The latest signals of each model are as follows:

- Ultimate market timing model: Sell equities

- Trend Model signal: Neutral

- Trading model: Bearish

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real-time here.

The stealthy hostage taker

For several months, the market has been gripped by a stealth hostage crisis. The uncertainty of a contested election has gripped the market, and risk premiums have spiked as a result.

The fever seems to be partially fading. Google searches for “contested election” have fallen dramatically.

I have also been monitoring option market’s implied volatility (IV) since late September. For much of this period, IV spiked just after the election, and remained elevated into mid-December and beyond.

These unusual option market conditions have created confusion among traders, which can lead to erroneous interpretations of market sentiment.

Explaining the option market anomaly

The best explanation of current option market conditions can be found in a

Bloomberg podcast with volatility arbitrage trader Kris Sidial, co-founder and VP at Ambrus Group. Sidial explained that institutions had become wary of election event risk, and they have largely hedged using volatility derivatives. Since the market is almost fully hedged, it is difficult to envisage a volatility spike in November.

The entire podcast is well worth listening to in its entirety, but what Sidial left unsaid is worth exploring, and can create sources of confusion for technical analysts. First, the trading of volatility derivatives is not for amateurs and should be left to professionals with a thorough understanding of option math. What Sidial addressed is the institutional market. As the chart below shows, the index volume spike (grey line) shows the hedging activity of institutional investors. However, there has been a surge in single stop call option trading (orange line), which is mainly the province of retail traders.

We can see the divergence in activity between institutional and retail participants in the option market by analyzing the index put/call ratio (CPCI), which is mainly used by institutions, and equity-only put/call ratio, which is used by retail traders. First, the 50 day moving average of the put/call ratio (top panel) is near historical lows, which indicates complacency. In addition, CPCI (red line, bottom panel) is high, indicating institutional nervousness, while CPCE (blue line, bottom panel) is low, indicating retail bullishness. In the past, such high spreads between CPCI and CPCE has resolved with either market pullbacks or sideways consolidations.

What about Sidial’s remarks that a further volatility spike is unlikely because most players are already hedged? That comment has to be taken in the context that he is a volatility trader. While volatility is unlikely to surge, he was silent on the prices of the underlying stocks, or the market. It is entirely possible for the market to correct while the VIX shows little or no upside movement.

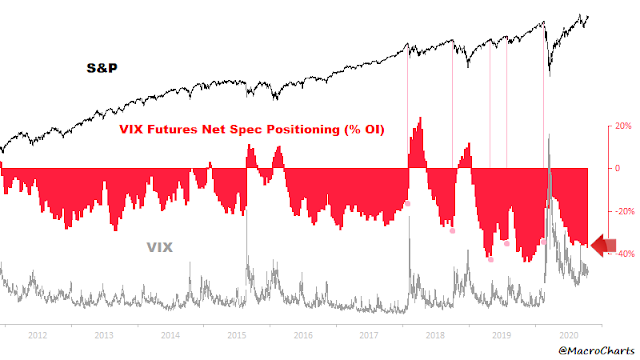

Another possible misinterpretation of current market conditions can be found in the analysis of VIX futures positioning. The blogger

Macro Charts observed that large speculators have a crowded short in VIX futures. The conventional contrarian interpretation is the market is poised for a spike in volatility, and an abrupt decline in stock prices. As I have already pointed out, IV spikes just after the election, and remains elevated soon after. Traders are therefore taking advantage of the steeply upwards sloping term structure to sell volatility, and that trade makes sense from a mean reversion perspective.

Elevated expectations

Current conditions make me mildly bearish on the equity market. Expectations of a Democrat sweep of the White House, the Senate, and the House of Representatives are high. Such an outcome would facilitate the passage of a large and significant fiscal stimulus bill, which would be equity bullish. However, odds of a sweep have been in retreat recently. The market is unlikely to react well to the prospect of a divided government, as it will make the passage of fiscal relief far more difficult.

Much has to go right on Election Night for the bullish scenario to materialize. Any hint of uncertainty, or a contested election, would spark a risk-off sell-off.

What to watch for on Election Night

The election represents a significant event risk to traders and investors. It is impossible to know what will happen. I have detailed the likely effects of either a Biden or a Trump win (see

How to trade the election), but that analysis was based on the assumption of a clean sweep by either party. In all likelihood, the Democrats will retain control of the House. This election is mainly about control of the White House and Senate. Here is what I will be watching on Election Night.

Early in-person and mail-in voting levels are very high in light of the pandemic. Astonishingly, the early turnout in Texas is about three-quarters of the total votes cast in 2016, and Texas is a state that has highly restrictive mail-in voting. Other states that have reported early voting at over 50% of their 2016 total are Vermont, Montana, New Jersey, North Carolina, New Mexico, and Florida.

