Preface: Explaining our market timing models

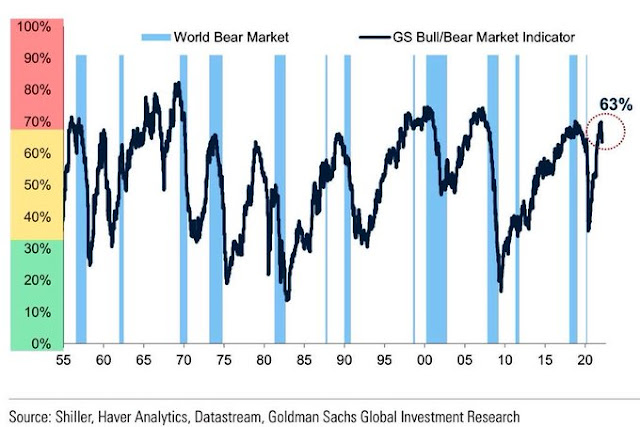

We maintain several market timing models, each with differing time horizons. The “

Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post,

Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The

Trend Asset Allocation Model is an asset allocation model that applies trend following principles based on the inputs of global stock and commodity price. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can bsoe found

here.

My inner trader uses a

trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don’t buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts is updated weekly

here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities

- Trend Model signal: Neutral

- Trading model: Neutral

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real-time here.

Another 200 dma test

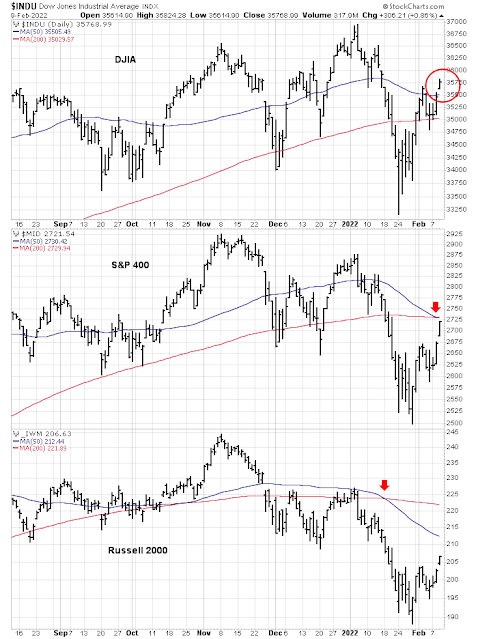

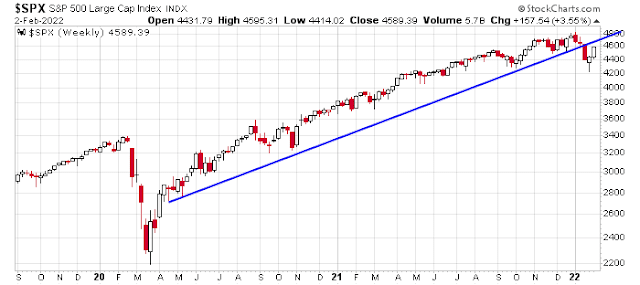

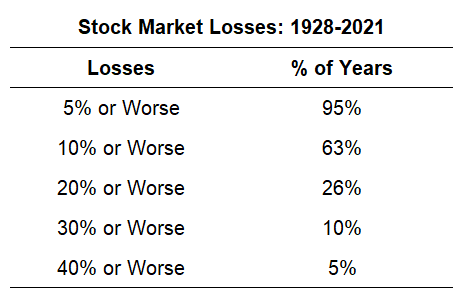

In the wake of the drama that played out in the stock market last week, the S&P 500 weakened to test the 200 dma. Is this just a re-test of the January lows or the start of a new bear leg?

To answer that question, I step outside the realm of pure technical analysis and pose three questions for both bulls and bears.

- What will happen to earnings and earnings expectations in the wake of the hot January CPI report that spooked the market?

- Fed Funds futures are now discounting a half-point liftoff at the March FOMC meeting. Some analysts have even speculated that the Fed may raise by a quarter-point in a surprise inter-meeting move. Will the Fed acquiesce or push back against those expectations?

