Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Model is an asset allocation model which applies trend following principles based on the inputs of global stock and commodity price. This model has a shorter time horizon and tends to turn over about 4-6 times a year. In essence, it seeks to answer the question, “Is the trend in the global economy expansion (bullish) or contraction (bearish)?”

My inner trader uses the trading component of the Trend Model to look for changes in the direction of the main Trend Model signal. A bullish Trend Model signal that gets less bullish is a trading “sell” signal. Conversely, a bearish Trend Model signal that gets less bearish is a trading “buy” signal. The history of actual out-of-sample (not backtested) signals of the trading model are shown by the arrows in the chart below. The turnover rate of the trading model is high, and it has varied between 150% to 200% per month.

Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the those email alerts are updated weekly here.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities

- Trend Model signal: Bullish

- Trading model: Bullish

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of the those email alerts is shown here.

Rising household stress

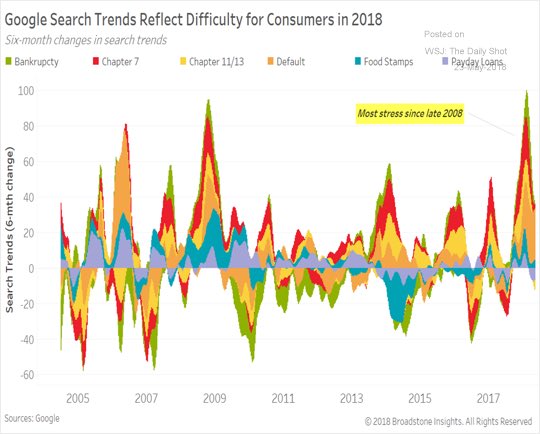

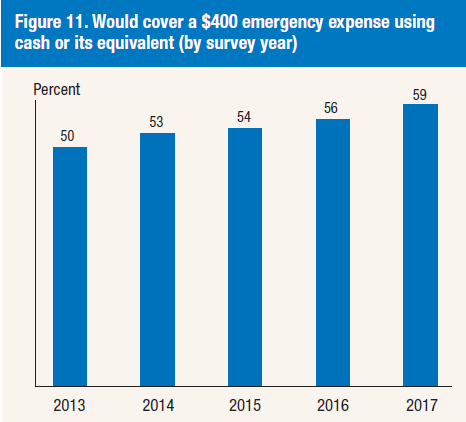

The headlines look dire. CNN proclaimed that “40% of Americans can’t cover a $400 emergency expense”, according to the Fed’s annual Report on the Economic Being of US Households. Further research from Google Trends showed that interest in consumer items is tanking.

In addition, searches for bankruptcy and financial reorganization spiked recently, indicating rising stress in the household sector.

Last Friday’s release of consumer sentiment missed expectations and readings are continue to deteriorate.

The economy is at or near full employment. Is this as good as it gets? Is this what prosperity looks like? What does this mean for policy makers?

For investors, the key question are:

- How stressed is the household sector; and

- Is this precursor to a bull market killing recession?

A household sector report card

To assess the financial status of the American household, let us first consider real retail sales, which is an important driver of economic growth. History shows population adjusted real retail sales has topped out before past recessions, and the latest data shows a possible plateau, but the jury is still out on that score. In the past, it takes about six months to confirm an actual peak in retail sales. The last peak occurred in November 2017, and the May 2018 data has not been reported yet.

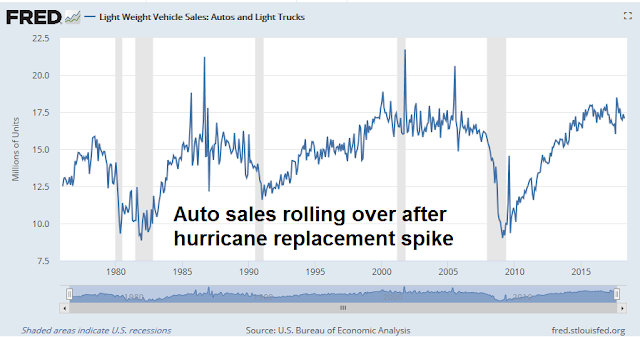

If consumer spending were to weaken, it would show up in the cyclically sensitive consumer durable sector. The report is also mixed. On one hand, auto sales appear to be rolling over after the most recent hurricane replacement spike.

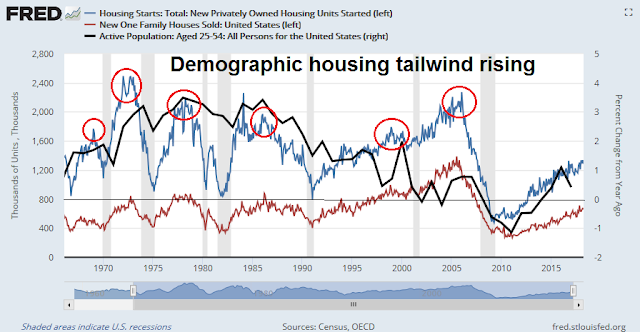

On the other hand, the housing sector appears to be still healthy. This cyclically sensitive sector has topped out ahead of past recessions, though it is enjoying a start of a demographic tailwind as millennials begin to enter the market and raise housing demand.

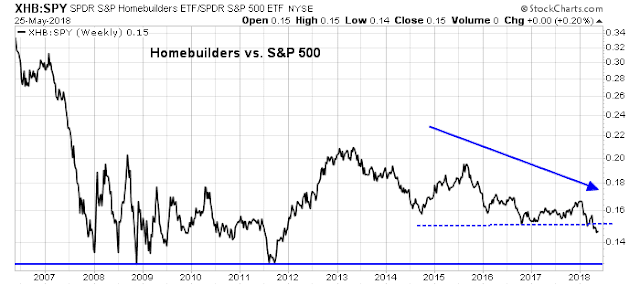

That said, the weak performance of the homebuilding stocks relative to the market has to be regarded as disappointing for the housing outlook.

Score retail sales and consumer durable sales growth as neutral. Real retail sales are trending up but may be plateauing, but the jury is still out. Auto sales are rolling over, but the housing sector remains strong, buoyed by positive demographics. The dire stories about a tanking consumer may be overblown.

The anatomy of consumer finances

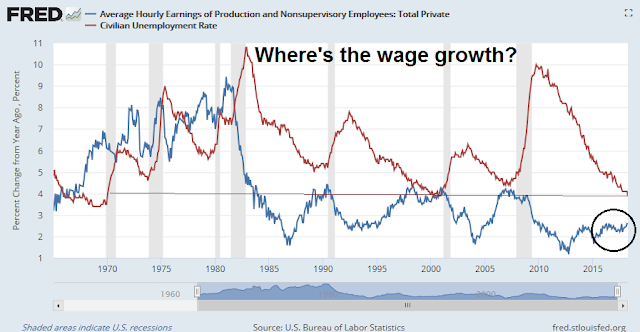

Still, there is an element of truth that household finances are becoming more fragile. My analysis of consumer spending considers its underlying elements. It all begins with wage growth. While average hourly earnings have been rising steadily and annual growth now stands at 2.6%, the level of wage growth has been extraordinarily muted by historical standards. The unemployment rate is 3.9%, which was last seen in 2000, and before that, the 1960`s.

One of the puzzle that has bedeviled economists and policy makers is the lack of wage growth in the current tight labor market. A number of explanations have been advanced, such as demographics, where retiring well paid Baby Boomers are replaced by younger and less well paid Millennials. Another is the rise of an employer monosony holding down wages. The following chart from the San Francisco Fed shows “wage rigidity”, or the percentage of employees who have received no wage increases. Even with the unemployment rate at 3.9%, the current level of wage rigidity is higher than the peak seen in the last cycle.

Wage growth is the primary driver of consumer spending. As this chart from Political Calculations shows, median real household income has been flat since 2000.

Still, households have other ways of coping in the face of stagnant pay increases. The first avenue of coping is to spend more by saving less.

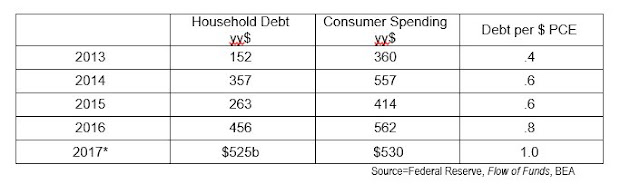

After drawing down savings, consumers could borrow to finance spending. The Fed’s flow of funds data shows that households are funding virtually all of their marginal expenditures with debt, up from 40% in 2013.

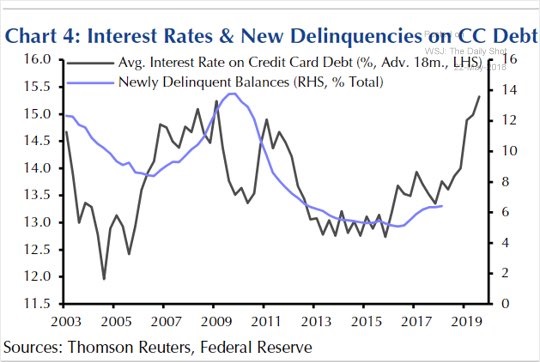

Rising debt raises financial risk for households. An analysis of the credit card delinquencies shows that as interest rates rise, delinquencies are likely to rise to recessionary levels by next year.

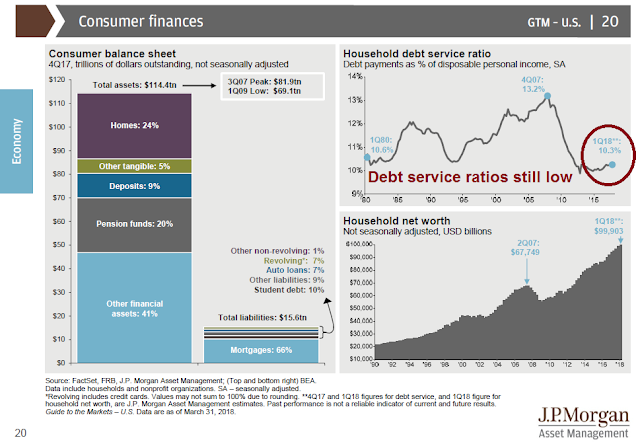

Despite the dire picture, household finances are not that dire as they seem. The latest update from JPM Asset Management shows that household debt ratios are still low, and their balance sheets are in good shape (annotations are mine). In other words, they have plenty of room to borrow if they want to.

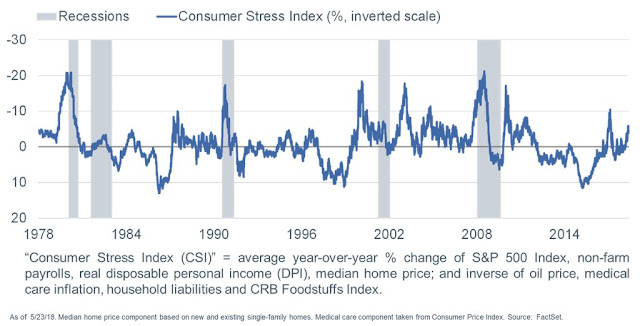

Liz Ann Sonders at Charles Schwab has created a Consumer Stress Index to measure the state of household finances. The latest readings indicate that consumer stress is rising, but readings are not in the danger zone yet.

Oh, and the headline about 40% of American households who can`t cover a $400 emergency expense? While the absolute level is still worrisome, the same Fed survey shows that the trend has been steadily improving.

Moreover, the percentage of survey respondents who report that they are “finding it difficult to get by” has been falling as well.

A growing financial divide

Does this mean the ominous headlines about deteriorating consumer finances are overblown and it’s time to sound the all clear? Not so fast!

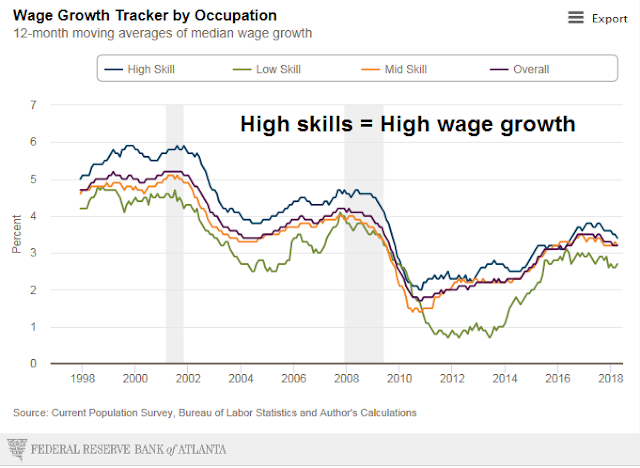

Detailed analysis an picture of bifurcated consumer finances and rising household fragility that will haunt the economy in the next downturn. The Atlanta Fed’s wage growth tracker captured this effect. People with high skill sets consistently enjoyed higher wage growth compared to the rest of the population. Remember your math, a consistently higher wage growth will lead to an acceleration in wealth differences over a lifetime.

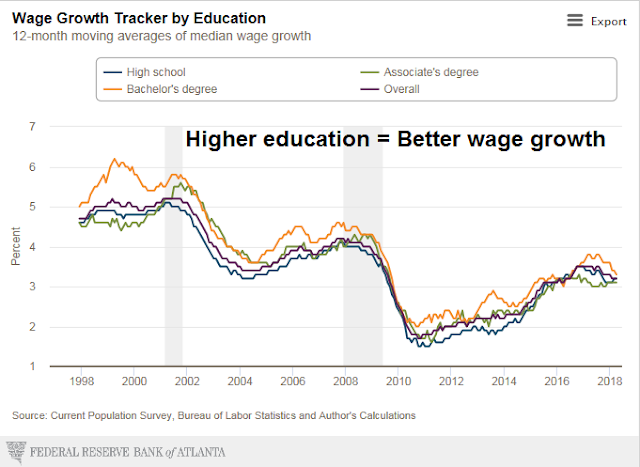

While the relationship is less clear, skill sets can be proxied by education levels.

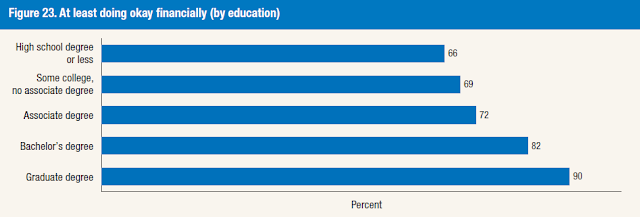

The Fed’s annual Report on the Economic Being of US Households tells a similar story of a financial divide is by education. Survey respondents were asked if they were “doing okay financially” and results increased steadily as education levels rose.

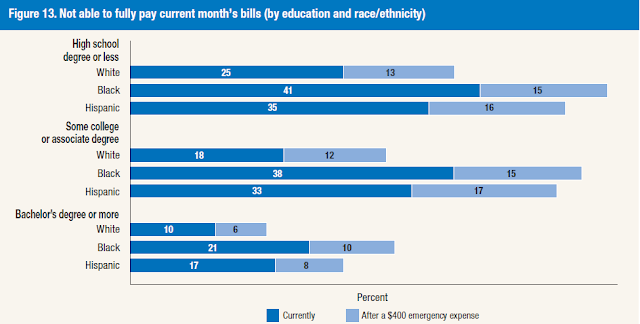

The flip side of the coin shows the respondents who were unable to fully pay the current month’s bills. We can observe a marked deterioration by education, and within each educational grouping, by race.

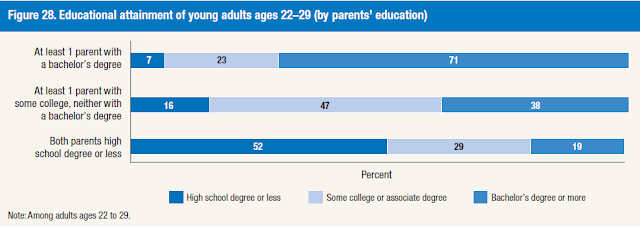

What about the American Dream and the idea of America as the land of opportunity? If education is the great equalizer, then the future looks problematical. Survey results show that parental educational attainment affect their children’s education levels.

In conclusion, aggregate statistics of household finances indicate that while consumer stress is rising, they do not constitute a danger signal of looming recessionary conditions. However, aggregates don’t tell the entire story, and further detailed analysis shows a bifurcation of household finances that will exacerbate the magnitude of the next downturn, and create longer term political problems in the United States.

The week ahead

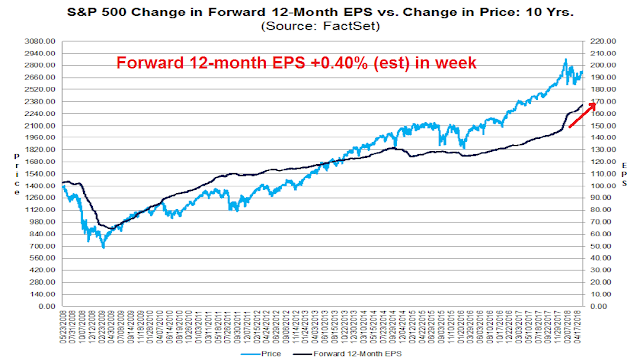

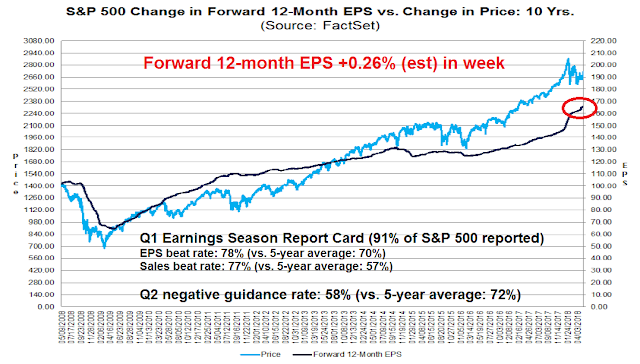

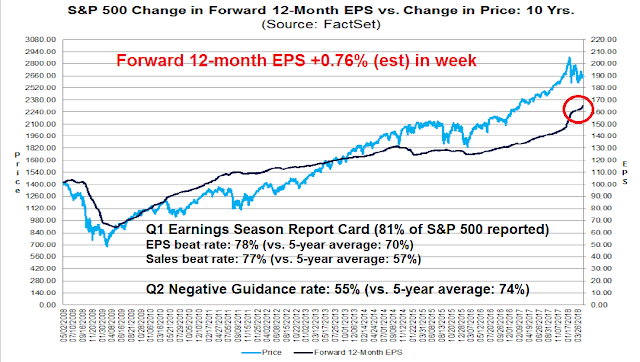

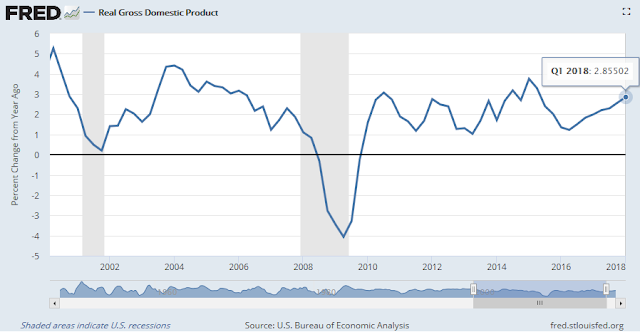

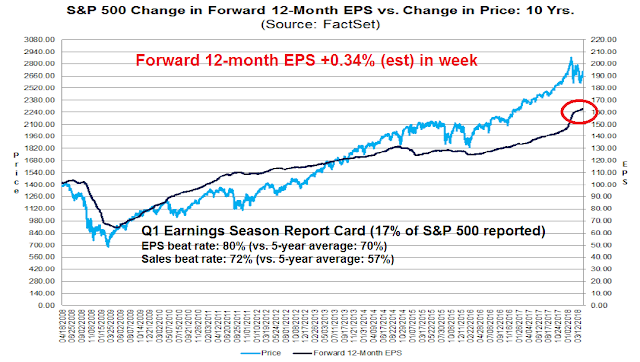

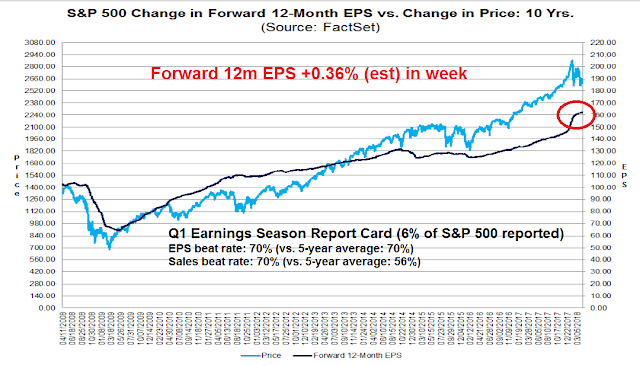

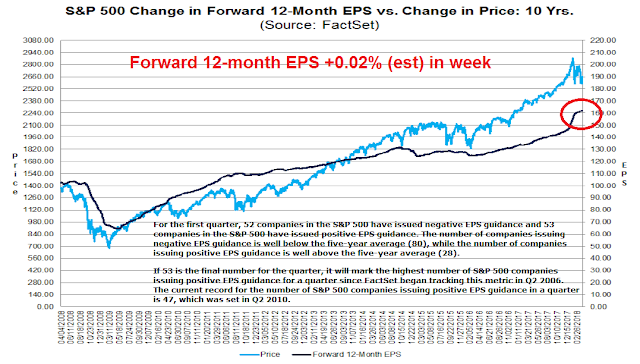

Looking to the week ahead, positive macro momentum is holding up this market. The latest update from FactSet shows that forward 12-month EPS continues to surge upward.

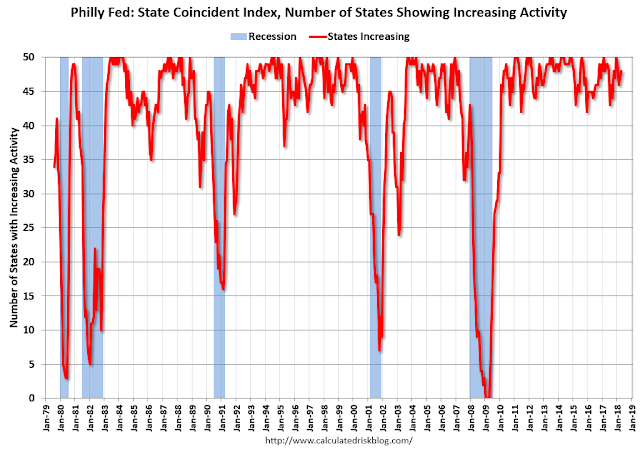

Other nowcast indicators are flashing bullish readings. The Philly Fed coincident state indices rose in 45 states, and the three month diffusion index was up in 49 states out of 50 (via Calculated Risk). Other elements of the Philly Fed indices are also upbeat (see Bear markets simply don’t start this way).

