While the adage that the stock market isn’t the economy and vice versa is true. one of the puzzles facing investors is why the US equity market testing its all-time highs even as the economy suffered its worst setback since the Great Depression. This market seems like a Potemkin Village, which shows an external façade of calm while hiding the real trouble behind the scenes.

The Fed isn’t entirely responsible for the market’s strength. The Fed has taken steps to stabilize markets so they can function in an orderly way. A Fed Put can put a floor on prices, but it cannot make asset prices skyrocket the way they did.

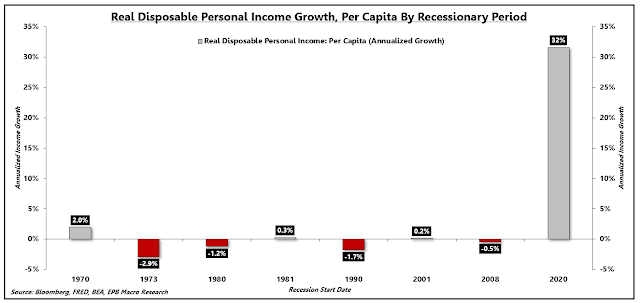

A more reasonable explanation is the unprecedented level of fiscal support to support growth. This recession is completely unlike past slowdowns. The government’s safety net has allowed consumers to maintain their spending to prevent a complete collapse in demand.

In that case, why hasn’t the stock market skidded as it became clear that Congress could not agree on a second stimulus package, and that Trump’s Executive Order and Memoranda designed to do and end run around Congress appears to be ineffectual (see a detailed analysis in Earnings Monitor: Slower growth ahead). The Washington Post reported that the Street generally agrees with my analysis.

“If this is all we get for fiscal policy for the rest of the year it would represent a significant downside risk to our growth outlook,” JPMorgan Chase chief U.S. economist Michael Feroli wrote in a Monday note. “These executive orders likely will provide stimulus of less than $100 billion, while we have been expecting Congress to add at least $1.0-1.5 trillion of spending once an agreement is reached.”

The team at Oxford Economics comes to a similar conclusion, finding “the relief is inadequate, legally questionable and falls dramatically short of the booster shot the economy desperately needs,” per a note from senior U.S. economist Lydia Boussour. “In the absence of a more comprehensive stimulus package, economic activity will be constrained just as the recovery plateaus.”

Barry Ritholz offered a different sort of explanation, based on a radical difference between the construction of the market indices and the economy, in a Bloomberg opinion piece. Big Tech comprise a gargantuan weight in most major US indices.

The so-called FAANGs (along with Microsoft) derive about half — and in some cases even more — of their revenue from abroad. Beyond that, the pandemic lockdown in the U.S. has benefitted the giant tech companies’ sales and profits. No wonder the Nasdaq Composite 100 Index, which is dominated by big tech companies, is up about 26% this year.

Simply put, the rest of the market really doesn’t matter no matter how badly the underlying sectors and industries perform.

Take the 10 biggest technology companies in the S&P 500 and weight them equally, and they would be up more than 37% for the year. Do the same for the next 490 names in the index, and they are down about 7.7%. That shows just how much a few giants matter to the index.

On some level, it’s completely understandable why many people believe that markets are no longer tethered to reality because the performance doesn’t correspond to their personal experience, which is one of job loss, economic hardship and personal despair. But what’s important to understand is that indexes based on market-cap weighting can be — as they are now — driven by the gains of just a handful of companies.

This week, we explore the outlooks and performance of two groups, Big Tech, and the rest of the market.

