Mid-week market update: I told you so. Earlier in the week, I wrote that the market had become overly hawkish about interest rate expectations (see Hawkish expectations). Leading up to the November FOMC meeting, the Fed had signaled that a QE taper is about to begin and, if everything goes along with projections, the first rate hike would occur in late 2022.

The Fed doesn’t want to drop the new framework at the first sign of trouble. The issue of full employment still obstructs the path to rate hikes. If the Fed were to pull tapering forward, the implication would be either the Fed is abandoning its new shiny new framework or that it has redefined full employment. Remember, there is institutional inertia at play here…The new framework sets the Fed apart from its central banking peers that are quickly pivoting in a hawkish direction. Indeed, the new framework is intended to prevent such a pivot, which means that if the Fed were to move in the BoC/BoE/RBA/RBNZ direction, it would amount to abandoning the new framework.

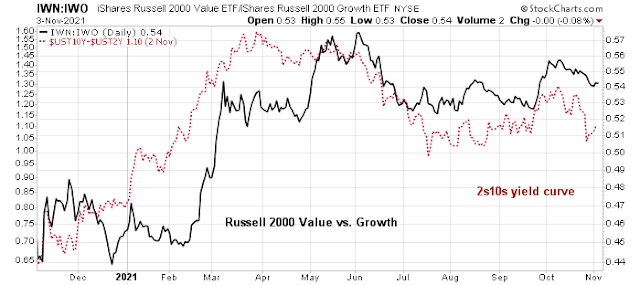

We got a dovish taper, which is what I expected. The 2-year Treasury yield eased in reaction to the FOMC decision and the yield curve steepened.

As well, ECB head Christine Lagarde said today that conditions for rate hikes are unlikely to be met next year. As a consequence, German 2-year rates also fell.

Rising bond yields

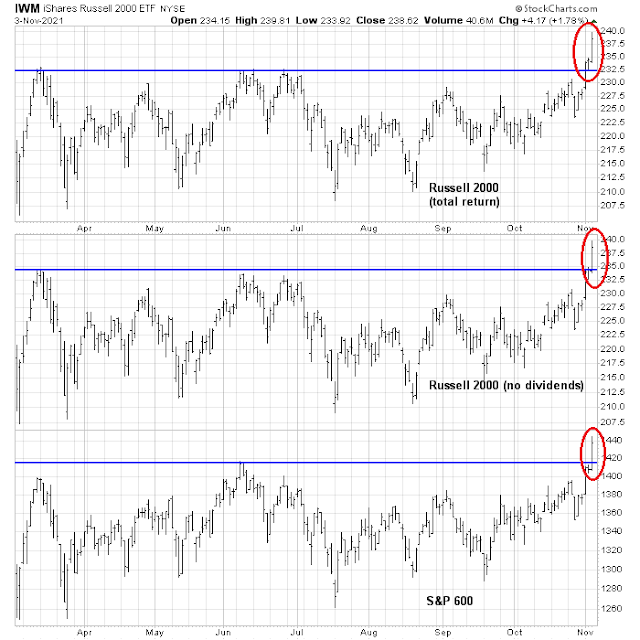

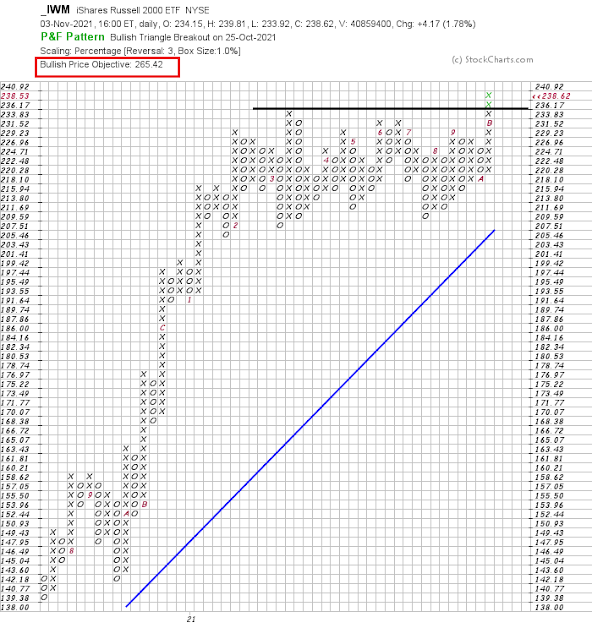

Small caps break out

Year-end rally underway

At an interesting juncture for my portfolio here, which is currently in 100% cash. As I transition further toward capital preservation mode, I have to come up with strategies for decoupling from FOMO.

