What’s on the calendar this week? Did you forget?

Oh yeah, there’s an FOMC meeting this week, and there’s the November Jobs Report on Friday. While not much policy change is expected from the Fed this week, Barron’s has already anointed Jerome Powell as “the winner”. (Has anyone started to call him the Maestro yet?)

Before everyone gets too excited, here are the challenges facing the Fed in the post-electoral and pandemic era.

Out of firepower?

Former New York Fed President Bill Dudley penned a Bloomberg Opinion article declaring that the Fed really is running out of firepower. He concluded that while the Fed can still take some steps to ease monetary policy, they won’t be very effective and it’s time for fiscal policy to take up the baton.

No doubt, Fed officials should still commit to using all their tools to the fullest. But they should also make it abundantly clear that monetary policy can provide only limited additional support to the economy. It’s up to legislators and the White House to give the economy what it needs — and right now, that means considerably greater fiscal stimulus.

To be sure, the Fed can engage in unconventional monetary policy in the form of quantitative easing. But QE also has its limits. As the ECB and BOJ found, the central bank can end up owning a substantial portion of outstanding government debt, and central bankers can only stimulate by going out further on the risk curve by buying MBS, corporate bonds, and stocks.

Dudley and other Fed speakers are right. Fiscal policy is the most effective form of stimulus at this point.

Reacting to a recovery

One of the questions for Fed is its reaction function to the steepening yield curve. Will the FOMC statement or Powell’s press conference address either the issue of rising 10-year Treasury yield, or the steepening yield curve in the form of rising growth and inflationary expectations?

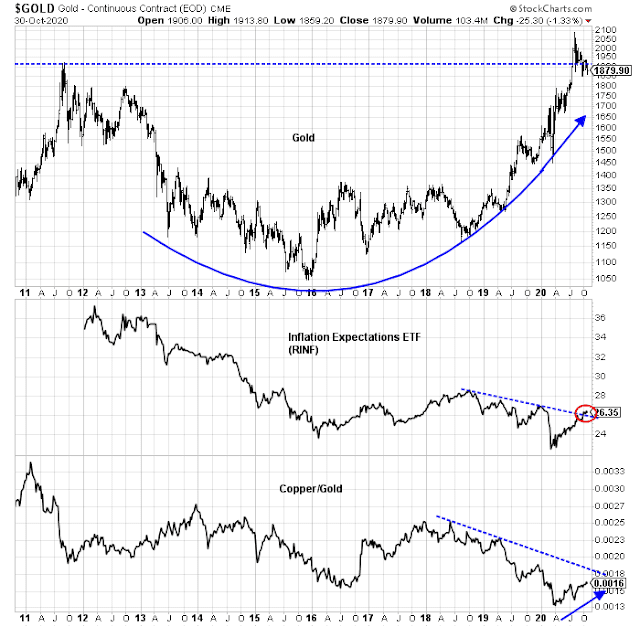

Sure, the Fed has said it is targeting an “average inflation rate” of 2%, indicating it is willing to tolerate some overshoot of reported inflation. In that case, it runs the risk of allowing inflationary expectations to run out of control, and become unanchored. Even as the economy emerges from the recession, we are already seeing signs of cyclical rebound in growth and inflationary expectations. Gold prices have pulled back and consolidating just below its breakout level. Inflationary expectations (RINF) have staged an upside breakout from a declining trend line. As well, the copper/gold ratio, which is an important cyclical indicator, is turning up, though it has not broken out of its downtrend to signal a liftoff.

Rose-colored glasses

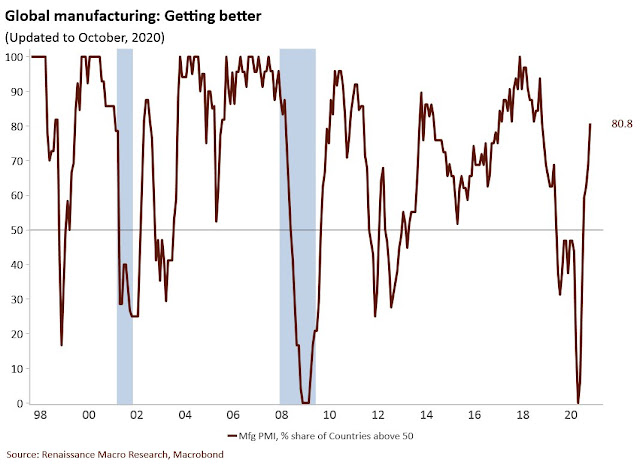

Let’s put on some rose-colored glasses and consider what might happen under a bullish scenario. The election results in a government that enacts a significant stimulus package. In the next 4-6 weeks several Phase 3 vaccine trials will report, and one or more of them are positive enough to see widespread vaccine availability by late Q1 or Q2. The global economy takes off. Already, 81% of global manufacturing PMIs are in expansion.

