With the US election just over two weeks away, it’s time to look past the election and focus on how the economy and markets are likely to behave. Barry Ritholz correctly advised investors in a recent post to check their political beliefs at the door when analyzing markets. Stock prices have done slightly better under Democratic administrations, but the effect is mostly noise in light of the small sample size.

With that in mind, let’s consider the differences in market environment if Trump were to win, compared to a Biden win.

Trump: The known quantity

For the purposes of this analysis, I will assume that one side will have control of the White House and Senate. It’s too difficult to fully assess the many electoral permutations. In light of the current backdrop of anemic growth, a scenario of divided government is bearish for equities, as the risk of an impasse over sorely needed fiscal stimulus is high.

Let’s begin with the scenario of a Trump and Republican win. After nearly four years, Trump is a known quantity. For investors, four more Trump years will mean:

- More tax cuts;

- More business deregulation;

- More trade frictions; and

- More restrictive immigration.

In other words, a Trump win will be friendlier to the suppliers of capital, and less friendly to the suppliers of labor. Trump came into his first term promising a tax cut, and he will undoubtedly follow the standard Republican playbook of proposing a second. The first tax cut boosted S&P 500 earnings by 7-9% on a one-time basis. While it’s difficult to know exactly what would be in the next tax proposal, the suppliers of capital will find the provisions friendly to them.

What Trump giveth, Trump can also taketh away. Trump’s America First philosophy has shown itself to be highly protectionist. Not only has the White House started a trade war with China, but trade friction has also risen with America’s allies, from members of the NAFTA bloc to the European Union to Asian allies.

Despite all of the belligerent rhetoric, the trade war hasn’t been very effective. Simon Rabinovitch at The Economist pointed out that China’s trade surplus with the US has actually risen since Trump took office.

In the meantime, global trade volumes have gone sideways since Trump took office. US policies designed to onshore manufacturing from China have seen only limited success. The Sino-American trade war has mainly shifted supply chains to other Asian low-wage jurisdictions, such as Vietnam.

Over the course of Trump’s term, Fathom Consulting’s China Exposure Index (CEI), which measures the performance of US companies most exposed to China, has been falling. A falling CEI indicates that companies with the highest China exposure are underperforming the market.

I would be remiss without a word on immigration policy. While the market mostly regards this issue as largely irrelevant, more restrictive immigration, and especially skilled immigration, can create a drag on an economy’s long-term growth potential. The

Department of Homeland Security recently proposed to limit the terms of student visas to no more than two years in length, though students can apply to extend their stay once their visa expires. This creates a high degree of uncertainty for foreign students. Notwithstanding the fact that many universities depend on foreign student tuition for their funding, this proposal has a chilling effect on overseas scholars. What aspiring researcher would commit to a Masters, Ph.D., or post-doc program with short visa windows without assurances that the visas would be renewed? According to

Nikkei Asia:

A comparison of 53 high-income economies’ share of immigrants and gross domestic product per capita shows a trend in which GDP per capita is higher where there is a higher proportion of immigrants.

The International Monetary Fund in April published a study that said “a one percentage point increase in the inflow of immigrants relative to total employment increases [economic] output by almost one percent by the fifth year.” Having a more diverse workforce makes an economy more robust, according to the IMF.

Biden: The pragmatist

While the economic path of four more years of Trump is well known because of his track record, the details of Biden’s policies are less clear. However, we can expect a philosophical approach that is the complete opposite of Trump.

- Higher taxes on corporations and wealthy individuals, who are the main providers of capital;

- More re-distributive policies aimed at reducing income and wealth inequality by favoring Main Street over Wall Street;

- Reversal of Trump era deregulations; and

- A less confrontational trade and foreign policy, and rebuilding global institutions like the WTO and NATO.

Despite the rhetoric about a lurch towards socialism, analysis from

The Economist concluded that Biden will govern as a centrist and pragmatist on economic policy. While the immediate priority will be to pass a stimulus bill in the order of $2T to $3T, a Biden White House is unlikely to pursue the spending policies advocated by the left-wing of the Party, like those of Bernie Sanders Elizabeth Warren, or Alexandria Ocasio-Cortez. Biden’s tax proposal will fall mainly on the top 1%.