(a) Patience. Waiting for attractive entries has been helpful. I’ve had several opportunities to buy pullbacks in 2021, in some cases buying twice into pullbacks that led to retests. Of course, I also end up selling early.

(b) Being content with lower returns. I can’t say I’ve learned to embrace the trade-off between lower risk and lower return – it feels more like a growing acceptance that the price of insurance often means leaving gains on the table.

My entire family (and several of my colleagues) began laddering into Series I Savings Bonds on Monday. The six-month annualized 7.12% yield is something I haven’t seen in a risk-free asset in a long time.

Hey there – is there any way to bypass the $10k limit on Series I bonds? At 7.12% I would love to put way more into them.

Rxchen,

I love reading your trades, and the accompanying emotions, it’s fun, funny and also illuminating in how as a person one would/does behave on a daily (sometimes hourly) basis to challenges of being a trader. Introspection is part of growing, so, your point (b) is good in that sense. We are all growing together, to borrow and paraphrase the quote from Ken. Keep up the good work!!

Thanks for the encouragement.

I began chronicling my trades along with the occasional emotional and/or reflective thoughts around each one since 2005. Keeps me honest and keeps me humble. Over time, I find it’s instilled in me the resourcefulness and resilience necessary to maintain an even keel. The daily (or even hourly) struggles/insights during the 2008-09 downturn in particular were often excruciating – buying too early into downdrafts or exiting too early on throwback rallies where I had to dig deep to find a way out or keep emotions in check. I now have a mental/psychological tool kit a mile long. Not for everyone – although many readers on the old Bill Cara blog that found the daily emotional approaches/strategies helpful during the desolation of ’09.

Reopening a couple of positions after hours at discounts to yesterday’s exits. FXI/BABA.

Also a position in EWZ.

Nothing else really fits my criteria for an attractive entry.

Nasdaq futures seem to be following a trendline on the hourly chart that would get us to 16500 by Friday’s close. SPX 4712 could be a decent spot to take some profits on long positions. Many cyclical laggards. While we do not have to worry about inflation as long as the Fed doesn’t, it raises the question where this will lead us. Central bankers are now already pushing back against expectations of rate hikes in 2022.

“it raises the question where this will lead us”.

100 Trillion $ deficit, -5% real interest rate on TNX, so far as (fictitious) CPI does not show inflation. Keep calm and keep selling USD and keep buying assets.

Powell is not going to raise rates before the mid-term elections. But is the Pfizer covid pill going to impact metaverse growth projections?

Reopening positions in TIP/ IEF.

Opening a position in XAIR.

Opening a position in PFE.

Opening a position in C.

Reopening a position in CGC.

Paring back on EWZ.

Guess I’m a guy who likes getting away from where everyone else is partying and moving to a quieter place – in this case, bonds.

Closing EWZ.

Closing PFE (minor loss).

Closing all non-bond positions. None of them are working this morning and I have little patience with positions that move against me.

Re CGC and the entire cannabis universe. There’s a well-known trader/philanthropist who has been bullish on this sector for at least the past two years – someone I used to follow when he was a columnist (and to his credit, quite successful at nailing entries). Now he’s twice as bullish on the sector, calling it a generational trade. It may well be – but after the devastating declines we’ve seen over the past two years I see the call as highly misleading.

The bond funds are catching bids.

Might it be the start of another great rotation?

https://twitter.com/sentimentrader/status/1456717377773711364

Glad I unloaded all positions in equities when I did.

For a little excitement on Monday, reopening a position in BABA. And opening a position in PTON.

Opening a position in TLT here.

And closing here ~147.7x. (Opened ~147.3x).

Scaling into VT ~107.8x.

Adding a few flyers in NIO/ QS/ LCID/ CGC.

Adding a second allocation to VT.

Is a pullback to SPX 4630 enough of a reset? -1.87% might do it. At least in the very short term.