In response to my recent publication (see A focus on gold and oil), a number of readers asked, “What about Bitcoin (BTC)?” Indeed, BTC has diverged and beaten gold recently. Even as gold prices corrected, BTC has been rising steadily since early October.

Here are the reasons why you should and shouldn’t invest in Bitcoin.

The long-term bear case

Bitcoin and cryptocurrency adherents and enthusiasts have promoted BTC as an alternative currency outside the control of national governments. In doing so, they either missed or forgot the lessons learned in Money and Banking 101, which is usually an upper-level course offered to undergraduate economics students. Let’s compare the characteristics of BTC (and other cryptocurrencies) to gold, which is widely acknowledged to be an alternative currency and asset class.

Is BTC a store of value?

Anything is a store of value if human society deems it to be so. Salt was a store of value in ancient societies. The Chinese today channel enormous savings into real estate, some of which are built on leasehold land, and apartments deteriorate over time. In the past, I have in a semi-serious way referred to China’s M4, which is the M3 money supply plus the value of China’s property market.

Gold is a store of value. For hard money adherents, a gold standard limits the ability of governments to print money. The global (gold) money supply is determined by how much miners take out of the ground each year. Based on these assumptions, the growth in gold should equal real growth in global GDP in the long run.

What about Bitcoin? The growth in BTC is a function of mining cost. Mining cost can be decomposed into the price of electricity and computing power. Over the long run, innovations like quantum computing will pose a threat to cryptocurrencies inasmuch as they make the mining process much easier. As Milton Friedman famously taught us, too much money chasing too few goods and services creates inflation.

Is BTC a medium of exchange?

In theory, gold is a medium of exchange, though it’s difficult to buy much with gold coins and bullion. During the civil war that led to the disintegration of Yugoslavia, there were anecdotal reports that gold was a medium of exchange, but the bid-ask spread on gold was wide – as much as 50%. Similarly, South Africans who wanted to emigrate during the apartheid years when the authorities imposed foreign exchange controls on the country could take their wealth out in gold bullion. However, they did have to pay a relatively wide bid-ask spread.

Today, BTC is not widely accepted as a medium of exchange. However, that is changing. PayPal announced in October that it would allow customers to use it and other virtual currencies to shop on its network. Reportedly, the S&P Dow Jones Indices will launch specific crypto indexes in 2021. Acceptance is widening.

One legitimate criticism of the use of BTC as a medium of exchange is price volatility. Until volatility starts to settle down, it will be difficult to use any cryptocurrency to pay for goods and services. If you are a merchant transacting in BTC, but your costs are in USD or any other conventional currency, why would you accept that kind of exchange rate volatility? Put it another way, what premium should a merchant put on BTC pricing over USD pricing for the same goods or services as compensation for BTC volatility?

Banking BTC

If BTC is indeed an alternative currency and medium of exchange, then a whole host of issues surrounding the banking of that currency arises.

In many ways, BTC banking resembles the early development of US banking. Today’s BTC owners typically buy and sell the cryptocurrency at an exchange, which charges fees of several percent to deposit funds and trade. Some early exchange ventures failed or saw their cryptocurrency inventory disappear either owing to theft or fraud in the manner of the Wild West of US banking during the 19th Century.

As exchanges have matured and become more established, they have become more mainstream. One example of an exchange is Coinbase, which is registered in the US with the Financial Crimes Enforcement Network and has an E-Money License from the UK’s Financial Conduct Authority. Other major exchanges include Kraken, Bittrex, and Binance. However, increasing financial regulation also means that one of the initial reasons behind the creation of an alternative currency beyond the reach of establishment authorities becomes weaker.

As well, some crucial questions involving BTC banking arises in the principles of Money and Banking 101.

First, if you lend out your BTC, how would you set the proper interest rate (that’s denominated in BTC)? Determining the interest rate on a loan is a function of several factors. The expected inflation rate, term premium, or the term of the loan, and creditworthiness are typical things to consider. In light of the enormous volatility of the exchange rate, what’s the expected inflation rate of a basket of goods and services in BTC?

