I received considerable feedback from last week’s publication (see How to outperform by 50-250% over 2-3 years), mostly related to gold and energy stocks.

In last week’s analysis, I had lumped these groups in with other cyclicals. Examining them further, I conclude that both gold and energy stocks have bright futures over the next 2–3 years. I estimate that gold prices could beat US large-cap growth stocks by about 100% over this period, and I would favor bullion over gold stocks. The upside target for energy stocks is a little bit tricky owing to their declining fundamentals and falling demand from ESG investing. The upside relative performance target is wider at 25–300% for this sector.

A New Commodity Supercycle

Both gold and oil are major commodities, and we may be seeing the start of a new commodity bull and supercycle for the next 10 years.

Commodity prices are very washed-out relative to stock prices. There is little or no institutional memory of what to do if inflation heats up. The last secular commodity bull began in the 1970’s, and there are hardly any portfolio managers working today who remember that era, and how to respond and position portfolios.

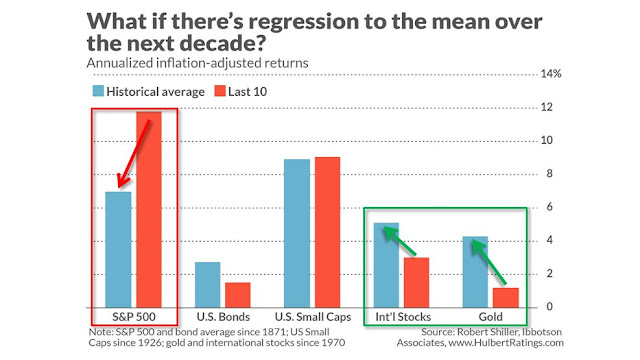

Here’s why investors should expect below-average returns over the next decade: the historical data exhibit a strong reversal tendency. To show this, I calculated a statistic known as the correlation coefficient, which would be 1.0 if the best trailing decade returns were correlated with the best subsequent decade returns, and so on down the line. The coefficient would have been minus 1.0 if the best trailing returns were correlated with the worst subsequent returns, and so on, while a coefficient of zero would mean there is no detectable relationship between the two.

When focusing on all months since 1881 in Shiller’s database, I calculated this coefficient to be minus 0.35, which is strongly significant at the 95% confidence level that statisticians often use when assessing whether a pattern is genuine.

At a minimum, it would be no surprise to see commodity prices rise as the global economic recovery gains strength as the COVID pandemic fades.

China has been a voracious consumer of commodities and the locomotive of global growth. Its November Caixin PMI, which measures the activity of smaller firms, has roared ahead to a decade high. This is supportive of a surge in commodity demand from the Middle Kingdom.

That brings us to the story of gold, which is traditionally viewed as an inflation hedge. Today, a combination of easy central bank policy determined to raise inflation and easy to neutral fiscal policy is likely to ignite a round of asset price inflation.

Indeed, inflationary expectations as measured by the 5×5 forward rate are rising. In response, the trade-weighted dollar (inverted scale) is falling. While inflationary expectations are still relatively tame at 1.9%, these readings nevertheless are signaling a rising inflation regime.

I expect that commodity prices will outpace the S&P 500 in the next few years. The chart below depicts gold prices, the CRB Index, and the ratios of the S&P 500 to gold and to the CRB. In particular, the S&P 500 to gold ratio is an especially sensitive barometer of commodity price strength. The bottom panel shows that we are undergoing a period of falling S&P 500/gold, which is reminiscent of the mid-1990’s and the post-GFC period when the economy was in expansion and commodities outperformed stocks.

Asset managers are catching on to this new commodity reflation trend. The BoA Global Fund Manager Survey shows fund manager weights in commodities began rising just as the S&P 500 to gold ratio started falling. Commodity weights are not excessive, and they have more room to run should inflationary and growth expectations rise further.

From a technical perspective, gold prices staged an upside breakout from a multi-year base. They retreated below the breakout as a test. One hint of bullish strength comes from inflationary expectations, which broke out of a declining trend line.

Moreover, gold sentiment has fallen to bearish extremes to levels last seen when gold was $1200/oz.