While Trump’s tax cuts raised S&P 500 earnings by 7-9%, the

WSJ reported that BoA estimates the Biden corporate tax plan will unwind those increases. The heaviest burden will fall on technology companies.

Democratic presidential nominee Joe Biden has proposed raising the corporate tax rate to 28% from 21%, imposing a new minimum tax on U.S. companies and increasing taxes on foreign income of many U.S.-based multinationals, among other plans.

Together, the tax proposals would reduce expected earnings among companies in the S&P 500 by 9.2%, according to estimates from BofA Global Research. The effects would especially hit technology companies.

In the short run, the market appears to be unfazed by the prospect of a Biden win.

Bloomberg reported that “A Clear-Cut Biden Win Is Emerging as a Bull Case for Stocks”, largely owing to the prospect of the enactment of a large fiscal stimulus package. The Democratic propensity towards redistribution is likely to put more money in the hands of lower-income consumers, who have a higher propensity to spend and boost economic growth.

What about the long-run effects? Kyle Pomerleau at the conservative think tank the American Enterprise Institute analyzed the effects of Biden’s tax proposal. Here are his key findings [emphasis added]:

- Using the Tax-Calculator (3.0.0) microsimulation model, we [the AEI] estimate that Joe Biden’s proposals would raise federal revenue by $2.8 trillion over the next decade (2021–30).

- The majority of new federal revenue would come from businesses and corporations ($1.9 trillion). The remaining revenue would come from individual income and payroll tax increases ($616.8 billion) and an increase in estate and gift taxes ($276.4 billion).

- In 2021, Biden’s proposals would increase taxes, on average, for the top 5 percent of households and reduce taxes on households in the bottom 95 percent. In 2030, Biden’s proposals would increase taxes, on average, for households at every income level, but tax increases would primarily fall on the top 1 percent of income earners.

- Using the open-source OG-USA (0.6.2) model, we estimate that Biden’s proposals would reduce gross domestic product (GDP) by 0.16 percent over the next decade, slightly increase GDP the second decade (0.19 percent), and result in a small reduction in GDP in the long run (0.18 percent).

The AEI estimates that the long-run effects of Biden’s tax policies on GDP growth over the next decade is -0.16%, and +0.19% for the following decade. Does anyone really believe economic forecasting models are that accurate? In other words, it’s really just a rounding error.

Here are the key differences between a Trump and Biden Presidency. The first-order effects of a Trump win (lower taxes, less regulation) are equity friendly, while the second-order effects (protectionism) are equity unfriendly. By contrast, the first-order effects of a Biden win are equity unfriendly (higher taxes), but the second-order effects (broader growth from inequality reduction that boosts Main Street) are growth-friendly.

While it is difficult to estimate the exact magnitude of the market-friendly and unfriendly factors, we can be fairly sure that a Biden win would represent a more favorable environment for value over growth stocks. The Biden tax proposals would hit technology stocks harder. Moreover, Congress is already scrutinizing large-cap technology companies through an antitrust lens. If the mood shifts toward re-regulation, the business models of these companies will come under greater pressure.

Another reason that favors value over growth is the behavior of stocks under differing economic growth regimes. Imagine a scenario where Congress passes a large stimulus that boosts spending in 2021, and one or more workable vaccine become available some time next year, regardless of who wins the election. The economic growth outlook improves, and the yield curve steepens accordingly.

A recent

Federal Reserve study analyzed the returns of different stocks using dividend futures. Stocks with high duration have been outperforming in the 2020 low-growth environment, while low duration stocks have lagged. As a reminder, growth stocks tend to pay no or little dividends, and have high duration, or interest rate sensitivity, while value stocks tend to have higher dividend yields, and therefore have low duration characteristics. A better growth outlook would see a reversal of that trend, and value would revive and beat growth.

In other words, investors pile into growth stocks when growth is scarce. They rotate out of growth into value when economic growth recovers. However, there is an important caveat to that forecast. Bank and financial stocks make up a significant weighting in value indices, and banks are likely to face regulatory headwinds should Democrats win the election.

Market expectations and positioning

In recent weeks, Wall Street strategists have begun to pivot to a Biden sweep being equity bullish because of the likelihood of a large stimulus bill. However, the market remains jittery over the prospect of a contested election. The latest BoA Global Fund Manager Survey showed that a contested election is the second-highest perceived tail-risk for the market, behind COVID-19. Most managers expect a contested election, and such an outcome would be the cause of maximum market volatility.