The two key early states to watch are Florida and North Carolina. Despite the controversy over mail-in voting. Florida has strong systems in place to count early mail-in votes because it is the home to many seniors, who historically have used that method to vote. Florida processes mail-in votes 22 days before Election Day, and a preliminary count should be immediately available on Election Night. North Carolina has reported an early turnout of over 50% of 2016 total votes cast, and it expects that 80% of the votes cast will be counted by the time the polls close at 7:30pm. By contrast, other battleground states like Pennsylvania does not begin to count early voting and mail-in ballots until the polls close, and results from that state are likely to be delayed.

The

WSJ has a useful article on the paths to victory for each candidate. Florida, with its 29 electoral votes, is a must-win state for Trump. If Biden were to score a decisive victory in Florida, the odds of a Trump re-election becomes extremely slim. If Biden were to win both Florida and North Carolina, he is more or less assured of being the next occupant of the White House.

Even if Biden were to score a decisive victory, the bulls are not out of the woods until control of the Senate is determined. Currently, the Republicans hold 53 Senate seats to 47 for the Democrats. Assuming that Biden wins, the Democrats need to score a net gain of three seats to control the Senate and pass a fiscal relief package. Most pundits expect the Democrats will take the Maine, Colorado, and Arizona seats from the Republicans, but lose the Alabama seat. To control the Senate, the Democrats will need at least one extra seat. The most likely targets are North Carolina and Iowa, with Montana, the two seats in Georgia, and Alaska as outside possibilities. Any other outcome that leaves Republicans in control of the Senate will be regarded as short-term bearish.

In summary, the election represents a significant event risk for the market. All the anxiety could be for nothing, much like Y2K, or we could see any number of surprises that sparks a risk-off episode. Tactically, it may pay to position for a reversal. If the market were to rise in the coming week into the election, a prudent course of action might be to sell ahead of the event, On the other hand, significant market weakness could be construed as a buying opportunity.

On an interim basis, the week ahead will be a test for Big Tech. The NASDAQ 100 is testing both the 50 dma and a relative support trend line.

Q3 earnings season earnings and sales beat rates are above their historical averages, though their pace of beats decelerated from the previous week.

Expectations may be set a little too high. The market has punished earnings misses far more severely than their historical average, though the reward for beats was only in-line.

If the Big Tech stocks were to exhibit more misses, then the NASDAQ 100 is likely to violate its 50 dma, and its rising relative trend line. Even though any possible technology weakness could signal a healthy rotation into value and cyclical stocks, this would also create headwinds for the overall market due to the heavy weightings of Big Tech in the S&P 500.

Stay tuned.

Everyone seems to have their eyes on the US elections but I feel that the market is greatly underestimating this second wave of Covid 19 and Emerging market debt.

Che Kwon Chung, I totally agree about the new wave. Europe has seen a massive, exponential rise in cases from a low start a few months ago. This reveals failures that behavioral scientists not epidemiologists must address. With similar behavior failures in America this winter likely, we will witness a tragic exponential growth from a high level starting point.

The situation in Europe where Covid has grown exponentially to US levels of new daily infections exposes the sad truth and final analysis that liberal, freedom-loving, impatient citizens of Western countries are the problem not political leaders. Leaders can mitigate the effects as they did in Europe but then the behavioral traits of the people’s culture overtakes even good leadership.

I thought as most did that the big difference in Covid outcomes in the East versus West was leadership and preparedness. Now, I see Europe that had it under control totally failing. I see Boris Johnson in the UK go from lose policies to very controlling after he got the Covid and yet Brits don’t listen to him or their own experts.

When the pandemic hit and comparisons to the 1918 Spanish flu were made, I looked at the huge tragic second wave back then and thought, “How could they have been so stupid? We won’t be that dumb not to adjust.” Well, it turns out that it is behavioral instincts that work against us. Those haven’t changed in a hundred years.

This tells me Western countries will have to live with this for a very long time. This is part of the “Grand Reshuffle’ I wrote about yesterday that momentum-style investing strategy will succeed in addressing.

The East have a different culture that in the case of Covid and pandemics in general, do very, very much better. Cinemas in China are at 90% of former capacity where the US is at 5% as an example. Their economy grew almost 5% YOY.

Life in Taiwan is back to normal.

If my momentum work points to Asia outperforming for this new truth, I will follow. I have opinions about politics but I will make money wherever. This could be an area like I said yesterday that the masses of Western investors feel uncomfortable about that silently evolves into a long term trend (or not.)

It is human nature. This is our problem.

The politicians promise and spend.