An important caveat for Canadian investors

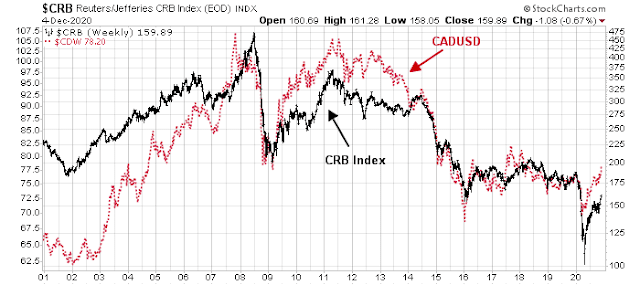

I would like to add an important caveat for Canadian Dollar denominated investors. Commodities are usually priced in USD, but the CADUSD exchange rate has been highly correlated with commodity prices. While CAD denominated investors should still profit during an era of rising commodities, they will face headwinds if their currency exposure is unhedged.

A similar warning applies to investors residing in other countries with high levels of commodity exports, such as Australia and New Zealand.

Oil and gas: The new tobacco

Turning to the energy sector, the fundamentals look terrible. A recent Bloomberg article blared that Peak Oil is upon us, but it’s a Peak Oil of a different sort. The old Peak Oil thesis relied on dwindling global supply and the inability of producers to meet demand. Today’s Peak Oil is all about falling demand.

British oil giant BP Plc in September made an extraordinary call: Humanity’s thirst for oil may never again return to prior levels. That would make 2019 the high-water mark in oil history.

BP wasn’t the only one sounding an alarm. While none of the prominent forecasters were quite as bearish, predictions for peak oil started popping up everywhere. Even OPEC, the unflappably bullish cartel of major oil exporters, suddenly acknowledged an end in sight—albeit still two decades away. Taken together these forecasts mark an emerging view that this year’s drop in oil demand isn’t just another crash-and-grow event as seen throughout history. Covid-19 has accelerated long-term trends that are transforming where our energy comes from. Some of those changes will be permanent.

Exxon Mobil Corp. is about to incur the biggest writedown in its modern history as the giant U.S. oil and gas producer reels from this year’s collapse in energy prices.

Exxon — traditionally far more reluctant to cut the book value of its business than other oil majors — on Monday disclosed it will write down North and South American natural gas fields by $17 billion to $20 billion. That could make it the industry’s steepest impairment since BP Plc’s 2010 Gulf of Mexico oil spill that killed 11 workers and fouled the sea for months. Meanwhile, capital spending will be drastically reduced through 2025.

Estimating upside potential

Hi Cam:

Can you please share your thoughts on Bitcoin replacing gold as a share of value? There is a school of thought that it is now the more popular asset class. More so, because in the old days there were only two ways to trade it i.e. the futures or the the physical. Now there is Greyscale Bitcoin Trust (GBTC) that trades millions of shares everyday and has reasonable correlation to the futures.

Another interesting item to note is that the Oil Drilling Sector (XOP) is outperforming the Oil (XLE).

XOP (or OIH) has more leverage in the oil bull cycle to the price of energy. SLB (and Apache) remains the poster child of this group. This relationship is well recognized as you point out.

It is akin to Semi equipment makers (AMAT) to Semis themselves.

Bitcoin remains highly controversial because central governments have never accepted them as a proxy to fiat currency. Time accepted storehouse of value and mechanism of exchange (gold) is a better hedge over the millennia, than Bitcoins and even USD or Euro, IMHO.

I am curious to see if anyone thinks we would see a 5 k $ per oz in gold prices in our lifetime (say in the next 2-3 decades).

Cam

If I had to state the inverse of the last panel of graphs, it seems to me that US large Cap tech is in a bubble, and one needs to cut exposure to this sector.

One way to do this is to increase exposure to RYT (equal weighted tech) and cut exposure to QQQs in a portfolio. That said, unfortunately, broad market indices like SPY, VTI etc. have very high exposure to tech, because of which portfolio construction becomes difficult. Are there broad market indices with reduced weighting in tech??

Bitcoin has no intrinsic value and it is a pure speculative play. The Bitcoin accolades always claim that it functions like gold because there is a finite amount of Bitcoin. Therefore it is an inflation hedge. But that argument makes no sense because there is no barrier to introducing another crypto currency. Just look at 100s of others that are out there and more on the way. Ethereum is gaining value too. Central banks and Facebook will introduce crypto currencies soon. So there is potentially an infinite amount of digital currency. So none of the arguments hold water. Bitcoin might win because it’s an established brand. But then what is it’s competitive advantage long term? I don’t know.

