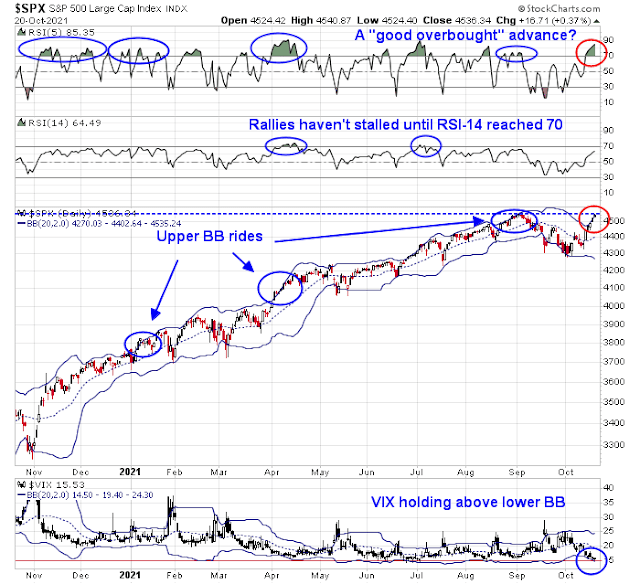

Mid-week market update: The S&P 500 has been undergoing a ride on its upper Bollinger Band (BB), which historically has been a bullish sign of price momentum. The bigger question is how the tape will behave when the upper BB ride ends.

Here are some observations:

- The 5-day RSI is extremely overbought, but overbought markets can stay in a “good overbought” condition as prices advance.

- The 14-day RSI isn’t overbought yet, and past rallies haven’t stalled until it became overbought or was near overbought.

- The VIX Index hasn’t fallen below its lower BB yet. In the past, penetration of the lower BB has signaled either a pullback or a period of sideways consolidation.

The initial verdict is short-term bullish, though the S&P 500 will have to contend with the all-time high resistance zone between the closing high of 4537 and intra-day high of 4546.

A sentiment Rorschach test

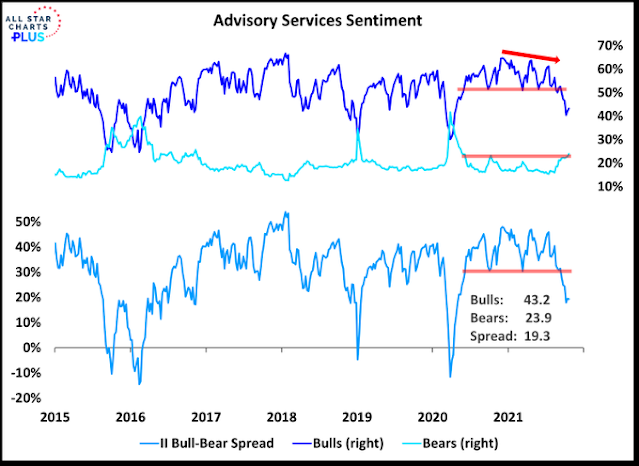

Sentiment readings are becoming a Rorschach inkblot test for traders. On one hand, the bull-bear spread from Investors Intelligence has begun to edge up from depressed levels, which indicates a recovery of extreme bearishness and a signal that this rally has room to go. In particular, bearish sentiment edged upwards, which is an indication of continued skepticism and the market climbing the proverbial Wall of Worry.

On the other hand, Helene Meisler conducts a regular (unscientific) Twitter poll. The results from last weekend saw net bulls-bears over 30. Such an extreme reading is rare and there were only three other instances during the brief history of her poll. The market pulled back on one occasion and continued to rise on the other two.

This is what I mean by the Rorschach test of sentiment model interpretation. I consider these models differently. The II sentiment survey tends to have a longer-term time horizon and the intermediate-term outlook for stocks is up. The Meisler survey respondent sample is made up of very short-term traders. Such extreme bullishness could be considered to be contrarian bearish in a conventional fashion or an indication of strong price momentum that could carry the market higher.

