Mid-week market update: As the market tests resistance at the old highs, is sentiment greedy enough? The Fear and Greed Index stands at 73, and recently peaked at 75. While readings at these levels can indicate high risk environments, they have also been inexact market timing signals.

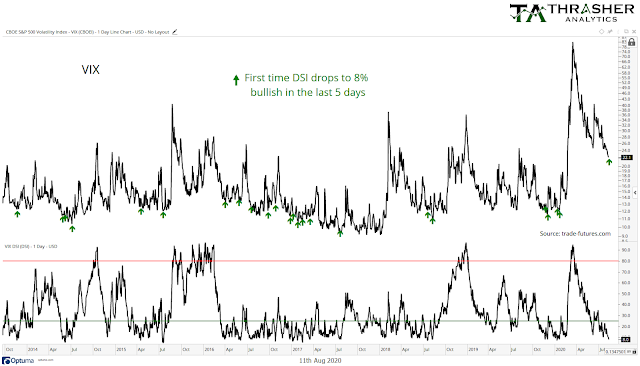

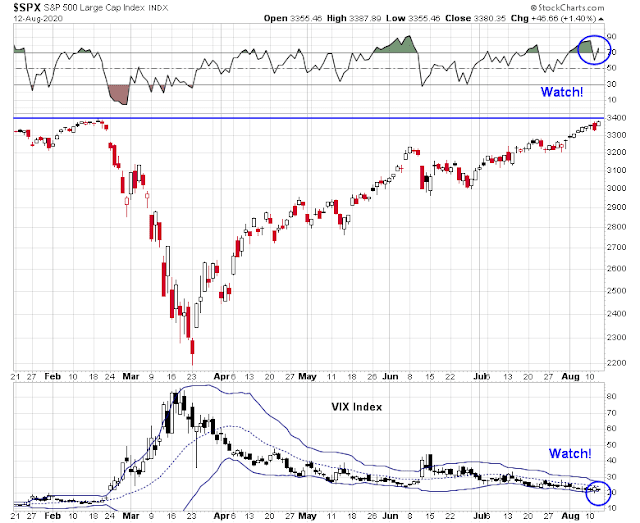

Andrew Thrasher pointed out that VIX sentiment has fallen below 10%, which is bullish for volatility and bearish for equities.

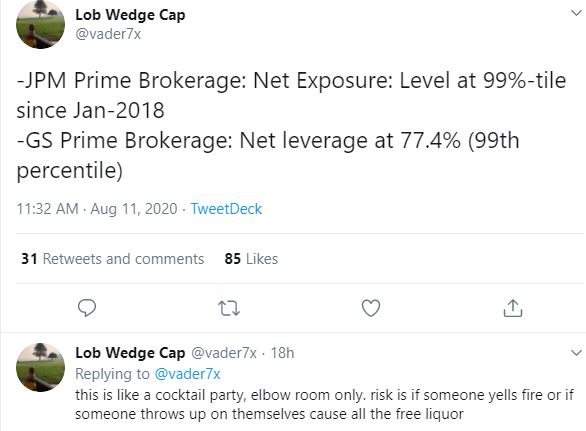

Hedge fund positioning is another matter. A recent survey of JPM and GS prime brokers that act as HF custodians reveals that the fast money crowd has gone all-in on risk.

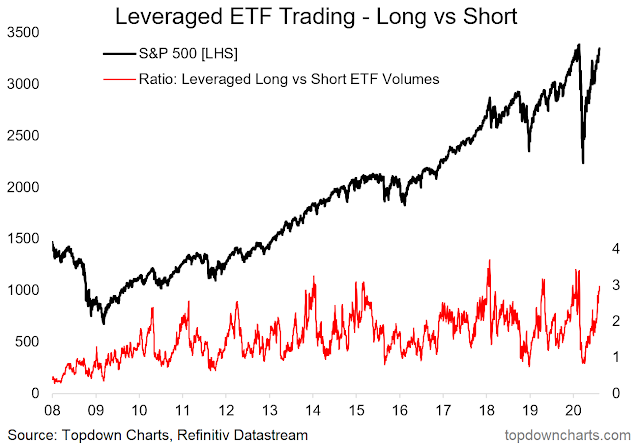

Speculative retail positioning, as measured by leveraged ETFs, is bullish. However, readings may not be extreme enough to be described as a crowded long (via Callum Thomas).

Does that mean that stocks are about to experience a risk-off episode?