- If stock prices were to weaken further, how will insiders react?

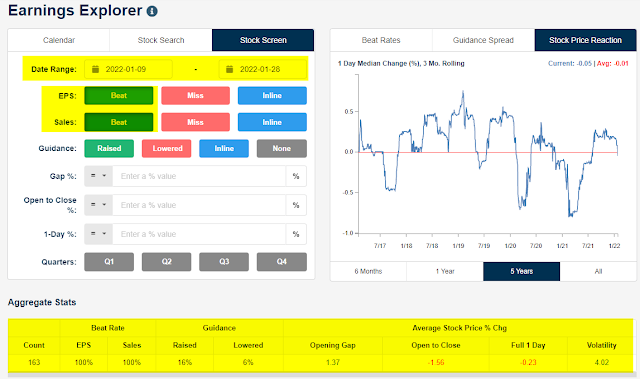

Earnings do the heavy lifting

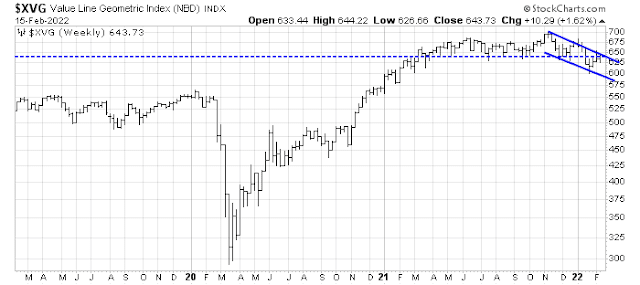

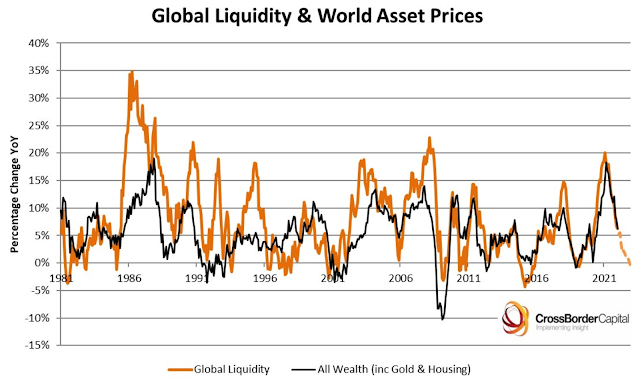

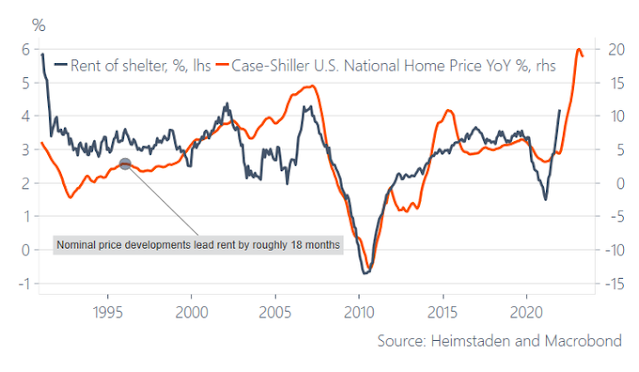

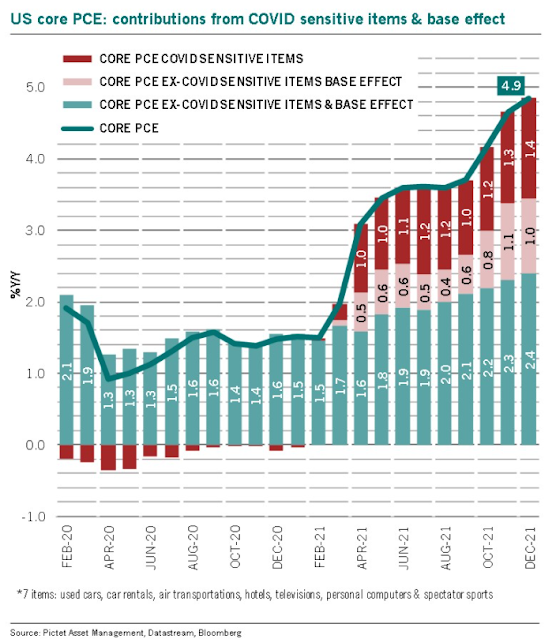

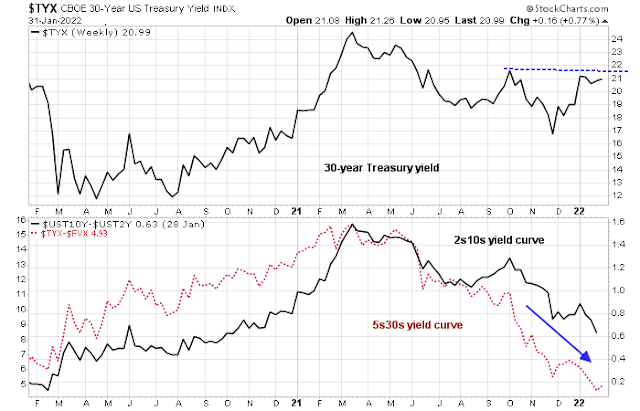

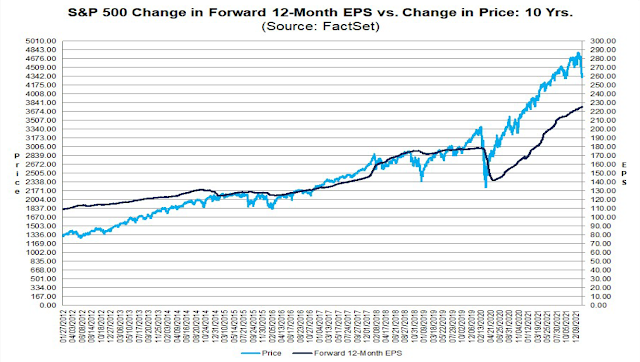

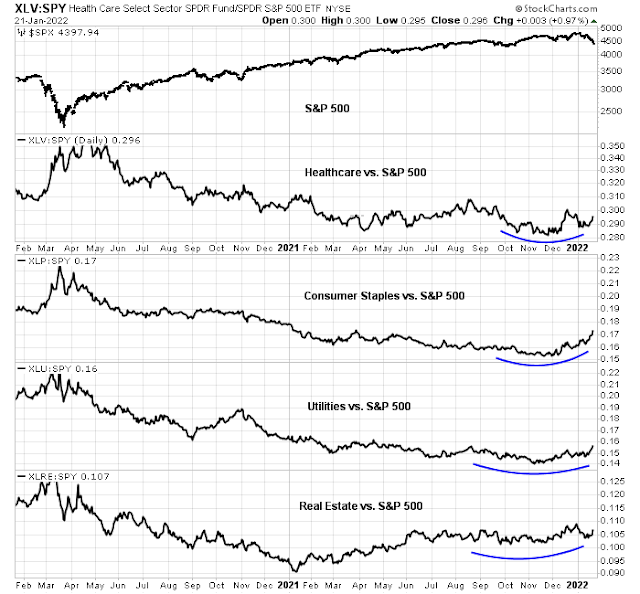

In the wake of increasingly hawkish expectations for Fed policy, bond yields have risen and the yield curve has flattened. Rising yields have consequently put downward pressure on the S&P 500 forward P/E ratio, which has become more reasonable by historical standards.

The historical experience shows that when the Fed first begins to raise rates as the economy strengthens, P/E ratios compress but stock prices can continue to rise. But earnings expectations will have to do all of the heavy lifting. So far, forward 12-month EPS are still rising and Q4 earnings season results have been moderately positive.

