Ho hum, another record in the major market indices. If you want to play catch-up, here is a lower risk idea to energize your portfolio. The most recent BoA Global Fund Manager Survey showed that managers are dramatically underweight energy stocks. The sector is hated, unloved, and beaten up.

Whether you are bullish or bearish on the stock market, energy stocks might be a contrarian way of making a commitment to equities with a favorable asymmetric risk/reward profile.

Constructive pattern

Energy stocks are performing well on a relative basis. The Energy SPDR ETF (XLE) is tracing out a constructive double bottom pattern relative to the market. This pattern is confirmed by the relative performance of European energy stocks (green line, top panel), and the relative performance of individual energy industries within the sector. I interpret these conditions as the sector is wash-out and poised for a rebound.

Investors may be in a position to get paid for waiting for a rebound. The indicated dividend yield on XLE is 11%, but dividends are being cut, and the annualized yield based on the last quarterly dividend is 5.5%, with the caveat that dividends could be cut further.

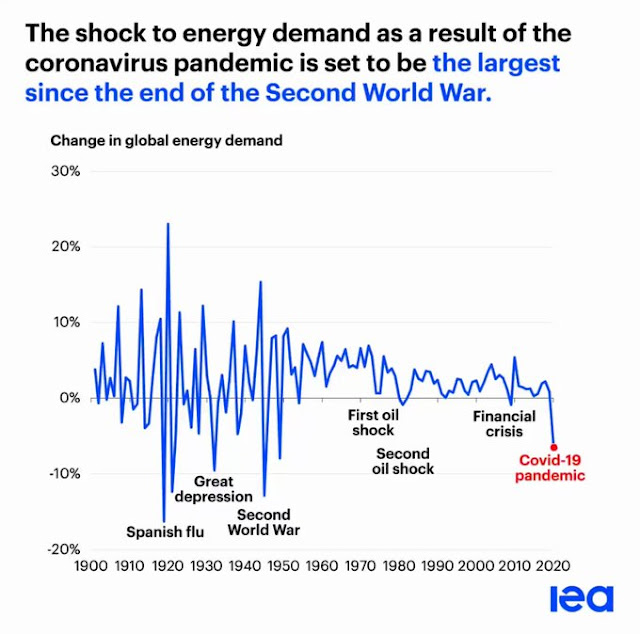

From a top-down perspective, the IEA has also documented how the COVID Crash has crashed energy demand that is largest since the end of World War II.

I am not making any forecasts about when the recession ends, and when energy demand normalizes. However, the combination of wash-out sentiment, constructive relative return patterns, and the upside potential of a demand recovery makes the energy sector a classic contrarian and value selection for equity investors.

Hi Cam,

I think there is a Fruedian slip in your 3rd line down, I think you mean, “risk/reward” and Not “risk/retard”.

I guess retard is someone buying at this point. Just kidding!!!

Fixed. Thanks.

Cam, I didn’t receive yesterday’s email newsletter. Judging by the turn out here today, maybe others didn’t either.

Ya I didn’t get the email either. I got the trade alert email this morning though.

I apologize. Some other people have made the same report. Did you get the trade alert email today?

Yes, I received the trade alert. Yesterday’s email must have been intercepted by the post office.

I just now received yesterday’s email.

Hi Cam

Jeremy Grantham agrees with you too….(I like his title for the essay 😉

https://www.gmo.com/americas/research-library/an-investment-only-a-mother-could-love-the-tactical-case/

After a rough decade for commodities and commodity producers, we see resource companies trading at record low valuation levels relative to the broad equity market on some measures.

Even if commodity prices were to stay flat, public resource equities would be well positioned to generate strong returns, either through a reversion in valuation or through the high dividend yields on offer.

At these valuation levels, investors interested in the resources sector don’t need to be bullish about commodity prices, but there are reasons to be optimistic. In particular, the capital cycle supports commodity prices by reducing supply when prices are low.

Most institutional investors will never go overweight the resources sector due to the perceived riskiness, but if you’re not going to go overweight resources now, when will you?

It’s not going to be a serious correction, not anywhere again down near those March lows. A little pause if we get that wave, but I don’t think it’s going to really stop the longer-term momentum upward.’

https://www.marketwatch.com/story/a-powerful-force-will-determine-what-happens-next-in-the-stock-market-wharton-professor-predicts-2020-08-25

And, let’s not forget that real estate has led almost every U.S. economic expansion higher and real estate is on fire!

ExxonMobil was dropped from the DJII and officially leaves next Monday. History has shown that stocks that get dropped outperform afterwards.

OMG oil is SO hated. ESG is here.

Thanks for the heads-up, Ken.

“Also leaving the index are drug company Pfizer and airplane and defense contractor Raytheon Technologies. They are being replaced by biotech Amgen and manufacturing conglomerate Honeywell. S&P Dow Jones Indices, the company that administers the index, announced the changes, which will take place August 31, on Monday. The index provider said the changes were necessary to make up for Apple’s impending stock split, which becomes effective the same day.”

“Exxon Mobil, which joined the Dow Jones Industrial Average in 1928, is being removed from the blue-chip stock market index. Its replacement: enterprise software company Salesforce.com.”

https://www.cbsnews.com/news/dow-jones-exxon-mobil-pfizer-raytheon-replaced-salesforce-amgen-honeywell/

What are some good commodity funds to buy? Thanks.

I don’t know, D.V. but here is a list

https://etfdb.com/etfs/asset-class/commodity/

Thanks Wally. Based on what Cam has written and GMO, it could be time to look at commodities for the next decade, but I am unable to find a one catch all fund.

VCMDX seems to be one.

D.V, here’s an interesting article on different commodity etfs.

https://www.thebalance.com/list-of-commodity-etfs-1214758

Buffett is buy gold stocks but he has to stick with the big ones so he has liquidity. We don’t have that problem. I have some gold and silver, most with some numismatic value also, but no stocks or etfs off that nature. Of course, if you have much hard assets you need to pay to store them somewhere. You don’t want to have a really large amount sitting in your home safe. It’s not safe. LOL

It seems (to me) that many analysts of the TV type are telling people to lighten up on their stock investments and especially big tech. Does that tell us that the market still has room to run much higher?

On another note, my charts show a monthly fib just above current S&P prices. Often these will mark at least a minor reversal.

So much for the fib resistance. After a 5 minute bounce off the confluence of a daily fib and the monthly fib the market just powered right through. At least the narrow market led by the FANGs.

Just an incredible rally off the March 23 lows.

I’m still seeing people on twitter trying to short AAPL and TSLA.

They have more money than brains.