So we went from money backed by gold, eventually in 71 total fiat…then the people in power continued to print until we are where we are, because everyone wants to avoid pain and so they “kick the can down the road” They will keep doing it until it just does not work anymore.

People get bored at home, don’t listen, get complacent about Covid, I dunno, hopefully the second waves will not be as virulent. We shall see.

FOMO is part of human nature too, as is the hindsight of a missed opportunity, call it “sideliner’s remorse”, but in the long run what kills you is big losses, and in this crazy environment, not losing is most important.

My problem with momentum is figuring out the short term stuff from longer term.

What will work for the next few months of this market may not work later on.

Stay humble if you do well, it is also human nature to feel like geniuses when on a good roll.

If you have a method that works, stick with it , but know that it may not work forever.

Human nature is absolutely a problem. But it also provides many opportunities in the form of behavioral patterns.

Understanding our own psychology, along with the many ways in which it intersects with crowd behavior, is probably one of the most important determinants of investing success.

Ken, I respectfully disagree…for example:

https://www.cdc.gov/nchs/nvss/vsrr/covid19/excess_deaths.htm#dashboard

Fairly clear graphic: https://imgbox.com/jenP8bFB

Words are almost meaningless at this juncture, only mathematics is working.

Ken, The post you made yesterday you said that Canada was providing liquidity. Could you explain how they do this ?

Here, the Fed uses QE, which seems to have a popular outlook of providing money printing, but really doesn’t do that at all. In QE the banks exchange bonds with the Fed for a special credit to their capital accounts. This credit can only be used with the Fed and certainly isn’t money. The net effect of this is to cause a shortage of bonds, which causes bond prices to rise (which is why the banks do it) and interest rates to fall (which is why the Fed does it) enriching bond holders ex nihilo.

But nowhere is money printing involved. M2 is increased, but total monetary base is increased even more and their ratio, proportional to the velocity of money, falls. So, QE is deflationary until it isn’t. I say until it isn’t because there has always been an interest rate low enough to cause people to start borrowing, but we’re not there yet. In the mean time more deflation with each QE.

QE and massive government spending on support payments for a wide range of people and businesses effected by Covid

Hi Che Kwon Chung

Obviously, given my previous comments here I disagree with your covid 19 second wave feelings and the market.

For example, from Sheffield, UK on RTE ONE last week…RTE is mainstream** Irish media: https://www.youtube.com/watch?v=Qgn4B2Iq2cg

An interview with John A. Lee, Retired professor of pathology & former NHS consultant pathologist

**https://www.rte.ie/

They give him some tough questions, which he bats away fairly easy.

I would agree with Cam’s advice ~ positioning for a reversal either way. Just be careful not to get faked out ahead of the real fake-out. 2020’s been full of ’em.

The contours of the election are coming into focus rapidly. Biden win with a slim majority in Senate. Post election, Republicans and Democrats would coalesce around a package. The big items in Pelosi agenda would wait till January. People will get quick relief while States would get it in January. Knowing relief is coming, they can manage the finances in the interim.

Heavy positions in short Vol is not necessarily indicative of a Vol spike!!

So to speak ‘Northstar’ of the market is Fed and fiscal stimulus. If one believes that they will not come through, being long Vol is the game.

Since 1929, stock market returns with one party control vs. split government are roughly the same around 7.5%. That is the path over last 90 years!!

https://www.investech.com/V20I10.pdf

Ken is a big fan of the above group. This was published recently and Investech has allowed circulation of this issue.

Cam

When all is said and done, with all the talk of “stimulus” and bigger stimulus next year, long term equity model remains a sell?

Long term model is a sell until the Trend Model turns bullish

https://www.yahoo.com/finance/news/us-now-seems-pinning-hopes-192341773.html

and stimulus and more stimulus!

I don’t have any opinion regarding election outcomes. My approach is strictly based on math. Even human behaviors can be modeled to good probabilities, with enough data.

Here is what is likely to happen based on math:

1. Hedging options will likely expire worthless. That means there is no extreme market movements.

2. More than 50% chances small investors (always called dumb money) will be right this time, following the trends already happening so far this year. This will create even more chaos going forward in the investing sphere. This is shaping up as the harbinger of water-shed change in investing. Time compression will be amplified, which implies you have to be in the right sectors/stocks. If you are right you will quickly make a lot of money. Otherwise you languish. A lot of decades-old investing techniques and indicators will be quickly obsolete. So observe and adjust.

Observe = watch trend changes and trend reinforcement in other words Momentum-Style investing strategy.

According to NBC and TargetEarly, early FL voting (modeled) results so far indicate a much weaker D adv than most polls suggested (both in lead and youth turnout %). In Tx, given it’s high turnout so far, is surprisingly R.