A door closes, others opens

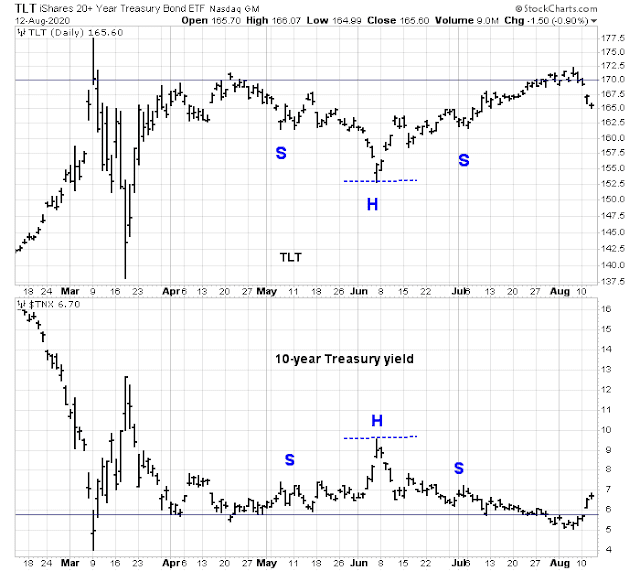

Not necessarily. I have been warning about a bearish setup for several weeks, but I was not ready to act until we saw some risk-off triggers. I had identified three tripwires to monitor. The first was the Treasury market, whose prices broke up in an inverse head and shoulders pattern, and whose yields broke down in a head and shoulders formation.

Time to turn bearish? Bond prices and yields dramatically reversed themselves yesterday, and the reversal continues today. From a technical perspective, there is nothing worse than a failed breakout or breakdown.

As the Treasury bond market closed, another opened. I had been monitoring the parabolic move in gold and silver prices. In the past, reversals in silver after a parabolic surge have not been equity friendly. We began to see a major reversal in precious metal prices yesterday.

Here is a close-up look at gold and silver. It’s impossible to know the magnitude of the stock market weakness ahead of them. In the past, some reversals have resolved themselves in minor stock market hiccups, others in major pullbacks.

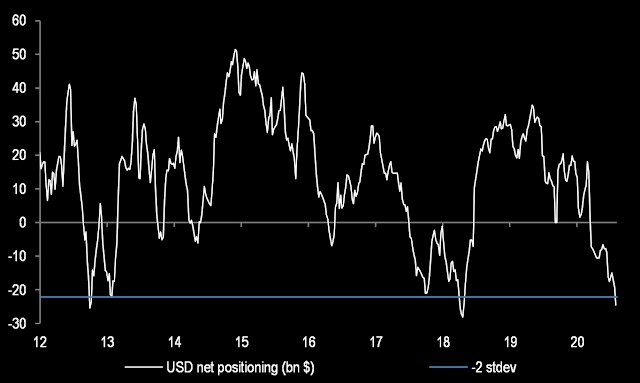

The third and final bearish tripwires is a reversal of USD weakness. USD positioning is screaming “crowded short”, and we just need some sort of catalyst to push it upwards.

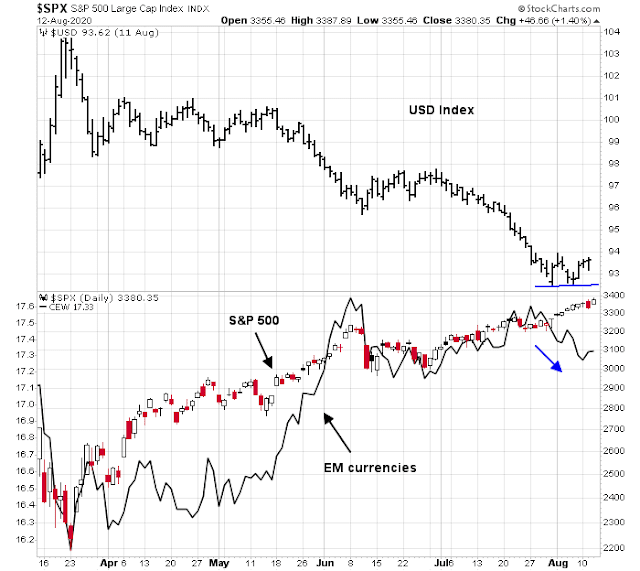

USD strength will create stress in the offshore dollar market, which negatively affects vulnerable EM economies and global risk appetite. The USD Index appears to have formed a double bottom and it is trying to rally. EM currencies are starting to show signs of weakness, which is not a good sign for equity prices.

