Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Asset Allocation Model is an asset allocation model which applies trend following principles based on the inputs of global stock and commodity price. This model has a shorter time horizon and tends to turn over about 4-6 times a year. In essence, it seeks to answer the question, “Is the trend in the global economy expansion (bullish) or contraction (bearish)?”

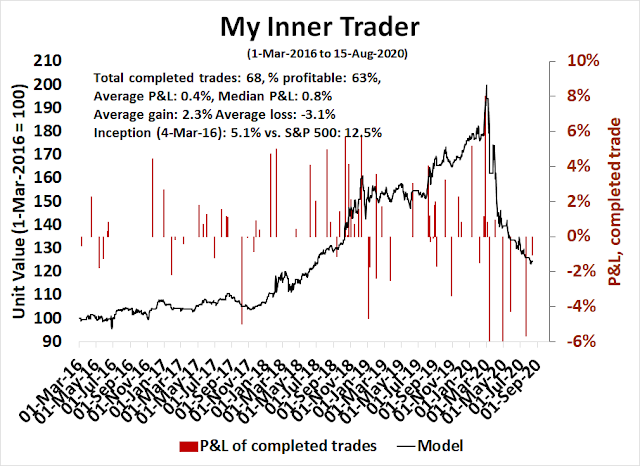

My inner trader uses a trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don’t buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the those email alerts are updated weekly here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Sell equities

- Trend Model signal: Neutral

- Trading model: Neutral

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of the those email alerts is shown here.

Subscribers can access the latest signal in real-time here.

False negatives?

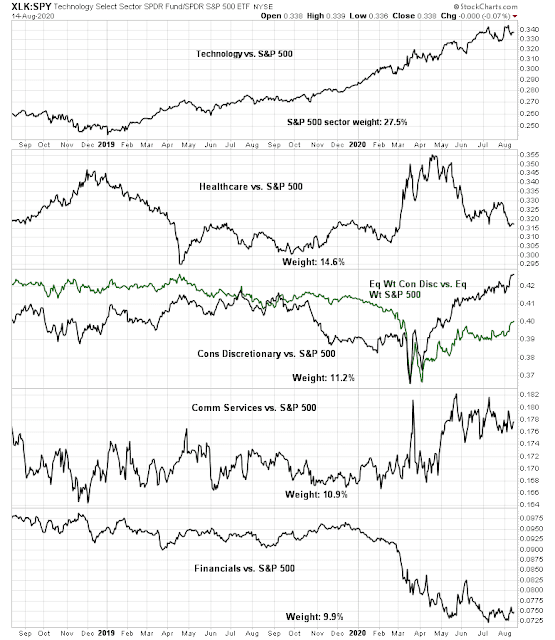

I have been writing about bearish setups for several weeks. In particular, risk appetite indicates have been sounding warnings. For example, the ratio of equal weighted consumer discretionary to consumer staples stocks, equal weighted to minimize the dominant weight of AMZN in the consumer discretionary sector, have been trading sideways and not buying into the equity rally.

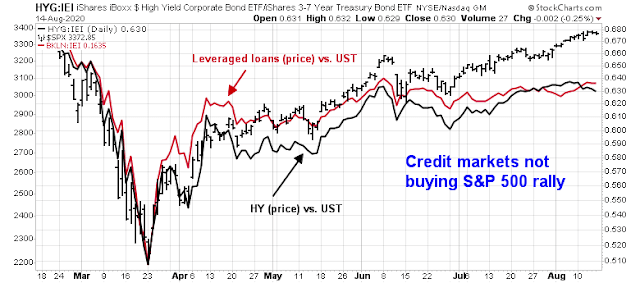

As well, credit market risk appetite, as measured by the relative performance of high yield (junk) bonds and leveraged loans to their duration equivalent Treasuries, are also not buying into the equity risk-on narrative.

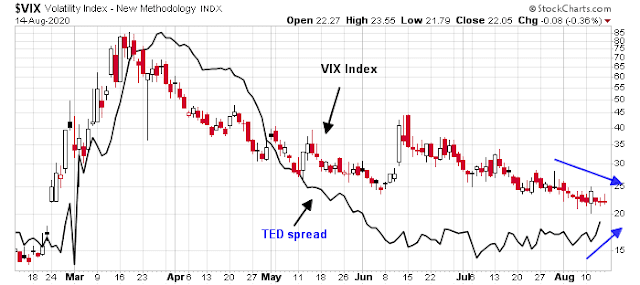

The divergence between the VIX Index and the TED spread, which is one of the credit market’s indication of risk appetite, is another worrisome sign.

In the short run, none of this matters. Here is what traders should really be paying attention to.

