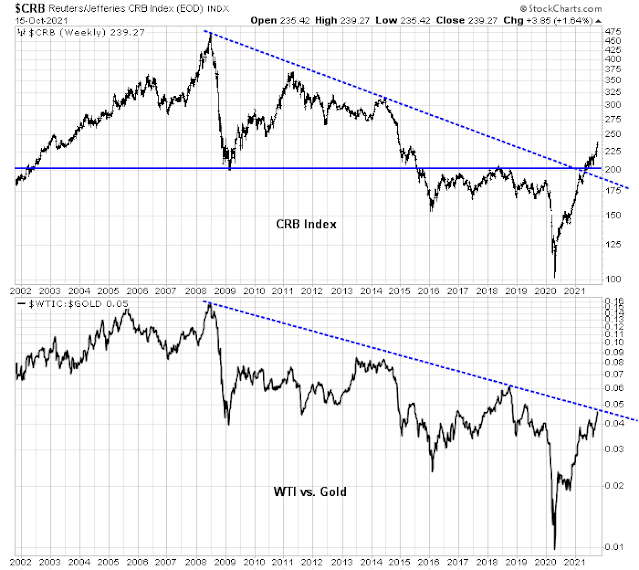

As the CRB Index decisively broke out to a new recovery high while breaking through both a horizontal resistance level and a falling downtrend that began in 2008, a divergence is appearing between crude oil and gold. The oil to gold ratio has strengthened to test a falling trend line.

This test of trend line resistance could present some opportunities for traders.

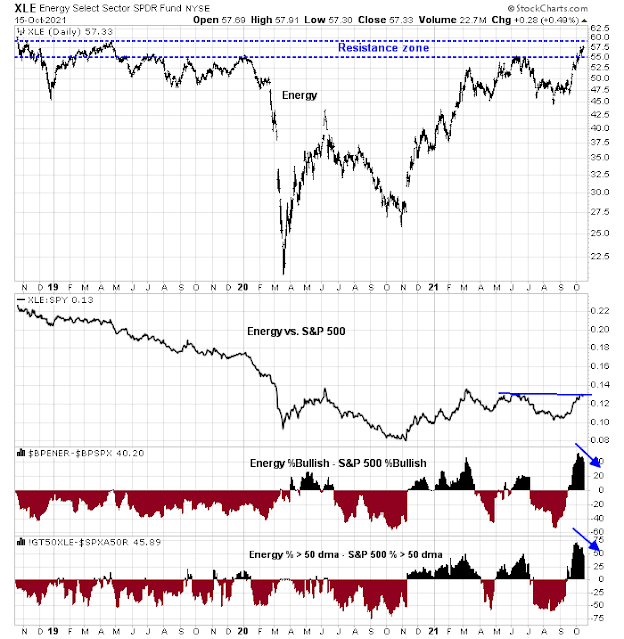

Extended energy

Has The Economist done it again? Is the latest cover a contrarian signal of a pending top for energy stocks?

It’s starting to look that way. As energy stocks test a key absolute resistance zone, they are struggling to overcome relative resistance. At the same time, relative breadth is deteriorating (bottom two panels).

Washed-out gold

By contrast, the technical outlook for gold and gold miners appears far more constructive. Gold prices have traced out a double bottom after testing a support zone. Moreover, TIPs prices are rising again, indicating falling real rates, which is supportive of rising gold prices.

The washed-out nature of this group is more evident in the gold miners (GDX). GDX rallied through trend line resistance, which is positive. The percentage of bullish stocks fell to an oversold level and they have begun to recycle. In addition, the GDX to gold ratio and the small-cap GDXJ to GDX ratio have both risen through falling trend lines. These are all signals of underlying strength.

In conclusion, energy stocks may be nearing a climax top while gold and gold stocks are showing bullish signals after several months of dismal performance. Traders should avoid energy exposure and buy gold and gold stocks for better potential performance.

