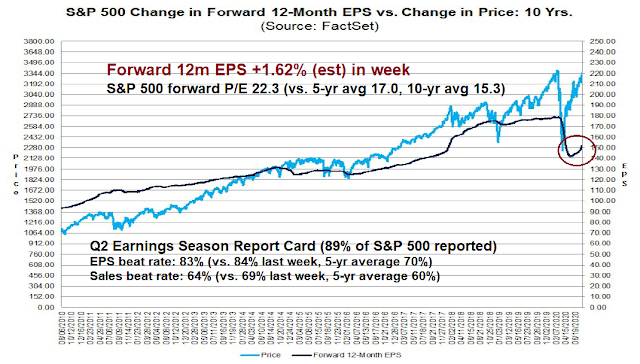

Q2 earnings season is nearly done. So far 89% of the market has reported. FactSet reported the EPS beat rate fell to 83% from 84% the previous week. The sales beat rate was fell to 64% from 69% the previous week. Both the EPS and sales beat rates are ahead of their 5-year averages.

The bottom-up consensus forward 12-month estimate continued to rise strongly at 1.62% last week after 1.03% the previous week The market is trading at a forward P/E of 22.3, which is well ahead of historical norms.

As 89% of the index has reported, this will be the final Earnings Monitor of Q2 earnings season.

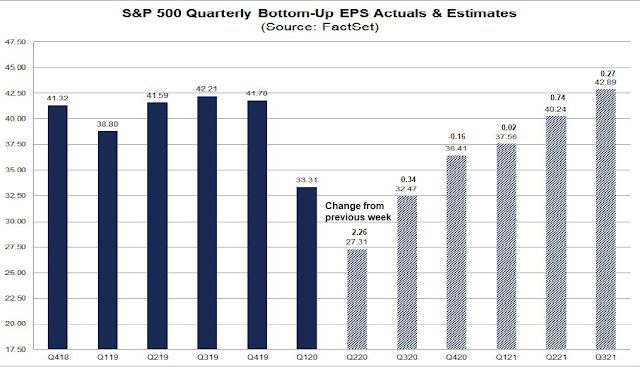

Strong positive revisions

The Street continues to be upbeat on the outlook of individual companies. Though the weekly changes in quarterly EPS estimates can be noisy, analysts have upgraded quarterly earnings estimates across the board, except for Q4 2020.

Company earnings guidance continues to be positive. FactSet reports that “11 [companies] have issued negative EPS guidance and 34 have issued positive EPS guidance. The percentage of companies issuing negative EPS guidance is 24% (11 out of 45), which is well below the 5-year average of 69%.” However, over half of the companies have withdrawn guidance, citing pandemic-related uncertainty.

Bottom-up caution

The Transcript reported that companies have adopted a cautious tone in their earnings calls:

Many companies and individuals have been hard hit by the pandemic and are having a tough time. All eyes are on another stimulus package to try to cushion them. Worryingly, cases are rising worldwide even in areas that were thought to have contained the virus. The picture from July and early August is one of a mixed and uneven recovery.

Here is a brief summary of the macro outlook:

- Most companies and individuals are having a tough time (Square, HSBC, Fannie Mae, Norwegian Cruise Lines)

- The hope is for another stimulus package (Starbucks, Richmond Fed)

- The picture of demand trends in July and early August is mixed and uneven (Global Payments, LGI Homes, Henkel, Yelp, Hyatt Hotels, CGP Applied Technologies, Summit Hotel Properties, Brookfield Infrastructure Partners, Planet Fitness)

- Are we placing too much emphasis on waiting for the vaccine? (St. Louis Fed, Hyatt Hotels)

- Worryingly, cases are rising again worldwide (Henkel, Fannie Mae)

Slower growth ahead

The story of Q2 earnings season has been a rapid climb in earnings and outlook, but the economy appears to be transitioning to a period of slower growth. The July Jobs Report was revealing in many ways. Even though some of the dire forecasts of negative jobs growth was averted and job growth came in at 1.8 million, which was slightly ahead of expectations, the trajectory of growth is slowing. Even though the unemployment rate fell, the unemployment rate for workers unemployed for 15 weeks or more continued to climb. This is an indication of a rising long-term unemployment problem.