The bottom-up view is the same. The latest update from The Transcript, which monitors earnings reports, tells an upbeat story of an economic recovery.

Most parts of the economy have normalized and the economic winners are booming. Technology, cloud service and e-commerce are leading the way and other industries are surging as well. Financial service firms focused on M&A advisory, trading and restructuring are seeing strong business. The housing market is also on fire with new home sales up 32% y/y. This week’s election and a renewed wave of COVID could dampen activity, but for now, the economy is doing remarkably well. COVID may have led to structurally higher productivity.

All this begs questions about the Fed’s reaction function.

- How far will it allow the 10-year yield to rise?

- How much steepening will it tolerate in the yield curve?

- Even though it is focused on employment and reported inflation targets, how does it address the problem of an upward surge in inflationary expectations? Runaway inflationary expectations risks setting off an inflationary spiral that gets out of control.

The pain trade? IMO, it would have to be successive gap-up opens every day this week. I don’t think it’s far-fetched. Markets are still oversold. Sentiment has pulled back, and the wall of worry rebuilt – indexes did pull back over -5% last week, after all. As Cam points out, both the FOMC announcement and the jobs report have receded into the background and may thus have the effect of sparking unexpected moves – and how many traders are positioned for an upside surprise?

Gonna need a jackhammer to get above 1.5 on the ten year.

Not a jack hammer but tax holiday and making previous tax cuts permanent (Fiscal policy) , now that the Fed printing presses are running out of ink (monetary policy).

Lisa Abramowicz on Twitter this morning:

One of the biggest US investment-grade ETFs, $LQD, had its largest-ever one-day outflow yesterday, of $1.4 billion. Meanwhile, $TLT, a long-dated Treasury ETF, saw its biggest daily withdrawal since March. Looks like some investors are making a bet on higher yields post-election.

The U.S. yield curve is steepening as traders place a record volume of short-bets on longer-dated Treasuries & withdraw cash from ETFs that own the debt. The gap between 2 & 10-year yields is almost back to the steepest since early 2018.

The bet here seems to be more about the U.S. being forced to pay more to finance its deficits, which are expected to balloon regardless of who wins the election. It does not appear to be a renewed bet on faster long-term growth, as breakeven rates are still below their 2020 highs

Isn’t the steepening yield curve indicating heightened growth expectation? Of course this would mean higher borrowing cost for the Fed, which it will control with yield curve suppression.

looks to me as if the tug of-war between the FOMC and the treasury market is being “won” by the the treasury market–this will be especially clear if Biden wins, Higher yields and higher inflation may cause the Fed to finally raise ST rates. what happen to the stock market under these emerging conditions? Bad for growthy stocks, that is clear. who wins?

Trimmed positions in XLE/ BAC premarket.

Looks like I’ll need to manage the BABA position-> -8% premarket on news that the Ant Group IPO will be suspended.

Taking losses on BABA/ BIDU.

AMZN off for a minor loss. GILD off for a minor gain.

EEM off.

XLE/ BAC completely off for good gains – due to position size, the gains eclipse losses on BABA/ BIDU.

Will trim RYSPX at the 730 window.

NIO/ NET/ SNAP off for good gain. Maintaining small core positions in NIO/ SNAP.

Trimming QQQ.

I ended up taking the entire position in RYSPX off at the 730 window. Might it close even higher end of day? Sure, but I think it’s common sense to take a +2.25% one-day gain in an index fund with election risk on tap.

Reopening a smaller position XLE, which has pulled back -2% from the pre-market exit.

Closed for a minor loss.

There is a case to be made that European stocks bottomed on the day of the ECB meeting. They made a lower low in futures, but that turned out to be noise. Thursday might be the big event for US stocks.

https://www.marketwatch.com/story/some-bond-traders-are-bracing-for-a-rate-shocker-after-u-s-election-day-11604436459?mod=mw_latestnews

Closing all remaining positions end of day. I was about 54% invested heading into today, and will close the day +0.8% overall. A new all-time high. I think it’s 50/50 whether we rally even harder tomorrow or sell off hard, and prefer to protect gains.

that’s completely prudent, either way today was a great day, congrats on the all time high! I still think we rally on the “clean sweep” scenario, but will know soon enough if that is in the cards. My only doubt is how much has been front run. Also saw there is a huge bet short volatility going into tonight. With everyone pre positioned for rally and a quick drop in volatility, the market could be in for a violent unwind on any surprises.