Here is an interesting interview with Paul Tudor Jones and his take on Bitcoin:

https://www.yahoo.com/entertainment/paul-tudor-jones-on-the-markets-and-economy-153243971.html

Jones seems to support my view that Bitcoin is one of many cryptos in competition with each other. This is probably how it will shake out and Bitcoin may win, but there is no guarantee. Gold won because it is the most rare, inert and least industrially useful metal. Can you make a similar argument for bitcoin? I think people will want a digital currency that is the most convenient for day to day use. Maybe bitcoin will be a collector’s item like art. But who knows.

Very good points. I agree with all you have written except one.

“Central banks and Facebook will introduce crypto currencies soon”.

Central banks like the Fed will have digital currency backed by the phull phaith backing of our great American nation which will give this Crypto or digital currency a special place. Visa, MasterCard, Discover, Amex and other such networks will become the cheerleaders of such digital currency. Those Fintech platforms like PayPal (?) who are now backing Bitcoins may find their Bitcoin backing may work against them.

On a bigger stage, USD is already transacted as digital transactions. Swap agreements between Central banks are a pure form of such transactions. International trade transacted in USD is already in the digital $ domain. It may take a while to convert such USD transactions to a retail digital domain, where I belong, but I am sure the US Fed is creating such rules. I can see one day, I pay for my coffee @ Starbux with $coin (In the lingo of Apple phans, these may be called icoins or in the Android world Androcoins; whatever).

Credit card companies are already doing that job, as a $ proxy.

One more thought on this and again there is a lot of uncertainty. On the long run (10-20 years) all crypto assets and digital assets in general are under the threat of quantum computing. Maybe this is an empty threat because quantum computers cannot be easily scaled up, and maybe quantum cryptography will become the norm. But these directions for computation will be so energy intensive it may become impractical. So I have doubts about digital assets in general as “safe” assets. We still haven’t figured out how to teleport physical assets, so at least you can argue that gold may have better long term potential.

I think Bitcoin will be one for the books. It has no intrinsic value. If you consider physics force and acceleration, something with very low mass can accelerate much faster for a given force than one of greater mass. Gold has not performed nearly as well as Bitcoin…why? because it is real. You can get that Goldmoney credit card /more like debit I guess since you put money in for gold and then when you use it, the gold value is used for the purchase.

When the EU and the USA have their own cryptocurrencies, what will happen? Bitcoin will be illegal (you know possible criminal activity), the the funds that have gotten into the space will exit….visualize an elephant getting out of the bathtub and seeing the real water level. If Bitcoin was worth 5 cents 10 years ago, how much is it really worth? Is it the best crypto that all these geeks can come up with? It might go to a million bucks on it’s way to zero, but I will take silver and gold. I prefer silver because it is really really useful, and getting harder to find, but I like gold also for the portability. You cannot make synthetic precious metals like you can do with diamonds. Can someone find a way to get it out of seawater? Maybe

“While CAD denominated investors should still profit during an era of rising commodities, they will face headwinds if their currency exposure is unhedged”.

Cam, for USD holders, would unhedged investments make sense based on the above?

EWC is the Canada market index trading on the NYSE. It is unhedged and gives you a boost when the $US is weak (or drag when $US is strong).

Here is my momentum chart on Canada (all in $US)

https://tmsnrt.rs/2NES0Dh

A new outperformer since the November 9 Vaccine Twist

In the November blog, I highlighted PICK (Global Mining) and XME (U.S. Mines and Metals. PICK is up 17% since then and XME up 12% versus S&P 500 up 2% and Bullion (GLD) down 3% and Gold Miners (GDX) down 6%.

I believe and have said that we are in a Value resurgence post the November 9th Vaccine Super Combined Twist in my Factor research. Commodities will be big winners if that continues. I use momentum to decide which commodity sector to own. That is base metals not gold. Gold is a currency play while base metals are economic. The return to global post-Covid health especially in Asia where there is huge base metals demand will favor PICK and XME. Also, check out the copper/gold ratio that favors copper now bigtime. Here is my momentum chart on PICK. Top is the classic 6 month lookback momentum. Middle chart is momentum leadership from the Vaccine Twist.

https://tmsnrt.rs/2EQCYdB

Note the 6 month momentum was negative until September. Something new and positive happened then.

Here is the same chart on Gold Bullion

https://tmsnrt.rs/32b92yc

Exactly the opposite. 6 month momentum was running very positive and turned negative when PICK was turning positive. Since the Vaccine Twist, gold is failing. Something new and negative is happening.