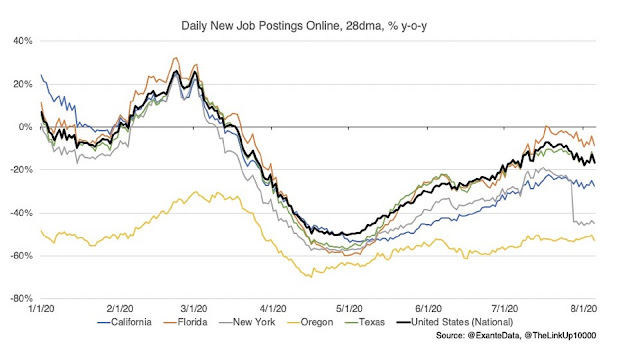

Notwithstanding the slight Nonfarm Payroll beat, high frequency data is pointing to a pattern of stalling growth. As an example, new online job postings are pulling back after a period of rapid recovery.

Trump tries to take the helm

The impasse in Washington over CARES Act 2.0 is not helping matters. Ironically, the constructive nature of the July Jobs report provided reasoning for Republican budget hawks in the Senate to resist pressures for additional stimulus. While there has been some discussion, the Democrats and Republicans are far apart on a number of major issues.

President Trump stepped in on Saturday and signed orders to try and break the logjam. He spoke at a signing ceremony at his Bedminster golf course, “We’re going to be signing some bills in a little while that are going to be very important, and will take care of, pretty much, this entire situation”.

However, his actions are problematical and they are reminiscent of the travel ban Executive Orders (EOs) when he first took office. Those EOs were challenged in court and it took several revisions before they could be implemented. Similarly, the some of the latest initiatives are subject to constitutional challenge, and others represent more glitz than substance.

Trump signed one EO and three Memoranda to extend the eviction moratorium; extend the supplemental weekly unemployment insurance support, which was reduced from $600 to $400 per month; defer the collection of the payroll tax; and to extend student loan relief. Let’s examine them one at a time.

Here is the Executive Order relating to evictions. Despite Trump’s announcement that he is extending the eviction moratorium, the EO is nothing of the sort. It directed various federal agencies to find ways to halt evictions, which is distinctly different from an eviction moratorium [emphasis added].

- The Secretary of Health and Human Services and the Director of CDC shall consider whether any measures temporarily halting residential evictions…

- The Secretary of the Treasury and the Secretary of Housing and Urban Development shall identify any and all available Federal funds to provide temporary financial assistance to renters and homeowners …

- The Secretary of Housing and Urban Development shall take action, as appropriate and consistent with applicable law, to promote the ability of renters and homeowners to avoid eviction or foreclosure…

- The Secretary of the Treasury, the Director of FHFA shall review all existing authorities and resources that may be used to prevent evictions and foreclosures

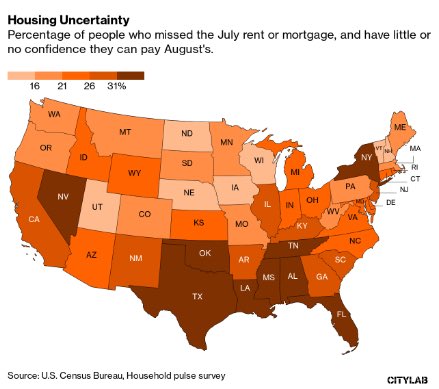

Eviction and homelessness is becoming a looming problem. An estimated 27% of Americans missed July rent payments. Of those, 39% were not confident they would be able to make their August payments.

More crucial to the growth outlook, here is the Memorandum to extend the supplemental unemployment insurance payments by $400 per week, down from the now expired $600 per week. The Trump Administration “declared an emergency” and raided the FEMA budget of $50 billion to pay for the extension. The measures were problematical in a number of way. First, state governors cannot pay the extra unemployment insurance without spending authorization from Congress, which the Memorandum does not. As well, under the law that governs FEMA, if the federal government declares a disaster, the state will have to request aid and pay 25% of the cost. It is unclear how many states would actually implement such a measure, and many states do not have the budget for the extra $100 per week. Even Ohio’s Republican governor Mike DeWine has expressed doubts about whether his state could participate in the program.

If this measure is fully implemented, the $50 billion would be used up in 4-5 weeks. For some perspective on the economic effects, of this measure, former Treasury official Ernie Tedeschi estimated that a $300 per week UI relief would reduce employment by 800,000 by year-end and GDP by -1%. A full expiration of $600 weekly support would reduce unemployment by 1.7 million and GDP by -2%. At best, the implementation of this measure will be highly uneven, and will depend on the legal interpretation and budget constraints at the state level.

