My Trend Asset Allocation Model has performed well by beating a 60/40 benchmark on an out-of-sample basis in the last few years. The early version of the Trend Model relied exclusively on commodity prices for signals of global reflation and deflation. While the inputs have changed to include global equity prices, this nevertheless raises some concerns for equity investors.

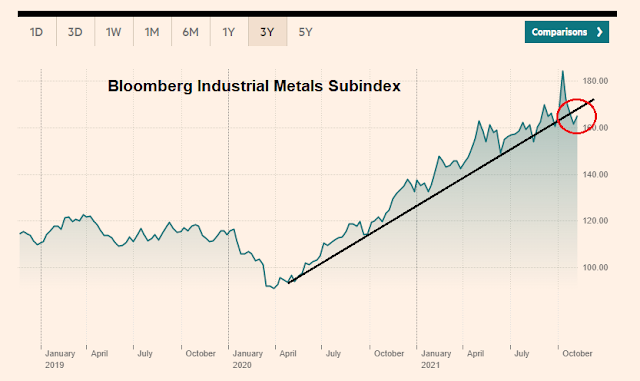

Commodity warnings

Silver linings

For the second week in a row oil has declined, joining shipping costs and all commodities, not just industrial metals, in retreating from highs. Gas prices should follow suit within the next few weeks. Note that the BDI has fallen by more than -50% from a peak just one month ago. This suggests that the supply chain bottleneck has passed its peak. If so, one would expect the huge increases in house and car prices to begin to abate soon.

Indeed, easing commodity prices are likely to put a lid on the inflation hysteria that emerged after the hot October CPI print. Producer prices (red line) have led CPI upwards in recent months and any commodity price weakness will cool off CPI in the near future.

China weakness contained

As China is such a voracious consumer of commodities, I believe commodity weakness is mainly reflective of a slowdown in China whose effects have so far been contained in Asia The relative performance of the stock markets of China and her major Asian trading partners tells the story. All are in relative downtrends compared to the MSCI All-Country World Index (ACWI). Several have broken relative support. Japan rallied on the news of a change in the prime minister, but gave up all of its gains soon afterward.

Within the global materials sector, Chinese material stocks have plunged relative to their global counterparts in recent weeks, indicating greater weakness within the Middle Kingdom in that sector.

On the other hand, the Chinese consumer doesn’t seem to be hurting very much. Alibaba reported a record 540.3 billion yuan in Singles Day sales this year. Moreover, European luxury goods maker LVMH, which derives a substantial amount of its sales in China, is performing in line with other consumer discretionary stocks.

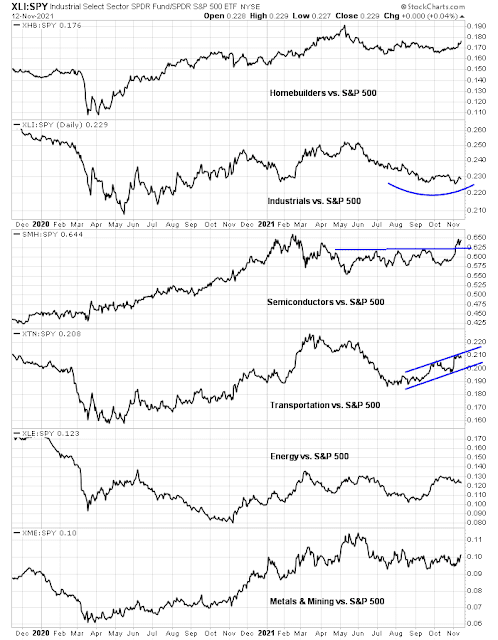

Markets in Europe and the US have mostly shrugged off any weakness coming from China. In the US, the relative performance of key cyclical sectors and industries appears constructive. Some are staging relative breakouts (semiconductors and transportation), others are range-bound (homebuilders, energy, mining), and one is bottoming (industrials).

In Europe, cyclical sectors like industrials and financials are not showing signs of relative weakness. However, basic materials are in a relative downtrend, which is unsurprising in light of a loss of commodity price momentum.

A decoupled China

In conclusion, weak commodity prices are signaling a slowdown in the Chinese economy. Although China Evergrande’s debt woes has not resulted in a Lehman 2.0 event in China, its debt problems have spread to other property developers. Yields on China’s USD junk bonds are soaring and the slowdown is manifesting itself in falling commodity demand.

However, we are seeing few contagion effects and there are some silvering linings to commodity price weakness. First, it should lead to better inflation prints in the coming months and alleviate some of the inflation hysteria gripping the markets. As well, falling commodity prices translate to lower input prices for manufacturers, which should improve operating markets and boost profitability.

Commodity and China weakness only represents a minor pothole in global growth. Topdown Charts recently pointed out that 90% of countries saw their October PMIs in expansion even as China weakened. This is what China decoupling and weakness containment looks like.