I agree. Traders have been front-running a good outcome to the election. How they define ‘good outcome’ is somewhat unclear – uncontested, perhaps.

Happy I took off all my PredictIt bets last week.

Growth up, value down is the new pain trade.

Looks that way! QQQ +3% in pre-extended hours.

Basically, yesterday I gave away QQQ and AMZN to much smarter traders.

On the other hand, my exit levels on XLE/ BAC were perfectly timed.

Success in trading often depends on faith – and despite my ability to sometimes accurately see where it might be headed, it requires a great deal of faith to trade against logic. Probably a lifelong challenge that I will never fully get my head around.

So what’s the plan for today?

1. If I were still holding, I’d be selling into the open. So I won’t be buying the open.

2. The hope is that we’ll see a little sideways action today and tomorrow. Maybe the outlines of a new trading range.

3. I don’t have a plan for this morning other than to watch the action from the sidelines. Basically, I don’t need to be involved in every move. There are a million ways to make money in the market – something ends up catching my attention almost every day.

Check out TLT. Do you have a take on this, Cam?

Bond market is rallying because the Blue Wave thesis is dead. No large fiscal stimulus, slower growth. So bond market rallies.

Thanks.

Banks are selling off hard.

IWM -1%.

The buy-and-hold portfolios are winning today. You really can’t buy into this – and too dangerous to short.

+4% on NDX so far. I guess the market bottomed?

Wholesale slaughter in cannabis names.

Seasonality is bad till 14 workday of Nov – and all two gaps down – 10 days ago are now filled = I sold all longs in SPY.

Nicely done.

Is KWEB breakout too obvious?

Taking another swing at SNAP.

SNAP off.

Best scenario (if looking for an entry) is to see consolidation over the next 1-2 days.

FOMC and unemployment numbers this week.

Right. There may be a reaction against which to trade in about ninety minutes.

Election uncertainty may also provide a little volatility.

But right now it’s just a grind higher than IMO can’t be traded.

unbelievable melt up today. i see resistance up at 3510, if asked this morning i would have said no way we get there today, but all bets are off. maybe we clip it and come back and consolidate before taking off again? The problem is where we do go back to for a good entry point? 3440 was last resistance, which is still pretty rich. This is the upside risk scenario i was worried about, but that was based on the ‘clean sweep’ we didn’t get. It seems the clean sweep wasn’t needed – was it just worry over chaos in the streets and with things being calm today it was off to the races? I might trim some positions over 3500, but would expect to buy back in quickly for a ride up to ~3700. Still some wildcards in the election that might spook us back down to a better entry point, but this entire week has just been incredibly bullish from a price action perspective.

Successful trading comes to understanding our own psychology and managing our emotions. At least it’s quite true for me.

Here’s how I’m handling things today (and I definitely consider the process of handling my emotional reactions to be of paramount importance – more important than any technical or fundamental analysis).

Generally, it takes the form of juggling the numbers in a way that provides more perspective.

1. I was able to sidestep the decline(s) that began September 2. So September 2 provides one reasonable starting point.

2. Most of my trades were made beginning ~the September 25 lows. Another reference point.

3. Since September 25, I’m up +5.2%. Versus a +5.8% gain for SPY. So I’m a little behind, but (a) I was never fully invested, and (b) until this morning, SPY was only up +2.3%!

4. More importantly, relative to the YTD high for SPY on September 2, I’m still up +5.2%, whereas SPY is down -3.6%.

So whether I’m ahead of or behind SPY is a matter of perspective. I prefer the one above, as it allows me to look for a reentry point with the least amount of emotional baggage.

To be honest I also assess dark pools activity. As of yesterday it was 41,1 – as an entry point I have 45. Sell is for me under 40. Looking forward to see todays market.

Any way you cut it, I can’t come up with a reason to have bought into Day 3 of a three-day rally.

I narrowed my focus today to trading just two stocks – SNAP and NIO. Not for spectacular gains, but enough to jack things up by about 0.1%. It doesn’t sound like much compared to the 2-3% I left on the table, but the impact is significant – like the little things that go your way on an otherwise bad day.