Bullish internals

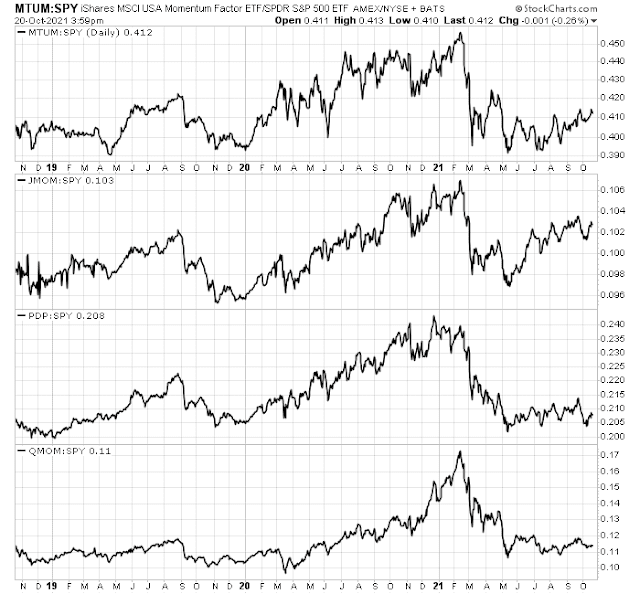

A consideration of the price momentum factor, which is a stock selection factor that measures whether individual outperforming stocks continue to outperform (as opposed to market momentum, which postulates that a buying stampede will lift the index), using different flavors of the momentum factor shows that returns have been flat to up. This is an indication of a healthy internal rotation between stocks as the market rises.

Equity risk appetite is constructive. The equal-weighted ratio of consumer discretionary to staples has made a fresh all-time high, which is bullish. However, the ratio of high-beta to low-volatility stocks have lagged, though conditions are not so severe to cause any great concern.

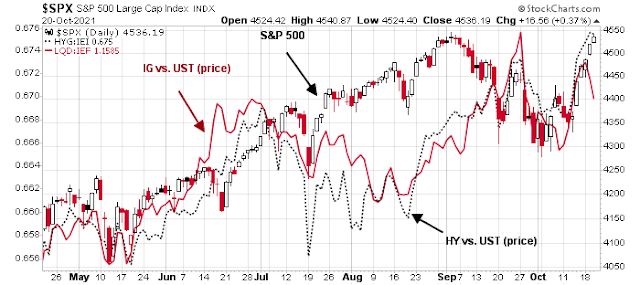

Credit market risk appetite presents a similar picture. The relative price performance of junk bonds to their duration equivalent Treasuries have made an all-time high, indicating a strong risk appetite. But the relative price performance of investment-grade issues has lagged, though not by such a degree to be alarmed.

A further bullish catalyst could be an agreement among the squabbling Democrats on Biden’s Build Back Better bill. The current period is reminiscent of the bargaining leading up to the passage of ACA, otherwise known as Obamacare. An agreement in principle could be forthcoming by the weekend. Keep an eye on the infrastructure ETF (PAVE). An upside relative breakout could be a signal for a bullish stampede into cyclical stocks.

In conclusion, the stock market appears to be starting its melt-up into year-end. As we proceed through earnings season, individual reports may cause hiccups in what is an overbought market, but investors and traders should seize the opportunity to buy the dip.

All the high level asset allocation webinars and articles I consume talk about the slight attractiveness of equities. I think it is better to access the extreme ugliness of bonds.

Bond lovers like David Rosenberg say that investors are overestimating inflation. Recent Fed research says the same. But the Inflation Surprise Index constructed like the CITI Economic Surprise Index is showing continual reported inflation stats above consensus. So, NO, people are underestimating inflation and that means they are underestimating bond market risk.

That leaves equities as the clear alternative.

It is unlikely that corporations are done with passing through higher input costs to consumers. With the China energy crisis worsening for much of this month there will be additional shortages of things like magensium and aluminium. Flash PMIs on Friday will give us some insight, but in Europe there may have been a notable worsening of conditions due to high energy, emission and input material cost. Moody’s reported that the supply chain situation in the US is worsening. At least there is hope the worst of the energy situation in China may be behind us.

