Mid-week market update: Volatility indexes are flashing a number of signals of interest. In the past few weeks, a yawning gap has opened out between MOVE, which measures bond volatility, and VIX, which measures equity volatility. The divergence has begun to close in the last couple of days as the VIX has risen and the spread has narrowed.

Another cautionary signal from vol is appearing in the form of an increased 5-day correlation between the S&P 500 and VIX, and VVIX, which is the volatility of the VIX. In the past, spikes in correlation has seen stocks either pause their advance or pull back. In particular, high correlations with VVIX have been more effective as short-term warnings than VIX correlations.

Does that mean the S&P 500 is at risk of a significant downdraft? Not so fast. A third volatility indicator suggests that downside risk is limited. Even as the S&P 500 weakened, the VIX Index has spiked above its upper Bollinger Band (BB), which is an oversold reading for the market. In the past, such events have marked indicating positive risk/reward for the bulls over a 3-5 day time horizon.

The stock market is roughly following its seasonal pattern. If the past is any guide, stock prices should pause its advance about now, which would be followed by a resumption of a rally into year-end.

In other words, the seasonal melt-up that I have been calling for remains intact.

Opportunities in gold

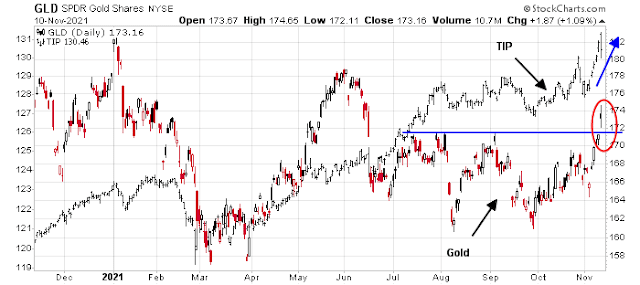

On a different topic, the October CPI print came in hot this morning. Both headline and core CPI came in well ahead of expectations. The strong CPI report highlights a tactical opportunity in gold and gold mining stocks. Gold, which is viewed as an inflation hedge vehicle, staged a decisive upside breakout through resistance today and its strength had already been signaled by the rally in TIPs prices.

In addition, the gold miners have also staged an upside liftoff from a support zone. The improvement had been signaled by a bottom in the percentage bullish indicator, which had recycled from an oversold condition. Gold miner strength has also been confirmed by the miner/gold ratio and the high-beta junior/senior gold ratio (GDXJ/GDX).

Disclosure: Long SPXL

The situation in the Chinese High Yield Bond market has gone from bad to chaotic. The ICE High Yield Corporate China Issuers Index has fallen 22% from the beginning of October and 35% from mid-July. It is an ugly chart that shows a rather stable index until July and then falling off a cliff.

In US bear markets I watch the high yield (especially CCC) spreads. They bottom when the stock market makes its final low. Going forward from the stock index low, the high yield spread falls as economic stress is relieved. It is a great indicator of stress.

The China High Yield Index has not found a low. It is straight down now.

All this to say I would not touch the Chinese market or the East Asia region with a ten foot bamboo pole until the high yield index bottoms.

This is the second largest economy in the world. Instability there can be a boost to gold as an alternative, safe asset.

Right now the US dollar is in a rally mode as inflation looks to raise interest rates in America sooner. This is normally bad for gold. But within a week, I expect Brainard will be appointed Fed Chair. Expect swift filling of empty Fed vacant seats by Biden. It will be a MMT cheerleading team that will have people fearing easy money policies that will hurt the long term US dollar outlook. Again, good, no great, for gold.

The Chinese economic stress as shown by the collapsing high yield index has negative implications for industrial metals and possibly even oil.

I was in the midst of rereading Cam’s November 3 post (‘A no-surprise Federal Reserve’) looking for clues to the bond market when TLT underwent a violent selloff. I took advantage of the reaction, and in doing so all of my subsequent real-time posts on Wednesday ended up beneath the November post.

For the sake of continuity (as I intend to either close or add to several positions this morning), I’m reposting the comments here.

rxchen2 says:

November 10, 2021 at 10:08 am

Opening a position in TLT here.

Reply

rxchen2 says:

November 10, 2021 at 10:11 am

And closing here ~147.7x. (Opened ~147.3x).

Reply

rxchen2 says:

November 10, 2021 at 12:42 pm

Scaling into VT ~107.8x.

Reply

rxchen2 says:

November 10, 2021 at 12:53 pm

Adding a few flyers in NIO/ QS/ LCID/ CGC.

Reply

rxchen2 says:

November 10, 2021 at 12:56 pm

Adding a second allocation to VT.

Reply

rxchen2 says:

November 10, 2021 at 1:08 pm

Is a pullback to SPX 4630 enough of a reset? -1.87% might do it. At least in the very short term.

Wasting no time closing positions in NIO/ QS/ LCID in the premarket session. In this market, overnight gains of +3% to +5% should be taken immediately.

Looks like a limit buy for ASHR filled in the after hours session last night, which I also plan to close ASAP.

Reopening a position in EWC.

Closing 75% of my position in VT here.

Closing CGC.

Closing ASHR.

Closing the balance of VT here.

Just feels as if the market has more work to do on the downside.

Not seeing the bounce in EWC I expected – closing here.

Once more in 100% cash.

I really like gold here, but is it going high enough in the short term to really invest in? Any ideas you have on the timetable of price appreciation would be appreciated. Its been 10 years of sideways, I don’t have a feel for how gold increases.

In my opinion, we are about to be amazed by the price rise in gold. If anyone is hesitant, I would say that on the appointment of Brainart (I think is a slam dunk) as Fed Chair, holding gold related assets would be a clear inflation protection asset. She is an uber-dove and Biden will fill the current vacancies with others of the same. Expect extreme MMT experiments.

When Obama and the Dems lost the House and Senate in 2010, the GOP shut down his fiscal policies. The Fed took up the mantle and eased super aggressively because Washington was a fical economic drag. Picture the GOP after winning back the Senate in 2022 blocking fiscal spending and a Brainard led MMT Fed thinking they need to be printing money in double time. now picture where the US dollar and gold will be.

Ken,

What gives you so much confidence that Brainard will be appointed the next Chair? It seems most people on Wall Street would prefer if JPow continues as the Chair. Even on the Capitol, only Warren seems opposed to JPow.

I think the recent Democrat loses in VA and NJ were likely due to the policies advanced by the Progressive Wing of the party. Appointment of Brainard will reinforce that notion.

However, as you said, Democrats may lose both Houses in the next mid-term, and they may want a stronger ally at the Fed to advance their agenda.

As my mother used to say, “I’ll bet dollar to donuts” that Brainard is appointed.

Thank you, Ken.

Infrastructure improvements have finally made their way onto local budgets.

I met this morning with our city manager + a next-door neighbor who also happens to be a recently retired civil engineer with extensive project management experience. He was more or less hired on the spot as a consultant!

The purpose of the meeting was to revisit the possibility of coordinating imminent pavement rehabilitation work with the undergrounding of all electrical lines by PG&E. We had initially planned to propose splitting the costs with the city (the expense would have been minimal with the street already torn up for resurfacing)- but it turns out there is now money in the city budget for exactly that kind of work! It may even be bundled with broadband cable. Not exactly sure where the money is coming from, but aging infrastructure is finally being addressed in meaningful ways in California. I honestly believe that companies and/or residents who relocated to other states left just before we see the local economy come roaring back – and moving back will be cost-prohibitive.