Mid-week market update: My trading view remains unchanged. The market is consolidating for a rally into year-end (see The seasonal rally is intact). Initial S&P 500 support on the hourly chart is at about 4680, and secondary support is at 4630-4640. If the S&P 500 breaks out to an all-time high, we’re off to the races.

Uptrend intact

Here are some bullish data points to keep in mind. The recent Dow Theory buy signal indicates a bullish primary trend.

As well, the relative performance of defensive sectors to the S&P 500 are not showing any signs of strength. The bears are not showing any signs of life.

Breadth indicators are positive. The NYSE Advance-Decline Line broke out to a fresh high. Net NYSE and NASDAQ highs-lows made a recent high before the market retreated. The percentage of NYSE stocks above their 50 dma broke resistance, though the NASDAQ counterpart is still lagging.

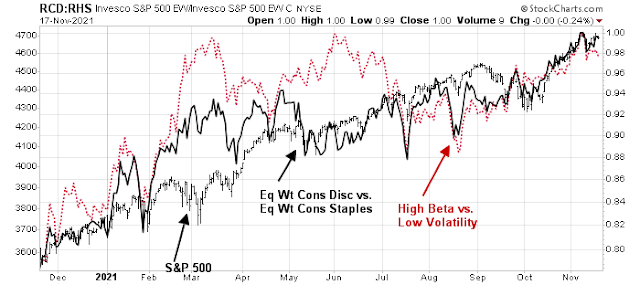

Equity risk appetite is confirming the strength in the S&P 500 and there are no negative divergences.

Finally, semiconductor stocks represented one of my bullish tripwires. These growth-cyclicals staged an upside relative breakout through a range and they are now testing another relative resistance level.

In conclusion, the market is trading sideways but internals remains bullish. My inner trader is keeping an eye on 4680 initial support and 4630-4640 secondary support as ways to control downside risk. He remains bullishly positioned.

Disclosure: Long SPXL

Most of the confirmation in the transport index was made by a meme stock Avis. Today, was a disappointing day with the rally in qqq led by two stocks mainly AMZN and TSLA. The Russell 2000 was sharply down. Personally, it might be my nature but I would not throw caution to the wind. Junk Bonds are tanking, copper made a high in May. Stocks are not going up on good news but are churning. I am not yet ready to short the market but the upside does not look very attractive.

The AD line looks good, as does the high yield spread, but I agree with you the market seems treacherous. Isn’t it a classic that at the top you have the big stocks behaving differently from the rest? I am mostly in cash, I accept some loss to inflation as an option play in the case of a bear market that starts fast. It is psychologically very hard to walk away from a 10 to 15 % loss at the start of a bear, so people end up holding on hoping to get back to the top and then find themselves still holding when that nasty second move which the Ellioticians would call 3rd wave….I can handle FOMO much easier….I have a position in Cameco which has outperformed my expectations, I am hanging on for a few reasons, Santa Claus rally, tax deferral in 6 weeks, uranium and energy and green energy has moonshot potential just because of how that space is so small.

Tesla, I watched a video on their 4680 batteries. Amazing stuff. So for TSLA my advice is to take a page from the Amazon history…it peaked at around 110 in the Dotcom bubble and crashed down to 6. So if this crash of the ages happens and TSLA loses 95% and still is doing well in the EV space, then buy some if it has not gone bankrupt (which is why I would not write some way out of the money puts). These new batteries mean that the sticker price for a new EV can be lower than an ICE car, and when you factor in the lower maintenance costs it would make an EV preferable, but if the market goes bear a lot of ETFs will unload that TSLA so the downdraft could be shocking. In 2020 TSLA dropped from around 200 to around 70, so 65%, meanwhile the SPY went from around 330 to 220 so 33% give or take, which suggests that if the market really crashes in a year or 2 or whatever that TSLA could easily match what AMZN did in 2000-2002. Now could TSLA match what AMZN has done after 2002? Maybe , but who needs a 500 bagger lol, even a 20 bagger would make me happy…so I resist FOMO telling myself that there could be a glorious shopping opportunity in the most too distant future.

Oil (WT) is carving out a support at 50 DMA around 77$ give or take for January futures. Watching this; opened a long position @ 77 $, January futures. Looking to get out at 20 DMA around 80.50$, give or take.

The reflation trade may have peaked, Bloomberg Business Week has inflation in big letters on its cover. Other sectors are showing similar patterns and signs of a possible top, like crypto, retail sales and EV and semiconductor stocks.

Ok, semis seem to be holding their breakout, setting up for the start of bullish seasonality next week.

Adding a second tranche to BABA on the post-earnings decline.

Adding a second tranche to FXI.

LCID continues to offer good day trading opps.

Closed BABA at the open. No patience with anything in free fall.

Made me look at BABA lol. Well if we are making a top with a crash declaring itself in a year or so then BABA could make a classic head and shoulders top by then. Look at BABA:SPY, now that is nasty looking.

Closing the remainder of my positions (DIA/ FXI/ VT/ IWM) here.

Feels odd to be playing defense when the SPX is green!

Retreating to 100% cash just feels right.

Just in time!

Learning to take losses is perhaps the most valuable skill one brings to the table.

(a) There’s the mechanical aspect – learning to reverse one’s take on a dime and taking minor dents before they transition (often quickly) into major hits.

(b) Then there’s the emotional aspect – learning to accept losses as a routine part of trading. It’s a mistake to equate a loss with failure. It’s how we handle a loss that determines whether the trade was successful. Not all successful trades are gains.

How many times in life do we find ourselves making good headway up a mountain path, only to find that we chose the wrong route and will need to retrace the entire journey in order to reach our destination?

That’s a frequent scenario in trading.

Reopening all positions here for another swing.

Reopening GDX.

Closing BABA/ VT/ DIA here, as I’ve repaired most of this morning’s damage.

OK. Out of GDX.

The selloffs in crypto/ cannabis/ China/ EVs continue with no respite.

I’m out of trading ideas for the time being.

And we got a Hindenburg Omen today too.

https://mobile.twitter.com/McClellanOsc/status/1461442580067938304

I don’t think a single Hindenburg has much predictive value. But a cluster of them often precedes downdrafts.

I read somewhere today that a single Hindenburg only has a 25% chance of predicting crash.

Didn’t know that you can have a cluster of them in succession.

This is quite wild!

Nasdaq 100 makes new high and so does the number of Nasdaq stocks making new lows.

https://mobile.twitter.com/Norseman1/status/1461495054724485124

Long live Megacaps.

Reality is also wild. Megacaps with unlimited access to capital are taking over the world and making inroads into traditional industries (VISA, automakers just recently) while central Europe is going back into lockdown and Mrs Lagarde is killing the Euro.

Re the miners. Every time they get up they get knocked back down.

Reappointment of Powell will likely result in a violent rally. Brainard would be an unknown and probably bad for the banks. “Wild-ass rumour” Yellen would probably be bullish as well.