In my book on momentum, I say that momentum trends persist until the winner fail or the losers start to lead. Gold and Base Metals are classics of trend changes in that regard.

Why would gold be underperforming? Many governments especially China and Europe are exploring cryptocurrency, a gold alternative. Poorer countries (including Russia) needing cash due to Covid economic stress are selling their bullion. Portfolio managers who bought gold as a pandemic hedge and Trump hedge are switching back to stocks as they see a new post-Covid bull market rising.

On oil, I live in oil country and follow it closely. In the May-June huge market runup Oil stocks were huge outperformers. Like now, they were the best subgroup from my May 18 Twist to the June 8 peak. Then they totally crapped out (down 40% when the S&P 500 up a bit). Oil is in global oversupply and politics are toxic and ESG is turning institutions away. In my mind, oil is a trade, real hot potato that could suddenly turn against us.

Base metals, lumber and agriculture (MOO ETF) are my choices. Investors have been exposed to oil/energy and gold news for their investing lifetimes and hardly have witnessed base metals. The price of copper has doubled since March. Think of all the copper, nickel and aluminum in electric cars. Think of metals used in green infrastructure. Think of the new housing boom using metals. Think of Asia growth consuming metals. Mines are long term projects and a metals buying boom won’t lead to more production quickly. It will lead to shortages and high prices. If copper doubles or triples in price, it’s a small cost extra in a Tesla electric car.

Ken, thanks for your insights as always. I definitely agree with your call on base metals re green tailwinds. I’ve also done very well with my lithium bet, ALB.

What’s the thinking behind agriculture and lumber? Is there a way to play lumber in an ETF Thanks!

Lumber no. Just Weyerhauser WY and in Canada, West Fraser Timber WFT.

In inflationary times or even when economic times are just better post-Covid, food prices go up. Farmers can spend more on equipment and fertilizers. China and developing countries buy more of the North American crops, not because of a Trump deal but because their people are eating better and demand more. Maybe peoples habits change and they buy more produce and cook at home. Maybe there is a labor shortage of migrant farm workers so farmers buy more equipment. Maybe climate change reduces arable land and therefore need more fertilizer and advanced equipment. Here is the momentum chart on MOO. (gotta love the stock symbol)

https://tmsnrt.rs/2NFP0qB

Re Lumber reasoning

US new home building is surging as well as renovations to have more work-at-home space. Mortgage interest rates will stay low. Forest fires are reducing supply. Lumber prices have doubled since March.

Thanks Ken. I guess you can add to the lumber demand the move to the suburbs out of the cities. Although, it will be interesting to see if that’s just a temporary phenomena that’ll reverse once the pandemic is behind us.

I do worry about the momentum leading Home Construction ETF that has started failing since the Vaccine Twist. Maybe investors are rethinking the Grand Exodus from cities. Maybe the weakness in long term treasuries that are the basis of low mortgage rates are turning negative. Here is my momentum chart on Home Construction, kind of iffy all of a sudden.

https://tmsnrt.rs/2CbgQFz

Bond yields are rising which is putting a damper on lumber demand

I guess there’s an iShares ETF: $WOOD

and Invesco has one too: $CUT

Thanks. I’ll add them to my momentum list (now over 80)

jyl087, here is the momentum charts on WOOD. Looks fine to me.

https://tmsnrt.rs/3geYtCP

Thanks for the heads up.

Cam, I’ve seen my copper (COPX) stake rocket up 25% in the past couple of months. What’s your medium and long term outlook for copper? Thanks.

Copper should perform well during a cyclical recovery.

Hi Ken,

I also wanted to point out that you had pointed out South Korea sometime back. The leveraged ETF KORU

of the country was up 20.18% this week. Momentum works!!! I have always been big believer. Using Relative Strength and big Volume in an index has always been a profitable strategy. The trick is knowing when to sell.

Congratulations on a good call.

I appreciate that.

Along with a momentum shift from Growth to Value, there is an important shift to Global-ex US especially to Asia. Their markets are going up and the US dollar is falling. Also, foreign market indexes are filled with value stocks whereas US has a big growth company tilt.

I’ve discovered over thirty years of investing/trading that it’s unnecessary (in fact, impossible) to be in everything – the most important key to success is to find and then stick to what works for you.

That said, I agree with everything that both Cam and Ken have pointed to in the past couple of weeks. The SPX was an attractive trading vehicle last summer – it doesn’t feel that way here. I’ve been wrestling with the choice of an alternative vehicle.