These TargetEarly modeled results were somewhat accurate in 16 and more accurate in 18, which makes them semi-reliable in my books. The ramification however, is that these early results are not what most polls showed.

Nothing moves in a vacuum. *IF* the TargetEarly FL and TX (even MI and WI) results are accurate, it would mean the elections results would be very surprising for many people, and possibly to the market as well.

I guess we will find out soon.

source on TX/FL election turnout?

I can’t seem to find anything on party affiliation, just overall voter turnout.

https://electproject.github.io/Early-Vote-2020G/index.html

You can find modeled early voting statistics here:

https://targetearly.targetsmart.com/

You can slice and dice by state too. It appears that their “unaffiliated” category is their “error” term so don’t jump to conclusions without paying attention to the level of “unaffiliated” voting.

Here’s the one from NBC (at state level, which again is from target early), you can swap states under “By States”.

https://www.nbcnews.com/politics/2020-elections/wisconsin-results

Take these modeled results with a HUGE block of salt though. In my exp, FL, AZ, NV and TX results are more reliable than other states, especially the mid-west ones (since they don’t reg by party, all results are inferred only).

I use these mostly to check for the Electorate most polls say we *should* see (to check if the most important ingredient of good polls is captured). So far, the fabled “youth voters for Biden” are nowhere to be found. Ie, their overall % is down, not up.

Another thing I look at is, are we seeing the D-R vbm margin most polls say we *should* see (2.5:1 at least). Again, not seeing it other than PA but that’s because no early in person voting.

In TX, early voting turnout has surpassed total 2016 election turnout in some counties. Granted the bar wasn’t very high, but its still worth noting that electoral participation seems to be quite a bit higher.

Reopened positions in EEM/ ASHR/ BAC.

Small XLE.

Reopened NIO.

FXI.

Plan to exit RYGBX (Rydex long bond) at the close.

Taking another swing at SNAP.

Reopening a downsized position in RYSPX at the 730 window.

SPX undercuts 3400. It needs to close above 3400 for me to remain bullish.

So, I hear about “factor” investing, “rotations into the right sector” “momentum investing”. I have been hearing about these for the better part part of last two decades.

Please show me evidence that these strategies have beaten the market (S&P 500).

Cam’s models seem like a step in the right direction. Thanks.

https://www.wsj.com/articles/SB10001424052702303851804579560170046544420

I have a folder in which I keep Newspaper cuttings like the above. These are some of the few that have delivered above market returns, but please study their methodology.

Of the above, only Bob Brinker and Investech have delivered with lower risk. That said, Brinker was in the market circa 2008 and never cut back on stock market exposure. He missed the boat in 2009 and advised clients to start buying when S&P was around 1400. The rest is history. To Brinker’s credit, he was fully in cash in March 2000, just before the bear market started.

Investech on the other hand, SO FAR, have been successful in cutting stock market exposure before Bear markets. Their methodology is to pull money into cash side of the ledger before mega losses accrue. This was the same for Bob Brinker, but he missed the call in 2008.

Cam, to his credit is trying the same approach, the way I see it.

Ken is a big fan of Investech. Investech has given permission to circulate their Newsletter addressing Stock market performance and elections, which I have posted above, earlier. Cheers.

I do not get paid by Investech nor Bob Brinker to write this.

It’s all relative, but sometimes relative price movements provide clues. Of the positions opened this morning, the ones in emerging markets and China are faring the best (ie, down the least).

Cam

The hedging of the market using options and futures seems to indicate that such market indicators may not show real fear going forwards. That said, would these prevent large market losses (in excess of 20%)?

Hard to say. As I pointed out, index put/call is high but equity put/call is low. This means institutions have hedged and retail is still bullish. In the past the market faced headwinds. It struggled to rise though a significant correction was not always the outcome.

TLT +1.13% and acting as a nice hedge this morning.

The market recovery from the bottom of March 2020 was very steep, much steeper than circa 2009. Barring a stimulus, I would like to think that the decline, if any, from here on, may also be very steep.

I have just sold all short position with a loss and enter small long position on SPX.

From seasonality perspective is the last week in Oct. the most positive except Christmass time.

What you have written is generally true. That said, some of the larger market corrections started in October. Last one was Q4 2018.

The selling has been intense, and I think the 100-point decline in the SPX will hold for at least a day or two. In any case, I plan to add to RYSPX end of day (as well as close RYGBX).

Agree. Today so far approx. 90% down day – more down move will most probably be in cards. But one-two day relief rally is more than possible. I am from Czechia – partial lockdown – all countries around has severe problems with Covid – Germany, France, etc. But for the markets nothing new tommorow.

SPX close 3400.97. That’s good enough for me.