Mid-week market update: I have written about how Big Tech is dominating the market. Here is another perspective of how tech stocks are eating the market. The combined market cap of FANGMAN (Facebook, Apple, Nvidia, Google, Microsoft, Amazon, Netflix) is reached all-time highs and nearing a total of $8 trillion.

The angst over Big Tech is growing, and until the parabolic rise reverses, major stock market averages are likely to continue to grind higher.

The manager’s dilemma

The dominance of Big Tech in the top five stocks is presenting portfolio construction and risk control problems for portfolio managers. The top five stocks comprise 22.1% of index weight. Since they tend to move together, even holding a market weight in these stocks creates a high degree of concentration risk for the portfolio and can violate portfolio construction constraints, e.g. “no more than 20% in any one sector”.

Big Tech dominance also creates a portfolio construction problems from a stock picking perspective. Managers have some process for ranking stocks as buy, hold, or sell. The portfolio construction process would typically have some rules, such as holding index plus x% if a stock is a buy, index weight if it’s a hold, and index minus x% for a sell. The level of x% will depend on the manager’s stock selection process. A quantitative manager that relies on models to bet across an array of factors would seek to minimize stock specific risk and maximize model risk, so x% is not likely to exceed 2%. A fundamentally oriented investment manager would seek to maximize his stock picking skills, and x% might be 5%, or even 10%.

These kinds of portfolio construction rules run headlong into risk control constraints. Suppose that x is 5%. If Apple were to be ranked as a buy, the target weight would be 12%, which is excessively high for an individual position. A 10% move in Apple stock would move the portfolio’s returns by 1.2%. If all of the top five were to be ranked buys, total weight would come to 22% (index weight) + 25% (overweight) = 47%, which is an astounding level of portfolio concentration risk.

This level of concentration is creating a business problem for mutual fund and other investment managers. Mutual fund managers have been underweight these stocks even as the stocks have outperformed this year.

Don’t blame your fund manager if he’s lagging the market this year. His risk control process is holding him back, and for good reason.

Holding an index tracking ETF like SPY is no panacea as it exposes you to a high level of concentration risk. One way is to analyze tracking error, defined as the difference in performance between a portfolio and a benchmark. The tracking error of not owning the top five stocks in the index has skyrocketed to levels no seen since the dot-com bubble.

Sentiment warnings

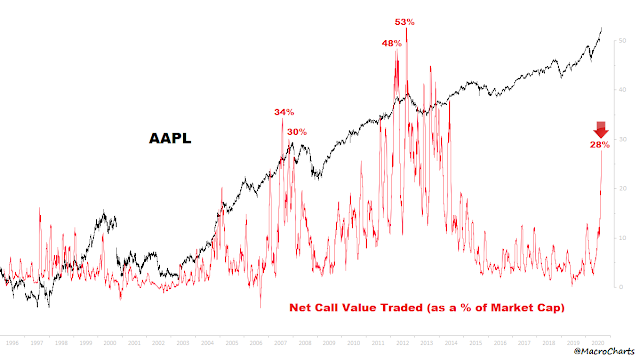

Big Tech is certainly looking frothy and bubbly. Macro Charts warned that speculative call option activity on Apple, the top stock in the index with a 7% weight, is “spiking into the stratosphere”.

Macro Charts also observed a developing base in VXN, the NASDAQ 100 volatility index, and it is poised for a disorderly rise. Past similar episodes has been signals of market corrections.

There are other signs that the current Big Tech bubble has exceeded dot-com bubble levels. Maverick’s Q2 investment letter pointed out that the difference in relative performance between the price momentum factor and value factors have skyrocketed to highs that well exceed past bubble peaks.

Waiting for the trigger

That said, all of these warnings are only trade setups, but we don’t have a bearish trigger just yet. Conceivably, this bubble could last longer than anyone expects. I am still keeping an eye on the all important NASDAQ 100 and semiconductor stocks. Neither has shown signs of sustained weakness, either on an absolute or relative basis.

From a tactical perspective, short-term breadth on the NASDAQ 100 was already overbought as of last nights close, and today’s advance makes the market especially ripe for a pullback.

Jerome Powell’s virtual Jackson Hole speech tomorrow presents the market with event risk. Unexpected remarks from the Fed Chair could be the catalyst for more market volatility.

Be vigilant.

Powell gave us a bit of a selloff last month with his comments. I don’t see why he can’t do it again or even why he wouldn’t want to temper enthusiasm a little right now.

But, the real question is will the deep market forces manage to keep the markets from crashing before the election? It’s long two moons between now and election day.

Hi Cam

Yep…wild times!!

https://threadreaderapp.com/thread/1289207237034926081.html

1. Passive being ‘buy and hold’ is misleading as really they are actually systematic active investors at any price

Positive flows = buy at any price

Negative flows = sell at any price

2. Passive is cornering stocks float

Take Amazon for example

Market cap minus inside ownership (15%) =$1.2T

Passive holds ~$910B which isn’t for sale and is increasing with positive inflows

Which means available float is only ~290B

Index funds are in process of cornering $AMZN stock

Interesting perspective, Donald. Thanks.

____________

Additionally, there is a very thought provoking graph of Tech vs Energy shown in the opening of this recent video:

https://youtu.be/kEAkxO0TO1s?t=11

As a long time trader, I recall the way stocks corrected in the late 1990s. Even though most folks write about the gorillas as though they will lead the market down, that’s not the way it traditionally worked.

The strong stocks were always the last to correct, but they always followed (not led) the others down. Now, some time back Ken kindly put up a graph of the gorillas and the S&P 493. I think if we had a graph of the NDX 93, we’d have a way to trade the gorillas while nimbly avoiding the corrections.

Wes, the non FAANG stocks are already weak. Can has showed this several times with Equal weighted S&P 500 index.

Apparently only when compared to the S&P. The S&P 493 is in a gentle uptrend with higher highs and higher lows.

Saw the alert this morning. Maybe a trade for mean reversion?

Thought about going long bonds.

I put on a little short position to get a little inline with Cam, but I have this aversion that markets have drilled into me over the years – don’t try to catch falling knives or get in the way of ballistic missiles.

watching twitter feed on this dump… everyone suspects its a bear trap.

More from Trader Ferg.

I love his thoughts on this Barron’s headline from July 17th:

__________

Companies

Barron’s Stock Pick

https://www.barrons.com/articles/msci-and-spglobal-are-pricey-but-more-gains-could-be-in-store-51595027303

Why MSCI and S&P Global Stock Are Worth Buying at Any Price

_________

https://traderferg.com/time-is-a-flat-circle/