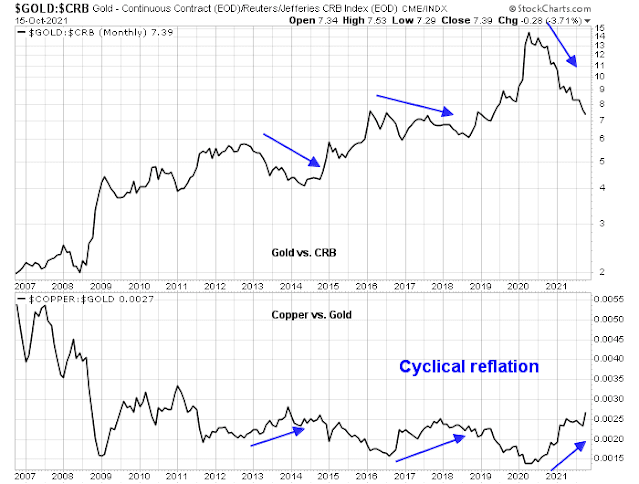

However, make no mistake, any gold rally should be treated as a tactical bull rather than a secular bull. The gold to CRB and cyclically sensitive copper to gold ratios are signaling a reflationary regime. Long-term investors should therefore seek exposure to cyclically sensitive base metal and other commodities over the shiny yellow metal for better returns.

Hi Cam, I hope you are well!!

“However, make no mistake, any gold rally should be treated as a tactical bull rather than a secular bull. The gold to CRB and cyclically sensitive copper to gold ratios are signaling a reflationary regime. Long-term investors should therefore seek exposure to cyclically sensitive base metal and other commodities over the shiny yellow metal for better returns.”

Should long term investors also stay long the energy sector in your opinion, or is your recommendation to sell energy more than just a tactical move?

Thanks,

Mike M

Mike, the long Gold over Energy is a short term trade based on the ‘peak’ bullish % observation over the past three years. Chances are it is over-extended and a lot of optimism is already in the price (which makes prospective return less attractive vs risk).

Supply and demand equation is still favourable for Energy longer term due to lack of capex. Speed to transition to green energy is over-estimated. This creates a perform storm for the traditional dirty energy sectors (oil/gas/coal).

Thanks Andy, well said!

Cam, do you expect silver / silver miners to perform as gold / gold miners do?

Thank you.

Mark Hulbert has also been looking for a run-up in GDX. I’m going to take Cam’s advice and restart a position in GDX after hours.

The major indexes may be poised for a pullback this week, but I think many of the small-caps (eg, NIO/PLTR/QS) are ready for sustained moves up.

Hi Cam, increasingly thinking about when the 10 year will peak or peak relative to 30 year. This will be the signal for when the bottleneck is ending I think. That seems a way off. Does it really make sense that energy is peaking now? Tactically perhaps, your analysis is compelling … but surely not a top till the ten year also peaks. Additionally there seems to be a policy total war on traditional energy worldwide so I am in camp higher for longer on energy, although admittedly not too much upside from here.

Trimming positions in BABA/ NIO/ PLTR/ GDX in the premarket sessions to lock in a few gains.

A trim and trail strategy might work well going forward.

Position sizes were relatively small, but it’s enough for a +0.3% gain to start the day which keeps FOMO in check when early indications point to a gap up.

Adding positions in IWM and EWZ.

Adding a position in QS.

Adding back to NIO.

Adding back to GDX.

Closing IWM.

Closing QS.

Initiating a position in MJ, which is finally showing some buying interest.

I may regret this, but I’m letting BABA go here. It just feels as if it’s in runaway mode, which is normally a good time to sell.

Ending the day in cash.

The market just feels overbought. Of course, as

Cam often points out it can get more overbought.

PG had some commentary related to inflation and it seems the bond market took notice.

Scaling back into NIO ~39.1x.

Off ~39.8x.