once [customers are] engaged in the digital relationship and they’re shopping [with] us holistically like that, the value of that customer relationship goes up.”

Here is Starbucks, which was hurt badly by the lockdowns:

I could not be more pleased with our US sales recovery, which progress faster than we anticipated. In our final quarter of fiscal 2020 we finished the quarter with the comparable store sales decline of 4% for the month of September, a vast improvement from the approximately 65% decline we experienced at the depth of the pandemic only 5 months ago.

Here is FedEx, which offers a window into the global freight logistics industry:

The growth that we expected to see over a period of three to five years happened in a period of three to five months.

Macro Charts pointed out that the San Francisco Fed’s Daily News Cycle Index is turning up from a low level. This is the trough of a cyclical recovery that should have legs.

Will the market look over the valley?

How do we resolve the bull and bear cases? Will the market correct in the face of deteriorating macro conditions?

Bill McBride of Calculated Risk summarized the dilemma this way. The vaccine news was already baked into most forecasts. The latest infection surge has analysts scrambling to downgrade the H1 2021 outlook while upgrading H2 2021. CNBC reported that JPMorgan has downgraded Q1 GDP growth to -1%, with a bounceback in Q2 of 4.5% and of 6.5% in Q3. The question for traders and investors is whether the market is willing to look over the valley.

On the other hand, Andrew Thrasher believes that the market is overbought, over-extended, and vulnerable to a setback. News of a pandemic-induced slowdown or Treasury’s sudden pivot towards austerity might just be the catalyst for a pullback.

Well rarely do we have 5 sectors with more than 90% of their stocks above the long-term moving average. The last time this occurred was after the mini-melt up in January 2018 and before that it’s occurred just three times since 2011. Each of these periods, where metaphorically everyone had already “jumped into the pool,” left little catalyst to give the market its next leg up and instead we say varying degrees of weakness enter the market. Most were not severe, remember in early 2018 we had a swift 10% pullback and then continued higher.

Whether you are bullish or cautious will depend on your time horizon, and pain threshold. Bear in mind that the intermediate and long-term bull case for equities can only be invalidated if the vaccine recovery story falls apart. The question is whether the market will correct, and how far.

I honestly don’t know. The market can weaken at any time, but corrections should be viewed as buying opportunities. I am watching the value and small-cap indices which recently exhibited upside gaps. These gaps are potential bullish runaway gaps. Pullbacks that fill the gaps would be tripwires of a correction.

Until then, give the bull case the benefit of the doubt.

In my book the outlook is not very confusing. To remove all the clutter of conflicting data just watch the 20 year Bond (TLT). It just has broken a very long downtrend lines i.e. yields are dropping. If this were to continue it would negate the thesis that the economic strength has legs. All the markets on a weekly basis have had inside weeks. The “Tell” will be in which direction they break. Another Index which is a harbinger of good times or bad is the semi-conductor index. It has stalled close to a double top. The market will show its hands shortly.

Doesn’t dropping yields on TLT indicate Yield curve repression? The Fed may be behind this, and will leave the investing public with no other option but to invest in stocks. Sure, we may retest 3250, in the short term, but wouldn’t that be a “buy the dip” moment for the longer term?

https://www.barrons.com/articles/how-the-vaccine-era-could-be-a-sweet-spot-for-stocks-51605961801?siteid=yhoof2

Still leaning bullish. In my opinion, it’s been a sideways consolidation since the November 9 slingshot, to be followed by a sustained move to the upside. The distribution phase of the two vaccines may prove to be complicated, but the fact remains that we have two effective vaccines.

Look at the above Value indexes and you see that they were at the June level when they broke out with the better-than-expected and sooner-than-expected vaccine announcement.

This sector of the market does not have very optimistic investors. Think of energy, banks, REITs etc. that have constantly disappointed. I don’t see investors shifting from Growth to Value even though Value is the only area going up since the election or the vaccine announcement.

After the huge surge in Value on November 9, it has gone sideways. This shows great strength. I would have expected a pullback before the next upleg.

I believe we are birthing a long term momentum uptrend in Value. It has been underperforming for years which leaves a lot of upside available as it scales a wall of worry.

I will be monitoring this objectively and will be first to sell Value if momentum fails.

I’m totally convinced that we are in a ‘Grand Reshuffle’ with unknowable outcomes for society, businesses, globalization, technology, climate, regional politics etc. Only momentum-style investing keeps one on the winning side of this very foggy future.

An investor that worries about the unfolding US pandemic tragedy should look at the Asia region that is witnessing a new momentum outperformance upswing. The Covid-successful region signed a free trade zone agreement that includes Japan, Australia, New Zealand and all of Asia ex Taiwan. On my momentum rankings, Korea is a leader with Australia just breaking out and Singapore looking good. The economic strength of the Asia region plus the better outlook beyond is also energizing international mining ETFs (Like PICK ETF) to outperformance. These commodity ETFs have been underperforming for years and hence have big upside.

Also, Non-US stock global indexes (VEU ETF for example) are now outperforming which is a new phenomena.

So there is lots of fertile non-US investment areas to own while America sorts itself out and joins the post-Covid party.