Big Tech dominance

I wrote about how Big Tech stocks are dominating market action (see A Potemkin Village market?). Indeed, the Big Tech sectors (technology, communication services, and consumer discretionary/Amazon) comprise roughly half of S&P 500 index weight. It would be virtually impossible for the market to move without the significant participation of these top sectors. So far, technology has been in a well-defined relative uptrend, consumer discretionary stocks have been strong on a relative basis, and communication services relative strength has been moving up in a choppy pattern.

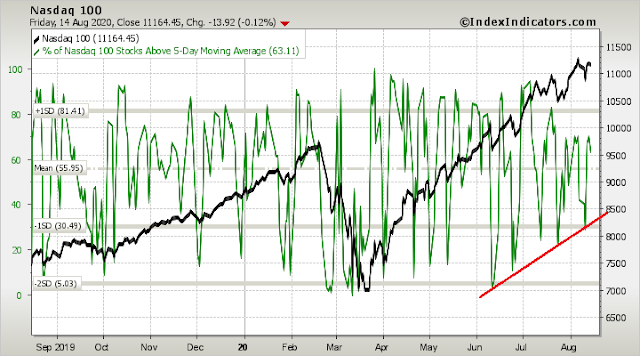

The NASDAQ 100 remains in an uptrend, though breadth indicators are sounding negative divergence warnings. Until the NASDAQ 100 breaks its trend line, it would be premature to turn bearish despite the widespread warnings.

Macro speed bumps

There are also warnings from a top-down macro perspective. Disposable income had been held up in this recession by fiscal support.

The expiry of the $600 per week supplemental unemployment insurance at the end of July has caused UI outlays from Treasury to fall off a cliff. Undoubtedly that will show up in falling confidence and retail sales in the near future.

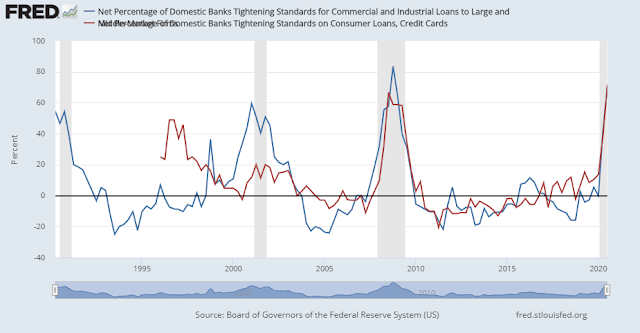

Banks are responding predictably by tightening credit standards. We have the makings of an old-fashioned credit crunch, which will crater economic growth in the absence of further significant fiscal and monetary policy support.

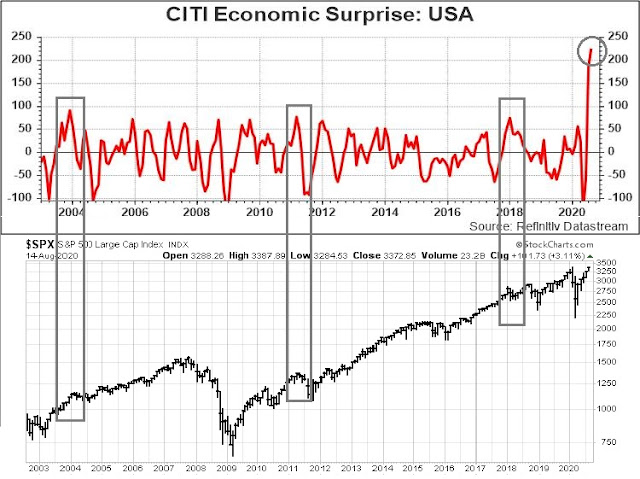

The narrative for the economy is turning from bounce back rebound to a stall. Historically, the stock market has encountered headwinds when growth expectations disappoint, as measured by the Citi Economic Surprise Index (ESI).

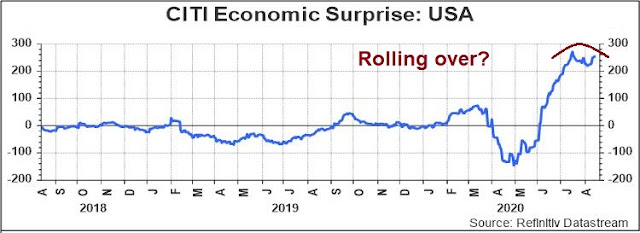

Here is a close-up look at ESI, which is showing signs of topping out.

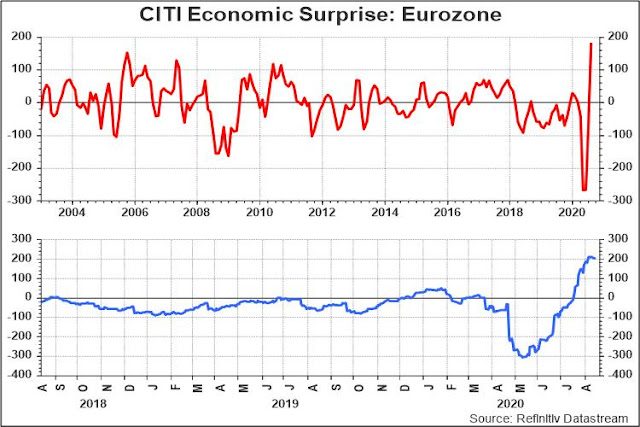

This trend of stalling ESI is evident globally. Here is Eurozone ESI.