Big Tech dominance

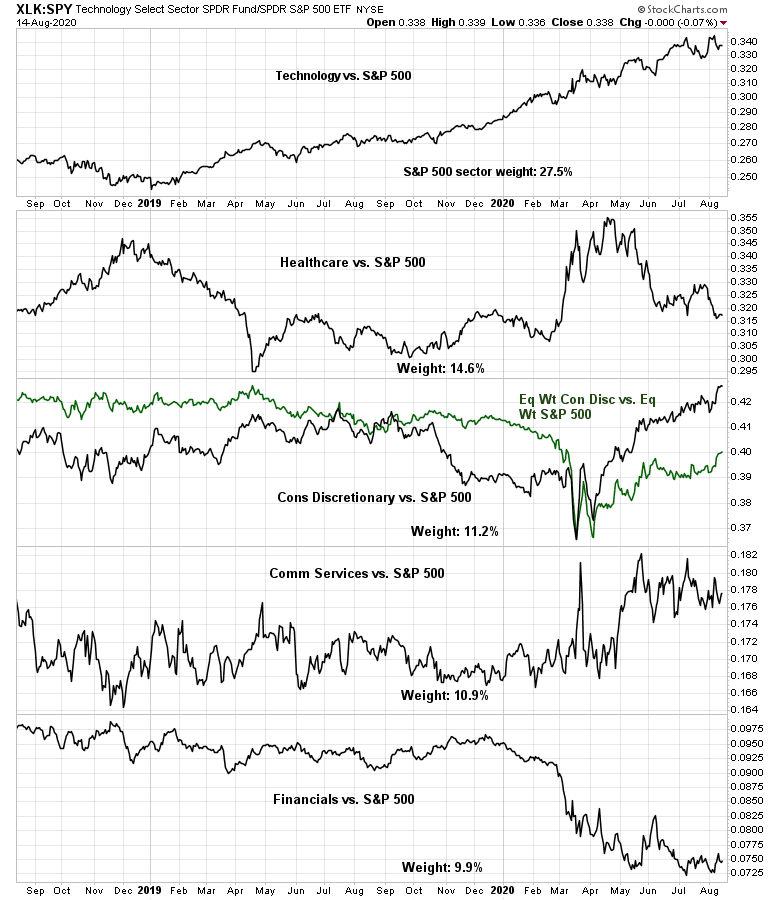

How big and dominant is Big Tech? The chart below of the relative performance of the top five sectors in the S&P 500 tells the story. These five sectors comprise 74% of index weight, and it would be difficult for the market to significantly rise or fall without the participation of a majority. The weight of Big Tech sectors (technology, communication services, and consumer discretionary) make up about half of index weight. Consumer discretionary stocks is dominated by Amazon, and the chart shows the relative performance of equal-weighted consumer discretionary (in green), which minimizes the effect of heavyweights, as an illustration of how Amazon has dominated the sector. The equal weighted relative performance is far less impressive than its float weighted counterpart.

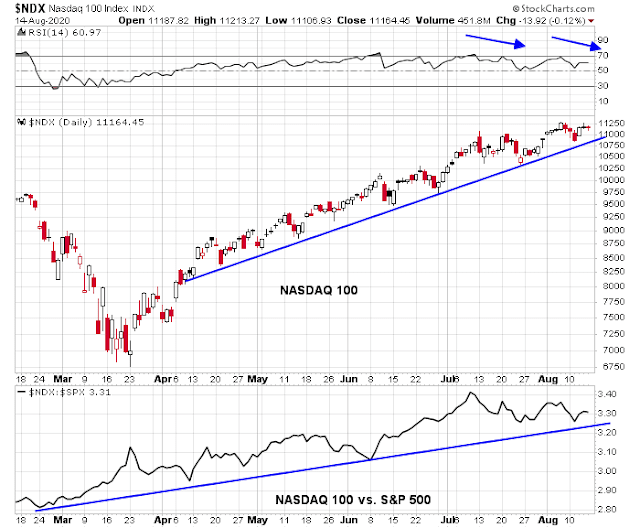

How long can Big Tech dominance last? Here are the short and intermediate term perspectives. In the short term, one shorthand for measuring the performance of Big Tech is the NASDAQ 100. The NASDAQ 100 remains in well-defined absolute and relative uptrends. While there are warnings of negative RSI divergences indicating a loss of momentum, there are no bearish trendline breaks to be concerned about.