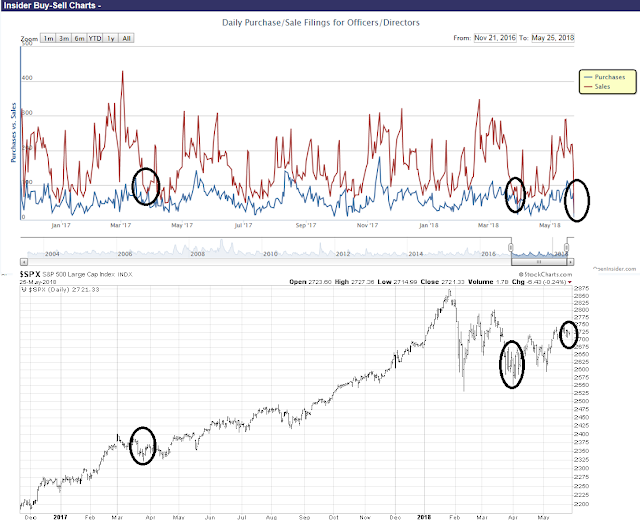

From an intermediate term technical perspective, the outlook is bullish. This chart from OpenInsider shows that insider selling usually exceeds insider buying and rarely do the two lines cross. In the last two instances where the two lines have intersected, downside equity risk was minimal.

The OpenInsider buy signal was confirmed by the weekly summary of insider activity from Barron`s.

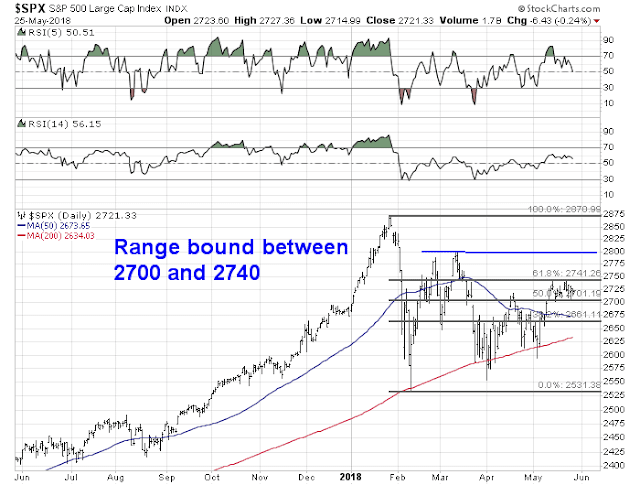

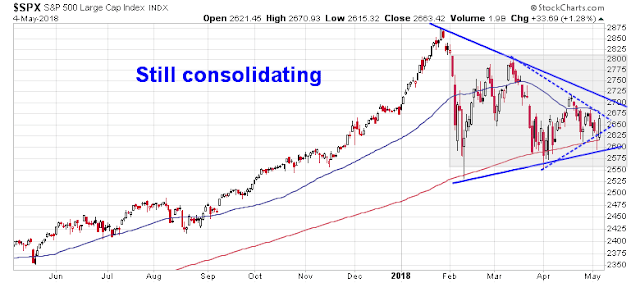

Shorter term, the SPX remains in a short-term no-man’s land between Fibonacci retracement levels of 2700 and 2740, with further resistance at 2800. Until either the bulls or bears can demonstrate sufficient resolve to break either of these levels, my inner trader is leaning slightly bullish but he is playing a waiting game.

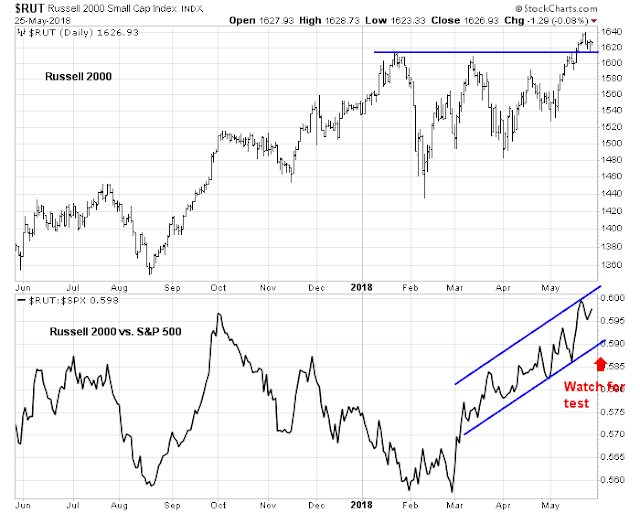

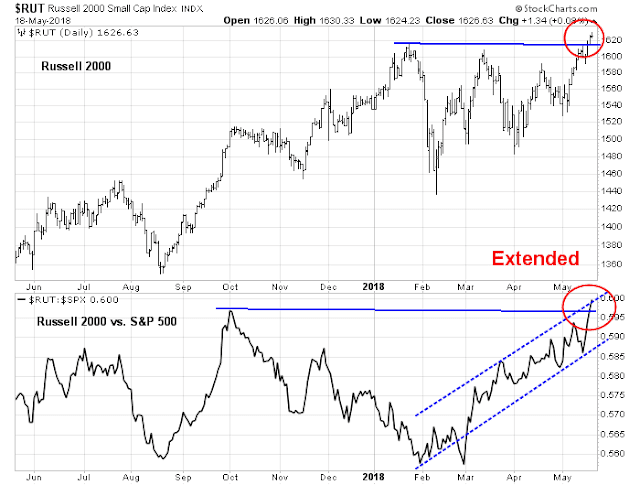

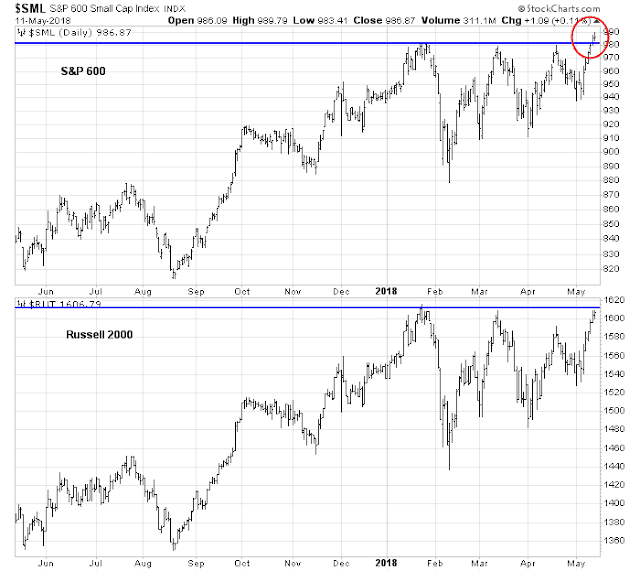

Small cap stocks, as measured by the Russell 2000, remains the market leaders as they staged upside breakouts to fresh highs and the index has held above the breakout level. However, the relative performance chart (bottom panel) shows that small caps are in the middle of an upward sloping relative uptrend channel and have little information about short-term direction. My inner trader is still watching for a test of the channel as a possible buy signal.

Stock prices are likely to grind higher into the summer months, and my inner investor is bullishly positioned. My inner trader has partial long market positions, and he is prepared to add to them on pullbacks.

Disclosure: Long SPXL

Cue the fiscal and inflation fears

Was the recent big tax cut not enough? CNBC reported that President Trump is proposing further tax cuts before November. He went on to pressure Congress to enact funding for his budget priorities on Twitter.

These actions prompted Steve Collender (aka @thebudgetguy) to declare in a Forbes article that Trump May Be The Most Fiscally Reckless President in American History:

But think about why Trump is asking for rapid action on the 2019 appropriations: He wants even more spending. Even though his policies have spiked the annual budget deficit to a new normal of a $1 trillion (with $2 trillion definitely within view) and interest rates are now starting to go up in large part because of his out-of-sync-with-the-economy stimulative fiscal policy, Trump is demanding that federal spending and the government’s red ink be increased even further.

There was no hint in this or any other subsequent tweet that Trump is going to propose offsetting spending cuts (or, heaven forbid, revenue increases) to compensate for the additional spending he’s demanding.

Trump’s recently-announced rescission package (which is already in a great deal of political trouble with congressional Republicans) doesn’t come close to offsetting the new spending Trump said he wants. It also won’t come close to being an offset even if the first package is followed with that second rescission plan Trump has said is coming, but which so far seems to be totally imaginary.

Here at Humble Student of the Markets, I believe that the determination of the proper path of fiscal policy is above our pay grade. Instead, my focus is on positioning portfolios for any changes in government policy.

Plenty of concerns

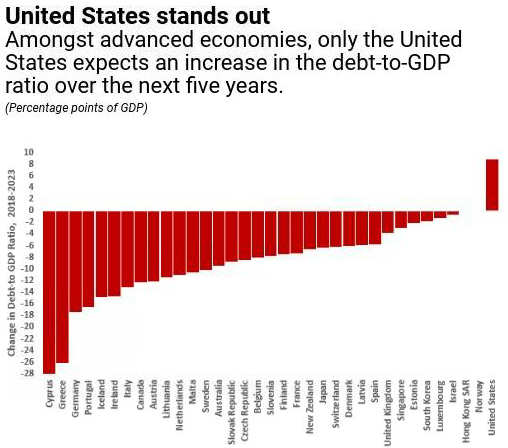

Steve Collender is not the only one to raise the alarm about the US fiscal position. The IMF also expressed concerns, as the US is the only major industrialized country projected to see increases in its debt-to-GDP ratio.

Goldman Sachs also recently raised questions about the fiscal outlook.

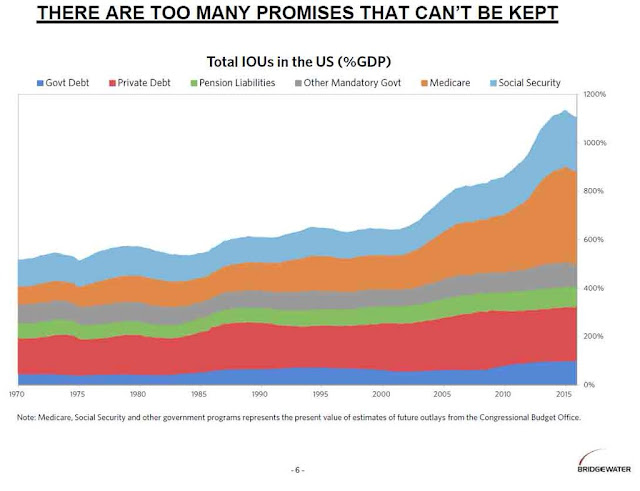

Federal debt is just the tip of the iceberg. Bridgewater Associates recently published a chart of out of control IOUs.

Rising inflation fears

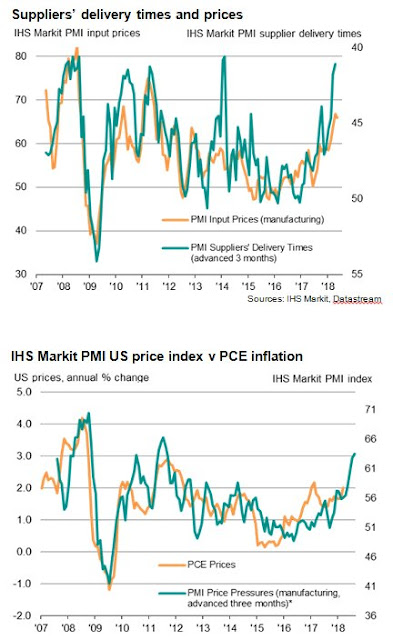

The usual solutions to runaway debt are either default or inflation. For a country whose currency is a major global reserve currency, the easy answer is inflation. Already, the latest update from Markit shows rising inflationary pressures.

The latest FOMC minutes added fuel to the inflation fire by affirming the symmetry of the inflation target at 2% and signaling a tolerance for an overshoot [emphasis added]:

With regard to the medium-term outlook for monetary policy, all participants reaffirmed that adjustments to the path for the policy rate would depend on their assessments of the evolution of the economic outlook and risks to the outlook relative to the Committee’s statutory objectives. Participants generally agreed with the assessment that continuing to raise the target range for the federal funds rate gradually would likely be appropriate if the economy evolves about as expected. These participants commented that this gradual approach was most likely to be conducive to maintaining strong labor market conditions and achieving the symmetric 2 percent inflation objective on a sustained basis without resulting in conditions that would eventually require an abrupt policy tightening…It was also noted that a temporary period of inflation modestly above 2 percent would be consistent with the Committee’s symmetric inflation objective and could be helpful in anchoring longer-run inflation expectations at a level consistent with that objective.

What to buy?

Regardless of my personal beliefs about the correct path for US fiscal and monetary policy, I believe investors in an era of rising fiscal tension and rising inflationary expectations should be buying inflation hedge vehicles for protection.

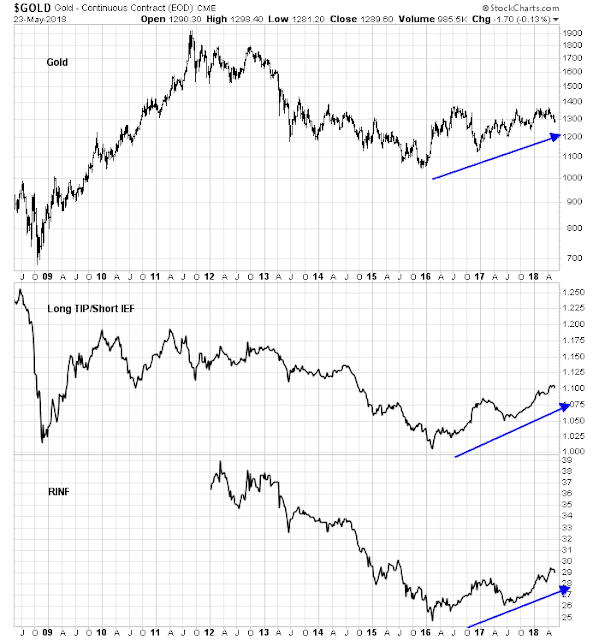

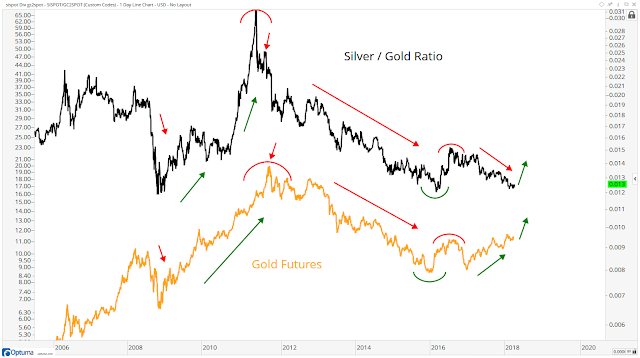

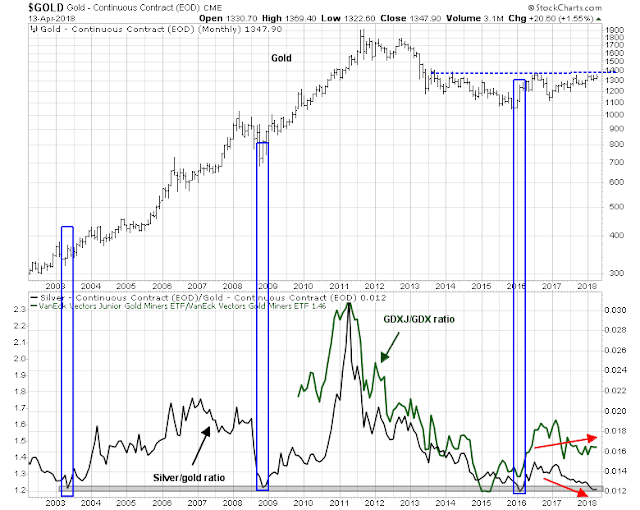

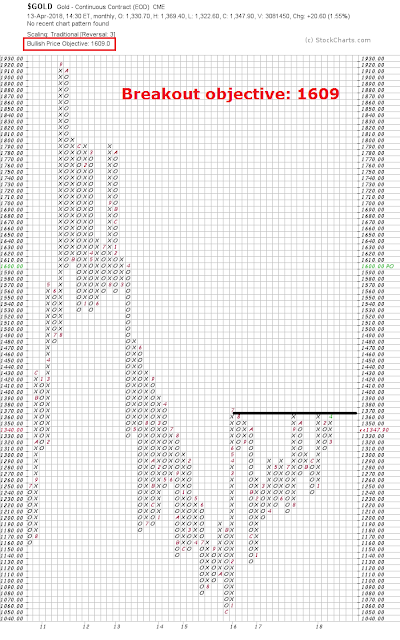

I have two suggestions. The classic inflation hedge is gold. From a technical perspective, gold has been basing since 2013, and in an uptrend that began in early 2016. More remarkable is the resilience of gold in the face of recent USD strength, which has shown an inverse correlation to bullion.

Absolute return oriented investors may wish to consider buying inflation breakeven in the credit markets. Kevin Muir, otherwise known as the Macro Tourist, explains it this way:

Although my short-term forecast is uncertain, I have a long-term one. Eventually, the Federal Reserve will lose control of inflation expectations. When that happens, owning TIPS might not be a winning trade in absolute terms, but rather simply offer relative protection versus traditional bonds from a rising inflation environment. If you want to profit from this widening, you need to have the other side of the trade on too. You have to be long TIPS, but also short Treasuries. Owning TIPS outright is not good enough.

Muir went on to outline two ways of trading inflation expectations. One is to buy TIP and short a Treasury ETF (IEF or TLT) at the right hedge ratio. The other is to buy an illiquid inflation expectations ETF (RINF) with a high (3.87%) gross expense ratio. Please note that the accompany chart showing a long TIP and short IEF position is for illustrative purposes only as it takes duration risk and therefore not interest rate neutral.

None of these hedges are perfect. You pay your money and take your chance.

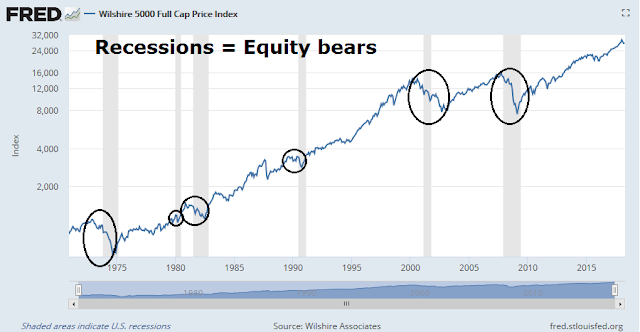

Bear markets simply don’t start this way

Mid-week market update: There remains a fair amount of stock market skittishness among my readers and on my social media feed. Let me assure everyone that bear markets simply don`t start this way.

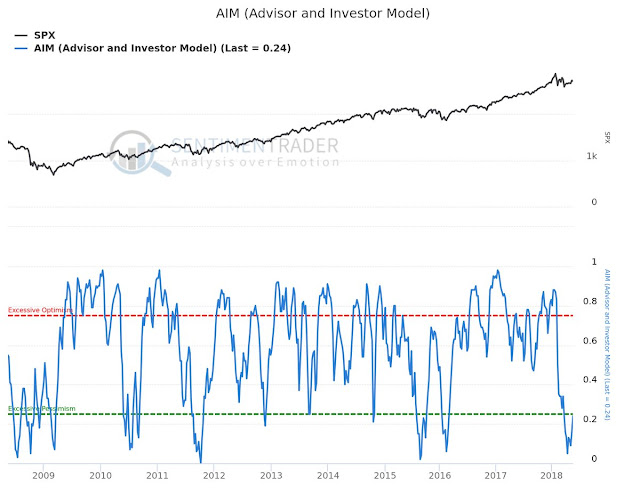

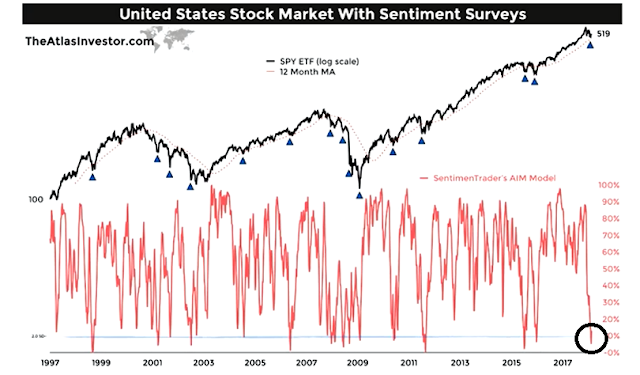

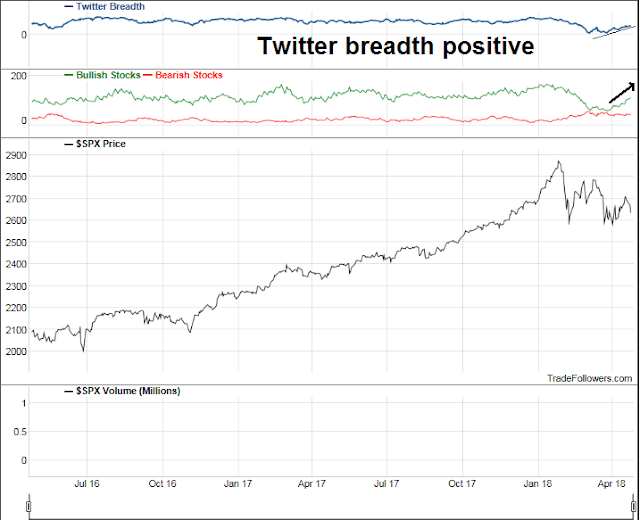

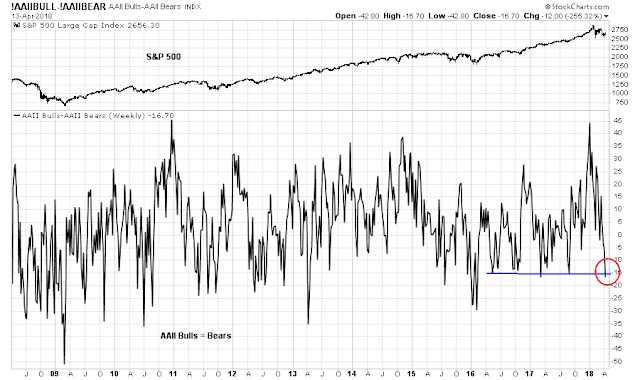

SentimenTrader has an intermediate to long-term sentiment model called AIM “which averages the momentum of the four major sentiment surveys”. This model is not perfect at calling the exact bottoms or spotting exact turning points. Nevertheless, it has done a good job of defining the risk and reward of owning stocks when readings are at bearish extremes, which is contrarian bullish. The model is currently on a buy signal.