In addition, the 2020 hurricane season is expected to be more severe than average, and FEMA would be left without a budget for disaster relief. This measure is likely to spark a constitutional crisis, as Congress is the only arm of government authorized to spend and tax. The President has no authority to extend the payment of unemployment benefits.

The Memorandum on payroll tax deferral is equally problematical. It directs the IRS to temporarily suspend the collection of payroll taxes until December. It is not a tax holiday. Trump has promised to forgive all of the suspended payroll taxes owing if he is reelected. This measure presents a quandary for employers. Since this is only a tax deferral, do they continue to deduct payroll taxes from employees until December? The prudent course of action would be to put these deferred taxes into a separate account until they are payable. In that case, there is no stimulus effect. If the employer does not deduct the payroll tax, he may be put into a position of trying to claw back the taxes from employees and former employees in the future. The hope of the policy is the employer either does not collect the tax, or does collect the tax and uses the funds for other purposes. But that course of action creates many legal uncertainties for both employers and employees.

As payroll taxes are used to fund Social Security and Medicare, Joe Biden was quick to jump on Trump’s measure as “defunding Medicare”. Undoubtedly, this will spark a healthcare funding debate in the coming days. In addition, this measure is also subject to a constitutional court challenge, as it is Congress that has taxing authority.

Of all the measures, the Memorandum on student loan relief has the least problems. The Secretary of Education does have the authority to defer student loan payments in hardship cases.

In summary, these measures are not well-written, and they are highly reminiscent of the ill-fated travel bans early in Trump’s term. Nebraska Republican Senator Ben Sasse called them “constitutional slop”. Despite Trump’s efforts to take the helm, at best these efforts will cause confusion over their implementation. At worst they will be mired in court challenges. In all cases, their economic effects will be minuscule compared to the proposals tabled by either the Senate Republicans, or by the Democrats. For an idea of the difference in scale, the $50 billion from FEMA to fund more unemployment insurance relief, even if fully implemented, is dwarfed by the sized of Republican $1 trillion relief bill, and the over $3 trillion HEROS Act passed by House Democrats. Moreover, Trump runs the risk of politically “owning” the coming slowdown with these half-measures ahead of the election.

In conclusion, Q2 earnings season has been upbeat, and Street analysts are busy raising their earnings estimates. However, the economy is likely to undergo a phase of slower growth. The CARE Act 2.0 impasse is exacerbating the effects of the slowdown, and could bring the economy to a dead stop. Wall Street has not recognized those risks, and estimate revisions are poised to lurch downwards.

Ahhh, a clean slate to work with. Sort of like a re-birth.

Wally,

LOL. You are hilarious buddy!! Let’s get started with comments in 3…2…1..

Lol.

Hate to look on the bright side, but…

Also from ‘The Transcript’: Demand for Homes is Phenomenal’

You looked at XHB lately?

Recommend this, from Ben Carlson: ‘The Most Counterintuitive Recession Ever’

https://awealthofcommonsense.com/2020/08/the-most-counterintuitive-recession-ever/

Credit card delinquencies falling, housing starts booming, etc.

I think .5 (!) on the ten year is the line in the sand. Technicals may point lower, but fundamentals don’t support.

(Reposted, stuck in moderation on prior post.)

Good point, Len. Lowest mortgage rates ever and people getting claustrophobia from staying home in their apartments has created a massive housing boom. Housing almost always leads the economy higher.

Thanks for the link to that article, len!

Yes, 2020 may go down as the year so much fiscal and monetary stimulus was unleashed that the markets almost had to rally to new heights. Kind of like a guy who starts a GoFundMe page when his $250k house burns down and ends up with $30 million in donations.

Consumer America liquified itself after the 2008 bust, handing over the baton of indebtedness to corporations and the US government. Nothing new here.

What is new here is the unprecedented rate of money printing. 7 Trillion, did I hear in a short period of time?

I am increasingly worried that without an effective cure or a vaccine, we are peering into a deep decline in Stocks.

https://twitter.com/RyanDetrick/status/1293014805851316224

That is one scary thought, D.V.

Thanks for the link, Len g.

Let me start by saying Congress has been given a reprieve. They now have a few weeks to come up with a reasonable bill to help Americans survive the pandemic a bit longer. Don’t blow it!!! Taxpayers don’t have long memories but they won’t need one to remember what happens (or doesn’t happen) next.