October PMI data was particularly encouraging last week. The data show that the proportion of countries with a PMI above 50 reached 90%. Most countries are seeing significant economic growth as the world fights off the final wave of COVID-19 (knock on wood).

I monitor the high yield market to see if there are any signs of economic stress. This is not my area of expertise and I would differ to Cam and Ken to shed more light on this subject. However, in the last week both JNK and USHY which are high yield etfs traded sharply below their 200 Day moving averages. Also, the 20 Day average is below the 50 Day moving average. What it means is that the yield on junk bonds is going up. In the past this was the first sign of a slow down in the economy. We live in strange times and what worked in the past may not be harbinger of things to come. I would watch the QQQs to see if they break down.

You have to adjust the price of JNK to the move in USTs on a duration-equivalent basis. The downdraft in credit is roughly in line with the weakness in the S&P 500.

See https://stockcharts.com/h-sc/ui?s=%24SPX&p=D&yr=0&mn=6&dy=0&id=p48404725516&listNum=1&a=988028301

The junk bonds only went down because interest rates in general went up. Their spread to Treasury yields stayed the same. This maintains their strength and show NO economic stress. Last week Fitch rating agency said high yield defaults would be just 0.08 percent at year end. So the ludicrously low spreads are a winning trade.

Government stimulus is so much that the weakest companies are thriving.

Yes, you need to look at the spreads. $$HYIOAS is one on stock charts I remember it as High Yield Index Of American Stocks, only it’s a spread. I think it’s the same as the Bank of America one you can get from the Fed website. But the mnemonic helps me with remembering the symbol. The problem of course is that the spread can look good until it doesn’t and when it is starting to rise does it mean disaster or a correction? At some point you need to decide to get out, accept you did not sell at the top and also accept that the market can then turn just after you get out just to p#@s you off, because that’s what it does best. But that’s the fear greed thing at work. Other things I look at are the AD lines, and TLT:SPY (which behaves a lot like $$HYIOAS ), only here the signal is basically yields going down more strongly than SPY, in other words why does the spy not go up as strongly as the drop in rates….both of these indicators reflect decreased risk appetite….is it just noise or the real thing?

Unusually volatile week for me in terms of trading. I had opened positions in bond funds the previous Friday based solely on price action that seemed to defy the inflationary scenario. Bonds did in fact run up Monday and Tuesday. As is generally the case, I exited the positions early on Tuesday. However, just as I began to experience (and manage) the usual regret on Wednesday, bonds tumbled midday. After a brief (5-minute) foray into TLT for a modest gain, I then waited for the closing minutes to open two allotments in VT. I again exited early the following day – but hey, it was a decent week. I was able to book gains on bonds earlier in the week and then profit from a shakeout in global equities.

There’s no perfection in trading. For that matter, there’s no perfection in life. Any reader here has done well in life. But looking back several decades, it’s a certainty that much of our successes were due to fortuitous choices/decisions, chance encounters, and even accidental successes. It’s much the same in markets. If someone had told me I would profit from moves in both bonds and stocks this week I would have had a hard time visualizing exactly how that would happen. Which is exactly how the markets operate!

There are some indications that besides the trouble in the bond market, the economic impact on the Chinese consumer is somewhat contained, but we will be getting China retail sales data in just a few hours. Goldman noted last month that the most important aspect to watch for was if the Evergrande projects were being continued and according to reports this is what happened. I still have Mike Wilson’s notes on my watchlist however and he said there will be some “payback in demand” which could result in stock market weakness after thanksgiving. Until then, however, its probably better to focus on positive developments and speculation about a new dovish Fed chair.

Longer term, the “controlled implosion” of Chinas property sector looks like a large scale real-world experiment to keep inflation under control – in this case real state prices – without monetary policy intervention and I wonder if this kind of thinking will find its way into western economic models at some point in the future.

Russell Clark wrote in his final hegdefund letter “US markets are essentially a bet on the Fed unable to raise rates, and congress unable to regulate big tech or raise corporate tax rates. Commodity markets have now become a bet on Chinese policy objectives, and currencies have become a bet on what Chinese policy objectives are too.”

In fact Fed is indeed not able to raise rates much in the future, with its balance sheets ballooning and US population aging fast. This will exacerbate the wealth inequality even more. Rich people and investor class in reality rely on peasants continuing to work to sustain their investments’ worth. Eventually it has to have a reset.

This pandemic is already showing the beginning of what the future will look like. In China the lying-flat mentality is spreading through every layer of the society, because the system is hopeless. Putin thinks in 20 years China will become one of the poorest countries. In US, lying flat will gain momentum. Voila! The system is also increasingly hopeless. Since people today are whimpy and soft, they don’t have stomach for revolution of the blood-shed type. So passive resistance is the type of choice.

I think human beings will just be rotting away if the current trend persists.