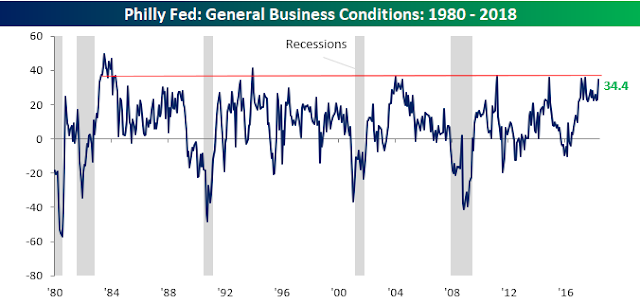

From a top-down macro perspective, Bespoke recently pointed out that the Philly Fed General Conditions Index hasn’t been this high for some time. Despite the mutterings of permabears (I’m looking at you Rosie), recessions simply do not start this way.

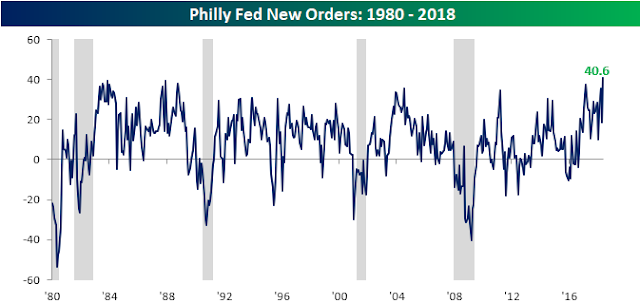

BTW, the Philly Fed New Orders component surged to an all-time-high, and the last time it rose this much in a single month was October 2005.

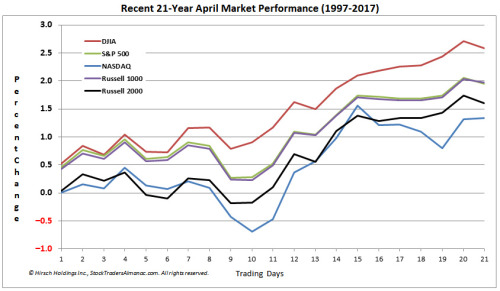

These conditions are all pointing to further intermediate term equity strength. Expect a test of the old highs in the major equity indices this summer, and probably new all-time highs.

However, stock prices don’t go up in a straight line. The short run equity outlook is a little different.

Trust the bull, but verify the trend

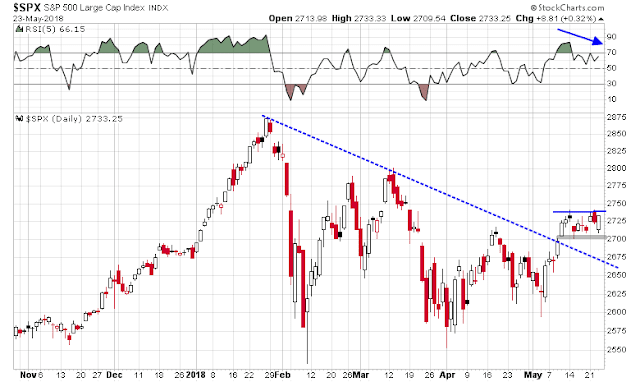

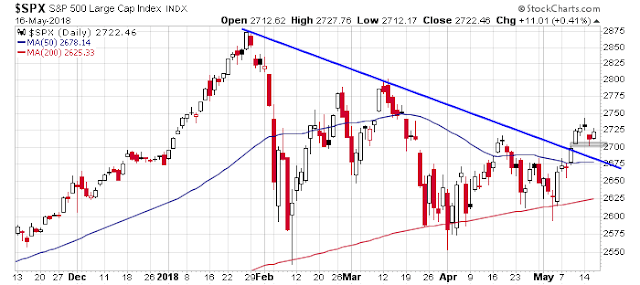

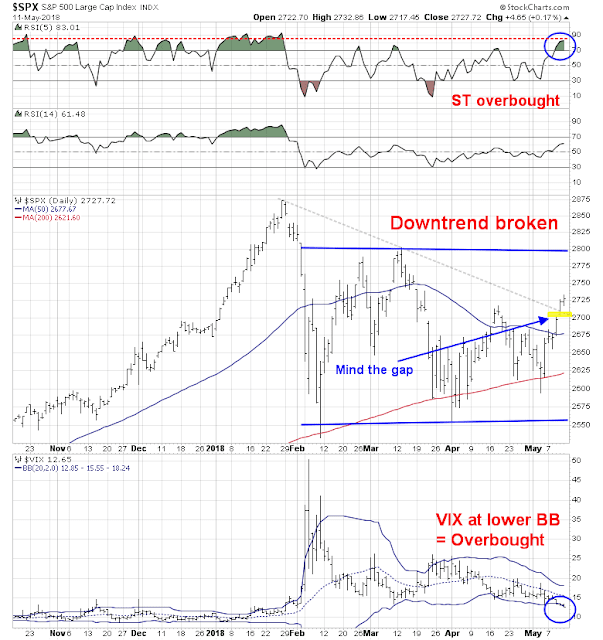

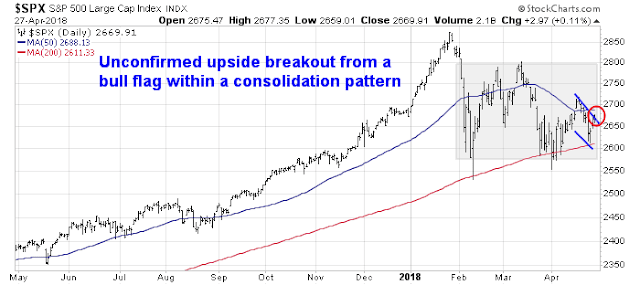

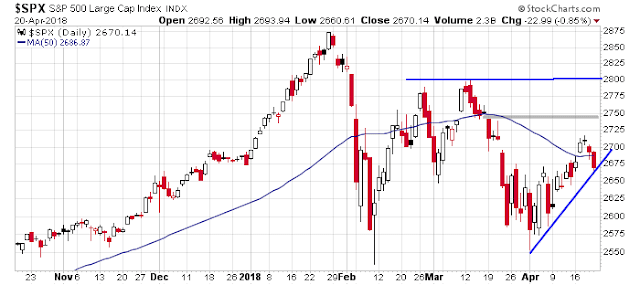

In the short-term, the bulls face a number of challenges. While the upside breakout through the downtrend line is constructive, the SPX failed at 2740 resistance while exhibiting a negative RSI-5 divergence. These conditions suggest some consolidation or pullback over the next few days. Likely support can be found at the partially filled gap at about 2700.

The hourly chart is also supportive of the minor pullback thesis. The index breached an uptrend line that began on May 8, 2018. Under these conditions, minor weakness is likely, and it will be up to the bears to see if they can take control of the tape.

In light of the recent resurgence of small cap leadership and likely short-term market weakness, my main working hypothesis calls for either a successful SPX test at 2700, or a test of the small cap relative uptrend as signals that the pullback is over.

My inner trader remains partially long the market. He trusts the bull, but he is verifying the short-term trend.

Disclosure: Long SPXL

The struggling Canadian canary

Back in March, I wrote about the new Fragile Five, which were five highly leveraged developed market economies that were undergoing property booms. The five countries are Australia, Canada, New Zealand, Norway, and Sweden.

As a reminder of how insane property prices are in Vancouver, which is one of the epicenters of the real estate boom, I highlighted this little gem that was listed for about USD 1 million.

Here is the same beauty from the back.

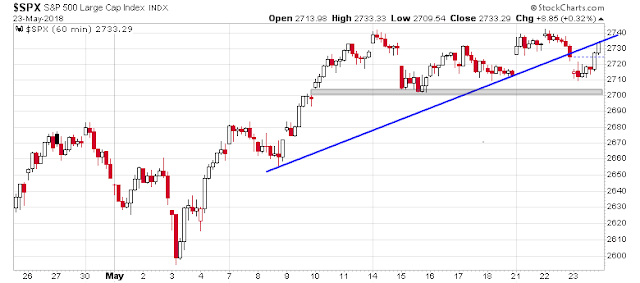

For some perspective. This chart depicts the debt bubble in Canada and Australia. If you are worried about runaway debt in China, then you should be equally concerned about the property bubble in the other Fragile Five countries.

So far, this has been a “this will not end well” investment story with no obvious bearish trigger. Now, there seems to be signs of a turning point in the Canadian economy.

The canary in the coalmine

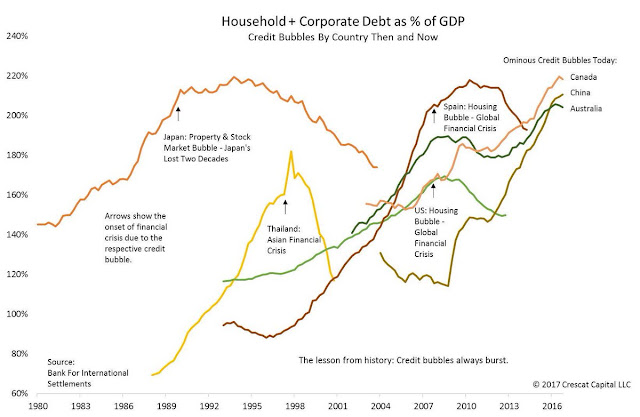

The Financial Post reported last week that the long end of the Canada yield curve had inverted.

The yield on Canada’s 10-year government bond briefly rose above the nation’s 30-year securities for the first time in more than a decade Thursday. The shorter-maturity notes have sold off in the last few days, pushing yields above 2.5 per cent for the first time since 2014. Canada is the only developed economy with that part of its yield curve inverted, according to data compiled by Bloomberg.

While I recognize that most investors monitor the yield curve at the short end, because central bankers control the short rate and short-to-long yield curve inversion is a signal of the central bank’s monetary policy. An inversion at the long end is equally disturbing, because it is reflective of the market’s growth expectations.

By week’s end, the yield curve had steepened and the 30-year Canada was trading 1bp above the 10-year. Whew!

Nevertheless, the Canada yield curve is very flat starting from the 10-year mark. This is a sign that the Canadian canary in the economic coalmine is struggling.

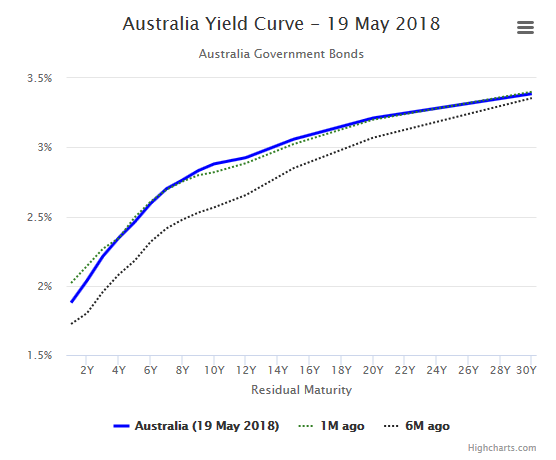

To be sure, the yield curves of the other Fragile Five countries continue to be upward sloping and there are no other danger signals. Here is Australia as an example.

How bad can it get?

While property bubble in Canada has begun to spread to a number of Canadian cities, it has largely been concentrated in Vancouver and Toronto. The rise in prices began with the leakage of excess liquidity from China into overseas property markets (see How China’s Great Ball of Money rolled into Canada). Locals joined the buying stampede, fueled by cheap and easy credit.

Not all bubbles are the same, but the Canadian experience is reminiscent of the Spanish experience with Costa del Sol before the Great Financial Crisis. Foreign (European) money poured in the region, attracted by the warm climate, and the location within the EU. Fueled by cheap credit, a buying and construction stampede followed. We know how these bubbles all end.

The historical experience shows that prices fell by between one-third and one-half over the course of several years. Expect a similar price adjustment process for Vancouver and Toronto real estate.

While a 30-50% price decline is painful, it can wipe out late buyers, as many bought in with 5-10% down payments. Moreover, the local papers was full of stories of homeowners who borrowed at 2-3% with home equity lines to fund mortgage lending pools that were lending at 5-8%. It was free money! What could possibly go wrong?

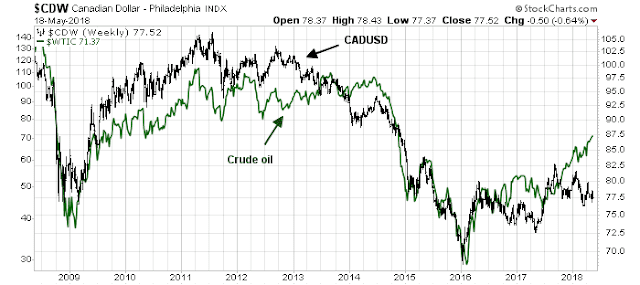

I have been asked for ways to short Canadian real estate, but there are no obvious plays. Much of the pain will be borne by the Canada Mortgage and Housing Corporation, which is a federal government entity that sells mortgage insurance. In that case, one way to play a collapsing Canadian property bubble would be to short the Canadian Dollar. The risk to that trade is CADUSD has historically been correlated to oil prices, which has been trending upwards.

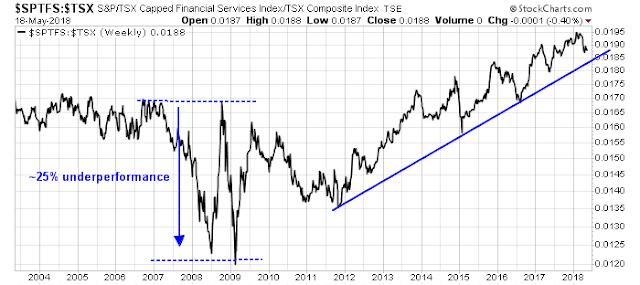

The carnage will also be felt by much of the financial sector. Canadian financial stocks underperformed the market by 25% in the last crisis, but banks had adhered to far more prudent lending standards compared to America in 2007. This time, Canadian institutions have been piling into property lending like drunken sailors, and expect loan losses to exceed the experience in the last cycle. The key risk to this trade is timing. While Canadian financials have begun to roll over relative to the market, the sector remains in a multi-year relative uptrend.

Rather than try to profit from a bursting Canadian property bubble, I prefer to take a global view and monitor the situation. Should Canada be the first of the G-7 markets to roll over into recession, it will serve as a warning to the other Fragile Five economies – and the rest of the world.

Disclosure: As a Canadian resident, I am naturally long CAD

Deconstructing the institutional pain trade

Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Model is an asset allocation model which applies trend following principles based on the inputs of global stock and commodity price. This model has a shorter time horizon and tends to turn over about 4-6 times a year. In essence, it seeks to answer the question, “Is the trend in the global economy expansion (bullish) or contraction (bearish)?”

My inner trader uses the trading component of the Trend Model to look for changes in the direction of the main Trend Model signal. A bullish Trend Model signal that gets less bullish is a trading “sell” signal. Conversely, a bearish Trend Model signal that gets less bearish is a trading “buy” signal. The history of actual out-of-sample (not backtested) signals of the trading model are shown by the arrows in the chart below. The turnover rate of the trading model is high, and it has varied between 150% to 200% per month.

Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the those email alerts are updated weekly here.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities

- Trend Model signal: Bullish

- Trading model: Bullish

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of the those email alerts is shown here.

Institutions and the pain trade

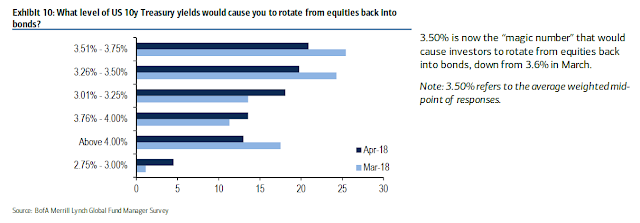

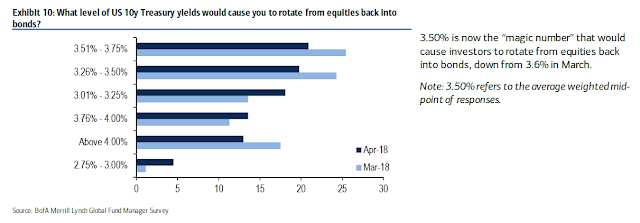

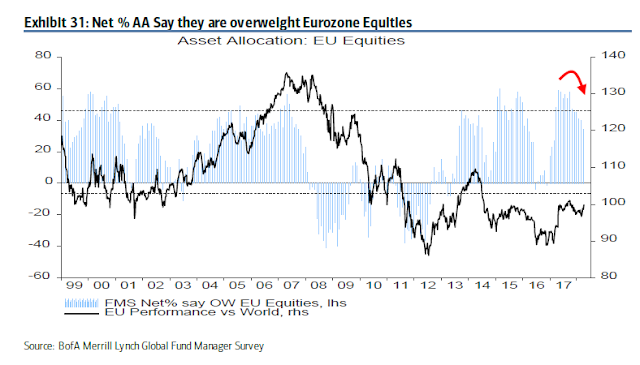

The BAML Fund Manager Survey (FMS) is one of the most interesting surveys around, as the frequency is regular (monthly), extensive, and it has a long history. For readers who are unfamiliar with the survey, it reflects mainly the views of fund managers with global investment mandates.

Reading between the lines of the latest FMS results, I found that institutional managers are positioned for a late cycle inflation surge, but they are starting to de-risk their portfolios in anticipation of weaker growth. To summarize, institutional managers believe that:

- Growth momentum is slowing, but

- Inflation expectations are rising, but

- The day of reckoning, as defined by either a recession or even a yield curve inversion, is still a long way in the future.

Fund managers have positioned their portfolios:

- In commodities, which I interpret as positioning for a late cycle inflation surge, but

- They are de-risking by selling equities,

- Selling their emerging market (EM) positions, and

- Buying bonds, but

- Portfolio risk appetite remains above average.

The highlights of the consensus portfolio bets amount to long energy, short USD, and short bonds. This analysis is highly speculative, but if I were the market gods and I wanted to inflict the maximum level of pain on market participants, here is what I would do.

What institutions believe

Let`s start by unpacking the FMS results. Institutional investors believe that the economic cycle is in the late phase of an expansion. Growth momentum is slowing.

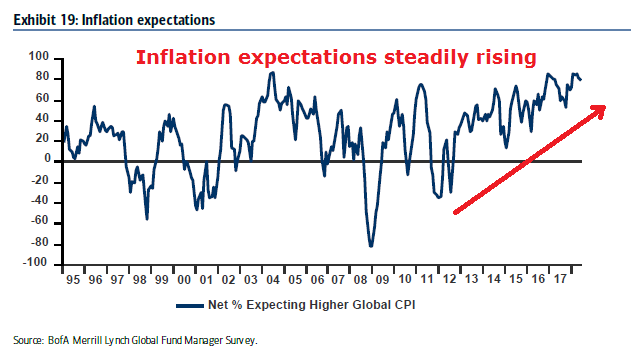

Inflation expectations are rising and they have been steadily increasing for several years.

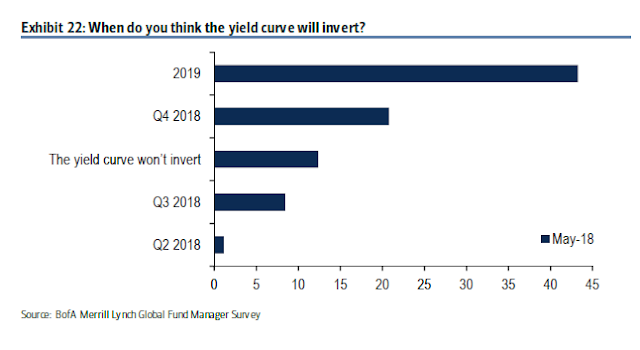

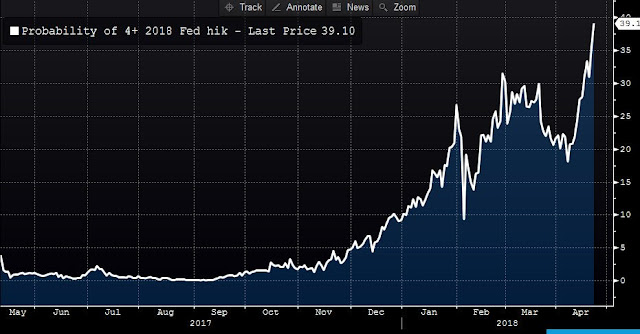

Here is a possible anomaly. Even though managers believe that they are seeing classic signs of a late cycle expansion, the median manager believes that a yield curve inversion, which has preceded past recessions, will not occur until some time in 2019. How late cycle can the markets be if a yield curve inversion is that far off?

As well, the median manager expects the next recession will not occur until late 2019.

Buying inflation hedges, but de-risking

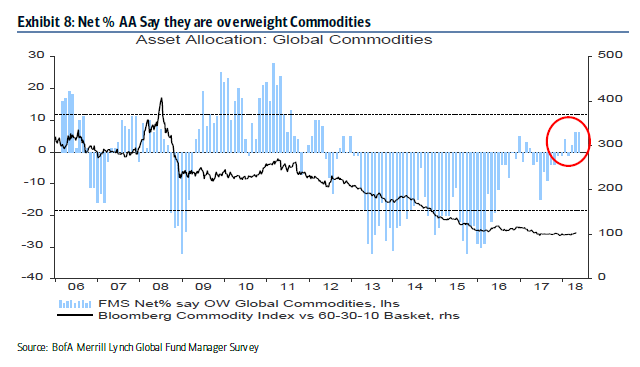

In accordance with the belief in rising inflation expectations, institutional managers are overweight late cycle inflation hedges such as commodities, though positions are not excessive.