Reminds me of an old Stones song-

https://www.youtube.com/watch?v=FhzCnZ1vAvw

I remember that. All my Stones songs are on my lp’s that I can’t play now. I think I have a turntable somewhere – probably in the attic after the last move.

Wally, I read your comment on your high end trading software being thwarted. Most likely this is caused by trading robots programed by psychologists to search out your stops.

I’ve read that the latest trading pods consist of a computer, a man and a dog. The computer’s job is to trade against you. The man’s job is to feed the dog. The dog’s job is to bite the man if he goes anywhere near the computer.

I think you are right, Wes. But it was about 15 years ago so I think it was traders doing the same thing on manual basis. Very frustrating. I see it happening all the time even with the indexes. They break to a new daily low (or high) only to reverse the other direction. I should be jumping on those reversals but I don’t want to become a daytrader. It requires too much of a time commitment.

Two conflicting views of the unemployment extension and lack of stimulus relief package. Now I’m not sure what to think, as the “band aid” provided thus far could kick the can down the road for a few months and delay pain in markets. Or perhaps Barry Ritholz is correct that pain would not be felt in markets?

Optimistic view re markets:

https://www.bloomberg.com/opinion/articles/2020-08-04/why-markets-don-t-seem-to-care-if-the-economy-stinks

Pessimistic view:

Nick Timiraos

@NickTimiraos

JPM’s Feroli on the four executive actions:

“All of these have either legal or operational problems that will very likely limit their effectiveness in supporting economic activity.”

They will provide less than $100 billion in stimulus versus expectations of $1-$1.5 trillion

Nick Timiraos

@NickTimiraos

JPM’s Feroli: “If this is all we get for fiscal policy for the rest of the year, it would represent a significant downside risk to our growth outlook.”

It is not that Rithholz is oblivious to the pitfalls ahead. He is saying so long as the big co’s do well the index will be OK. Like an NBA team, if your stars score most of the points every game the team will be fine. Who cares about the role players? Your stars have the highest salaries (biggest market caps) and score most of the points (biggest profit share). The way it should be. When your stars start to age, you trade for younger stars. Just like the markets have been doing since the very beginning. But when the whole system does not foster and produce young talents into stars, then we will have a big problem. This is the situation in Europe and partially in Canada.

That’s a great post by Ritholtz!

Thanks for the link, Ellen. That article is along the lines that Cam has been preaching in his newsletter. That is probably the reason his analysis has been having trouble anticipating market moves. Maybe Cam should find or create some of his indicators that exclude everything but the FAANG+ stocks.

Will be trimming a few positions this morning, mainly IWM/ iJS (small-cap sectors) which I believe need a breather.

Other than that, still bullish.

The market’s extended and can’t go much higher without a pullback, right? The SPX will hit resistance at 3393, right? It’s too late to buy into the rotation into banks + airlines, right?

Says who? The market will answer all of those questions and more if we take a step back and give it a chance to speak.

Closing IWM/ IJS/ RPV for 2-day gains of ~+3%/+7%/ +6.7%. It just makes sense to lock in those kinds of gains. And I am now free to reopen positions at any time on pullbacks.

‘Russia Registers World’s First Coronavirus Vaccine’

‘”As far as I know, a vaccine against a new coronavirus infection has been registered this morning, for the first time in the world,” Russian President Vladimir Putin declared, according to RIA Novosti. “I know that it works quite effectively, forms a stable immunity and, I repeat, has passed all the necessary checks.” He added that one of his daughters was vaccinated against COVID-19, despite Phase 3 trials that normally last for months and involve thousands of people. At the end of July, the WHO said that there were 26 candidate vaccines in the clinical evaluation stage, including one registered in Russia that was developed by the Gamaleya Research Center.’

It’s all BS – unless it’s true…

LOL Let’s see how Putin’s daughter fares after taking their vaccine, if true.

The third SPY gap up in recent days. Market slapping a giant ‘kick me’ sign on its back.

Closing 2/3 of the SPY position (in the form of RYSPX) @ the 730 pst window in order to diversify into DIA +/- VTIAX +/- VTRIX +/-VEMAX +/- VVIAX end of day.

You might refer to these moves as herding cows 🙂

Cats, not cows. Cows are easy.

