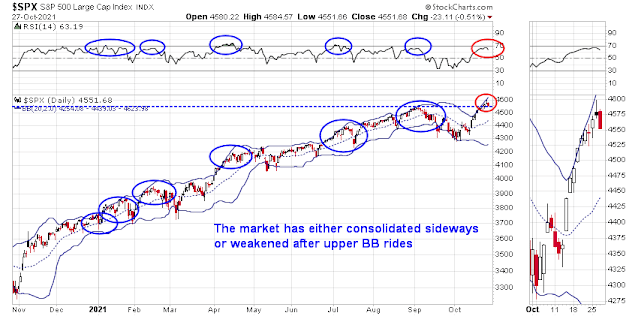

Mid-week market update: The S&P 500 had been on an upper Bollinger Band ride, but the ride may be over. In the past year, such events have resolved themselves in either a sideways consolidation or pullback. As well, the 14-day RSI has reached levels consistent with a pause in the advance.

Based on recent history, we should know about the magnitude of the pullback within a week. Initial support can be found at the breakout level of about 4540.

Intermediate-term bullish

Regardless of the scale of any stock market weakness, the intermediate-term outlook remains bullish. There is nothing more bullish than fresh highs, and the Dow recently punched its way above resistance to an all-time high. The Transports have surged to test resistance but weakened. Further gains in this index would constitute a Dow Theory buy signal.

Market breadth is showing signs of strength. The S&P 500, NYSE, S&P 400 Advance-Decline Lines reached all-time highs. Only the NASDAQ and S&P 600 A-D Lines are weak. These are signs of broad underlying strength, not weakness.

To be sure, small-cap indices are struggling with resistance and they have not staged upside breakouts and they are weak relative to the S&P 500. However, relative breadth is improving (bottom panel) and we are entering a seasonally positive period where small stocks should enjoy some tailwinds.

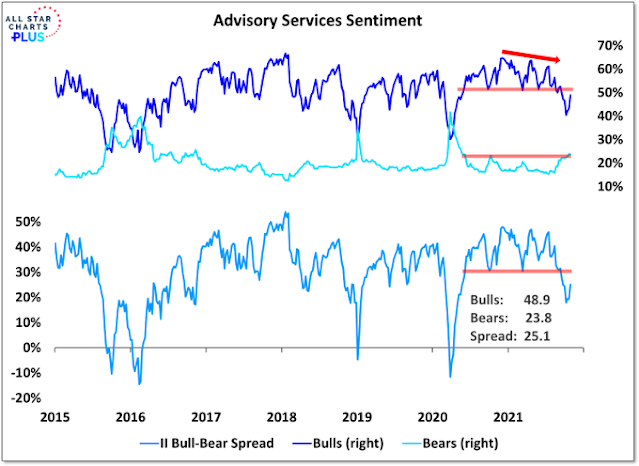

Sentiment not extreme

Sentiment readings are supportive of further gains. The latest update from Investors Intelligence shows that % bulls are recovering, but % bears remain stubbornly high. There is much more room for sentiment to improve before they reach an overbought extreme.

Bullish and bearish catalysts

I interpret these conditions as conducive to further gains after a brief pause. Possible catalysts for either upside or downside volatility could come from the FOMC meeting next week. The Bank of Canada sounded a hawkish tone today by announcing the end of quantitative easing and pulling forward the calendar for rate hikes. The Canada yield curve went bonkers. 2-yield yields rose the most and the curve flattened in response. While recent Fedspeak has signaled the start of tapering, the risks is next week’s policy response will be skewed hawkish.

As well, a deal for the Biden fiscal plan may be close this weekend. While a general corporate tax increase is off the table, a 15% corporate minimum tax could be passed. Such a measure would negatively affect Big Tech and pharmaceutical companies with intellectual property held in subsidiaries resident in low-tax jurisdictions.

In my book, the only favorable trade from a risk reward is gold or gold stocks. Gold has crossed $1800 which was resistance. If it can gather momentum the old highs are easily achievable. More so, because of the disparity of performance compared to Bitcoin. The stop would be below the recent pullback.

Cam, most likely is right that this might be just a plain vanilla pullback. However, in some cases markets make a nominal new high and break hard (double top). Both $SPX and the Dow are exhibiting these formations. I would watch the intensity of the break to see if volume picks up on the downside. More worrisome is that the Semi-Conductor Index which to me is a “tell” did not make a new high in this rally. I would watch it closely.