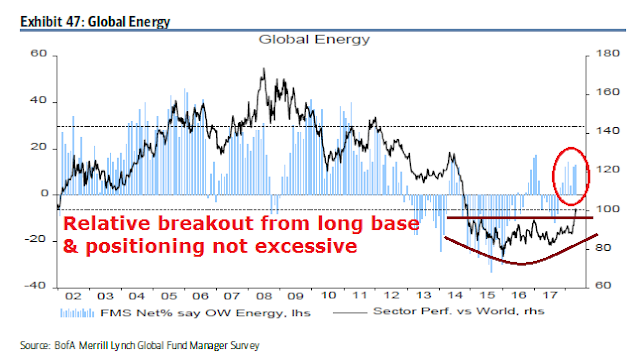

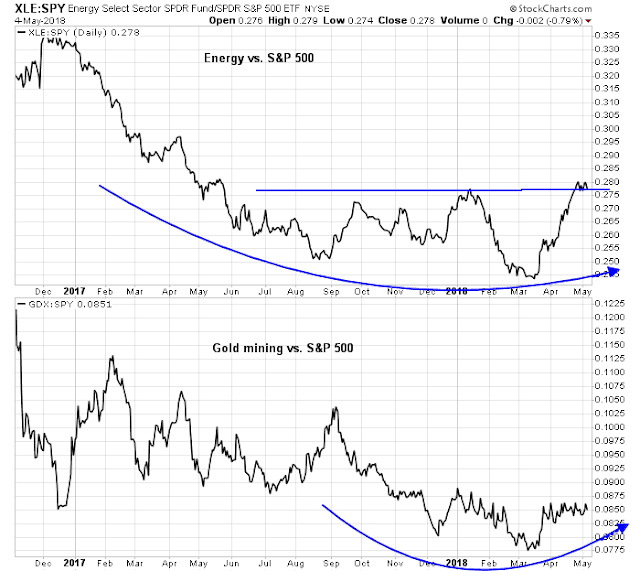

Similarly, energy stocks have staged an upside relative breakout from a multi-year base. Managers are also overweight, but positions are not extreme.

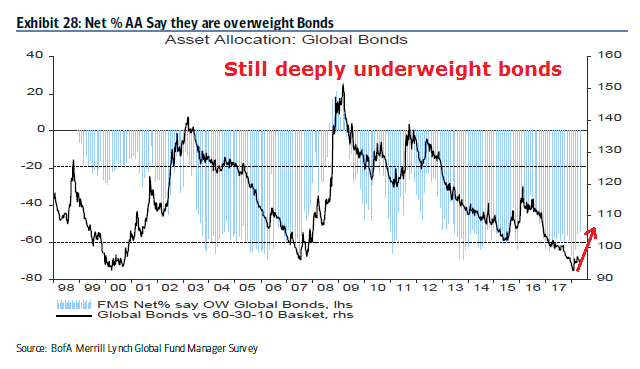

Risk on? Not so fast. Managers have begun to de-risk their portfolios by unwinding their extreme underweight bond positions, though they remain deeply underweight.

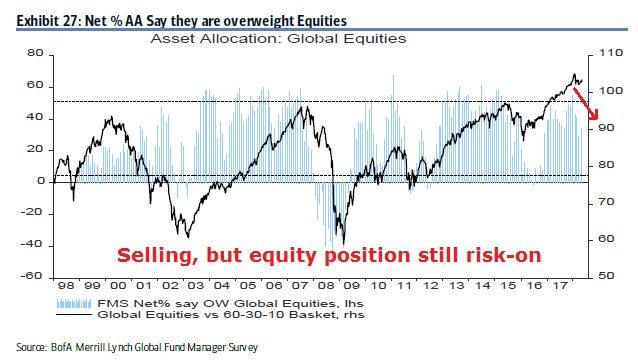

At the same time, they have begun to lower their equity weights, though their positioning remains risk-on and above average.

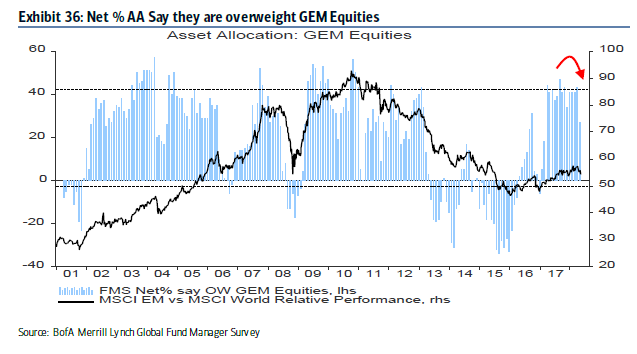

The de-risking starts with a sale of their high-beta EM positions.

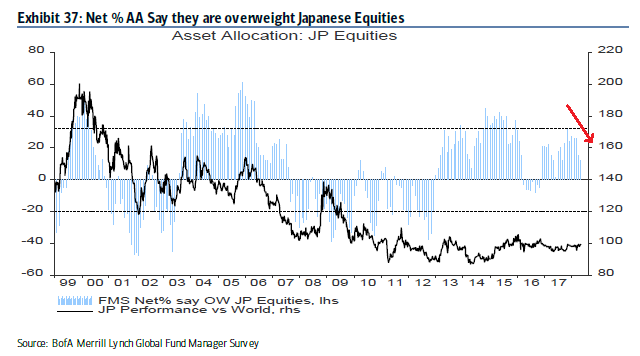

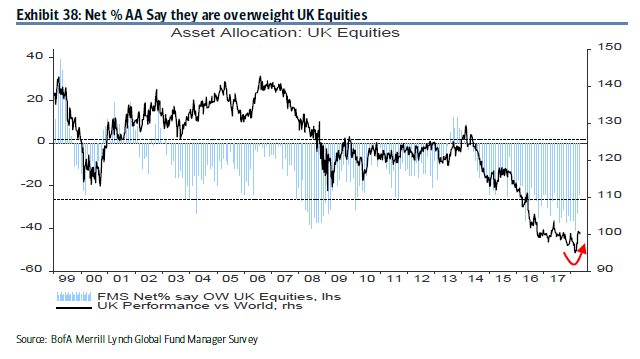

The equity weights in most developed regions have been falling.

The only major exception is the UK, which enjoyed a rebound. However, the weight of the UK in the MSCI All-Country World Index (ACWI) is only 5.8%.

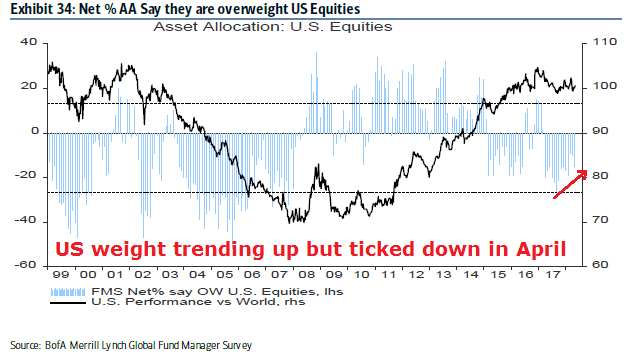

The weight of US stocks, which has a 52% weight in ACWI, has been mixed. While US portfolio weights have been trending up for the past few months, it ticked down in the latest month.

How can managers be selling stocks while you espouse a belief in rising inflation, and overweight commodities? Shouldn’t they be buying beta instead of selling beta under these circumstances?

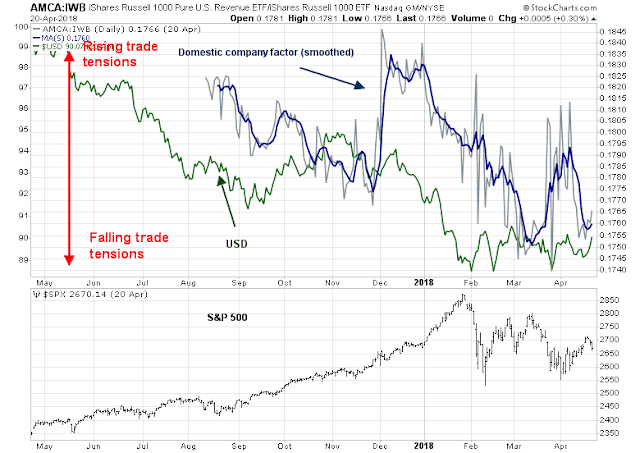

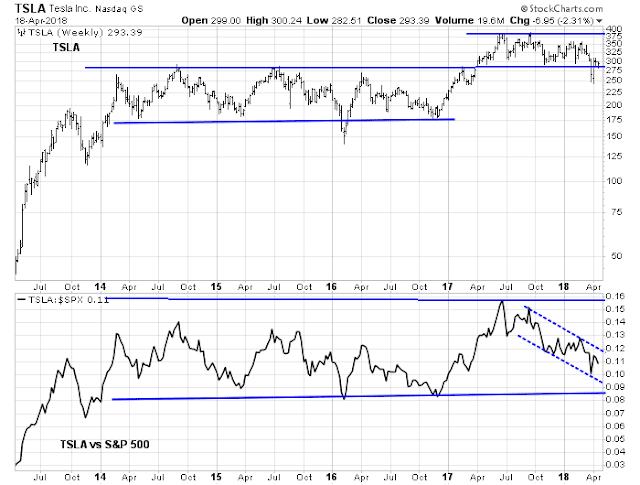

How the pain trade could develop

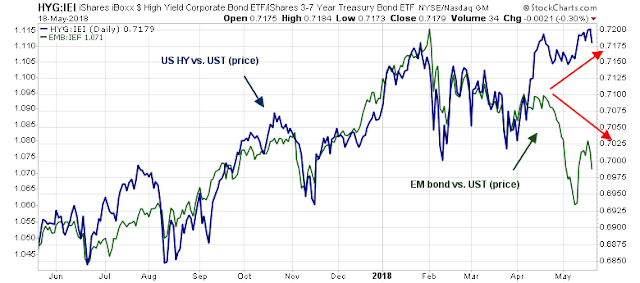

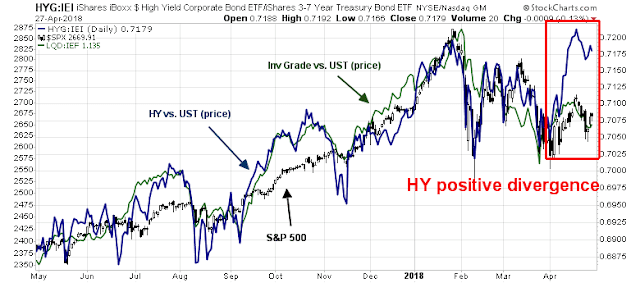

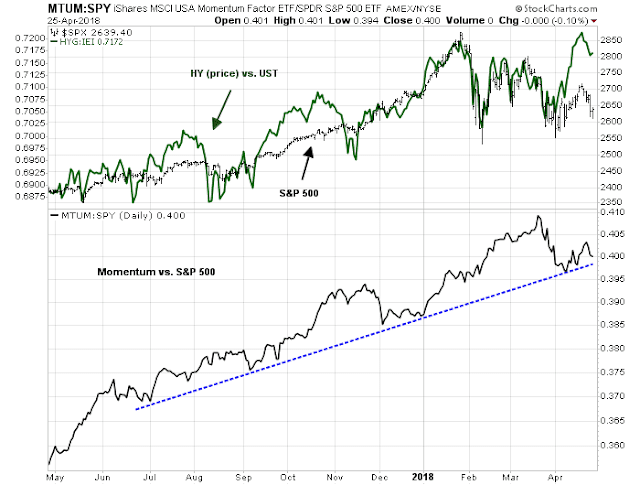

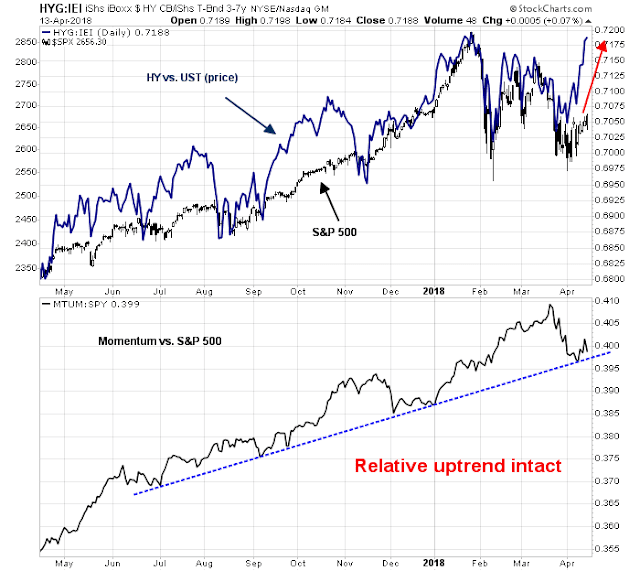

One of the clues to the pain trade comes from the recent EM weakness. What was unusual about the sale in EM positions is that that rush for the exits was not accompanied by other signs of risk appetite pullback. The chart below shows the price performance of US high yield debt relative to their duration equivalent Treasuries, and that of EM bonds. Note the yawning price gap that began in early April.

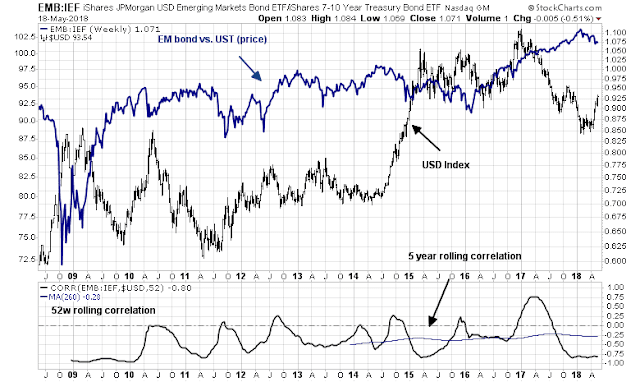

The weakness in EM debt can be attributable to the strength in the USD. As the USD rises, the risk of a crisis in overly indebted EM countries with USD denominated debt rises. The bottom panel of the following chart shows that the history of EM debt relative performance is negatively correlated with the US Dollar.

Here is how a pain trade might develop. What if the US Dollar were to strengthen further? Continued intermediate term USD strength makes sense from a technical perspective. The RRG chart, which is used to measure group rotation, shows that the USD is the only currency that is in a leadership position. All other currencies, which includes gold, are either in the weakening or lagging quadrants.

The recent USD strength caught most market participants by surprise. The USD is currently overbought, and a minor pullback or consolidation would be no surprise. What if it paused briefly here and continued to rally?

Commodity prices are historically inversely correlated with the USD, and further USD rally would cause managers with overweight positions in commodities and energy stocks considerable pain.

But first, a USD pullback

To be sure, the market gods are tricksters who like to draw their victims in so that they can suffer maximum pain. The USD rally is probably unsustainable in the short run, as the spike in US yields have pushed the greenback up against other currencies. The differential between the 10-year Treasury note and other global yields has reached 1%, which is extreme by historical standards. Something has to give, and expect some pullback in Treasury yields, which would weaken the USD.

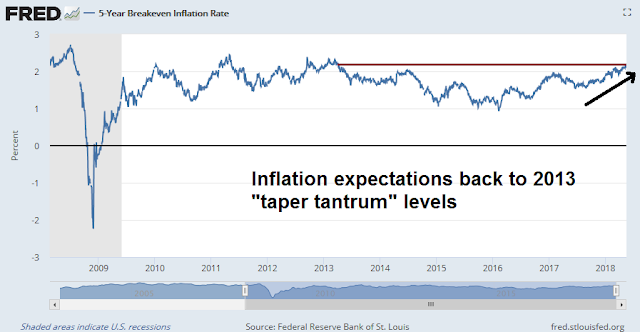

At the same time, there is ample evidence that inflationary pressures are rising. Inflation expectations, as measured by the 5-year breakeven rate, is back to 2013 “taper tantrum” levels.

The combination of near-term USD softness and rising inflation expectations should draw in buyers into inflation hedge vehicles. In that case, watch for gold prices to stage an upside breakout from a multi-year base should the USD decline. In the interim, gold’s ability to remain in an uptrend in the face of USD has to be regarded as constructive for the precious metal.

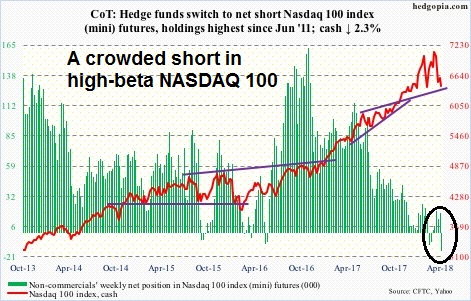

A summary of the latest Commitment of Traders from Hedgopia shows that large speculators are bailing out of their long gold positions. This is a sign of capitulation, and counter-trend USD weakness that buoys gold prices will be another source of trader pain.

At the same time, the erosion in large speculator long positions in crude oil even as prices advanced is a sign that oil prices are climbing the proverbial Wall of Worry.

All we need is one or more catalysts, such as a falling USD, or tighter supply from Iranian oil embargoes, to spike the oil prices. CNBC reported that Paul Hickey of Bespoke indicated that the current combination of rising oil prices and rising USD, while unusual, has historically been bullish for oil prices:

When we looked back at these prior periods in the market when you see these simultaneous rallies, crude oil has had a little bit better-than-average returns. The energy stocks have done really well going forward as well as the overall stock market.

A separate CNBC article indicated that expectations are building for $100, or possibly even $150 oil prices:

- The geopolitical risk premium in oil has driven crude prices to nearly four-year highs and shows no signs of abating.

- The U.S. exit from the Iranian nuclear deal, the rocket attacks between Iranian and Israeli forces and the general belief among the U.S., Saudi Arabia and Israel that Iran’s regional expansion needs to be stopped all argue for a continued rise in the price of crude.

- President Trump’s position on Iran has emboldened both Israel and Saudi Arabia, together, to challenge Iran more openly than at any time in the last four decades.

I have pointed out before that one-year changes in oil prices of 100% or more have tended to coincide with stock market peaks, largely because of a combination of the recessionary effects of higher oil prices and the Fed reacting to the leakage of commodity inflation into core inflation statistics. All that is needed is a WTI price of $85-90 by this summer.

Under such a scenario of near-term USD weakness, and upside breakouts in gold and oil price spikes, it would draw in the FOMO traders in a bullish stampede. Evidence of rising inflation and inflation expectations would likely result in a Fed-induced tightening cycle that puts upward pressure on the USD.

That’s how the ultimate pain trade would develop. One particular point of vulnerability are the EM economies. Bloomberg reported that Carmen Reinhart stated that EM countries are highly exposed in the current environment:

While money managers from Goldman Sachs Group Inc. to UBS Wealth Management still tout investing opportunities in emerging markets, the asset class has one notable critic: Harvard professor Carmen Reinhart.

The Cuban-born economist points to mounting debt loads, weakening terms of trade, rising global interest rates and stalling growth as reasons for concern. In fact, developing nations are worse off than during their two most recent moments of weakness: The 2008 global financial crisis and 2013 taper tantrum, when equities endured routs of 64 percent and 17 percent respectively.

“The overall shape they’re in has a lot more cracks now than it did five years ago and certainly at the time of the global financial crisis,” Reinhart said from Cambridge, Massachusetts. “It’s both external and internal conditions.”

Edward Harrison at Credit Writedowns suggested that Fed chair Powell is prepared to throw the EM economies under the bus. These countries are on their own if there is a crisis. In a recent speech, Powell stated:

Monetary stimulus by the Fed and other advanced-economy central banks played a relatively limited role in the surge of capital flows to EMEs in recent years. There is good reason to think that the normalization of monetary policies in advanced economies should continue to prove manageable for EMEs.

It also bears emphasizing that the EMEs themselves have made considerable progress in reducing vulnerabilities since the crisis-prone 1980s and 1990s. Many EMEs have substantially improved their fiscal and monetary policy frameworks while adopting more flexible exchange rates, a policy that recent research shows provides better insulation from external financial shocks.

Translation: The Fed is only responsible for the American economy. EM countries are on their own.

In addition, some Fed researchers published a rather timely discussion paper on the effects of Fed tightening cycles on foreign economies [emphasis added]:

This paper analyzes the spillovers of higher U.S. interest rates on economic activity in a large panel of 50 advanced and emerging economies. We allow the response of GDP in each country to vary according to its exchange rate regime, trade openness, and a vulnerability index that includes current account, foreign reserves, inflation, and external debt. We document large heterogeneity in the response of advanced and emerging economies to U.S. interest rate surprises. In response to a U.S. monetary tightening, GDP in foreign economies drops about as much as it does in the United States, with a larger decline in emerging economies than in advanced economies. In advanced economies, trade openness with the United States and the exchange rate regime account for a large portion of the contraction in activity. In emerging economies, the responses do not depend on the exchange rate regime or trade openness, but are larger when vulnerability is high.

Ouch! As a reminder. Even though the FMS shows that institutional managers are de-risking, their portfolios remain in a risk-on mode.

Should the pain trade scenario develop as I outlined, the fake-out begins with inflation exposure in institutional portfolios growing as the USD initially weakens and commodities rise, drawing the momentum players. Once it becomes an unbearable crowded long, interest rates would rise, the USD rally, and the trade would reverse itself, causing much pain and misery.