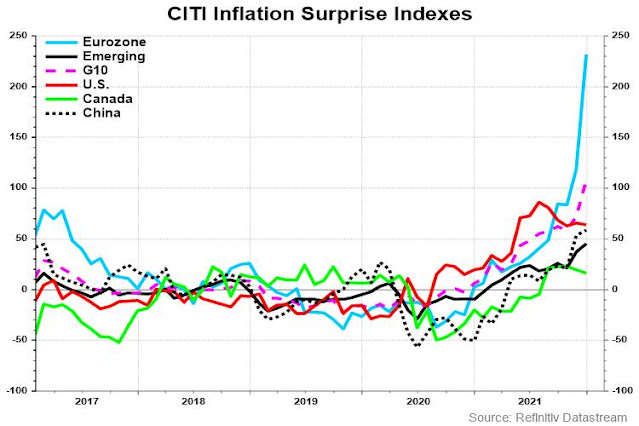

Fed expectations

In reaction to the strong January CPI report, Fed Funds futures are now pricing in a half-point rate hike by the March FOMC meeting.

Leading up to last week’s CPI report, a total of five Fed speakers pushed back on the need for a half-point rate hike in March. Will the Fed push back against the sudden change in expectations? Fed communication policy, which began under the Yellen and possibly even the Bernanke Fed, has shown that it doesn’t like to surprise markets. If future Fedspeak is silent on this subject, it will be a signal that policy makers have decided to acquiesce to the consensus and raise by a half-point in March. On the other hand, Fed speakers could reiterate their go-slow tightening policy in order to dial back market expectations.

The instant reaction is somewhat constructive for risk assets. St. Louis Fed President James Bullard, a well-known hawk, stated that he supports a full point rate increase by the July FOMC meeting. However,

CNBC reported a number of other regional Fed Presidents have pushed back against Bullard’s hawkish view.

Atlanta Fed President Raphael Bostic told CNBC Thursday after the inflation report, “My views have not changed” for three or four rate hikes this year, likely beginning with a 25-basis point hike. That was the same view he gave CNBC on Wednesday before the inflation report…

Richmond Fed President Tom Barkin said in a speech that “I’d have to be convinced” of the need for a 50-basis-point rate hike, saying there may be a time for that, but it did not appear to be now.

San Francisco Fed President Mary Daly said after the inflation report a 50-basis-point hike is “not my preference.”

Stay tuned for more Fedspeak next week. In addition to the schedule shown below, Jerome Powell and Lael Brainard will appear before the Senate for more confirmation hearings.

Will insiders buy?

As forward P/E ratios fall, valuations have become more attractive. While we can argue about valuation until everyone is blue in the face, a more objective test is the behavior of insiders, who are regarded as “smart investors”. When the market hit an air pocket in early January, insiders exhibited net buying activity, which is a bullish signal. The signal faded as stock prices rallied.

A key test is whether insiders will step up and buy if stock prices decline again, which would be a constructive signal for equity prices. A word of warning – insider activity is an inexact market timing indicator. Instead, investors should look for clusters of insider buying as a signal that a long-term bottom is forming, as it did during the GFC.

Insiders were also timely in their purchases during the Greek Crisis of 2011, though the timing wasn’t absolutely precise. In both 2008 and 2011, insider buying rose, which is a more bullish signal than the pattern of insider selling (red line) falling below insider buying (blue line) exhibited recently.

