Risk takers are fond of the line, “No guts, no glory”. With that in mind, I present three cases of risks, and possible opportunities.

The Turkey in the FX coalmine

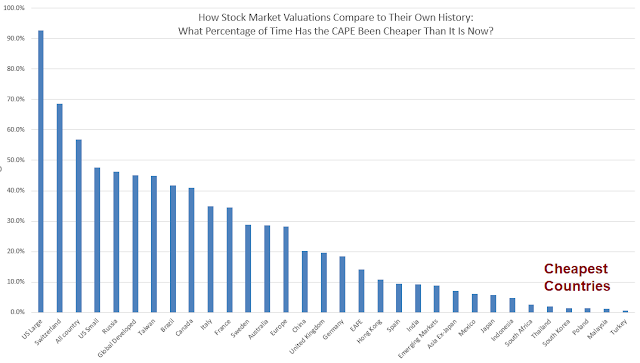

In late June, I highlighted analysis from Research Affiliates of country values by CAPE relative to their own history. At the top of the most attractive list was Turkey, followed by Malaysia, Poland, South Korea, and Thailand (see A bleak decade for US equities). Turkish equities represents a classic Rorschach inkblot test of risk and opportunity for investors.

While Turkish stocks are cheap on a statistical basis, they are not without risk. The Turkish lira (TRY) is under severe pressure because of a falling current account. Bloomberg summarized TRY’s challenges:

- Official reserves fell $7.7 billion as government-owned banks sold dollars to support the Turkish currency, which weakened more than 13% against the dollar in the first half of the year.

- Interventions via state lenders continued at a time of volatile capital flows. Non-residents sold $31 million of Turkish stocks and $427 million of government bonds.

- Net errors and omissions, or capital movements of unknown origin, showed a monthly inflow of $1.98 billion.

The Turkish lira is weakening to all-time lows, and that’s even before the USD has shown any signs of strength as greenback positioning is at a crowded short.

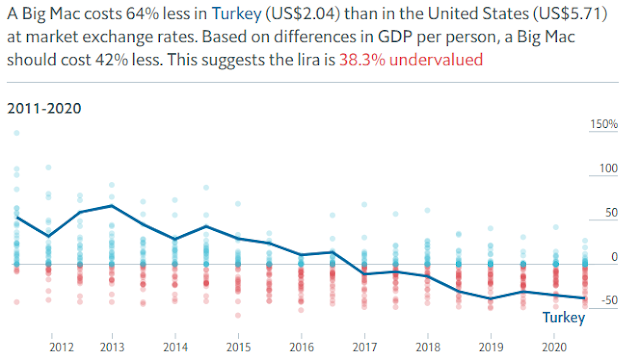

The Big Mac Index from the Economist shows the TRY to be considerably undervalued against the USD. However, currencies can take years, and even decades to converge to purchasing power parity.

In the short run, rising geopolitical tensions in the Eastern Mediterranean will not help sentiment. Turkey recently dispatched an exploration ship with a naval escort to disputed waters off the southwest coast of Cyprus, This is provoking a possible confrontation with the Greek and French navy, which is raising the temperature with EU relations and causing fractures within NATO. The Eastern Mediterranean has significant natural gas potential. Cyprus, Israel, Egypt, and now Turkey are trying to secure shares of the resource.

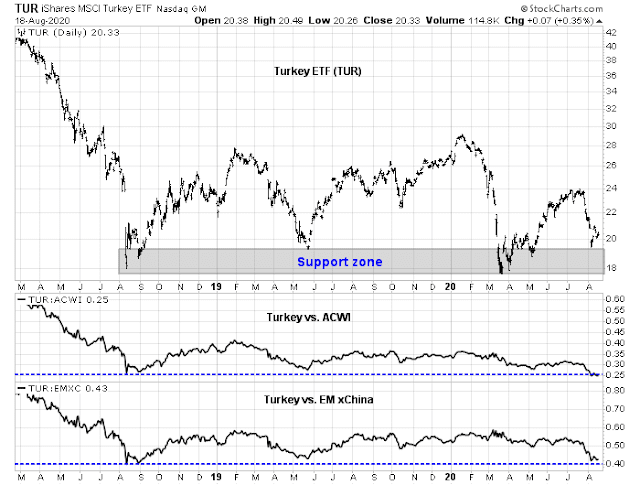

I have been monitoring the progress of the MSCI Turkey ETF (TUR). TUR has been testing a support zone. The relative performance of TUR relative to MSCI All-Country World Index (ACWI) is testing a relative support level, and so is the relative performance of TUR relative to EM xChina.

On a relative basis, Turkish equities looks washed out and presents a contrarian opportunity for investors. On the other hand, SentimenTrader pointed out that USD positioning is at a crowded short. The TRY exchange rate is at severe risk should the USD ever strengthens.

No guts, no glory?

American Brexit

In the US, the recent dispute over the Post Service highlights the rising risk of electoral chaos. Ian Bremmer and Cliff Kupchan of the Eurasia Group characterized this political risk as “American Brexit”.