Near-term bullish

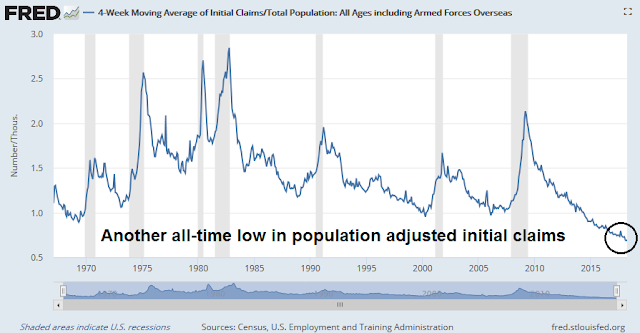

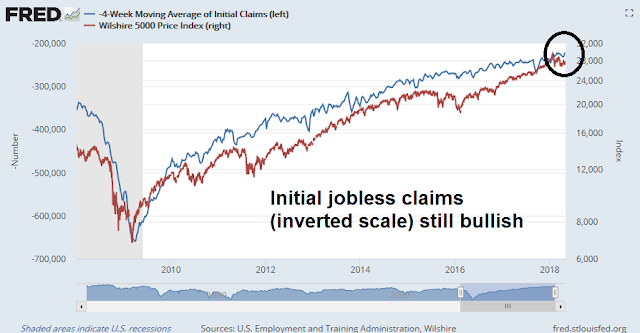

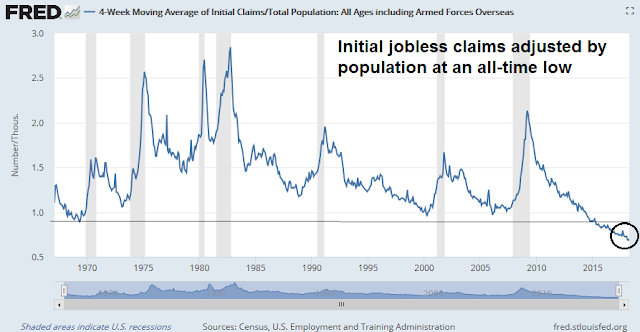

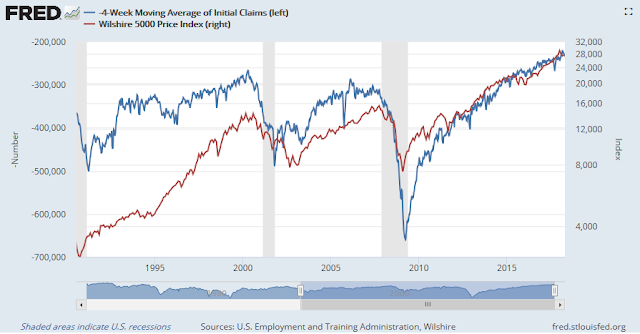

In the meantime, the near-term outlook is still bullish. The 4-week moving average of initial jobless claims, which is inversely coincident to stock prices, fell to another cycle low and to levels not seen since 1969. Population adjusted initial claims is already at another all-time low.

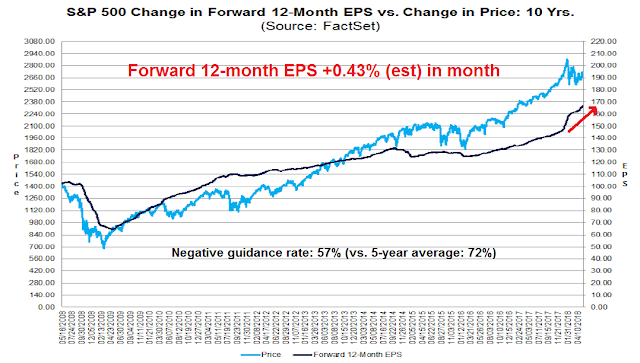

Forward 12-month EPS estimates is another indicator that is coincident to stock prices. The latest update from FactSet shows that forward EPS continues to rise, and Q2 guidance is better than the historical average.

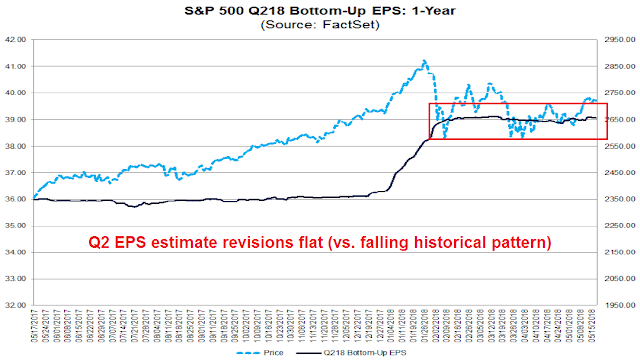

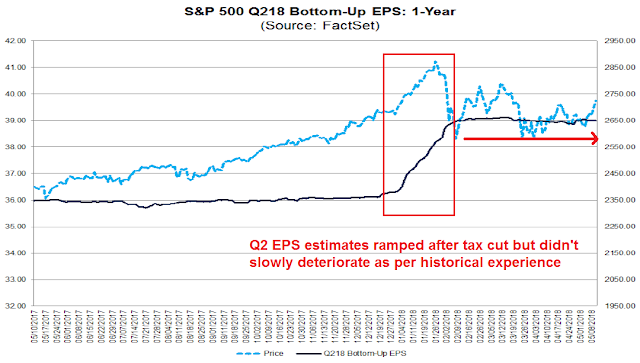

Drilling down further, the evolution of Q2 EPS estimates is encouraging for the growth outlook. Historically, Street analysts tend to be overly optimistic about earnings. Initial estimates tend to be high, and they slowly deteriorate over time. Q2 2018 EPS breaks that pattern. After an initial ramp because of the tax cut, estimates have stayed flat instead of degrading.

The week ahead

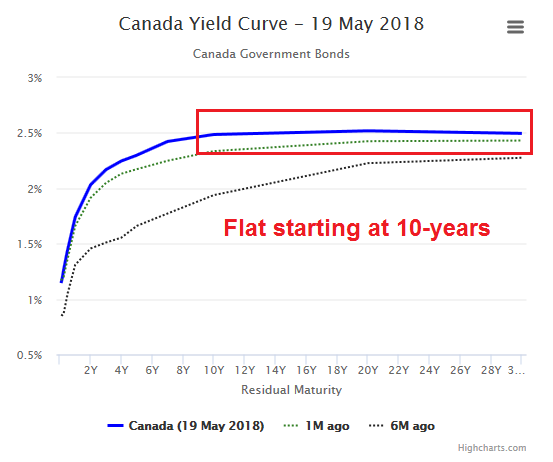

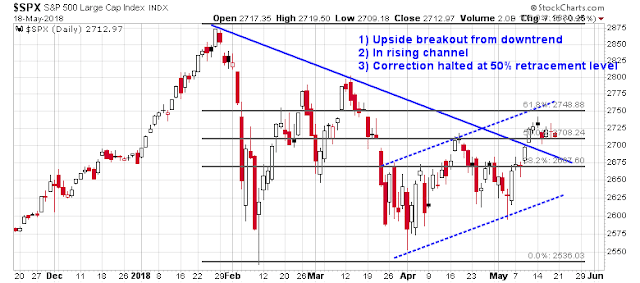

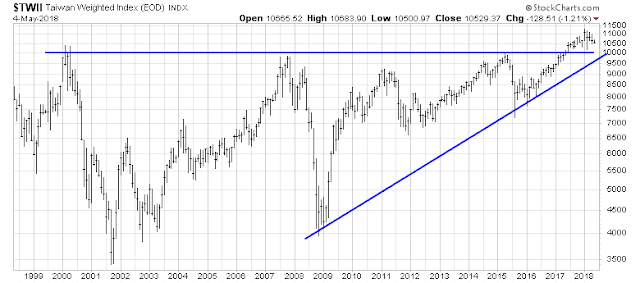

Looking to the week ahead, it’s hard to discern likely market direction despite my bullish intermediate term outlook. The bulls can be encouraged by the recent upside breakout from the downtrend (solid line), and stock prices appear to be in a rising channel (dotted lines). As well, last week’s weakness was halted at the 50% retracement level.

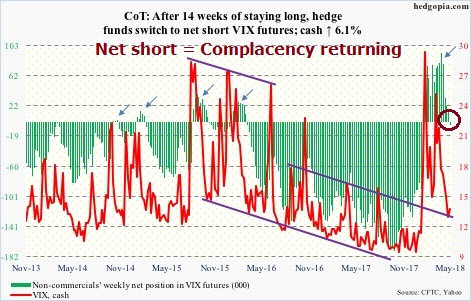

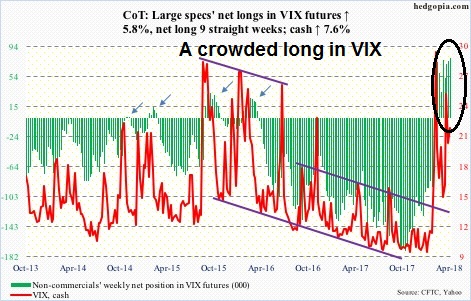

The latest CoT data shows that large speculators have moved from a net long to a net short position in VIX. Complacency is returning to the markets, but readings are not extreme and rising VIX shorts can be interpreted as a sign of positive equity price momentum.

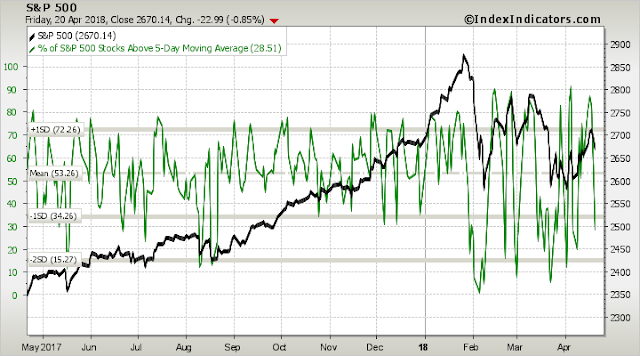

On the other hand, the current rally off the bottom has been led by small cap stocks, and the small cap move looks extended and due for a pause.

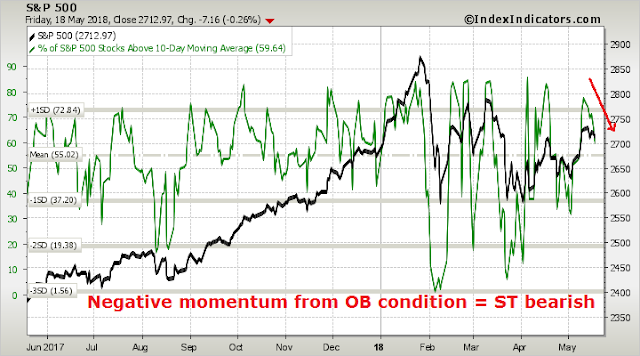

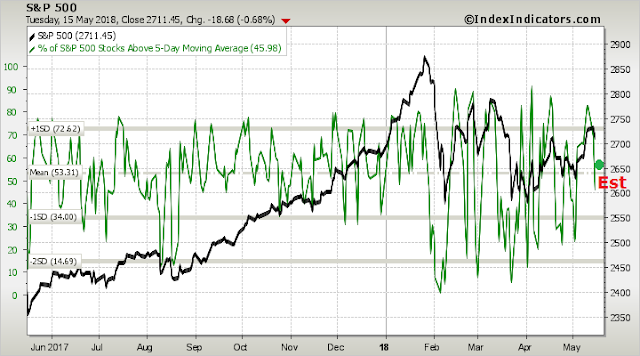

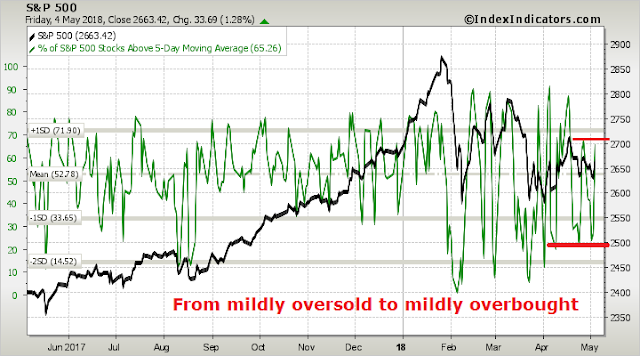

In addition, breadth indicators from Index Indicators show that the market is working off an overbought condition and exhibiting negative momentum, which is short-term bearish.

These kinds of market conditions call for a careful assessment of risk and reward. While my inner trader is leaning bullish, this is not the time to take excessive risk, and he prefers to step back and he is prepared to be not fully invested should the market rally from these levels. At the same time, he is keeping dry powder to buy the dips should they materialize.

My inner investor remains constructive on equities.

Disclosure: Long SPXL

Market waves and ripples

Mid-week market update: Charles Dow once characterized the stock market`s price movement as being composed of tides, waves, and ripples. We can see a mini version of this thesis by the market’s action in the past week. The major indices had staged an upside breakout through a downtrend and sentiment had turned bullish.

This week, the narrative became more cautious:

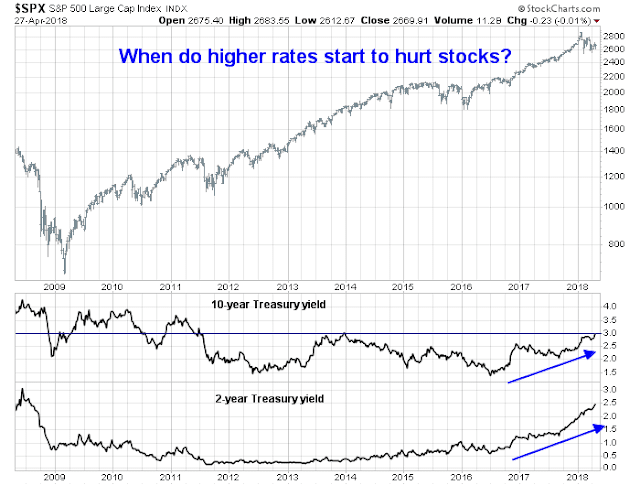

- 10-year bond yields had spiked significantly above 3%.

- The US-North Korea summit is at risk of going off the rails.

- The anti-migrant Lega Nord and anti-establishment Five Star Movement are on the verge of forming the next Italian government.

- The Sino-American trade talks are undergoing their own roller coaster. Trump’s weekend “rescue ZTE” tweet was followed by a White House clarification that walked back some of rhetoric.

Which is the wave? Which is the ripple?

Intermediate term trend is up

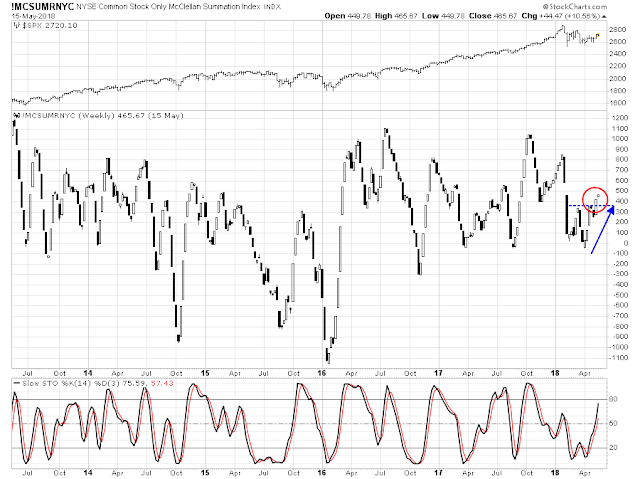

From a technical perspective, the intermediate term trend remains constructive. Breadth, as measured by the NYSE Common Stock only McClellan Summation Index, has broken out to the upside, and stochastics are not overbought.

Another constructive data point comes from Mark Hulbert. Hulbert’s sample of NASDAQ market timers have turned bullish, indicating positive momentum, but readings are neutral and not extreme yet.

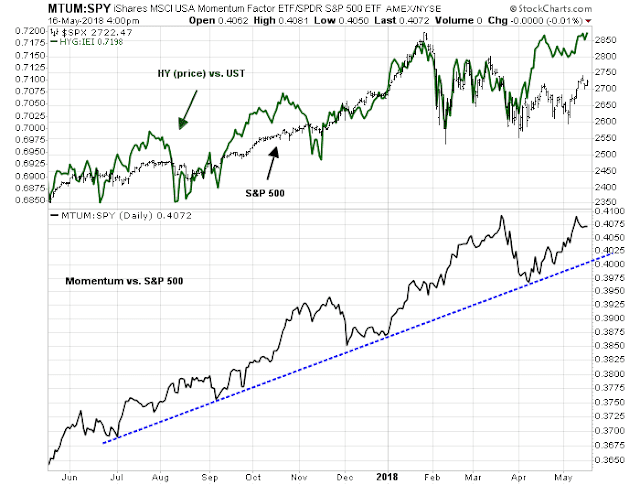

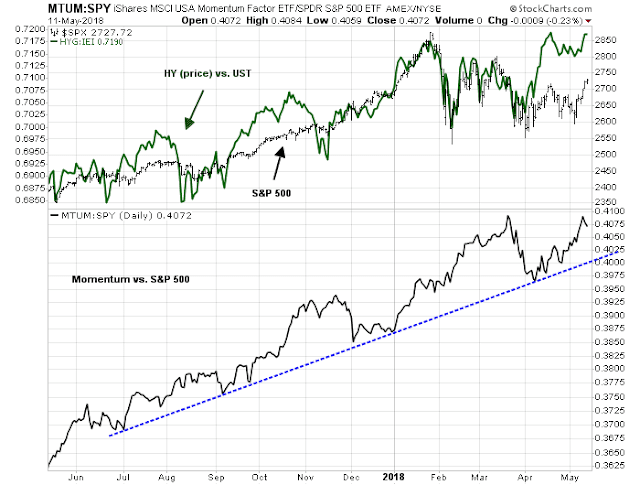

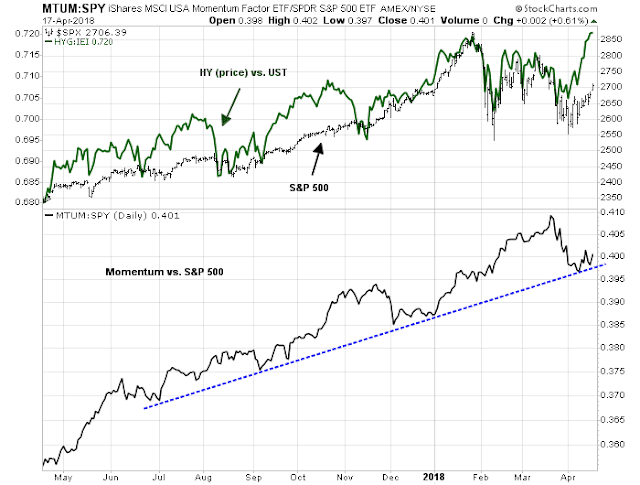

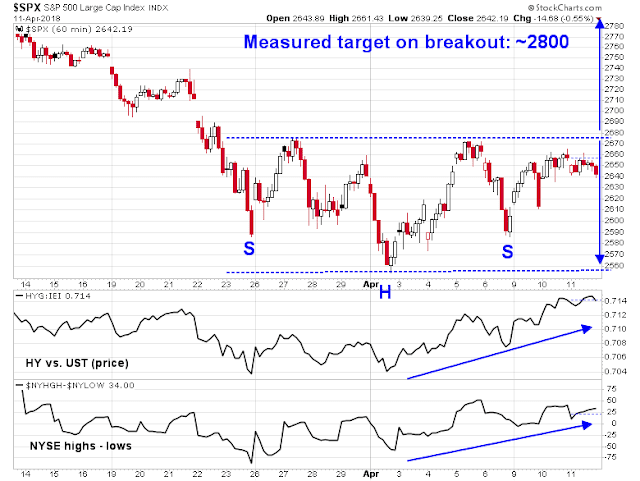

Risk appetite, as defined by HY relative price action, and price momentum, remain in uptrends.

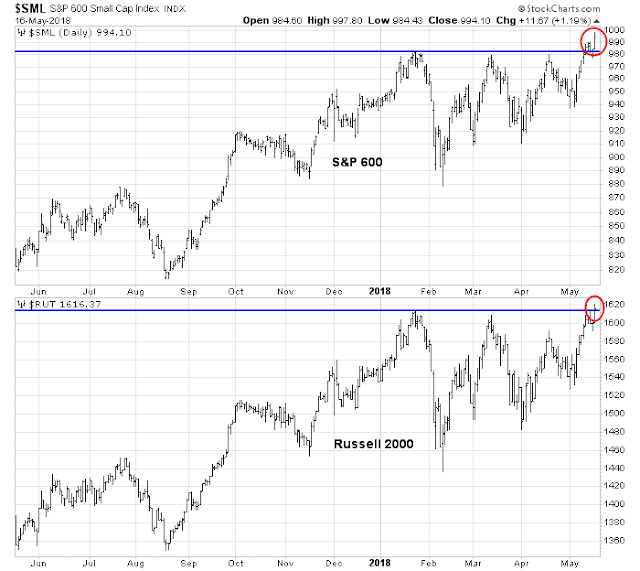

The high beta small caps are breaking out to the upside. The S&P 600 had already broken out to all-time highs, and the Russell 2000 just made a new high today.

Watch the ripples

I had suggested that there was support for the SPX at about the 2700. An open gap was partially filled, and the area is also the site of the downtrend line which the market could test on a pullback.

Short-term breadth (1-2 day time horizon) from Index Indicators is sloping downwards and have not reached oversold levels, which suggest that the pullback may not be over.

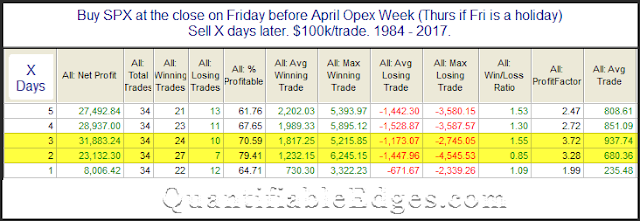

This week is OpEx week, and Rob Hanna’s study found that the historical pattern for May OpEx had no edge, with 17 up weeks and 17 down weeks.

I interpret the current market action as the stock prices undergoing a minor pullback in an intermediate uptrend. Short-term indicators are not oversold, and history suggest further choppiness. The path of least resistance is up, but the correction has probably not fully run its course.

My inner trader is long the market and he is buying the dips.

Disclosure: Long SPXL

Tame inflation? Don’t get too complacent!

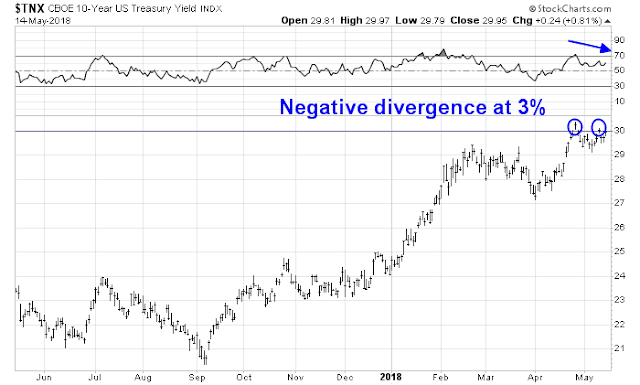

The Treasury market rallied last week when the 10-year Treasury yield tested the 3% level and pulled back.