Event risk remains elevated with a compromise on US corporate and capital gains taxation looming (both ways) and the Evergrande bond payment deadline as well – does it really not matter anymore?

Nomura and others noted that positioning in bonds is extremely bearish already, this may be a contrarian signal, but yields continue to trend higher.

Soon bonds short positioning will reverse. It then favors long duration. Think Tech.

November is the strongest month of the year.

Systematic algos’ lagged re-leveraging is on-going, indefinitely. Now vix is lower and index RV is going lower too. This is mostly price-insensitive.

2022 will be a big year for buy-backs. So look for those companies.

Just about whole world is on crypto trading, even grandmas, except perhaps for Amazonian tribes. The fever pitch exceeds dot-com boom. Don’t want to predict. Just watch and participate in the game, like Soros suggested.

Jens Weidmann is quitting Bundesbank. With Christine Lagarde at the helm, Europe will be easy money forever. Think the ramifications.

I would have expected more EUR/USD weakness, but lets wait for the PMI reaction tomorrow.

Scaling into EEM premarket.

Scaling back into PLTR.

EWZ small.

GDX.

I opened a small position in TLT after hours yesterday, and adding to it this morning.

Closed the portion opened this morning.

Limit orders in for IWM/ QQQ.

First set of limit orders filled.

Scaling back into NIO.

My take right now-> underinvested traders get pulled in early and are then tested later in the day. Selling into an opening ramp and buying back lower near the close would be ideal, but ideal scenarios are rare. Opening partial positions allows me to hedge my take.

Adding positions in VEU and FXI.

Closing TLT.

Add ASHR.

Add PAVE.

Add BABA.

Added to IWM/ QQQ on strength.

Added (small) to EWZ on weakness.

EFA.

SPY.

NIO/ PLTR finally catching what I believe will be sustained bids.

Reopening a position in QS.

Opening PICK here.

MJ.

KWEB.

Limit bid on XLE.

Limit bid hit.

VTV.

EFV.

EWC.

Time to sit back and let it all play out, or not.

Looks like IBM will single-handedly be responsible for a red print in US indexes.

The pain trade appears to be higher. Yet another ‘V’ to frustrate bulls and bears alike.

It’s always tricky when trading near all-time highs. The path to SPX 5000 (obviously) runs through 4600/ 4700/ 4800/ 4900. We always have our own ideas about how the path should unfold. But it almost always fails to match the real deal. Most of us think the market will be higher by year end. Most (or at least many) of us also think it needs to pull back first. What if it doesn’t?

We may be watching a “great rotation” from bonds into stocks right now. At least the narrative that inflation is bullish for equity seems to be winning. At least for now, as risk factors like an outright Evergrande default, soaring energy prices and higher corporate taxes seem to be moderating.

Trimming a few positions in the premarket session- ASHR/ GDX/ XLE.

To lock in ST gains while also participating in what may be a runup into year end I plan to trade around core positions (hopefully lowering my basis with each ST roundtrip).

Paring back further on GDX.

Paring back on BABA.

Selling two dogs altogether, as I don’t know when/where the selling stops-> QS/ EWZ.

Not a fan of two things here:

(a) The sudden U-turn in US indexes.

(b) Problems with the Fidelity platform.

Spent the past thirty minutes closing all positions (although given issues with order confirmation I’m still not entirely certain I’ve closed them all).

Back to 100% cash.

I recall watching the Flash Crash in real time at work. So I take platform failures seriously.

I’m a little ticked off. Up maybe ~+0.3% earlier in the day. As things turned around I began to close a few positions – only to find the order displays frozen with no execution(s). That prompted me to enter additional orders to close, with the same result.

Now more or less flat for the day. Probably a waste of time to file a complaint. I’m sure Legal included a disclosure re technology failures which all clients signed off on.

Reopening BABA and NIO here.

Reopening FXI here.

Opening a position in VTI here.

Reopening GDX.

Paring back further on GDX.

Paring back on BABA.

This weakness is not what we typically see on a Friday, but the day is still young.

Bonds turned decidedly negative about 10mins ago…

I’ve cut back from 25% exposure to about 15% and simplified the portfolio structure. I plan to add back on any weakness next week.