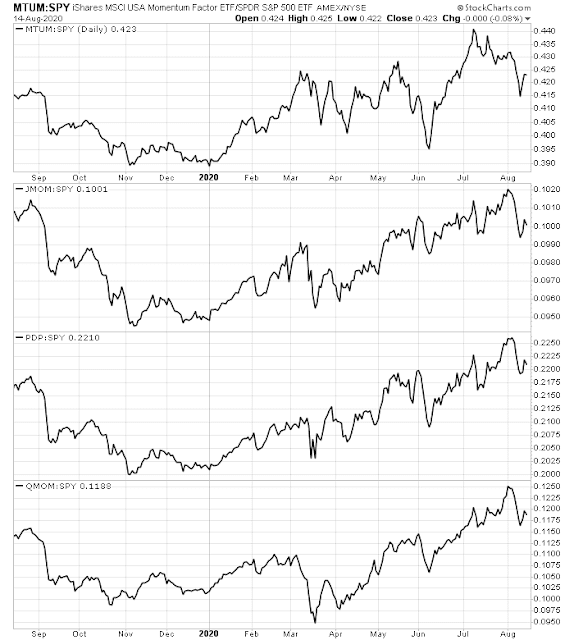

Another way of measuring the strength of Big Tech is through the price momentum factor. Price momentum factor portfolios become highly concentrated because of the strong performance of technology stocks. The relative performance of a variety of price momentum ETFs indicate that momentum remains in choppy but positive uptrends. One factor that may exacerbate the price momentum effect is a greater commitment to indexing. This technique creates a self-reinforcing cycle of positive money flows that mechanically buys more and more Big Tech heavyweights and creates a self-reinforcing price momentum effect.

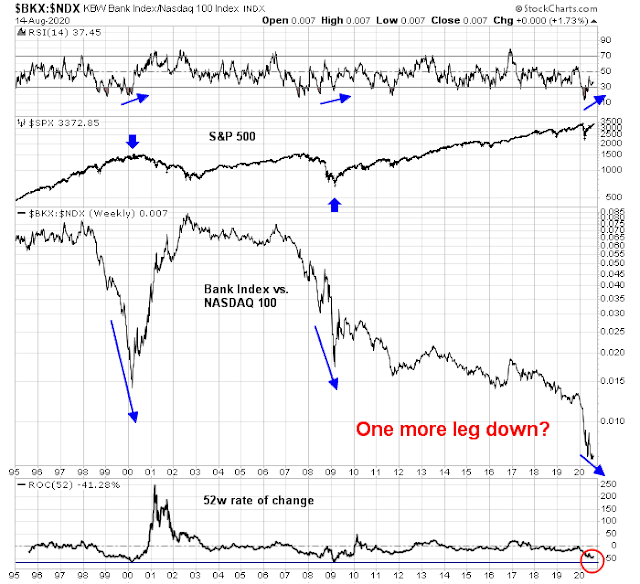

A longer term way of thinking about the dominance of Big Tech is to measure the relative returns of banks, which represent an important component of the economy, to the NASDAQ 100. This is another way of measuring the value to growth performance ratio. Bank stocks have been beaten up so badly that they are overweight in most value indices, while the NASDAQ 100 is the poster child of growth. The Bank Index to NASDAQ 100 ratio has flashed a positive RSI divergence, which is bullish for banks and value stocks, but historically this ratio has not bottomed out until its annual relative performance nears -70%. This analysis suggests that there may be one final leg down for this ratio, and one final leg up for Big Tech.

The risks to Big Tech

To be sure, the dominance of Big Tech has strong fundamental underpinnings. It’s a winner-take-all competitive environment, and the winners have been able to create competitive moats because of their dominance in their business. These companies have then been able to extract strong profits and high margins behind their moat fortifications.

However, strong corporate dominance invites antitrust scrutiny. CNBC analyzed the emails submitted to Congress in their antitrust investigation of Amazon, Apple, Facebook, and Google and highlighted some key vulnerabilities for each company.

Facebook: Experts speculate that an antitrust case against Facebook would center largely around its acquisition strategy and whether it broke merger laws by buying up a nascent competitor or violated anti-monopoly law by taking anti-competitive actions to build or maintain dominance in its market.

Amazon: An antitrust case for Amazon may resemble the line of thinking Sen. Elizabeth Warren, D-Mass., offered in her presidential campaign platform on breaking up Big Tech. Warren argued large tech companies designated as “Platform Utilities” should not be able to control and participate on their own platforms. The FTC has been talking to third-party sellers on Amazon’s platform, according to Bloomberg, following concerns that Amazon undercuts sellers on its marketplace.

A recent Wall Street Journal investigation found that Amazon employees had used internal data to inform their private-label brand strategy and compete with other sellers. Though the employees reportedly used aggregated reports combining multiple sellers’ performance, they sometimes contained as few as two sellers, making it easy to extrapolate a single seller’s data. Amazon has said it was launching an internal investigation into the allegations by the Journal but said it didn’t believe the claims to be true.