The decline in yields (and bond prices rally) was not a big surprise for a number of reasons:

- 10-year yields (TNX) was exhibiting a negative RSI divergence

- A tamer than expected Consumer Price Index

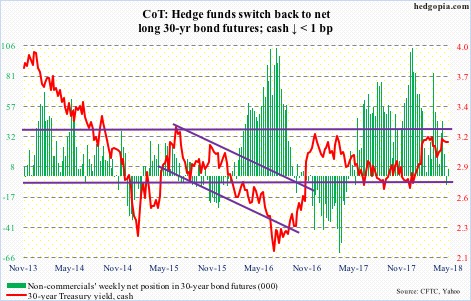

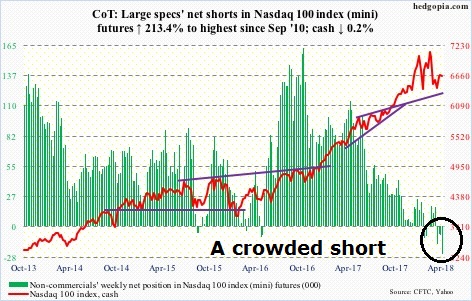

- Hedge funds were in a crowded short in the 10-year T-Note and T-Bond futures

While the bond market rally is likely to have a bit more leg over the next few weeks, my inclination is to enjoy the party, but don’t overstay the festivities.

A crowded bond short

The latest Commitment of Traders readings from Hedgopia shows that large speculators, or hedge funds, were in a crowded short in the 10-year Treasury Note.

Their positioning in the long Treasury bond also shows a lack of bullishness.

The combination of nervousness over a surge in a fiscal deficit induced Treasury issuance, which tactically put upward pressure on yields, a crowded short, and a positive inflation surprise were enough to spark a bond market rally.

Don’t get too complacent

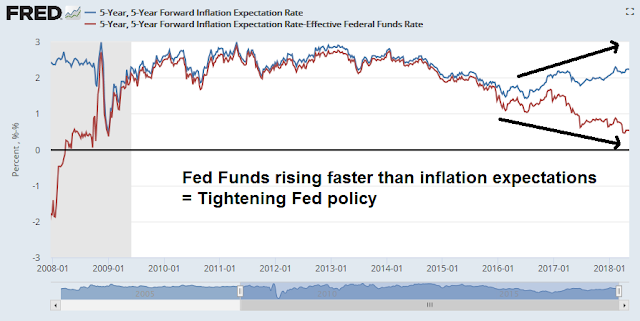

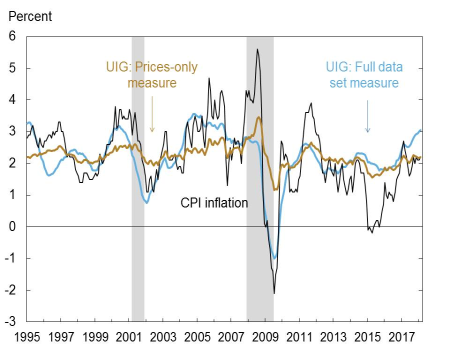

However, I would advise against getting overly complacent about inflation. Here is the big picture. Inflation expectations (blue line) have been steadily rising, and the Fed has been tightening in response. The spread between inflation expectations and the Fed Funds rate (red line) has been falling, indicating an increasingly tight monetary policy.

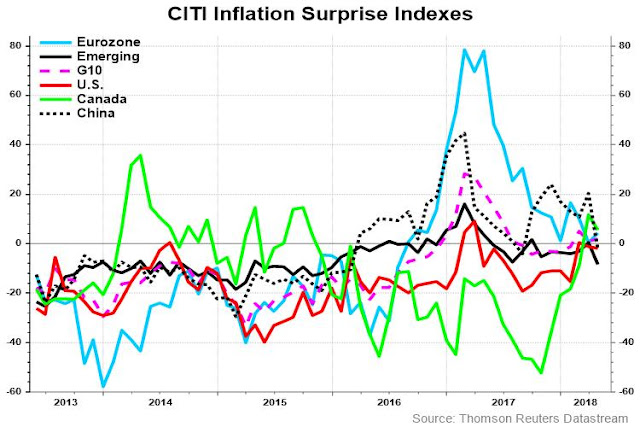

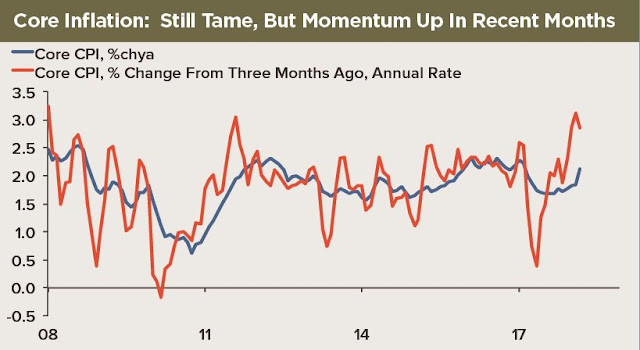

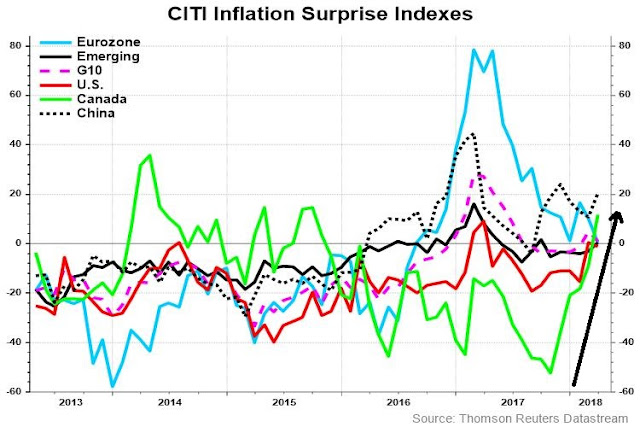

In the short run, inflation surprise began to tick up in early 2018 globally and readings have flattened out. Inflation momentum may be taking a hiatus, but the underlying dynamics still call for more upward pressure.

How pervasive is inflation pressure? The New York Fed’s Underlying Inflation Gauge stands at 3.2%, which is well above the Fed’s 2% inflation target.

The inflation “tell” from small business

Aside from the top-down analysis, the bottom-up view also shows a story of escalating price pressures. Eric Cinnamond pointed out a long list of 64 companies talking about inflation.

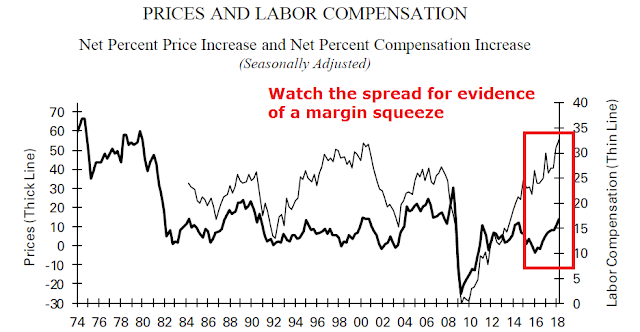

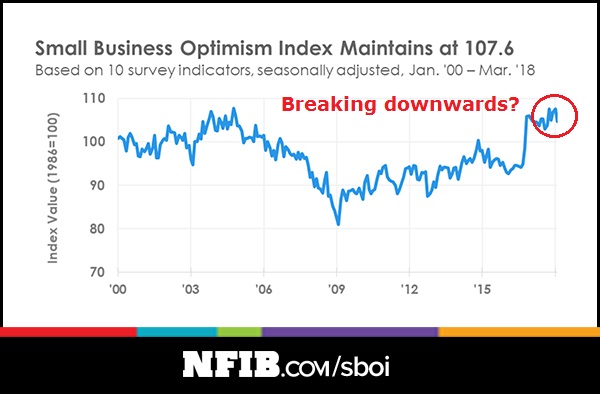

The latest NFIB survey also provides a fascinating window on inflationary pressures. These results are important because they come from small businesses, which are mainly price takers and have little bargaining power, and therefore provide a highly sensitive gauge of the economy.

First, small businesses are seeing upward pressure on prices.

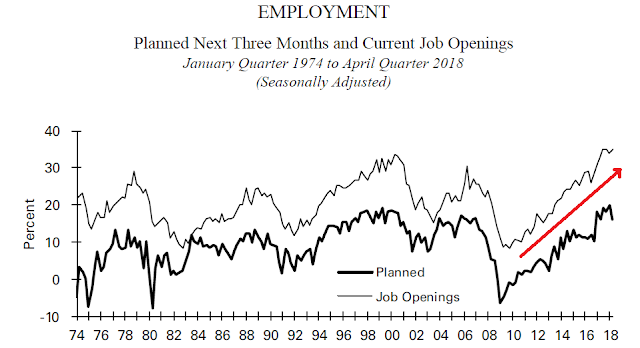

What about the labor market and wages, which is closely watched by Federal Reserve officials? Job openings have been rising steadily since the Great Financial Crisis.

As a consequence, small businesses are seeing increasing wage pressure. Unfortunately, the NFIB survey readings are a diffusion index (net up vs. down), we cannot quantify the actual level of wage increases.

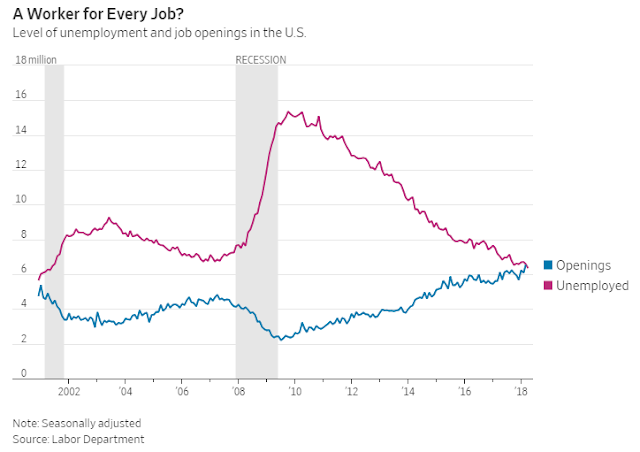

Even though the unemployment rate has been falling steadily during this expansion and now stands at a cycle lows for both the headline and U6 unemployment rates, the lack of wage growth has been a puzzle for many policy makers.

Moreover, this chart from the WSJ is remarkable as the JOLTS report shows that there is one job for every job seeker.

One theory advanced for the lack of wage growth is a labor monopsony, where the number of employers are highly concentrated in labor markets and therefore have greater bargaining power. Marshall Steinbaum at the Roosevelt Institute plotted the average HHI across occupations (and quarters) in each commuting zone. Commuting zones shaded orange and red have HHI greater than 2500, based on the CareerBuilder data. He found that the only labor markets that are unconcentrated by the standard of the Horizontal Merger Guidelines are the largest metropolitan areas.

Noah Smith, writing in Bloomberg, agreed with Steinbaum’s assessment:

New evidence is showing that employers have more market power than economists had ever suspected. Two papers — the first by José Azar, Ioana Marinescu, and Marshall Steinbaum, the second by Efraim Benmelech, Nittai Bergman, and Hyunseob Kim — find that in areas where there are fewer employers in an industry, workers in that industry earn lower wages. The two papers use very different data sources, look at different time periods and different geographical units, and use different statistical methodologies. But their findings are completely consistent.

I have no strong opinion as to whether the monopsony labor market thesis is correct. But if it is accurate, then we should be able to find evidence of wage pressure from small business surveys, as small businesses have minimal bargaining power.

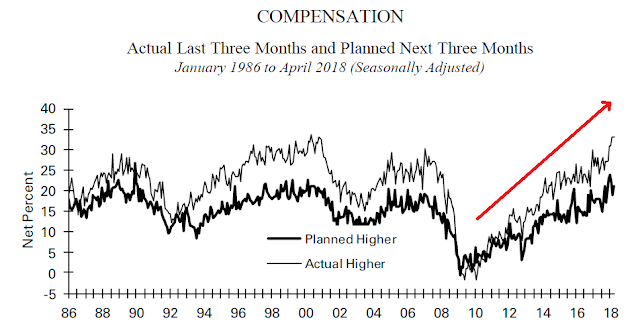

One of the key indicators that I am watching is the spread between labor compensation (thin line) and prices (thick line). Both have been rising steadily for about two years, and the gap between the two have been stable. This indicates that small businesses have been able to pass through their labor cost increases, which puts upward pressure on inflation.

We are not at the point in the cycle where the two lines are converging, which would indicate a margin squeeze and downward pressure on earnings growth.

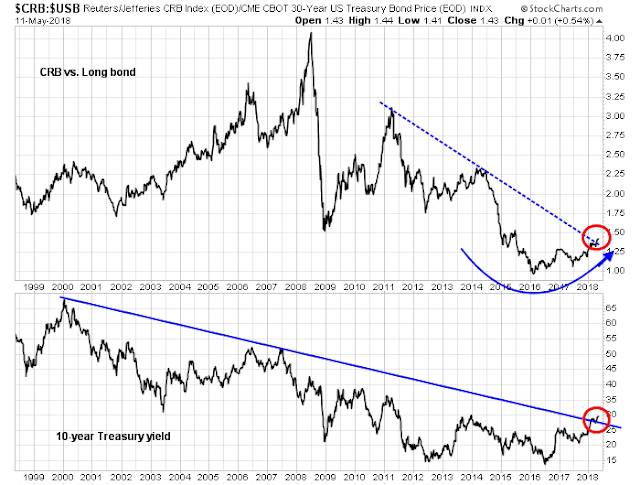

Asset inflation on the rise

For the last word, consider this chart showing the ratio of the CRB Index to the US long Treasury bond as a way of measuring the inflation/disinflation trend. The ratio bottomed out in early 2016 and it has been rising slowly, and it recently breached a downtrend line that began in 2011. The downtrend breach also coincides with the downtrend violation of the 10-year Treasury yield. This is an indication that the cycle has turned. Asset inflation is on the rise and disinflation is in retreat.

From a tactical perspective, Goldman Sachs recently pointed out that 13 out of 24 commodity contracts that they monitor is in backwardation (red). As a reminder, backwardation is the condition where the near-term futures contract is trading above the long-dated contract. This is usually an indication of a supply shortage which puts upward pressure on prices.

Now tell me that there is no inflationary pressure.

In conclusion, bond yields are tactically falling because of market positioning and a short-term inflation surprise. Recognize these circumstances as a trading opportunity, but don’t mistake it for a long-term trend.

How I learned to stop worrying and love rising rates

Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Model is an asset allocation model which applies trend following principles based on the inputs of global stock and commodity price. This model has a shorter time horizon and tends to turn over about 4-6 times a year. In essence, it seeks to answer the question, “Is the trend in the global economy expansion (bullish) or contraction (bearish)?”

My inner trader uses the trading component of the Trend Model to look for changes in the direction of the main Trend Model signal. A bullish Trend Model signal that gets less bullish is a trading “sell” signal. Conversely, a bearish Trend Model signal that gets less bearish is a trading “buy” signal. The history of actual out-of-sample (not backtested) signals of the trading model are shown by the arrows in the chart below. The turnover rate of the trading model is high, and it has varied between 150% to 200% per month.

Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the those email alerts are updated weekly here.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities

- Trend Model signal: Bullish

- Trading model: Bullish

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of the those email alerts is shown here.

Yellow flags galore, but no red flags

In the wake of last week’s publication (see Why I am not ready to call a market top), I had a number of discussions with investors that amounted to, “What about _________ (insert the worry of the day)”.

The main themes discussed, in no particular order, were:

- Rising rates and the flattening yield curve;

- Trade war;

- Oil price spike; and

- Fed policy error as they tighten into a decelerating economy.

I conducted an (unscientific) Twitter poll, and respondents were mostly concerned about a Fed policy error, while the oil price spike was the least of their worries.

While I believe that all of these risks are legitimate, they can be characterized as yellow flags, but there are no red flags that signal an imminent recession or equity bear market.

Fed policy error risk

Let’s consider each of these risks, one at a time. The greatest fear cited by investors is a Fed policy error, where the Fed tightens monetary policy into a weakening economy and pushes it into a bull market killing recession. I have expressed concerns in the past about such a scenario, and there are signs that monetary policy is starting to bite.

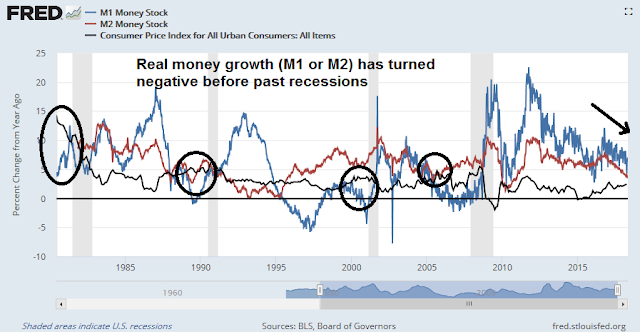

The effects of monetary policy normalization can be seen in money supply aggregates. In the past, either negative real M1 or M2 growth has been recession warnings. The latest readings show that real M2 growth is steadily decelerating and below 1%, and it is on pace to turn negative later this year. Call it another yellow flag, but no recessionary red flag warning.

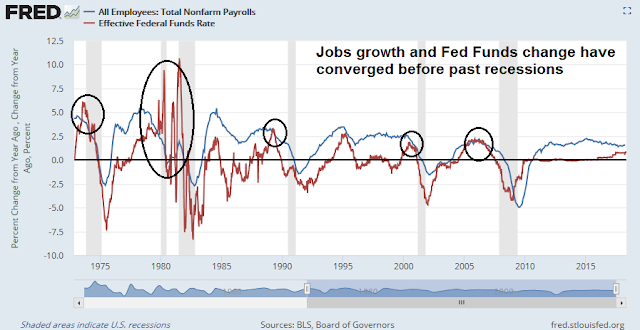

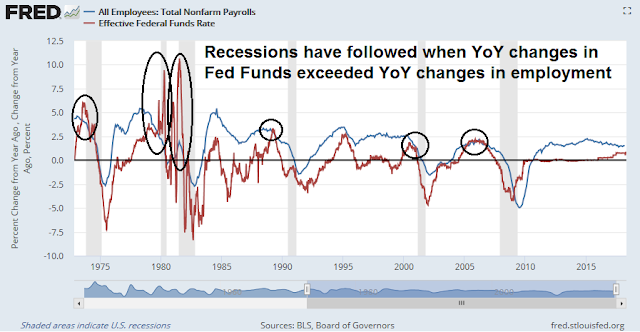

In addition, New Deal democrat constructed a simple recession forecasting model based on Non-Farm Payroll and the Fed Funds rate:

1. a YoY increase in the Fed funds rate equal to the YoY% change in job growth has in the past almost infallibly been correlated with a recession within roughly 12 months.

2. the YoY change in the Fed funds rate also does a very good job forecasting the *rate* of YoY change in payrolls 12 to 24 months out.

As the chart below shows, YoY jobs growth (blue line) is converging with YoY Fed Funds rate changes (red line). While the two lines are close, they have not crossed yet.

New Deal democrat went on to interpret the data in a cautionary, but benign fashion:

Because the Fed funds rate has been hiked by 0.75% in the last year, that suggests that a further YoY% decline in payrolls growth is already “baked in the cake” over the next 12-24 months, to a level of roughly +0.8% YoY.

That suggests that if the Fed makes 3 more 0.25% interest rate hikes in the next year, the “red flag” will be triggered at some point in that 12-24 month window.

In other words, the risk of a Fed policy error is a yellow flag, not a red flag.

Rising rate risk

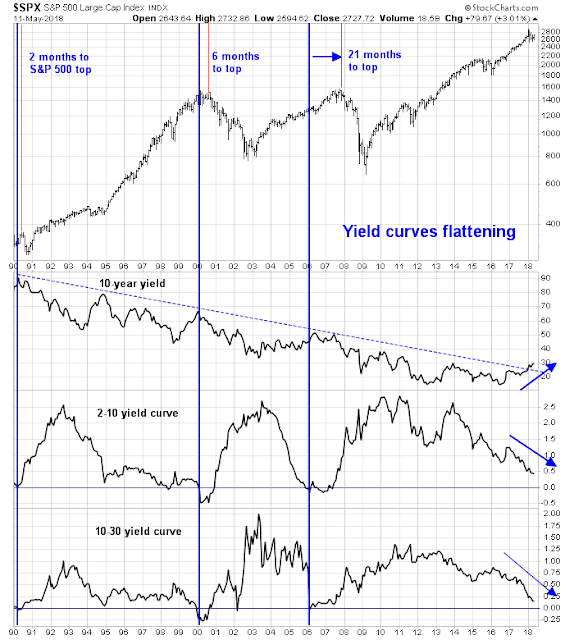

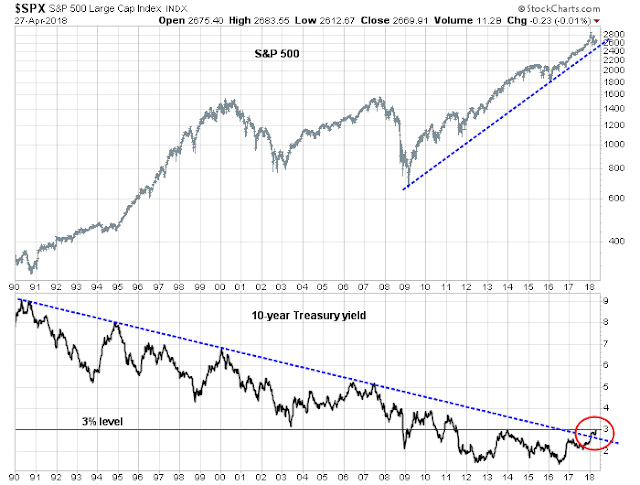

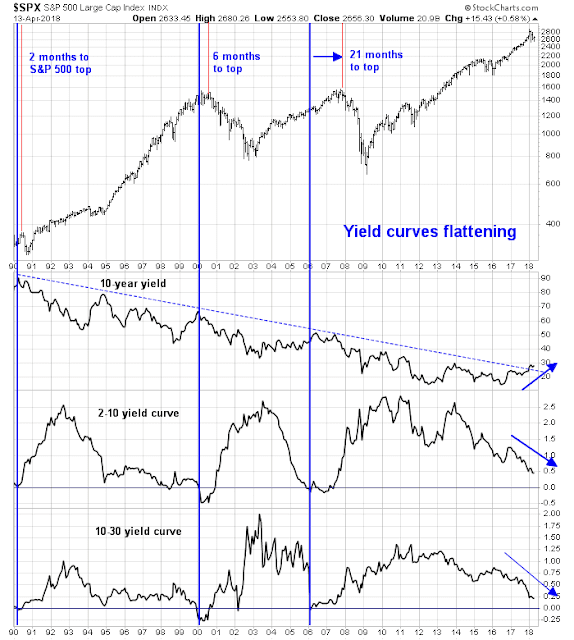

One of the most often cited worry is the combination of rising rates and a flattening yield curve. Indeed, 10-year Treasury yields have been rising, and they have breached a multi-decade downtrend. Moreover, both the 2-10 and the 10-30 yield curves are flattening to 43bp and 13bp respectively. Past instances of yield curve inversions have been sure fire recession signal.