Is that from actual experience? 🙂

I learned it watching Eastwood’s opening scenes in ‘Rawhide’ sixty years ago.

Movin’, movin’, movin’,

Though they’re disapprovin’,

Keep them dogies movin’, rawhide

https://www.marketwatch.com/story/heres-a-bullish-case-for-owning-bonds-now-even-with-yields-close-to-zero-2020-08-11?siteid=yhoof2

Good time to prime the pump for more negative rates down the line. Value stocks, (High dividend, solid moat, low price uncertainty), some commodities, gold, non-US scrips and long end bonds, probably is a good mix next few years.

Interesting article, D.V. I’ve been saying inflation and interest rates need to go up for the last 10 years. And, I’ve been wrong.

Market seems to me very extended. Fear Greed (SPX) = 75 today. RSI(14) = 71, 14, RSI(5) more than 88. Other indicators also. VIX = crossed downline of BB…

Petr, following these indicators as well… you thinking Nasdaq more extended than SPX or will one hold up better than the other in your view?

Thanks for posting, Petr. I didn’t realize the indicator had moved that high. I think Cam normally uses 80 as a threshold, but I’m more conservative and inclined to say 75 is ‘close enough.’

Now 50/50 as to whether to pull the plug on a 2-day trade.

Ellen, I am pretty nervous because Cam covered all shorts couple moments ago. I am thinking about my next step.

Petr– same… sidelined for now…

My guess is that Nasdaq has not yet fully bottomed and has a bit more downside in Aug. We will see.

Short covering was due to my risk control discipline. I’m still nervous about this market

Agree Cam and Petr– Aug looks very volatile to me… think VIX and DXY are making a comeback this month.

Ellen, I am still short – but nervously. VERY.

SPX or QQQ?

Personally I think your trade will pay off in the near future!

Nice trade Petr! Congrats!

OK, you guys have convinced me. Closing remaining positions either now or at the close.

It appears that SPX held support @ 3348. I’m now considering reopening positions in IWM/ SPY and/or adding DIA/ even QQQ.

And SPX now breaching support->3343. I’ll wait to see if it reclaims 3348.

Which it has – but it’s a long 22 minutes ’til the close.

This is definitely herding cats.

Yep. I think there will continue to be a bit of a flush in the indices for at least a few more days. Not in a straight line down though. VIX is up and DXY is holding while precious metals getting hit.

Selling accelerating into the close. Will be closing the remaining 1/3 of RYSPX end of day – and back to 100% cash.

yes let some of this weakness work itself out. VIX is a problem short term.

You’re probably right. Next stop SPX 3270.

rxchen yep and if DXY rallies even short term with VIX SPX is going lower than that.

+0.6% gain for the overall portfolio over two trading days. IMO, it’s a decent gain – and absolutely phenomenal when compared to the +1% per year earned on a CD.

Agreed it has paid to be in the market but in the short term personally I’d let this play out.

Market gods…

Human psychology. Makes you want to close a position at the absolute worst time. It happens to all of us more often than we care to admit.

Why not reopen the position after hours @ 9.23? I don’t short, mainly because I don’t like anxiety ;)…but I have been taken out of longs just prior to an upside reversal – and done quite well buying back in at higher prices. It all depends on one’s conviction in the reversal.

Agree rxchen. It might gap and crap tomorrow. Personally I don’t think this sell is done with the VIX up here.

Thank you Cam for your sacrifice to get this started to the downside today!

Cam,

What’s going on with the 10 and 30 Year treasuries? That move was very unusual.

Not sure. Tuesday had the feel of a violent unwind of some positions. We’ll have to see how the markets react on Wednesday.

A +25-point gap up in the SPX. Feels a little like I got played 😉 When that happens, I debrief during my early morning walk. Here’s my take:

(a) I was actively looking for a reason to reset all longs in the final 15 minutes of Tuesday’s session. Had I done so, I would held the remaining 1/3 position in SPY, and added 1/3 positions in DIA and QQQ. I would also have reopened the same IWM position I closed early in the morning.

(b) The acceleration in selling near the close prevented me from doing the above. To be absolutely honest, however, I sensed panic heading into the close and had to fight my own second-guessing about moving to cash. It looks like I should given the thought more weight. It happens.

All that matters right now is whether and how to play today’s open. Both IWM and SPY are set to open about where I closed yesterday morning. In that sense, I haven’t lost any ground – ie, had I not taken gains yesterday morning then the current gap-up simply erases any paper losses I would have incurred overnight. What I’m hoping for is another down draft – but the market rarely gives us what we hope for.