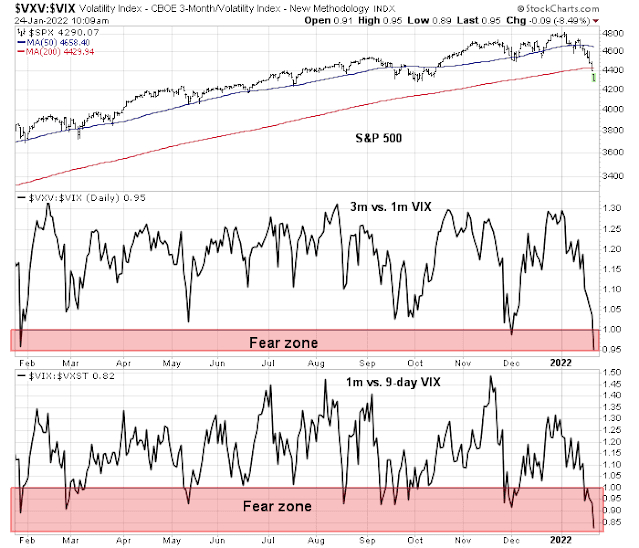

Elevated fear levels

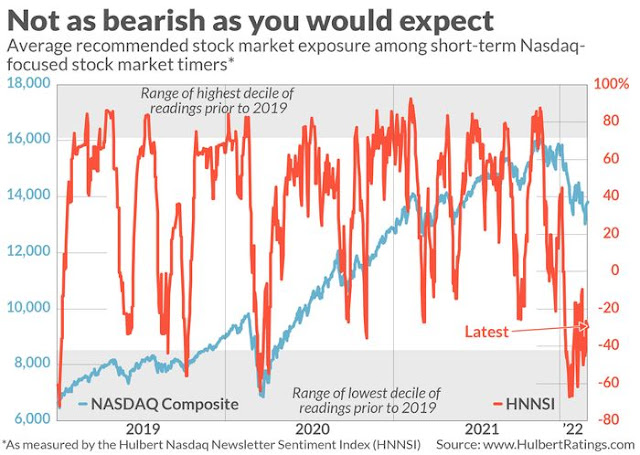

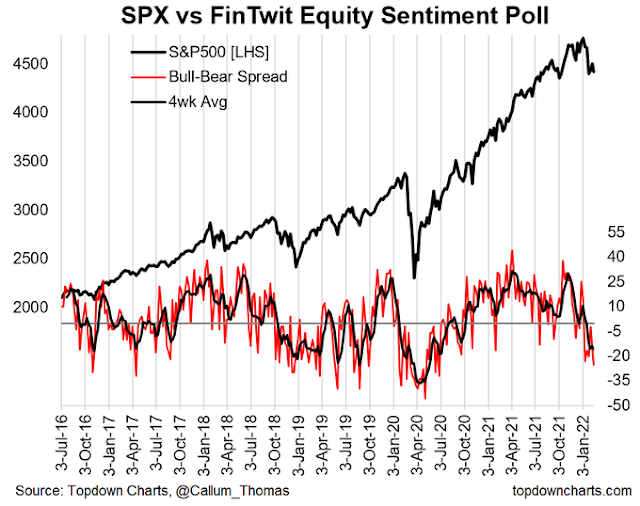

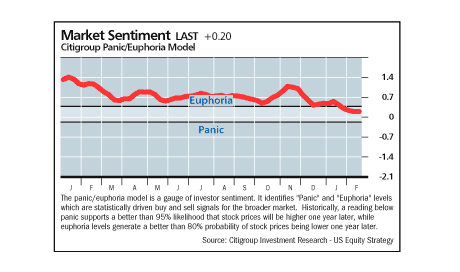

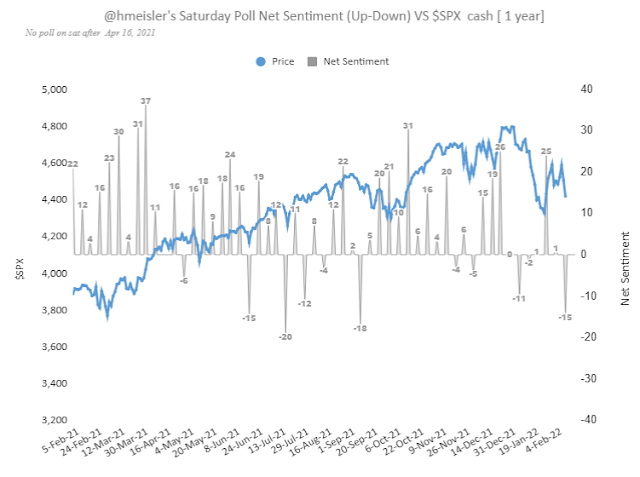

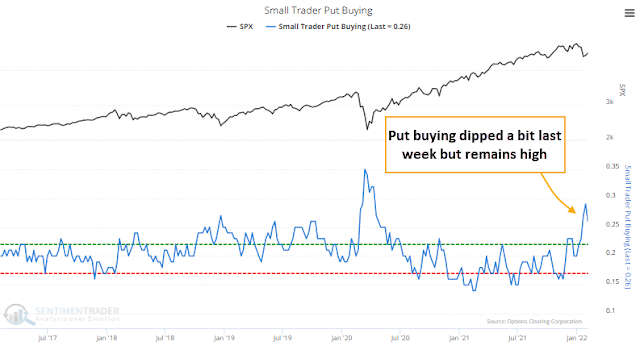

In the short run, some sentiment indicators are showing signs of a fear spike.