Apple: The antitrust theory against Apple centers on its control of the App Store. While iPhones are prevalent throughout the U.S., Apple ranks only third in worldwide market share for smartphones at 13.3%, according to IDC, while the market leader, Samsung, holds a 21.2% share.

A potential case against Apple could look similar to one against Amazon, focusing on the fact that it both owns a marketplace (the App Store) and has its own pre-loaded apps such as Apple Music and Apple Podcasts that compete with other apps on its platform, such as Spotify.

Some developers who offer their apps through the App Store — the only way Apple allows for apps to be added to users’ devices — have complained about Apple’s opaque and sometimes seemingly arbitrary process for accepting new apps.

Google: Google’s sprawling business has attracted antitrust scrutiny on multiple fronts. Regulators have looked into Google’s search business, online advertising platform and Android mobile operating system. Here’s what they might be looking for in each:

– Search: Vertical search competitors such as Yelp and TripAdvisor, which offer search engines for specific purposes such as local businesses or travel, have complained for years that Google prioritizes its own services over their own, including by offering its own competing services above theirs in relevant Google search results.

– Advertising: Google’s advertising business has attracted scrutiny over a variety of concerns that essentially boil down to the question of whether Google’s expansive control over the digital media supply chain allows other companies to compete. While Google has competitors across many functions of the advertising marketplace, it operates in both the buy side and sell side of transactions, leading to some questions about whether it remains objective about where it routes advertising dollars. Competitors also argue that Google’s prices are hard to match because it bundles its ad tools. And on YouTube, Google eliminated the ability to buy ads through third-party services, funneling all spend through its own tools.

– Android: With its Android mobile operating system, Google requires device manufacturers who use its platform to pre-install its app store and other native apps such as Gmail and its Chrome web browser. The European Commission required Google to stop bundling its apps on Android phones and allow EU users to select their default search engine after fining the company $5 billion over alleged antitrust abuse.

In the short run, the Trump administration’s Executive Order against TikTok and WeChat has the potential to crater Apple’s earnings. A recent Bloomberg article explains the challenges for Apple, which makes up 5.8% of the S&P 500, and 12% of the NASDAQ 100. If the company is forced to remove WeChat globally from its Apps Store, it could have devastating consequences.

[WeChat] connects a billion users globally and is used for everything from chatting with friends to shopping for movie and train tickets to paying restaurant and utility bills. While questions remain on how Trump’s orders will be implemented, any ban on the use of WeChat threatens to cut off a key communication link between China and the rest of the world and prevent U.S. companies like Starbucks Corp. and WalMart Inc. from reaching consumers in the world’s second-largest economy…

If Apple was forced to remove the service from its global app stores, iPhone annual shipments will decline 25% to 30% while other hardware, including AirPods, iPad, Apple Watch and Mac computers, may fall 15%-25%, TF International Securities analyst Kuo Ming-chi estimated in a research note. Apple didn’t immediately respond to Bloomberg News’ requests for comment.

A survey on the twitter-like Weibo service asking consumers to choose between WeChat and their iPhones has drawn more than 1.2 million responses so far, with roughly 95% of participants saying they would rather give up their devices. “The ban will force a lot of Chinese users to switch from Apple to other brands because WeChat is really important for us,” said Sky Ding, who works in fintech in Hong Kong and originally hails from Xi’an. “My family in China are all used to WeChat and all our communication is on the platform.”

So far, the market appears to be ignoring both the short and long term risks to Apple and other Big Tech stocks.

Rotation is healthy, but…

What about the rest of the market? I wrote last week (see Sector and factor review: Not your father’s cycle) that as the momentum in Big Tech falters, the market is poised for a rotation into cyclical stocks. I had identified consumer discretionary (6.7% ex-AMZN) and materials (2.6%) are showing some signs of life. But those sectors comprise just under 10% of index weight, and they can’t possible do all the heavy lifting if Big Tech were to falter. Andrew Thrasher raised an important caveat about sector rotation.

Traditionally rotation is bullish. It allows the market to “reload” to so speak as new leadership emerges. But the weighting we have today is different than what the market’s used to. It’s like replacing a sumo wrestler on a teeter-totter with a 3rd grader, not the same.

While the stock market isn’t the economy, and vice versa, the non-Big Tech market is a reasonable approximation of the economy. New Deal democrat, who monitors coincident, short leading, and long leading indicators, recently assessed the economic this way.