If we do see a decline, the odds of successfully playing another bounce are significantly lower than they were had we bought last night’s down draft. The correct play is usually buying the first decline.

I would take a swing ~3347.

https://twitter.com/LindaRaschke/status/1293527903393718272

Without really understanding what she means, I also understand exactly what she’s trying to say.

Treasury yields are climbing again today. Is there a US/China conflict over Taiwan coming or something like that? Something must be driving up yields.

How about inflation expectation – todays CPI, core CPI in the US….

My understanding is yields are climbing because of excess supply.

This week we had a record 3 year auction yesterday, a record 36b 10 year auction today and 26b 30 year auction tomorrow. with record deficits, the supply pressure will only get stronger. the main supply pressure will continue to be the second week of the month – when the longer dated auctions are normally scheduled.

Supply of new Treasuries being auctioned? That makes sense. I was looking at the CPI core that Petr mentioned and it came in a bit stronger than expected.

https://www.fxstreet.com/economic-calendar

Thanks Petr and Cam.

From SentimenTrader-

‘A tale of two S&P’s’

‘We’ve seen how a few stocks have been taking over the market which has masked some underlying weakness in indexes. While the Advance/Decline Line has broken out to a new high, that doesn’t mean the gains are evenly spread, not even remotely. The stocks-only A/D Line still remains below its prior high.’

‘These quirks have allowed the S&P 500’s Total Return index to close at a new all-time high. This is the version of the index that takes dividends into account, which is what a “real” investor would receive. Yet the Equal Weight version of the index, which puts all 500+ stocks on equal footing, is still more than 7% below its own high, even though its relative performance has picked up in recent days.’

‘Over the past 30 years, there have only been four other days when this kind of quirk triggered. Even when relaxing the parameters to look for a 5% divergence, only a handful more days showed up, mostly around the same time frames. Stocks did not do well after those days, especially the capitalization-weighted version of the S&P 500.’

S&P 500 broke yesterday’s high and is just 10 points (roughly) from an all time high. I think there will be volatility when it gets there (if it gets there.)

Not so sure about that. This market has been good at sowing and then defying expectations.

James Deporre: “It will be interesting to see if the bears make another try late in the day. They have consistently been unable to press their bets when they have an advantage and that looks like the case again.”

https://realmoney.thestreet.com/investing/stocks/time-to-hit-reset–15397718

Back to herding cats. Opening midday positions in XLF/ XLE/ IJS/ RPV.

As we approach the final hour->I’m back at the trading table and faced with the same dilemma. Reopen positions in IWM/SPY +/- DIA/QQQ?

1. IWM. Last exit was Tuesday morning ~159. Currently 157.27. That’s a maybe.

2. SPY. Last closed 2/3 of my position ~336.15 Tuesday morning + remaining 1/3 for a -0.8% hit. I’m neutral with regard to chasing the +1.5% move today, as I’m really chasing a +0.5% move.

3. DIA. I missed yesterday’s buying opp. However, RPV is currently red and I may opt to substitute VVIAX (large-cap value) in its place.

4. QQQ. No interest in chasing a +2.7% move today. Yesterday’s play was for a bounce, which is exactly what we have today. I’m more interested in capturing the rotation into financials/ energy/ value.

It’s tough as hell to chase here. But might that be the right move? As in the possibility of a breadth thrust on Thursday that simultaneously nails the bears and leaves sidelined investors in the dust?

OK. At the close, will be positioning the investment portfolio-> RYSPX (SPY)/ RYDHX (DIA)/ VVIAX (large-cap value)/ RYRHX (IWM) at 30/30/30/10.

It’s a bet that:

(a) Tuesday’s late-session selloff was the last real buying opp.

(b) Few investors are positioned for a rally at this point.

(c) Even fewer are positioned for a reflation trade.

(d) There are no easy successful trades.

RX, my gut feeling is that they are going to close right around here and let the thinner overnight trade take the market to all time intraday highs. I think it will open over 3395 or higher barring any overnight bad news.

I’m OK with that!

Yeah I’m a little nervous – but it wouldn’t feel right if I wasn’t.

(Note that I managed to time entries into XLF/XLE/IJS/RPV at the absolute lows of the day! Now that’s karma 🙂

So far so good!