The option market’s pricing of risk reflects the market’s nervousness. While implied volatility has risen and fallen, its term structure shows that volatility spikes just after the November 3 election, and remains elevated into 2021.

Looking longer term past any possible electoral disputes, managers believe the global economy is in an early cycle phase and recovering. Therefore they are taking on more risk in their portfolios to position for a recovery. I would concur with that assessment and any volatility induced sell-off should be regarded as an opportunity to buy.

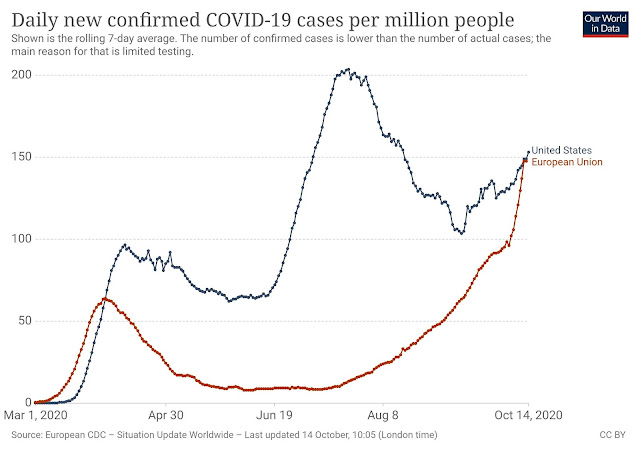

There are, however, several key risks to this bullish scenario. First, a second wave of COVID-19 is emerging, especially in Europe, and any lack of progress against the virus could be the catalyst for a double-dip recession. In addition, a coronavirus relief bill may not be passed until February, especially if the Democrats sweep the election, which could be too little too late to save the economy from another slowdown.

Of course, there is always the possibility of divided government, where one party controls the White House, and the other controls one or both chambers of Congress. Under that scenario, the risk of an impasse on spending when a fiscal boost is much needed is high, which creates a dysfunctional spiral of austerity which plunges the economy into a second recession becomes a real possibility.

In conclusion, here are my main takeaways from the analysis of the effects of the election.

- A Republican sweep would translate to an environment friendly to the suppliers of capital, and a less friendly environment to the suppliers of labor.

- A Democratic sweep would mean a less friendly environment for the suppliers of capital, but a friendlier environment for the suppliers of labor.

- Neither is expected to be extremely equity bullish or bearish.

- While I expect that value would outperform growth as an economic recovery proceeds in 2021, a Biden win would be more conducive to value.

nice summary.

This is a great find by one of Hulbert’s readers:

https://www.marketwatch.com/story/you-may-be-able-to-nearly-triple-your-return-with-us-treasurys-2020-10-16?mod=mark-hulbert

Kind of like building your own deferred annuity.

More from Hulbert-

https://www.marketwatch.com/story/more-good-news-for-the-us-market-investors-are-avoiding-stock-funds-and-etfs-2020-10-14?mod=mark-hulbert

On the other hand-

https://www.marketwatch.com/story/stock-market-weakness-is-likely-to-persist-as-extreme-bullishness-fades-2020-10-15?mod=mark-hulbert

My take (fair disclosure – currently ~30% long) based solely on Hulbert’s latest two articles-

(a) The Hulbert Sentiment Index pulled back about ten percentage points on Friday. In the very short term, this may be enough to propel markets higher on Monday, even if only during the morning session.

(b) In the short term, we can expect further weakness.

(c) In the longer term (ie, through year end), markets should move higher.

Plan A then becomes-

(a) Sell (as opposed to add) into Monday strength.

(b) Buy back on declines during the week – with an eye on a longer time horizon.

https://www.barrons.com/articles/if-biden-wins-experts-expect-to-see-the-first-u-s-woman-treasury-secretary-51602943712?siteid=yhoof2

Elizabeth Warren or Lael Brainard are names that have been floated.

So few comments today tells me everyone is just holding their breathe until November 3.

Simple truth is election trumps everything else!

Does anyone know what the black line kink for the ATM vol graph is getting at? Seems to be something happening mid March?