The bottom line from the short and long leading indicators is that the economy “wants” to improve, but over the next six months, the coronavirus, and the reactions of the Administration, the Congress, and the 50 governors to the virus are going to be the dispositive concerns.

Left to its own, the economy “wants” to improve. However, there are two key issues to be addressed before a recovery can be achieved. The first is the passage of another rescue package, which NDD assumes will happen. The White House and the Democratic leadership is deadlocked, and no deal is in sight. The economy is starting to go over a fiscal cliff. A key study concluded that 30-40 million Americans are at risk of eviction, which will spark a homelessness crisis and another consumer death spiral.

Federal emergency unemployment benefits have now stopped. Driven by panic by GOP members of the Senate up for re-election this year, I expect a deal to be struck to extend them.

The pandemic war

The other major issue is progress against the pandemic. No matter how hard any individual country tries to control the virus, the pandemic is global in scope, and growth will not return until there is substantial progress around the world. Even in countries that appeared to have controlled their outbreaks, second waves of community infection are appearing in disparate countries like Spain, Israel, Japan, and Australia. Even a vaccine may not be a magic bullet. Russia recently announced that it had a vaccine based on promising animal tests but before extensive human trials,but even if it were widely available, how many people outside Russia would take the risk of being inoculated?

In addition, Reuters reported that Dr. Anthony Fauci cautioned about the effectiveness of early vaccines:

An approved coronavirus vaccine could end up being effective only 50-60% of the time, meaning public health measures will still be needed to keep the pandemic under control, Dr. Anthony Fauci, the top U.S. infectious diseases expert, said on Friday.

“We don’t know yet what the efficacy might be. We don’t know if it will be 50% or 60%. I’d like it to be 75% or more,” Fauci said in a webinar hosted by Brown University. “But the chances of it being 98% effective is not great, which means you must never abandon the public health approach.”

John Authers detailed some of the practical considerations in vaccine development and deployment in a Bloomberg Opinion piece. The main points are summarized below.

- How to develop it? Conventional trials or human challenge trials? Conventional trials take longer, and involve more subjects. In the past, human challenge trials where volunteers are injected with a vaccine and then deliberately infected with the virus, there has been a cure for the illness. In this case, there are no cures, and what are the ethical considerations of such trials?

- How to pay for it? “A vaccine is meaningless if people are unable to afford it,” said John Young, the chief management officer of Pfizer Inc. Nobody asserts that drug companies should be able to charge whatever the market can bear for a Covid-19 vaccine.

- How to ration it? The pharmaceutical industry cannot produce enough vaccine for the entire global population of almost 8 billion all at once. Therefore, rationing is inevitable. Some people will have to wait. Who gets to make these decisions, and by what criteria?

- How to roll it out? Vaccinations work best when everyone receives them, since germs that can’t infect people tend to wither away. How do you create widespread vaccinations, which lead to herd immunity?

Investment conclusions

Cam,

Regional bank (relative to SPY) had a rare positive divergence given the 10 year yield break below Mar20 low. This is welcoming (really) early sign of rotation (to value) .

What (indicators) would provide confirmation of such inflection?

This is interesting. Things are so bad, remittances to Mexico are rising:

https://geopoliticalfutures.com/remittances-to-mexico-rise-as-the-us-economy-struggles

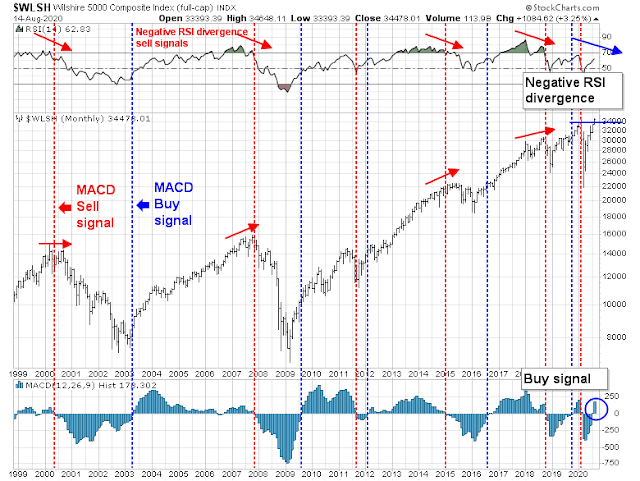

Re. The divergence between monthly MACD and the 14-month RSI, what does the historical data show regarding such occurrences?