Here is China ESI.

Pennies in front of a steamroller

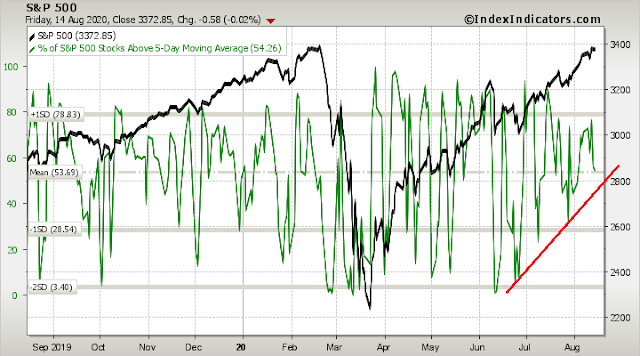

In the short run, none of this matters until the major market indices, and the NASDAQ 100 in particular, experience breaks to the rising trend lines. Short term momentum remains positive as the percentage of stocks in the S&P 500 above their 5 dma is exhibiting a series of higher lows.

A similar pattern can be found for the NASDAQ 100.

In conclusion, the negative divergence concerns that I raised in the past few weeks are still valid. However, nothing matters until we see trend line breaks, especially in the NASDAQ. Traders could try to buy dips in this environment. However, intermediate term downside risk is considerable, and buying here would be akin to picking up pennies in front of a steamroller.

Great writeup Cam. Several on Twitter were making interesting observations about $LQD prices dropping this past week and observing that they tend to precede $SPX drops. Thoughts?

https://twitter.com/hmeisler/status/1294706926161481728?s=20

Interesting question, Ellen. One of Cam’s sell triggers has been bond prices breaking above resistance. This week’s sharp drop in bond prices means they pulled back under that resistance, which would (following Cam’s logic (I think)) cancel any sell signal and imply that there’s more room for stocks to run.

ty Jerry and Cam!

The LQD adjusted price has tracked SPX far more than HYG

ty!

Did Hulburt called the bottom on rates.

https://www.marketwatch.com/story/heres-a-bullish-case-for-owning-bonds-now-even-with-yields-close-to-zero-2020-08-11?mod=mark-hulbert

Retail sales hit an all-time high last month.

https://twitter.com/RyanDetrick/status/1295048402632417280

Would 1.25 (still ridiculous) on the ten year kill the market?

Weird, says ‘published August 15’ but actually came out on 8/10.

Marketwatch does this all the time. They’ll republish Hulbert columns with minimal updates or a slightly different headline as if they were entirely new.

Worth a read: Rethinking Asset Allocation

‘We estimate that disruptive innovation will add $50 trillion to global equity market

capitalizations by 2032. Today, these technologies account for less than $6 trillion, suggesting that

they will deliver a 21% compound annual rate of return during the next 12 years.’

https://research.ark-invest.com/hubfs/1_Download_Files_ARK-Invest/White_Papers/ARKInvest_052720_whitepaper_Innovation-Allocation.pdf

Now look at ARKK since inception

https://ark-funds.com/arkk

Maybe a little ahead of itself?

Thanks for posting this white paper!

And finally: Reasons Not To Be Cheerful

https://www.gmo.com/americas/research-library/reasons-not-to-be-cheerful

OK I’m done.

Markets today are mechanical. A lot of people managing money have not adjusted, so they write of disbelief, out of fear of career destruction.

Here is a list of drivers which have the biggest impact on market:

1. 401k and 403b. Totally automated passive price-insensitive buying at fixed time interval. Over time this is the biggest driver of index compounding.

2. Systematic algo. Mostly tied to vix level. Mechanical price-insensitive buying or selling dependent on vix trends. You saw their effects during past Feb and Mar on the way down, and Mar to now on the way up.

3. Trend-following. This is where small guys play. Robin Hood guys are here, although they also have other styles of trading, if you can them styles.

I don’t know how to analyze this market. But following the big money is probably an effective way to make money. No need to be ecstatic or gloomy, just observe and adjust, with maximum flexibility built in your system. Like Napoleon, he came to battle fields to observe and adjust, with only a small baseline plan. So he had the maximum flexibility. Like buffet said: just be roughly right but avoid precisely wrong.