Macro Charts pointed out that put optiion buying is high, which is contrarian bullish.

Other option sentiment indicators, such as the term structure of the VIX, hadn’t inverted indicating elevated fear, though readings had briefly undergone inversions Friday afternoon before the close.

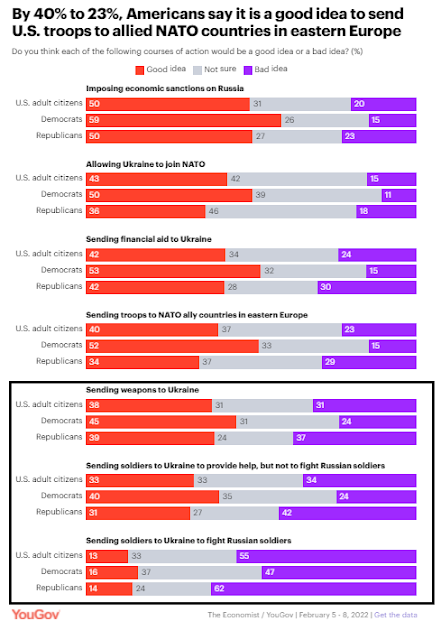

Just because fear levels are elevated doesn’t mean they can’t go higher. Much of the anxiety is attributable to the White House announcement that a Russian invasion of Ukraine is imminent and could begin as soon as Wednesday. Over a dozen countries have told their citizens to leave Ukraine.

I am indebted to Helene Meisler who highlighted the market action during the Iraqi invasion of Kuwait in 1990 as a possible template for the circumstances today. As a reminder, here is a brief history of what happened in 1990 (via

Wikipedia). The dispute began in the wake of the Iran-Iraq war, which left Iraq heavily in debt to Kuwait and strained Iraqi finances. A further fissure appeared when Iraq called for oil price increases to alleviate its cash flow problems, which Kuwait opposed.

Iraq began massing troops on the Kuwaiti border. On July 25, 1990, Saddam Hussein met with American ambassador April Glaspie to discuss the troop buildup, who told him Washington “inspired by the friendship and not by confrontation, does not have an opinion” on the disagreement between Kuwait and Iraq, stating “we have no opinion on the Arab–Arab conflicts”. When questioned later, Glaspie’s response was “we didn’t think he would go that far” meaning invade and annex the whole country”.

The invasion began on August 2, 1990, and Iraqi forces soon overran Kuwait. The S&P 500 began a decline that didn’t bottom out until two months later. Oil prices rose for the next two months, but oil equities, as proxied by XOM, peaked about the time of the invasion.

Here are some key differences between 1990 and 2022. The markets were taken off guard by the invasion. Although Iraqi forces had massed on the border, there was still doubt that hostilities would break out. Market expectations are much different today.

Consider the 2014 experience and the market reaction to the Russian invasion of the Crimean Peninsula. The market had already taken a tumble and did not weaken further as Russian forces crossed the border.

Fast forward to 2022. The Biden administration has adopted a strategy of declassifying and publicizing intelligence about Russian preparations in a manner that’s far more extensive than the public disclosures in 2014. How much of that is already reflected in the markets?

History doesn’t repeat itself, but rhymes. I interpret current conditions as a state of high anxiety over a possible conflict. If geopolitical tensions fade, risk asset prices should rally, particularly when it appears that other Fed officials are pushing back against Bullard’s hawkish views. On the other hand, should a hot war break out, stock prices may see a short and sharp downturn, followed by recovery (see my previous publication

Buy to the sound of cannons).

In conclusion, the S&P 500 is undergoing another test of its 200 dma and some open questions remain. So far, the preliminary answers appear to be tactically constructive for equity prices.