There is some merit to the idea that ‘big and dominant’ leads to anticompetitive behavior. Assuming they are broken up, would that lead to less growth in the economy? I would argue otherwise.

The underlying reason is innovation, research, and capital markets. This is not duplicated anywhere else.

All sectors must evolve to grow. Even the big financials!

You are making the Nifty Fifty growth-at-any price argument. At some point, the price of growth matters.

Not really! Breakups of large and dominant companies does promote more innovation and growth over period of time. I am arguing something fundamentally different from size. It’s research, innovation, capital markets, AND immigration of the best and the brightest to our shores!

You have to distinguish between the competitive environment of a company and an industry from the stock price of the company of the companies in the industry.

Nifty Fifty stocks of the 1970’s included names like Avon Products and Digital Equipment. All lose their competitive moats eventually.

Microsoft was a market performer for a decade after the Justice Department antitrust action .

Microsoft did not perform well due to lack of innovative thinking. Same may be said about Intel. Today’s large companies have no guarantees. If they fail to innovate and adapt, they too shall be relegated to laggards. Think of IBM.

On Morgan Stanley’s Combined Market Timing Indicator:

Seems like much ado about nothing. 3% drop over six months?

“With global markets appearing tactically stretched, a sell signal on our market timing indicator would certainly add to the notion that upside on markets may be capped near term,” they said in a note. Historically, after a sell signal, European stocks have fallen 3% over the subsequent six months.

One question we each need to answer for ourselves is how big a decline becomes ‘too big?’

You may recall the -7% hit I took on June 11-12 after reopening positions on June 8. That was painful. Yet well within the range of single-day hits I’ve experienced over the past thirty years. Including a couple of round trips out of/ back into the market since then, I’m now ~+5% above the June 8 level (or roughly +12% off the June 11-12 lows).

Let’s say the SPX moves up another +5% before it takes a -20% swan dive. If I’m lucky enough to cash out at the top, then a -20% decline becomes another buying opp. If I sit tight, then the -20% decline wipes out all of my gains since June 11-12 and shaves off an additional -3%.

The most likely scenario is somewhere between the two. So personally I prefer continuing to game the upside over waiting for a big decline.

I agree that the hit to the consumer in the form of no $2400/ mo stimulus will affect the market eventually. Question is when. I’m wondering if things become untethered after options expiration next Fri. We will see!

Here’s another perspective on the bull market from Kevin Marder-

https://twitter.com/mardermarket/status/1294706211317641216

Are we still debating whether the spring of 2020 was a bear market, or whether we’re now in a new bull market?

If a new bull began on March 23, then it’s early days.

Rxchen, one thing to consider is that everyone and their brother is expecting a move up to ~ 3400 then a pullback. Not to say it’s not going to happen, but feels like a crowded trade to me.

1. Not so sure that’s the case. Who’s everyone? It doesn’t appear to be these guys:

https://www.aaii.com/sentimentsurvey?

Institutions? As SentimenTrader has been reporting for several weeks now – perhaps. But if I were a fund manager, would I be selling now? That’s a pretty big risk – what if global keep climbing ’til year-end and I’m stuck in cash?

2. If everyone is expecting a move up to 3400 and then pullback – well I think the 338x we saw this week is close enough. In which case they were selling this week, and I think the contrarian trade becomes a gap-up on Monday.

The so-called smart money?

– it’s not the

…right place to be this summer, at least so far.

Yes definitely depends on your time horizon. Where things head directionally Mon I have no idea. I’m talking more the next 1-3 weeks. The historically low P/C ratio in SPY suggests retail is piled in.

Worth a read: Rethinking Asset Allocation

‘We estimate that disruptive innovation will add $50 trillion to global equity market

capitalizations by 2032. Today, these technologies account for less than $6 trillion, suggesting that

they will deliver a 21% compound annual rate of return during the next 12 years.’

https://research.ark-invest.com/hubfs/1_Download_Files_ARK-Invest/White_Papers/ARKInvest_052720_whitepaper_Innovation-Allocation.pdf

Now look at ARKK since inception

https://ark-funds.com/arkk

A little late to join the party, or just getting started?

Palate cleanser: Reasons Not to be Cheerful

https://www.gmo.com/americas/research-library/reasons-not-to-be-cheerful

Does anyone want to comment on the (old) news that Buffett sold some bank stocks and bought a gold stock?