One last interesting observation about forcing short squeeze. This is not new but until a few months ago is not reported. A Reddit group is forcing big short squeeze in TSLA shares by buying call options. This forced dealers to buy TSLA shares as delata/gamma hedging and caused big short squeeze. People with TSLA shares and call options profited big time. They are doing it again now after the announcement of stock split. It would not be surprising if there actually is collusion involving ARK. Check how much stake ARK (and some unscrupulous individuals) has in TSLA.

So what would you do to profit in the market? Fundamental analysis is increasingly difficult because of secular decline of bond yields. It would be even more so in the future. And government has always have a hand in the market. And there are rampant shenanigans everyday.

Ingjiunn, a very helpful post. Thank you!

Your posts are some of the best ones – thanks!

https://www.marketwatch.com/story/house-democrats-summon-postal-service-leaders-to-emergency-hearing-on-mail-delays-2020-08-16?siteid=bnbh

An election totally dependent on the efficiency and accuracy of the USPS. I don’t know to laugh or cry.

Where can I see the bid/offer on mail-in votes?

Too early yet. You can probably find some for sale on eBay late next month.

https://www.nytimes.com/2020/08/17/health/coronavirus-herd-immunity.html?campaign_id=9&emc=edit_nn_20200817&instance_id=21332&nl=the-morning®i_id=95220570§ion_index=1§ion_name=big_story&segment_id=36280&te=1&user_id=a2a4457180643d326a5b1fa66404df46

‘The pandemic will end only when enough people are protected against the coronavirus, whether by a vaccine or by already having been infected. Reaching this threshold, known as herd immunity, doesn’t mean the virus will disappear. But with fewer hosts to infect, it will make its way through a community much more slowly.

‘In the early days of the crisis, scientists estimated that perhaps 70 percent of the population would need to be immune in this way to be free from large outbreaks. But over the past few weeks, more than a dozen scientists told me they now felt comfortable saying that herd immunity probably lies from 45 percent to 50 percent.

‘If they’re right, then we may be a lot closer to turning back this virus than we initially thought.

‘It may also mean that pockets of New York City, London, Mumbai and other cities may already have reached the threshold, and may be spared a devastating second wave.’

‘

RX, we’ll have a vaccine soon. Probably announced in October and distribution in the coming months. I hope a year from now we’ll look back and just brand 2020 as the year that never was.

If we had rapid, cheap screening tests (See Michael Mina MD’s work) we could go back into society quickly. Other countries already have these.

If they worked so well, we would buy them or imitate them. Besides, testing won’t get you to immunity.

Not that simple Wally– FDA regulates the types of tests available here in the US. Rapid screening tests would allow us to easily reopen schools and some businesses. Check out Michael Mina MD’s work if you are interested.

Ellen, the FDA just approved the spit test with an emergency waiver. If they can do that then they would do it for other tests that were reliable. I did look at Mina’s work, he mostly just rags on the FDA.

BTW, many European countries are suffering from a second wave. It’s not testing that will save them but a vaccine. We are close!

True re: vaccine but we have 4% of the world’s population and 25% of the cases in the US. Europe’s outbreaks are miniscule by comparison.

Yes, we have an open society even compared to Europe. Hence more infections. For instance, when Italy locked down nobody was allowed to leave their home. You can’t legally require that in the U.S.

But this has noting to do with a cure. It’s either herd immunity or a vaccine even though cases are falling off. And you would be wise not to trust the data at CNN. Truth is not their middle name. Take a look at the trends on this site even though none off this will matter once a viable vaccine is approved and distributed.

https://covidusa.net/

Latest vaccine trials are showing promising results for long term immunity.

If this is true, it could be the first coronavirus to be successfully eradicated. This has long term positive implications beyond COVID-19.

Bonds tried to bounce but that faded as the day went on. This makes this violent up move in some growth stocks like NVDA and TSLA suspectible. Real yields have been going up over the last few days and today’s price action did not indicate a reversal of this trend in a convincing manner.

There were probably too many market participants looking for a new high in the SPX today – which almost guaranteed a failure.

Tomorrow? Tough call. If it’s going to happen, I htink it happens overnight.

Andrew Thrasher, CMT

@AndrewThrasher

13h

Charlie McElligott of Nomura noting the expected large drop-off in dealer gamma after this week’s opex could be as much as 30%.

This isn’t a strictly bearish data point, but opens the door for an expansion in (non-directional biased) price volatility.

Related fascinating Twitter thread on McElligott’s recent views https://twitter.com/edwardnh/status/1292871973702447104?s=20

New S&P intraday high. Wooo Hooo!!! You had to be fast to see it. LOL

Patience, grasshopper.

LOL!!

“Stocks will soar 14% by the end of next year on unyielding optimism,” long-standing bull Ed Yardeni says

https://www.msn.com/en-us/money/markets/stocks-will-soar-14-by-the-end-of-next-year-on-unyielding-optimism-long-standing-bull-ed-yardeni-says/ar-BB17UVPs