Gold has been a laggard asset. With looming taper, multiple central banks announcing unwinding of QEs, gold is unlikely to make new highs, IMHO. We will find out soon, how gold reacts around the upcoming 4th November FOMC meeting. While Cam had talked about buying gold earlier in the year, I am starting to have doubts whether gold has much upside.

PMIs are still in the upper 50s, but we may be getting closer to a point where those may come down somewhat. Not sure how much of a bounce we will be getting into mid-November, there is lack of excitement about the Biden economic plan and investors may be rightfully worried about upcoming economic data from China. There is increasing conviction that the supply issues may last well into 2022. Central banks are reacting to rising inflation expectations. In the bond market we may be witnessing an unwind of massive short positions on treasuries.

Agree with everything you said. That said, Treasury yields are going down (not up). This should be bearish for cyclicals (we saw that today). It is possible this is just a technical move for now. If this is a persistent move in yields, one would expect a tech rally, pushing indices higher. Seasonal tail winds also dictate a rally.

If I recall correctly, historically speaking, when Fed start tapering, the bond yield actually declined which is counter-intuitive.

Can someone verify this observation and prehaps shed some light on the driver for this phenomenon?

Andy

Yes, your observation is correct. As taper started (and eventually led to increased rates), money supply shrank, leading to reduced economy activities causing rates to fall (rather than rise). In the current situation, Congress may annul the taper by unleashing a new stimulus. Furthermore, current inflation needs to be moderated, taper may be appropriate as Corona virus led economic malaise seems to be in the rear view mirror.

https://jeffhirsch.tumblr.com

The last 4 trading days of October and the first 3 trading days of November have a stellar record the last 27 years. From the tables below:

Dow up 21 of last 27 years, average gain 2.00%, median gain 1.40%.

S&P up 23 of last 27 years, average gain 2.08%, median gain 1.50%.

NASDAQ up 23 of last 27 years, average gain 2.64%, median gain 2.30%.

Russell 2000 21 of last 27 years, average gain 2.24%, median gain 2.50%.

So bullish seasonality persists, at least until Wednesday. I suspect we are in the process of building out a double top, with the second half of November and December being less friendly to the bulls. The issue is that investors will want to position themselves for 2022, and the outlook for 2022 is less liquidity injections and a moderation of the sharp economic rebould that we have seen in 2021.

SPX 4900 anyone?

With a preponderance of calls for 4250, the pain trade may in fact be a run to 4900 before we revisit 4250.

Added to FXI/ EEM/ BABA/ XLE on their opening declines.

Adding to EWZ/ KWEB.

Trimming and/or closing a few positions which based on their price action yesterday and/or this morning leave me with reduced conviction levels-> EWZ/ XLE/ KWEB/ QS.

Trimming half of my position in VT here as I overreached a bit yesterday.

Trimmed further into the fantastic close.

As bullish as I am looking out over the next few months, it’s difficult to think that a string of 7-8 positive closes is a great point to buy and hold. Buying and trading around the positions would be a much better idea.

Cutting back even further after hours following selloffs in AAPL and AMZN, as my positions are largely shielded from large-cap tech and holding firm (at least for now). Intraday high in exposure was ~60%, and now down to 15%.

I was fortunate enough to end the day +0.7% to eclipse yesterday’s -0.5% hit.

Adding both AAPL and AMZN to the watchlist for Friday.

Adding back ~half of the FXI/ EEM/ BABA I closed at Thursday’s highs in order to lower my basis. I’m keeping overall exposure to China/emerging markets low at his point, maybe 3% of the portfolio.

Looking to restart exposure to QQQ. Ideally, it closes near the lows. Even better, a close near the lows followed by a gap down on Monday. I would take a serious swing ~365 or lower but the odds of that happening today are probably less than 30%.

Scaling into TLT for an intraday trade.

Closing TLT here.

Closing my position in KRE here.

I may regret it, but closing my position in IWM here as well.

Adding back the portion of NIO sold yesterday here.

Glad to have eliminated EWZ/ KWEB from the portfolio due to low conviction levels yesterday.

Not so glad to have eliminated QS!

The Qs are now green.