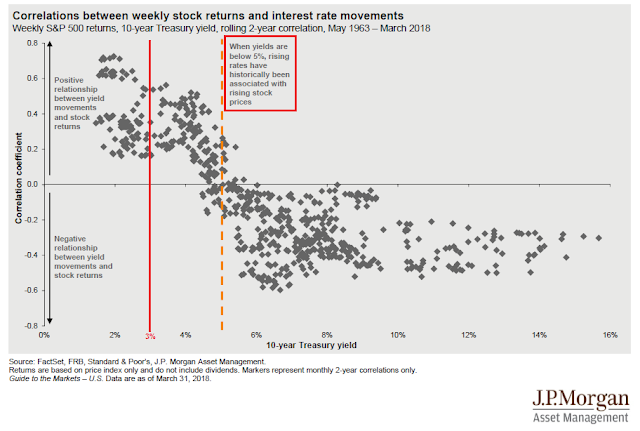

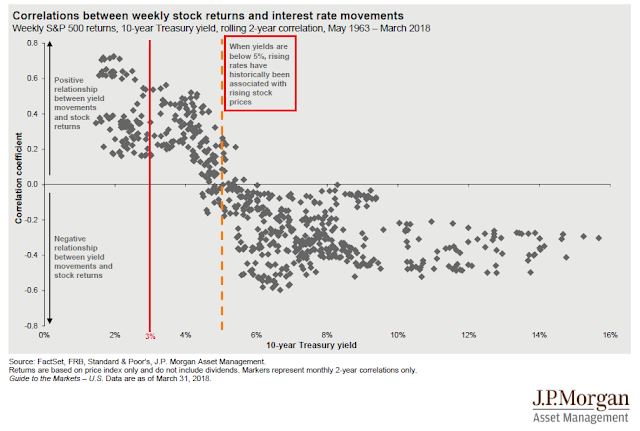

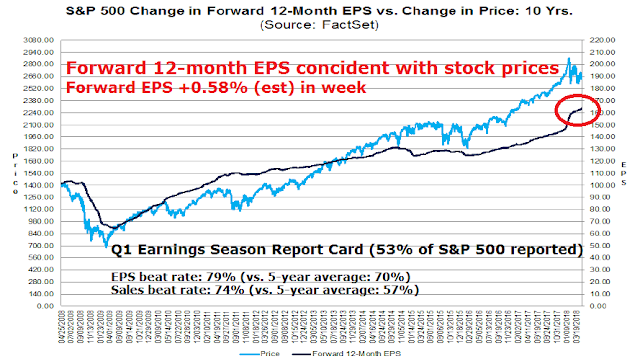

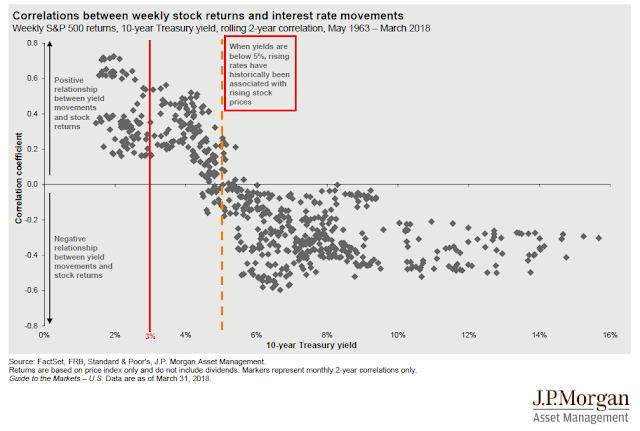

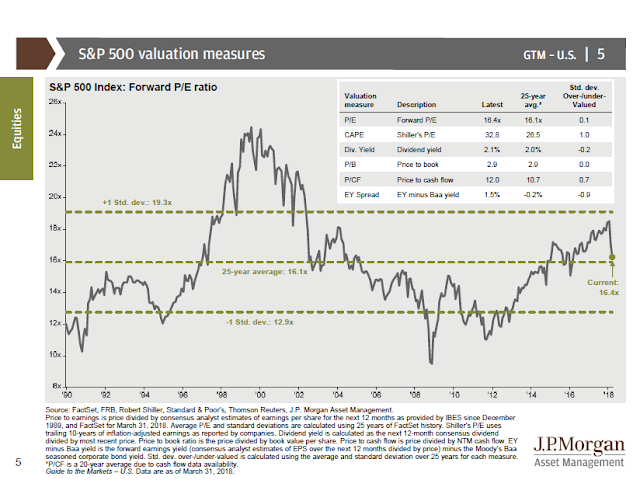

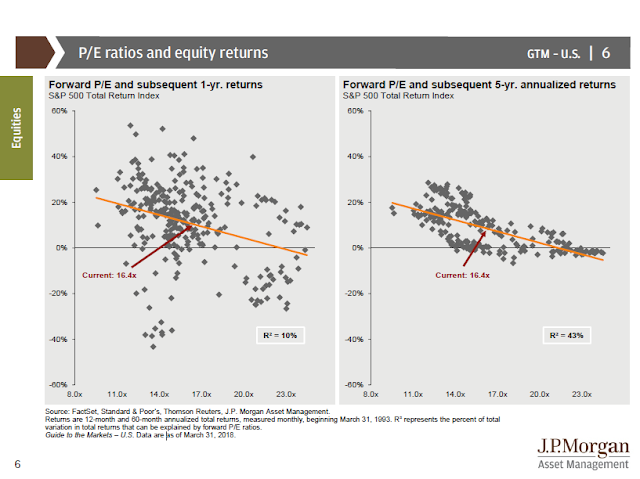

There are two issues here. Let us first consider the problem of rising yields, which I addressed in a past post (see How much does 3% matter to stocks?). I had pointed out that the historical data from JPM Asset Management showed that rising yields have not been a problem for equity prices until yields reached 5%.

The key to the relationship between yield and stock prices is a tradeoff between rising growth expectations, which is bullish, and rising rates, which is bearish. Early in the Fed’s tightening cycle, the market tends to focus more on growth expectations. At some point, psychology switches to the bearish effects of rising rates. The simple question is, “Is good (economic) news good (equity) news, or bad news?”

So far, good news is still good news. Call rising rates a yellow flag, but the red flag of “good news is bad news” has not appeared yet.

Too early to worry about a flattening yield curve

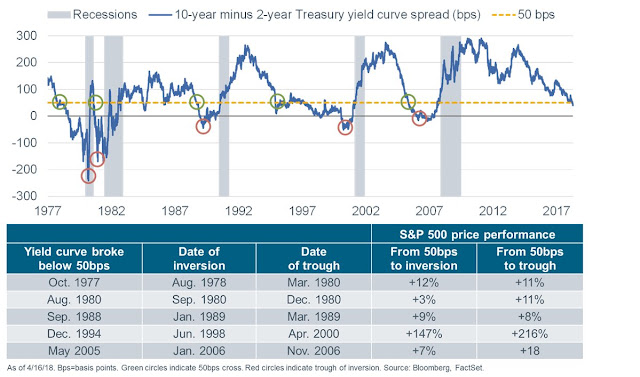

Once investors recognize the evolution of market psychology of the Fed’s tightening cycle, it should naturally follow that they should not worry about a flattening yield curve. True the yield curve tends to flatten as the Fed’s begins its tightening cycle. But flattening yield curves are not danger signals for equity prices – yet.

Liz Ann Sonders at Charles Schwab found that stock prices tended to risen as the 2-10 yield curve flattened below 50bp. The 2-10 curve currently stands at 43bp, and if history is any guide, there is still upside in stock prices.

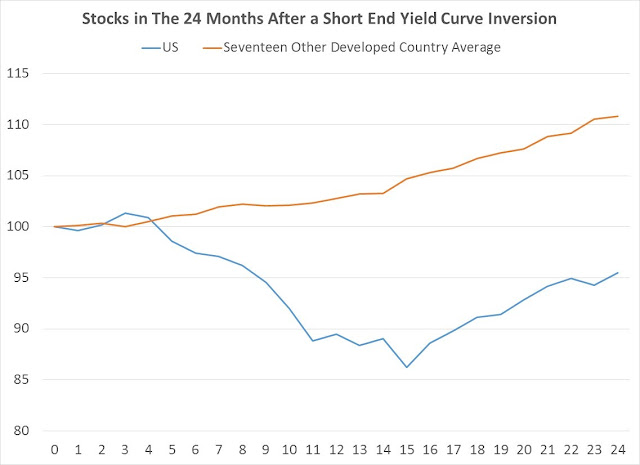

Kent Petersen at Insights From A Quant also studied the past history of yield curve inversions, as measured by the spread between the 2-year and 3-month Treasury Bill for the period starting from 1960. He found that US stock prices were flat to up 3-4 months after an inversion before falling. The current spread is a positive 63bp, which is a far way from an inverted condition.

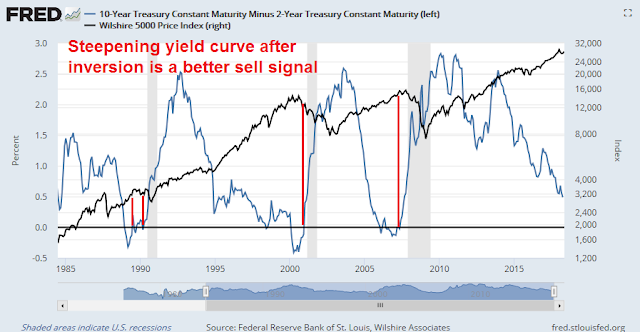

Even an inverted yield curve may not be a bear market signal. Even though the sample size is small (N=3), the historical evidence suggests that investors may be better served by holding stocks until after the 2-10 yield curve inverts, and then selling when it steepens back above positive.

In effect, a flattening yield curve can only be characterized as a yellow flag, not a red flag for equity prices.

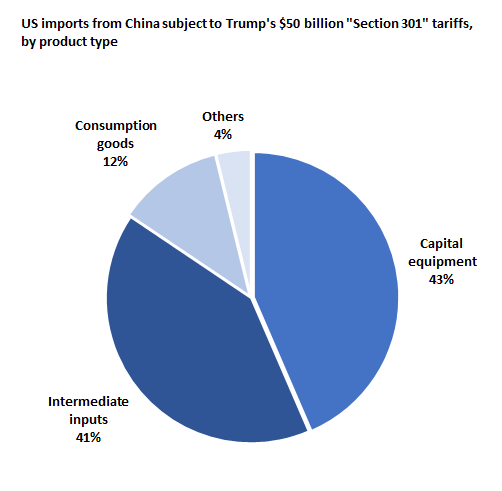

Can a trade war sink the economy?

Before the election of 2016, when the prevailing consensus called for a Clinton presidential, my scenario for the next bear market was based on a Fed induced recession. The emergence of Trump’s America First policy raises the risk of a trade war that tilts the global economy into a synchronized slowdown.

A recent CNBC report highlighted the risks of how a trade war could tip China into a hard landing.

- Nearly 20 percent of China’s exports go to the U.S.

- If a trade war ensues with the U.S., China’s GDP growth would drop 0.5 percent and could continue to fall as things heat up, the IMF warns.

- China’s debt-to-GDP has ballooned to more than 300 percent from 160 percent a decade ago.

- Chinese officials now warn of a financial-sector debt bubble that’s waiting to burst.

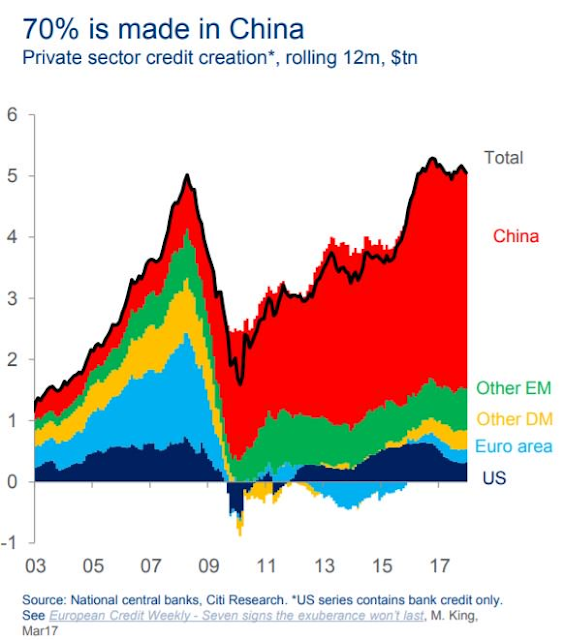

The risks are high. China has accounted for most of the global credit growth since the Great Financial Crisis. A trade induced slowdown has the potential to tip the Chinese economy into a hard landing, and drag down the economies of its trading partners.

The American economy is not immune to a slowdown in China. As an example, Ford’s recent temporary decision to suspend production of their most top producing F-150 light truck because of a fire at a supplier plant in Michigan is an eerie reminder of the catastrophic consequences of even small disruptions in the supply chain. Multiply those results by a hundred or thousand-fold in the event of a full trade war, and we can see the resulting production havoc from the current era of global supply chains. If Trump wants the trade deficit to fall, he can achieve those results with a trade war induced recession.

Geoffrey Gertz at Brookings characterized Trump’s adventures into the arena of trade and foreign policy as more bark than bite:

There is one fundamental rule for making sense of trade policy over Trump’s first 16 months in office: Do not overreact to new announcements. Indeed, with the benefit of hindsight, we can observe a growing list of at-the-time seemingly newsworthy policy announcements that ultimately went nowhere. For instance, back in January 2017, Trump suggested that he would pay for a border wall by imposing tariffs on Mexico. That never happened. In an April 2017 interview, Trump suggested he was interested in a “reciprocal tax” on imports, meaning the U.S. should tax imports from other countries at the same rates as those applied to American exports. In February of this year, he resurrected the same idea, declaring that the United States would “soon” announce a reciprocal tax, with more information forthcoming “as soon as this week.” Meanwhile, we’re still waiting. In late January, U.S. Trade Representative Robert Lighthizer suggested that “before very long” the administration would select an African country to begin new free trade agreement talks. The pro-trade U.S. Chamber of Commerce enthusiastically nodded its head. So far nothing seems to have happened.

Former Korea CIA analyst Sue Mi Terry characterized Trump’s negotiating style as transparent. While her remarks were in the context of American negotiations with North Korea, her comments are applicable to trade policy as well. She characterized Trump as someone who is looking for the affirmation of “a win”, regardless of whether the deal is substantive. Foreign leaders have figured out to flatter and praise him, while offering only token concessions but give the impression of “a win” (use this link if video is not visible).

We saw this pattern in the KORUS negotiation. The revised agreement was hailed as a great victory by the Trump administration, but the tweaks were only cosmetic in nature. The South Koreans agreed to two concessions. In return for an indefinite exemption from the steel and aluminum tariffs, Seoul agreed to a steel export quota to the US, but the quotas are toothless because they are contrary to WTO rules and could be challenged at anytime. In addition, South Korea doubled the ceiling on American cars which could imported into that country. The ceiling increase was meaningless because American automakers were not selling enough cars under the old ceiling. In other words, the KORUS free trade deal was a smoke and mirrors exercise and a face saving out of a potential trade war.

The trade negotiations with China appear to conform to a similar template, according to this CNBC report:

- Commerce Secretary Wilbur Ross said China appears open to some of the White House’s requests.

- “I think they agreed to the concept of a trade deficit reduction,” Ross said.

- The U.S. requested the majority of China’s deficit reduction come from purchases of U.S. goods — an idea Ross reiterated Thursday.

In short, the risk of a trade war induced recession is a yellow flag. Until a trade war actually erupts, it cannot be regarded as a red flag for the stock market.

Oil spike risk

Now that oil prices have spiked, concerns are appearing that rising oil prices could derail the economy. James Hamilton has been a pioneer in researching the link between oil shocks and recessions, and he found that 10 out of the 11 last US recessions were associated with oil price spikes. For more details, see his testimony before the Joint Economic Committee of Congress on May 20, 2009, and his study of historical oil shocks.

A 2014 Federal Reserve study agrees with Hamilton`s conclusion:

Although oil price shocks have long been viewed as one of the leading candidates for explaining U.S. recessions, surprisingly little is known about the extent to which oil price shocks explain recessions. We provide a formal analysis of this question with special attention to the possible role of net oil price increases in amplifying the transmission of oil price shocks. We quantify the conditional recessionary effect of oil price shocks in the net oil price increase model for all episodes of net oil price increases since the mid-1970s. Compared to the linear model, the cumulative effect of oil price shocks over the course of the next two years is much larger in the net oil price increase model. For example, oil price shocks explain a 3 percent cumulative reduction in U.S. real GDP in the late 1970s and early 1980s and a 5 percent cumulative reduction during the financial crisis. An obvious concern is that some of these estimates are an artifact of net oil price increases being correlated with other variables that explain recessions. We show that the explanatory power of oil price shocks largely persists even after augmenting the nonlinear model with a measure of credit supply conditions, of the monetary policy stance and of consumer confidence. There is evidence, however, that the conditional fit of the net oil price increase model is worse on average than the fit of the corresponding linear model, suggesting much smaller cumulative effects of oil price shocks for these episodes of at most 1 percent.

Should investors be concerned about rising oil prices tanking the economy and the stock market? Not yet. As the chart below shows, the historical evidence suggests that stock prices do not top out until the 12-month rate of change in oil prices reach 100%. They are only at about 50% right now.

This does not mean, however, that the market is out of the woods. WTI oil bottomed out last June in the low 40s. The combination of base effects, tight supply from collapsing Venezuelan production, and a looming Iranian oil embargo could produce an oil price spike. If prices rise to the $85-90 level this summer, then the 100% rate of change rule will be triggered. Such a level for oil prices is well within the realm of possibility. Bloomberg reported that BAML is forecasting that oil could hit as much as $100 next year.

For now, rising oil prices represent a yellow flag that needs to be monitored, and it is not a red flag sell signal.

Risks are rising, but too early to get overly bearish

In conclusions, warning signs are appearing for the stock market but there are no sell signals. The equity bull that began in 2009 is mature, but it is still alive and snorting.

Accounts with long term horizons could respond to these conditions with a neutral stance by re-balancing their portfolios back to their target asset mix. Investors with greater tactical orientation should remain bullish, as the final price top is likely still ahead.

The stock market will get bumpy, but the outlook is still bullish.

The weeks ahead

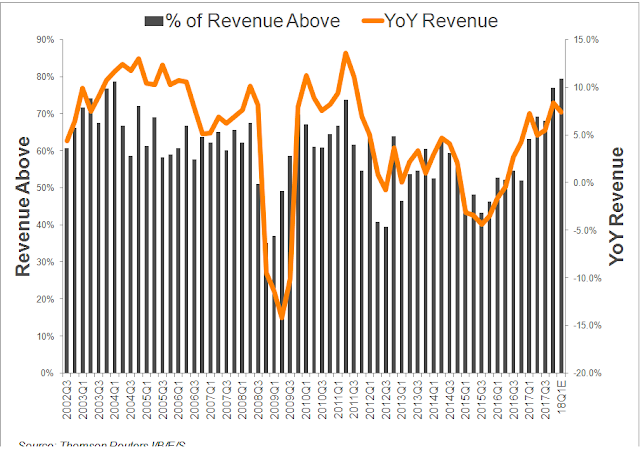

Looking to the weeks ahead, the intermediate term equity outlook looks encouraging. The latest update from FactSet shows that Q1 earnings season is mostly over and results have been solid. Both the sales and EPS beat rates are well above historical averages, and Street estimates continue to rise. Moreover, the negative guidance rate for Q2 is better than average, indicating further near-term fundamental upside.

Another way of thinking about the earnings outlook is to monitor the evolution of quarterly earnings estimates. Historically, Street analysts have tended to be overly optimistic in their EPS estimates, and estimates tend to degrade slowly over time. In this instance, Q2 estimate rose sharply due to the effects of the corporate tax cuts, and they stayed flat instead of falling slowly. I interpret this lack of EPS deterioration as equity bullish.

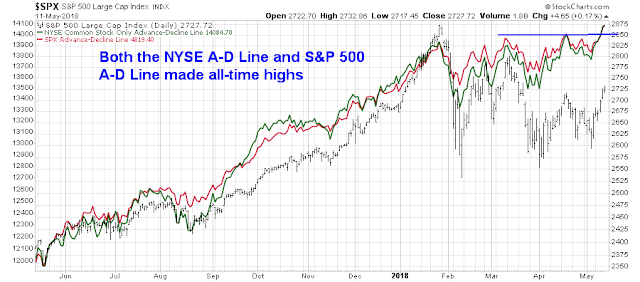

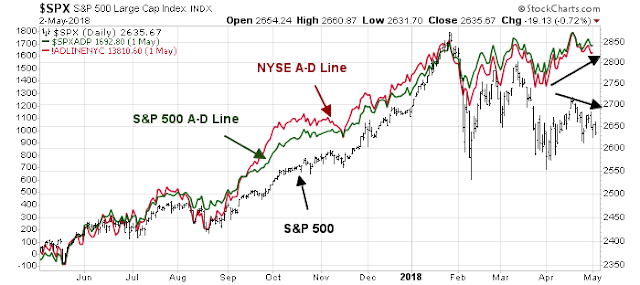

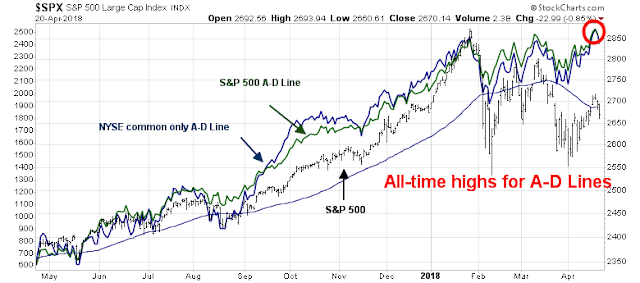

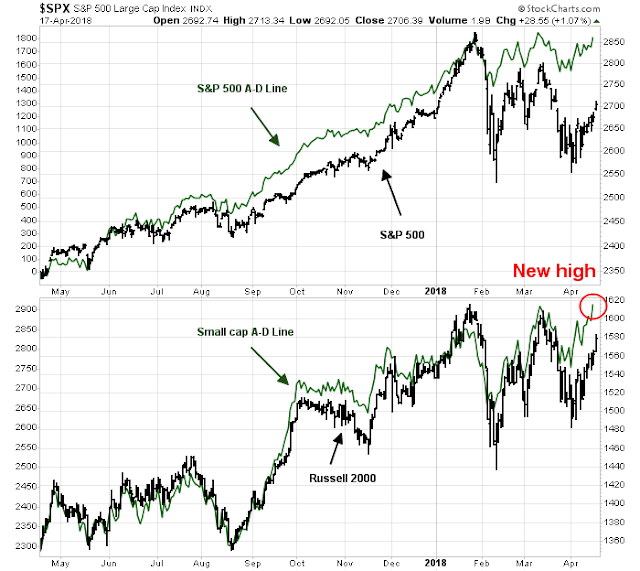

From a technical perspective, breadth indicators are flashing bullish signals. Even though the S&P 500 is below its highs, both the NYSE Advance-Decline Line and S&P 500 Advance-Decline Line, which is an apples-to-apples breadth indicator, have achieved all-time highs.