In addition, there are costs to holding BTC and other cryptocurrencies. These currencies are coded in multiple ledgers all around the world on computer systems. Computer systems cost money to maintain and operate. Implicitly, BTC begins with a negative interest rate or storage cost. Similarly, holding gold also has storage costs, but the storage cost is offset by the inflation hedge feature of gold.

More importantly, how do you deal with the fractional banking issue of money creation? Here is how money creation works. In a modern banking system, if individual A deposits $100 into a bank. The bank then lends out $90 of that deposit to individual B, keeping $10 in reserve. B then deposits the $90 into his bank account, and the bank then lends out 90% of the $90 ($81) to C, who then deposits the $81 into his account, and so on.

In the BTC world, can someone lend out their BTCs? Can an exchange lend out their BTCs on deposit? If so, how do the new BTCs get created, because each piece of a digital currency is coded in multiple ledgers? When you lend out a new BTC in a fractional banking system, how do the new funds get coded?

One alternative scheme is to require that if a bank or exchange lends out a BTC, those funds are not available to the depositor? In that case, the bank would have to distinguish between a demand deposit, like a checking account where the depositor can access his funds at any time, and bank-issued GIC-like instruments. Such a system would be a classic gold standard-like banking system that limits credit creation and put severe brakes on economic growth. It would also create disincentives for people to transact in that currency because of the inability of the banking system to finance growth.

In conclusion, Bitcoins and other cryptocurrencies are the latest digital equivalent of Beanie Babies or sports figure trading cards. It’s difficult to see how they can have value in the long run.

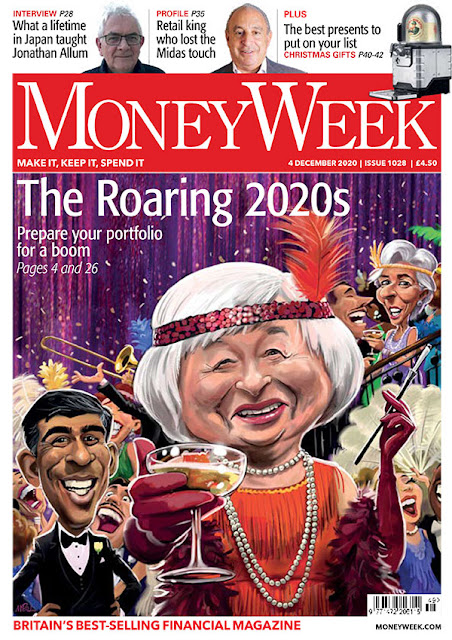

The FOMO party bull case

On the other hand, there are some good reasons for investors to get involved in BTC. The bid-ask spread on BTC and other cryptocurrencies is substantial. Market making and storage of BTC is a profitable enterprise, as long as proper risk controls are maintained. Invest not in BTC, but in BTC services and infrastructure.

In addition, Josh Brown forcefully laid out Five Reasons Why Bitcoin is Going Up which I summarize below (with my comments in parenthesis).

Reason one: It’s going up because it’s going up (otherwise known as FOMO).

Reason two: Paypal and Square’s Cash App (or widespread adoption).

Reason three: Wall Street legends are being won over (institutional FOMO).

Reason four: Gold and silver aren’t “working” (momentum trading).

Reason five: More on-ramps, in addition to PayPal and Square, are on their way. Bitcoin in your Fidelity account. Bitcoin on the Robinhood app. Bitcoin in your bank account. Bitcoin as a default option in your payments account, etc. (see reason two)

Brown concluded:

This is changing, slowly but inevitably. More access, cheaper pricing, less fear, less hesitation. Mainstream buy-in and adoption by the Fidelity’s and the PayPal’s of the world removes the counterparty risk concerns and the fear of theft from the front burner. The rise in price will serve as all the confirmation bias the adopters need in order to be spurred on even further into their allocations.

In other words, Bitcoin is becoming the next fad in momentum and FOMO investing. There are profits available in the short and medium-term. Enjoy the party, but don’t mistake it for a durable alternative currency.