(a) VT. The Lazy Boy approach.

(b) A sliding scale approach to VEU/ VTI. For instance, begin with let’s say 70/30 and move to 60/40 as international stocks catcup (or move to 80/20 if they continue to underperform).

(c) Merriman’s 10-ETF approach. A more sophisticated version of the Lazy Boy. I’ve tried it a couple of times in 2020 as a trading vehicle mainly because zero commissions made it easier. However, it’s probably more suited to a long-term portfolio.

(d) A combination of VT or VEU/VTI + lower weightings in sectors that may be poised to outperform. Value. Energy. Financials. Small-caps. Metals.

Superimposed over all of this is a second principle that’s worked well for me – keep it simple. I don’t need to be watching dozens of different indicators every day.

Recently, I’ve switched back and forth between index trades and day trades in small-caps. It’s surprising how well risking just 1-2% of the portfolio in several small trades each day can keep the portfolio abreast of percentage moves in the broader indexes.

So where am I now? Holding a few positions in small-caps over the weekend but otherwise in cash. For instance, currently sitting in a loss on NIO, but one which was eclipsed by selling PLTR/ AYRO at the highs and then reopening end of day at the lows. In essence, I now own all three (along with a few others) at lower basis points. I’m looking for an entry into one of the trading vehicles, but I would prefer to do it on a pullback.

YTD, I’m up about +8%. Trailing both VT and SPX by quite a bit, but given the volatility this year I’m content with my gains on a risk-adjusted basis. I would actually be happy with 8% for the full year (in comparison, I own a couple of 7-month CDs that are paying a little over 1%, and my company’s virtual ‘pension’ plan guarantees what I’ve always thought was a decent 5% annual return).

One of my professors at Michigan once went off-topic for several minutes to advise us on financial basics. ‘Maximize contributions to your 401k. Buy a house as soon as you can. Marry the right person.’ Nothing about trading, despite the fact that it was a finance class. A great example of the KISS principle.

I’m also fully cognizant of the role luck plays. I will probably never forget the 6-7% hit in June after going all-in on June 8 – had I gone all-in on June 11, my YTD gain might be 7% higher. On the other hand, I largely bypassed the -10% decline from the September 2 highs, and then went all-in on September 25. I was also fortuante enough to have captured two of the largest one-day spikes in DJIA history.

There’s always a tradeoff. To guarantee 100% participation in all upside moves, one needs to endure 100% of all downside moves. Personally, I can’t do that. So I’m happy with the middle ground.

Everyone has their own risk tolerance and financial circumstances. All of my investment ideas are observations and not recommendations. As Cam always says, we don’t know your personal situation so can’t recommend.

An important caveat for Canadian investors

I would like to add an important caveat for Canadian Dollar denominated investors. Commodities are usually priced in USD, but the CADUSD exchange rate has been highly correlated with commodity prices. While CAD denominated investors should still profit during an era of rising commodities, they will face headwinds if their currency exposure is unhedged.

A similar warning applies to investors residing in other countries with high levels of commodity exports, such as Australia and New Zealand.

Cam, if your country’s currency is strong, and you are investing domestically, why hedge?

Thanks

One more thought before I go out and enjoy the day (fully masked).

I made many comments today because I see a momentum shift, like an important one, to Value, including commodities. As a Canadian portfolio manager, I know that area well.

Let me offer a statistic that might stick in your mind;

In 1966, the Dow Jones Industrial Index DJII, hit 1000 for the first time. It stayed below that until 1982. Sixteen years sideways.

In the same sixteen years the Canadian stock market index went up five-fold. Our index is filled with inflation-loving companies whereas the US indexes are inflation hating.

Will all this money printing and negative interest rates lead to inflation? Who knows? But momentum reveals what is actually happening rather than what we forecast as we go forward into unprecedented times.

My wife is calling. All the best for now. We are in this together.

RE (fully masked): I’ve switched to one of these, after I smelt my wife’s perfume through my cloth mask and realised I needed greater protection: https://www.vyzrtech.com/products/bio-vyzr 😉

Celebrate the Canadian spirits. Let’s use the great Canadian player Wayne Gretzky’s words: “I skate to where the puck will be.” Use it for the investing, and you will be profiting handsomely. Less short-term trading (more likely be precisely wrong), and more anticipation/patience (more likely be roughly right), and it is proven by math.