The S&P 600 Small Cap Index also reached an all-time high last week, though the Russell 2000 is just a hair below fresh highs. The troops are leading the charge, the generals (major large cap indices) are likely to follow soon.

Risk appetite indicators from both the credit and equity markets appear to be healthy, which is bullish.

To be sure, short-term breadth (1-2 day) indicators from Index Indicators shows that the market is overbought, and some minor pullback or consolidation is to be expected.

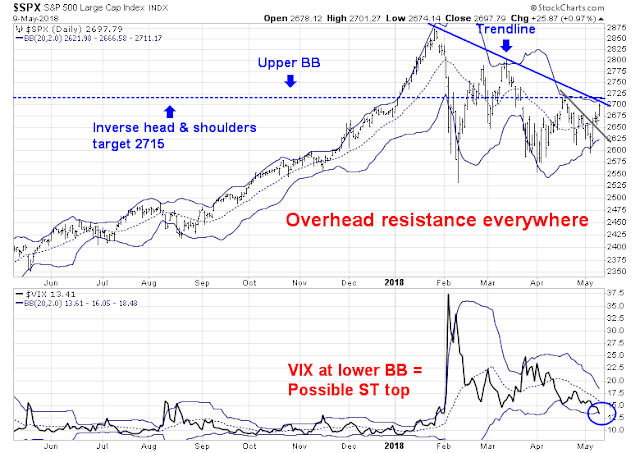

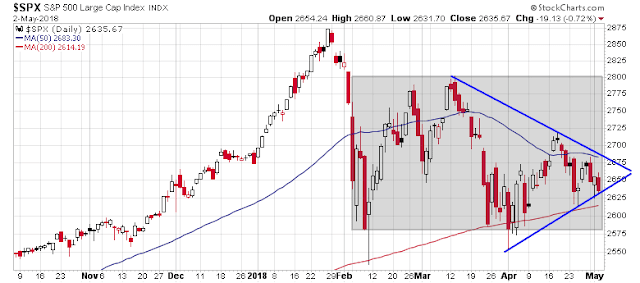

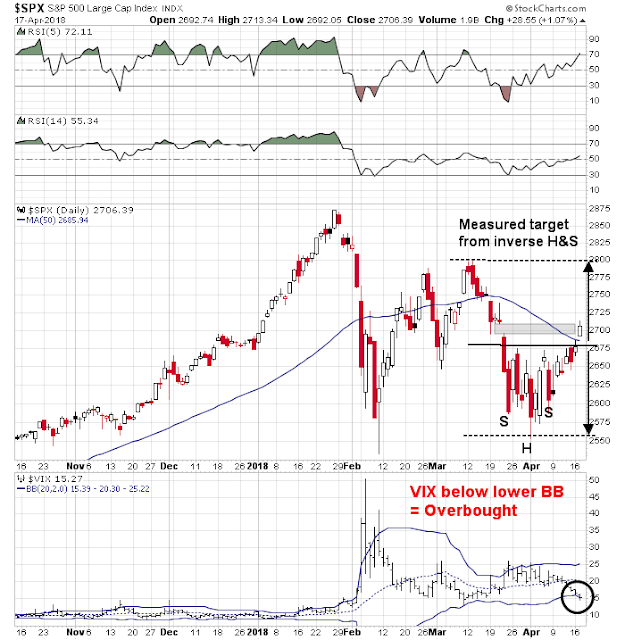

The market has broken a downtrend that began from the January highs, though it remains range-bound between 2560 and 2800. RSI(5) is overbought, and initial support on a pullback can be found at trend line and gap at about 2700. If stock prices were to begin grinding up from these levels, the challenge for the bulls will be to sustain a series of “good”overbought readings as prices rise. I had also previously highlighted a condition where the VIX falling below its lower Bollinger Band (BB) indicating a short-term overbought reading for the market (see The bulls are back in town).

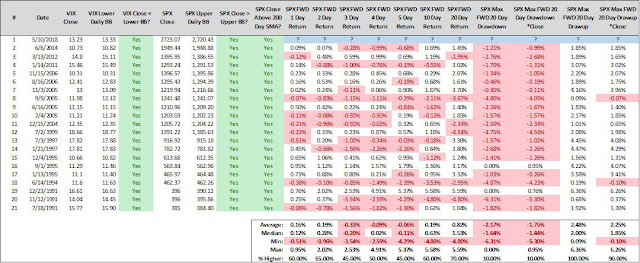

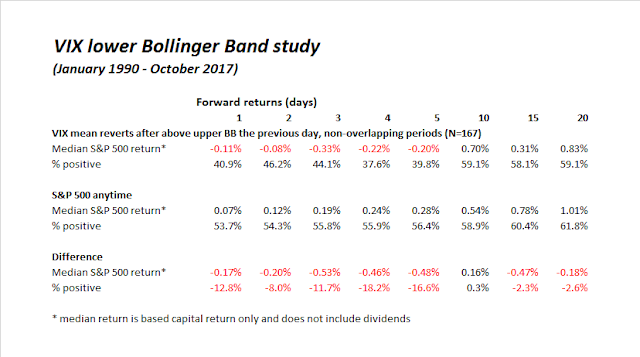

Steve Deppe conducted a study where the S&P 500 closes above its daily BB, and above its 200 dma, combined with the VIX below its BB. Returns are flat to slightly negative near term, but going out 10-20 days.

My base case scenario calls for some minor weakness or consolidation into mid-week, with a likely pullback to the 2700 area, followed by further strength for the remainder of May. My inner investor remains constructive on stocks. My inner trader lightened up his long positions late last week, and he is waiting for either the pullback or a breakout to buy more.

Disclosure: Long SPXL

The bulls are back in town

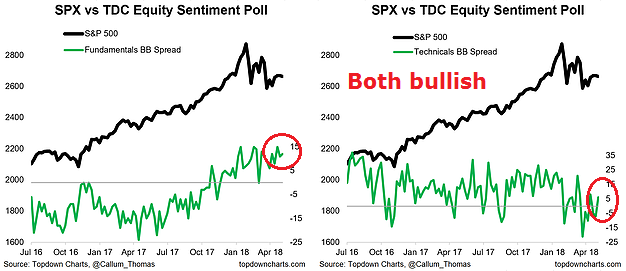

Mid-week market update: In my last mid-week market update (see Still choppy, still consolidating), I highlighted the weekly (unscientific) sentiment survey conducted by Callum Thomas. The poll showed fundamentally oriented investors to be very bullish, while technical survey was bearish. I suggested at the time that one of the signs that the sideways consolidation may end was an agreement between the fundamental and technical survey, indicating either positive or negative momentum.

The latest survey shows that such an event has occurred as technicians have flipped from bearish to bullish.

While this is not an unqualified trading buy signal, there are plenty of indications that the bulls are back in town.

Bullish indicators

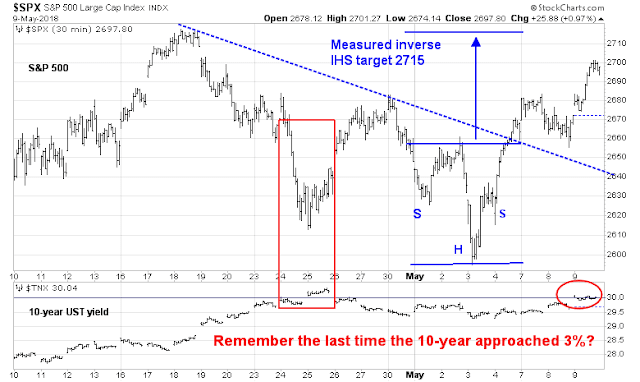

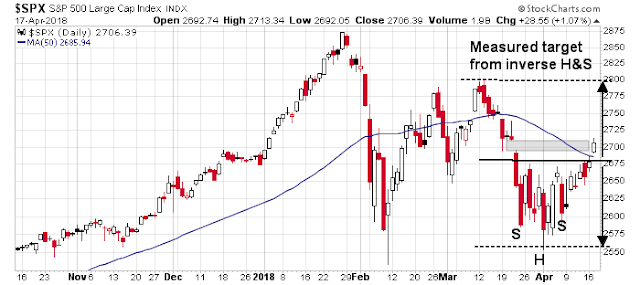

I can point to a number of constructive technical and sentiment indicators with bullish implications. From a short-term tactical perspective, the SPX has staged both an upside breakout through a downtrend, and broken out of an inverse head and shoulders (IHS) pattern. In addition, the market shrugged off a rise in the 10-year Treasury yield up to the 3% level. Remember how stock prices reacted the last time this happened?

If the bulls gain control of the tape, then price momentum is likely to become dominant again. This factor remains in an relative uptrend and it is poised for an upside breakout to new highs.

To be sure, I don’t pretend that this is an unqualified buy signal. There is plenty of overhead resistance that could stall this rally, starting with an initial resistance zone at about 2865. There is also a second declining trend line, which will act as secondary resistance. Beyond that, the IHS measured target of about 2715 also coincides with the upper Bollinger Band. The rally could stall at any of these levels in the near future. In addition, the VIX Index has breached its lower Bollinger Band, which is often the sign of either a short-term top, or a brief consolidation period.

Nevertheless, these developments are signals that the bulls are slowly gaining the upper hand and a summer rally may be just starting. My inner trader has been bullish for much of the consolidation period, but he is not so blind as to believe that stock prices are going to go up in a straight line. He is likely to take some partial profits should the market hit some of these resistance levels, and buy back in on the pullbacks.

Disclosure: Long SPXL

Why you shouldn’t get wedded to any market indicator

Over the years, I have had a number of discussions with traders who have religiously embraced specific trading systems and investment disciplines. This is a cautionary tale of how systems fail.

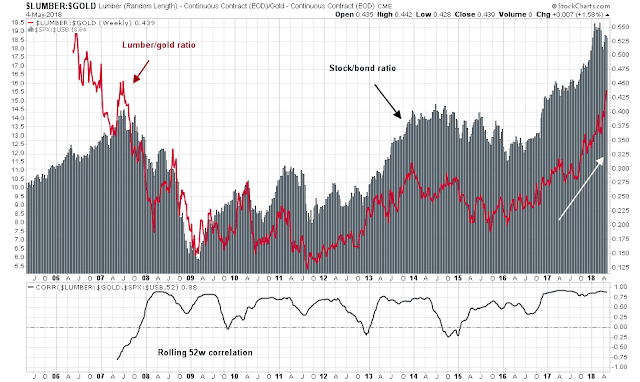

Charlie Bilello won the NAAIM Wagner Award for his work on the lumber/gold ratio:

Lumber’s sensitivity to housing, a key source of domestic economic growth in the U.S., makes it a unique commodity as it pertains to macro fundamentals and risk-seeking behavior. On the opposite end of the spectrum is Gold, which is distinctive in that it historically exhibits safe-haven properties during periods of heightened volatility and stock market stress.

When you look at a ratio of Lumber to Gold, it is telling you something about the risk appetite of investors and the relative strength or weakness in economic conditions. When Lumber is leading Gold, volatility in equities tends to fall going forward. When Gold is leading Lumber, the opposite is true, and equity volatility tends to rise.

History shows that the lumber/gold ratio has been an excellent indicator of risk appetite. The bottom panel of the accompanying chart shows the rolling correlation of the lumber/gold ratio (cyclical indicator) to the stock/bond ratio (risk appetite indicator). The lumber/gold ratio is rising, which is a buy signal for risky assets.

Does that mean that you should bullish on stocks? Maybe.

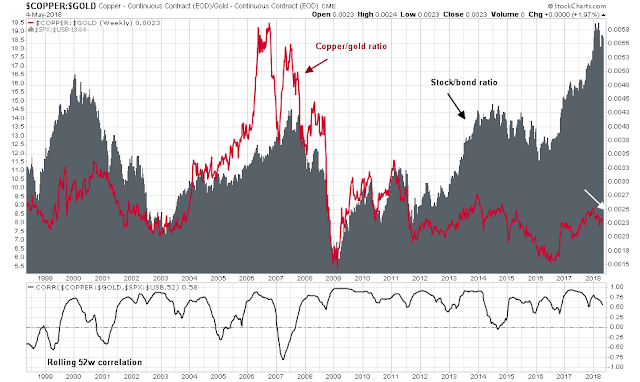

Consider the copper/gold ratio, which is another cyclical indicator based on a similar theme. The copper/gold ratio is telling a story of economic softness.

Should you be buying or selling? Which indicator should you believe?

Analyzing the indicators

I have long been an advocate of understanding the assumptions behind indicators and models. Let’s analyze the lumber/gold indicator and unpack its message. The lumber price being measured is an American lumber price that is affected by local conditions. Lumber prices started to take off when the US imposed tariffs on Canadian softwood lumber as part of a long running dispute between the two countries. Over time, homebuilding stocks have weakened relative to the market and breached a long term relative support level. Does the behavior of the homebuilders look like a sign of cyclical strength?

While lumber prices constitute a useful cyclical indicator because of it is mainly an input into housing, the housing sector has specific demographic characteristics that could affect its effectiveness. This chart shows prime age population demographics, and its correlation to housing starts.

Copper as China indicator

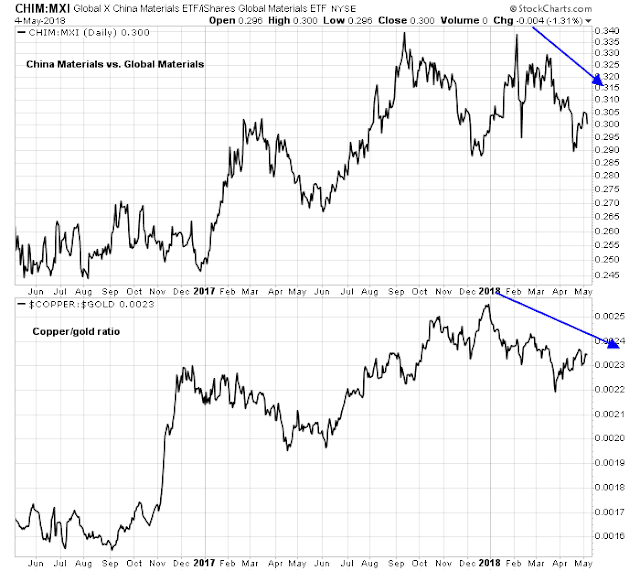

Copper has its own idiosyncrasies too. Long before China became the dominant global growth engine, copper was regarded as a good indicator of global cyclicality. Now that China has become the largest consumer of commodities, copper prices are reflective of Chinese economic activity. The chart below shows the ratio of China Materials ETF (CHIM) to Global Materials (MXI) in the top panel, and the copper/gold ratio in the bottom panel. The coincident weaknesses of the CHIM/MXI and copper/gold ratios are probably reflective of softness in China.

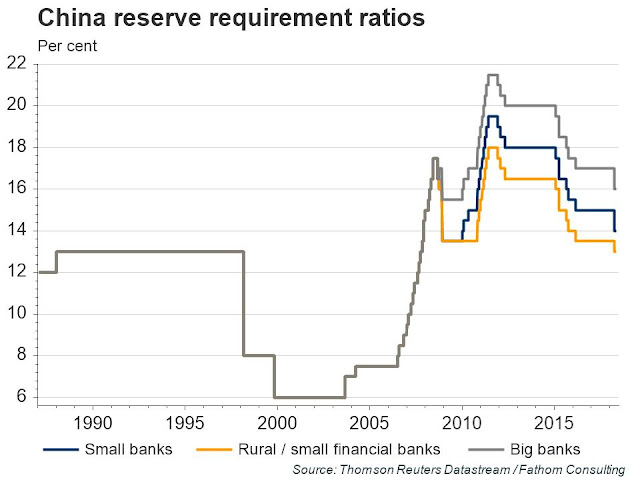

Slowing Chinese growth is also reflected in Beijing’s policy response to lower bank reserve ratios.

KOSPI: The global cyclical barometer

In addition to copper and lumber, the South Korean stock market has been regarded as a global cyclical barometer because of the significant weight of electronics giant Samsung in the KOSPI index. Moreover, the weight of Samsung`s suppliers in the Korean KOSPI index only serves to raise the weight of the “Samsung factor” to about half of the index.

The chart below shows the KOSPI (top panel), along with the relative returns of South Korean stock market to MSCI All-Country World Index, or ACWI, (second panel, all returns in USD), the copper/gold ratio (third panel), and the lumber/gold ratio (fourth and bottom panel). One of these indicators is definitely not like the other.

I began this post with the rhetorical question of which indicator investors should believe, the lumber/gold ratio or the copper/gold ratio? An analysis of the two ratios, as well as the Korea/ACWI ratio, shows that the bullish cyclical conclusion of the lumber/gold ratio as the outlier. The lumber/gold ratio has been affected by specific factors relating to US building materials market.

Further analysis of the Korea/ACWI ratio and the copper/gold ratio also reveals some differences. Both the Korea/ACWI and copper/gold ratios have been range bound for the last year. However, while Korea/ACWI has been trendless, copper/gold has entered a minor downtrend, but recovered in the last month. I interpret these conditions as copper/gold signaling some softness in the Chinese economy, but the global cycle Korea/ACWI remains trendless. Neither is signaling weakness that could lead to a recession.

The moral of this story? Models and indicators are not magic black boxes. Look under the hood before you make any investment conclusions.

Why I am not ready to call a market top

Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Model is an asset allocation model which applies trend following principles based on the inputs of global stock and commodity price. This model has a shorter time horizon and tends to turn over about 4-6 times a year. In essence, it seeks to answer the question, “Is the trend in the global economy expansion (bullish) or contraction (bearish)?”

My inner trader uses the trading component of the Trend Model to look for changes in the direction of the main Trend Model signal. A bullish Trend Model signal that gets less bullish is a trading “sell” signal. Conversely, a bearish Trend Model signal that gets less bearish is a trading “buy” signal. The history of actual out-of-sample (not backtested) signals of the trading model are shown by the arrows in the chart below. The turnover rate of the trading model is high, and it has varied between 150% to 200% per month.

Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the those email alerts are updated weekly here.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities

- Trend Model signal: Bullish

- Trading model: Bullish

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of the those email alerts is shown here.

Market top is still ahead

As stock prices chopped around in an indecisive fashion in past few weeks, the traders in my social media feed have become increasingly nervous and bearish. The bull can point to the SPX repeatedly testing its 200 day moving average (dma), which has held as technical support. However, the market’s inability to rally despite what has been good earnings news during a Q1 earnings season with solid results is worrisome.

My review of intermediate and long-term technical market conditions, as well as the macro backdrop reveals that no pre-conditions of a bear market are in sight. While there are concerns that the American economy is undergoing the late cycle phase of an expansion, which is typically followed by a bear phase. I am not ready to make the investment call that stock prices have topped out just yet.

Consider, as an example, the Relative Rotation Graph (RRG) as a way of analyzing changes in sector leadership. RRG charts are a way of depicting the changes in leadership in different groups, such as sectors, countries and regions, and market factors. The charts are organized into four quadrants. An idealized group rotation pattern occurs in a clockwise fashion. Leading groups (top right) deteriorate to weakening groups (bottom right), which then rotates to lagging groups (bottom left), which changes to improving groups (top left), and finally completes the cycle by improving to leading groups (top right) again.

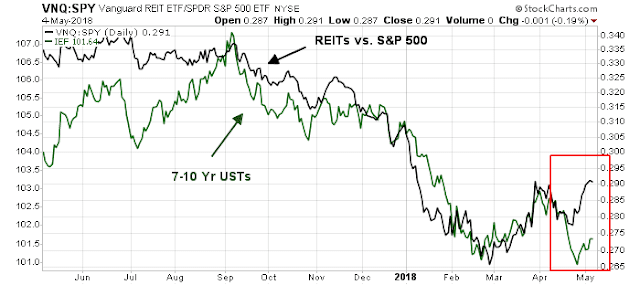

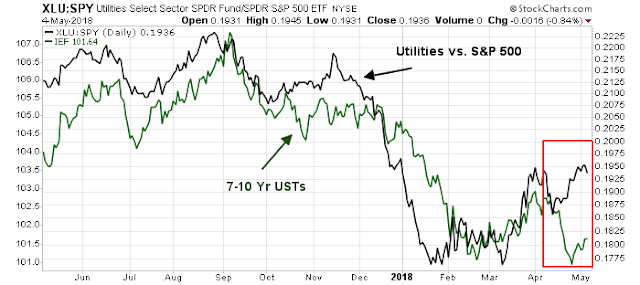

The latest RRG chart depicts a stock market with the emerging leadership of late cycle inflation sectors (gold and oil), which is the result of late cycle inflationary pressures, along with interest sensitive sectors (REITs and utilities) as the result of a dovish Fed.

This combination suggests that the market is setting up for one last inflationary blow-off before the Fed steps on the monetary breaks to cool the economy into a bull market killing recession.

Listen to the market

When I listen to the message from market leadership, inflation hedge sectors appear poised to assume the mantle of new market leadership, which is an indication that the economy is in the late cycle phase of an expansion.