In January, risk #1 described how US institutions would be tested as never before, and how the November election would produce a result many would see as illegitimate. If President Donald Trump won amid credible charges of irregularities, the results would be contested. If he lost, particularly if the vote was close, same. Either scenario would create months of lawsuits and a political vacuum, but unlike the contested George W. Bush-Al Gore election of 2000, the loser was unlikely to accept a court-decided outcome as legitimate. It was a US version of Brexit, where the issue wasn’t the outcome but political uncertainty about what people had voted for.

The Eurasia Group’s January forecast of American Brexit effects are already being felt today.

Meaningful (France-style) social discontent becomes more likely in that environment, as does domestic, politically inspired violence. Also, a non-functioning Congress, with both sides using their positions to maximize political pressure on the eventual election outcome, setting aside the legislative agenda. That becomes a bigger problem if the US is entering an economic downturn, on the back of expanded spending and other measures to juice the economy in the run-up to the election.

How would the markets behave under an “American Brexit” scenario? Let’s consider how the markets reacted after the Brexit vote surprise in 2016. The chart below depicts the FTSE 100, which consists mainly of UK large cap global companies, and the FTSE 250, which are small companies that are more exposed to the local economy. As ways of measuring a “pure” Brexit market effect, I also show the relative performance of the FTSE 250 to FTSE 100, the performance of UK large caps to ACWI, and the performance of UK small caps to ACWI. The markets rallied into the Brexit vote, thinking that the Remain side would win but fell dramatically after the unexpected result. Once we normalize the relative prices before and after the vote, downside risk varied from -4% to -14%, depending on the metric used.

This is a key risk for the US equity market. I have not seen any Wall Street strategists discuss the possibility of electoral chaos after November. Based on the Brexit event study, expect a similar range of downside risk of -4% to -14% in during the November to February period.

Brexit, the aftermath

Speaking of Brexit, the region has been the most hated in the BoA Global Fund Manager Survey for some time.

I know that the details of Britain’s divorce from the EU are not finalized yet, but UK equities look washed out and unloved. But the ratio of the FTSE 250 to FTSE 100 has been rising steadily before the COVID Crash, and it has been recovering steadily since the March low. From a global perspective, while UK large caps (EWU) continue to lag ACWI, UK small caps (EWUS) have been range bound, which is a more constructive pattern.I interpret these readings as the market has largely discounted Brexit risks, and there may be opportunity for superior performance in UK small caps, which are more exposed to the British economy.

One long-term bullish factor for the UK that few talk about is Prime Minister Boris Johnson’s decision to open the citizenship doors to Hong Kong residents with British National (Overseas) passports. This has the potential to inject the country with a group of English speaking, well-educated immigrants that could boost growth potential.

No guts, no glory.

Except for swing states, I think the US Election will be held without issues. Florida,Ohio, Michigan, Iowa, Pennsylvania, Wisconsin may see some unusual activity around November.

The problem are the states that want to mail ballots to every registered voter. That is a recipe for chaos. NY did something like that in their primaries and they are still trying to figure out what ballots are good and which aren’t. Studies show such a scheme would be a monstrous mistake. It’s ripe for fraud and challenges.

If you can stand in a crowd to protest you can vote in person with social distancing.

In this year’s local elections around March/April, I didn’t have any issues voting in person. Our precinct had early voting extended by 2 weeks and as a result, none of the polling stations were ever busy. It took me less than 5 minutes to vote after I parked my car. On the other hand… turn out in local elections is abysmal here… may not be comparable to an election for president.

However, voter suppression in low income areas is a real issue. The debacle in Wisconsin earlier this year was documented thoroughly, and I suspect voters in the most vulnerable areas will experience the same issues in crucial swing states. Reducing open polling hours, ID laws (an indirect poll tax), and removing polling stations have been fairly effective barriers to preventing more people from voting.

Adding in the “debate” on whether the pandemic will worsen once flu season starts again. Quite a bit may be happening on the run up to the election.

Every time I have voted in person here in northern Texas there has been a line down the hall and out the door. I imaging with social distancing that line will wrap around the block. And that is during the early voting days.

I would vote absentee but my signature is so odd they might toss my ballot. So, I’ll show up during one of the early voting days with my hazmat suit. LOL

Pulling in my horns this morning.

Trimming ~half of my positions into early morning strength. Will probably close remaining positions end of day.

S&P broke the high and got above that fib I mentioned. Now to see if it can hold it.

The breakout has been the Charlie Brown-type – no conviction. So I think a pullback is needed to launch the next breadth thrust.

It needs to distance itself and then pull back to the high. Otherwise it looks like it is making a top.

That’s a good way to look at it.

The release of the July Fed Minutes just blew the market out of the water for now. The 10 year bond has already recovered. The minutes just showed the Fed is concerned about the economy and that it is far under the pre-pandemic levels.

Bought some SPXL down here. I anticipate selling it today if we press the highs. Stop is a bit under today’s low.

Stop moved to BE. Market looks higher this last hour IMHO.

Disappointing. Out with a BE.

Closed all remaining positions.