Cautious but not bearish

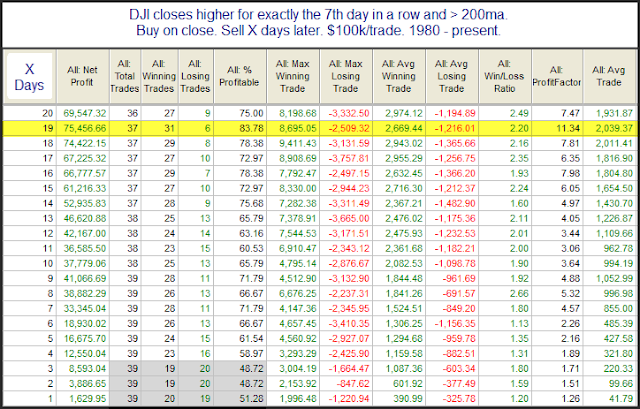

Does this mean that traders should turn bearish? Not necessarily. Price momentum remains strong. Rob Hanna at Quantifiable Edges documented what happens when the DJIA experiences a seven-day consecutive win streak, which it did until yesterday. While short-term returns can be volatile, returns over a one month time horizon have a bullish tilt.

Despite the intermediate term warnings, traders have to be open to the possibility that the market is advancing on a series of “good overbought” readings.

If the market were to undergo a period of weakness, traders should await tactical bearish triggers before making a commitment to the short side. Triggers include a recycle of the 5-day RSI from overbought territory to neutral, as it has already flashed a negative divergence signal. As well, watch for a breach of the lower Bollinger Band by the VIX Index as an indication of an extreme overbought condition.

My inner investor is nervous, but holding at a neutral asset allocation. My inner trader can best be described as cautious, but not bearish (yet).

Basically, I think ‘cautious’ is good.

1. The underlying anxiety supports the wall of worry.

2. The fact that hedge funds are bullishly positioned is (IMO) actually bullish. It tells me that are incentivized to keep the rally going. Many ways for them to make that happen. For instance, sell technology holdings in order to raise the cash to buy banks/ energy/ industrials, thus feeding public perception of a rotation which then pulls in more money from the sidelines. They’re able to ‘advise’ clients accordingly. There must be a ton of media opportunities to push their agenda.

3. Speaking of which. If HFs are maximum long, then it’s unlikely the retail sector is anywhere near. It’s when HFs begin selling to retail in earnest that the fun begins.

4. This is not 1999…yet. Most of my colleagues/acquaintances are far from outright bullish. Closer to ‘15% invested’ or ‘long with one foot out the door.’ I remember 1999. No one was 15% invested or positioned anywhere near the door.

5. Most investors expect a correction. What usually happens to majority expectations?

All of the above is just my opinion. And of course, I can’t help but be influenced by the fact that I’m once again just about fully invested. I may be wrong.

IJS/ RPV/ XLF/XLE closed up a combined average of +0.65% from the 1012 am (112 pm est) entries.

I was able to reopen RYSPX (SPY)at a +0.25% premium to my Tuesday morning exit on 2/3 of the position. Reopened RYRHX (IWM) @ a -0.877% discount to the Tuesday morning exit.

Unfortunately, I opened both VVIAX (large-cap value) + RYDHX (DIA) @ +0.79%/ +1.06% premiums to Tuesday’s close. That’s the price of fear!

South Korea’s Kospi at a 52-wk high, up +12% over the past month – it’s gapped up almost day for over a week.

It just seems that investors have failed to recognize/acknowledge one of the greatest global rallies of all time.

Sometimes overbought can get even more overbought.

Sorry, RX. I was up all night trying to move the market up but it wouldn’t budge. I think I needed larger orders. Oh well, I tried. LOL

No worries, bro. Relax and follow my philosophy-> let someone else do the lifting!

Cam, have you seen this chart of the VXN? Love Macro Charts’ work. https://twitter.com/MacroCharts/status/1293502493595283456?s=20

Yes. Another bearish setup, but no trigger

I think the VXN base/consolidation is at a much higher level than previous bases that signaled selloffs. That makes it looks very suspicious to me.

Today we’ll find out just how good Tom Lee is at specifying the exact starting date for a summer rally 🙂

Supposed to get a statement from Durham today according to Barr. Maybe that will move the market when it comes out.

Feels like they’ve ignited the booster jets.

Why do you say that?

There’s a mild trembling in the ground – but it’s 50/50 whether I’m on the ground in Florida or in Pyongyang.

I thought you were in California? It’s just the Cascadia fault starting to slip.

Postponed ’til Monday.