Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Asset Allocation Model is an asset allocation model which applies trend following principles based on the inputs of global stock and commodity price. This model has a shorter time horizon and tends to turn over about 4-6 times a year. In essence, it seeks to answer the question, “Is the trend in the global economy expansion (bullish) or contraction (bearish)?”

My inner trader uses a trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don’t buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the those email alerts are updated weekly here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Sell equities

- Trend Model signal: Neutral

- Trading model: Bullish

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of the those email alerts is shown here.

Subscribers can access the latest signal in real-time here.

Easy to be bearish

The sentiment backdrop is making it easy to be cautious about the stock market. Bloomberg reported that the bears are going extinct as the market rallied.

Skeptics are a dying breed in American equities. It’s another illustration of how risky it has become to doubt the resilience of the market’s $13 trillion surge since late March.

Going by the short positions of hedge funds, resistance to rising prices is the lowest in 16 years. Bears pulled out as buying surged among professional investors who were forced back into stocks despite a recession, stagnating profits and the prospect of a messy presidential election.

If that’s not enough, TMZ published an article with the headline “Day Trading on the Stock Market Is Easier Than You Think”.

Yet the stock market grinds higher. Even as bearish warnings of excessive bullish sentiment and deteriorating breadth, the bulls are holding steadfast, like the outnumbered Greeks at the Battle of Thermopylae.

A case of bad breadth

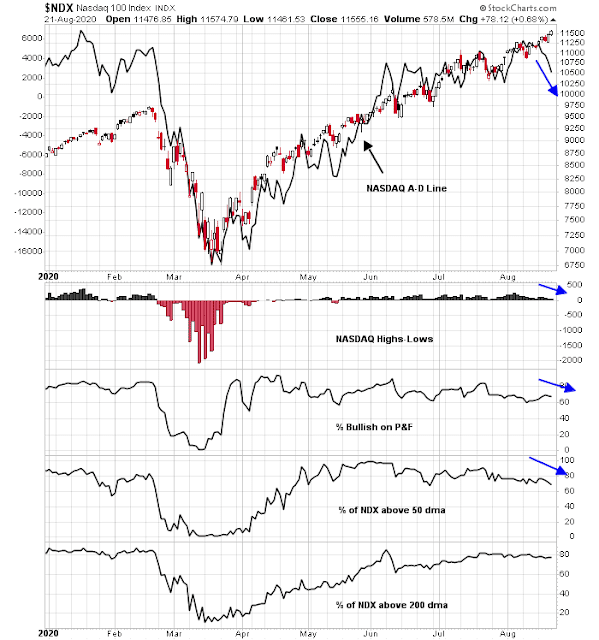

Even as the stock market rose and made new all-time highs, the advance is being made on deteriorating breadth. Breadth indicators, such as the A-D Line, 52-week highs-low, percentage bullish, percentage of stocks above their 50 and 200 dma, are all not confirming the new highs.

The NASDAQ 100 has led this market upwards, but even NASDAQ breadth is showing similar signs of negative breadth divergence.

When I see broad breadth divergences like this, I am reminded of Bob Farrell’s Rule #7, “Bull markets are strongest when they are broad and weakest when they narrow to a handful of blue chip names,”

Weakened risk appetite

Other risk appetite indicators are also not confirming the market advance. The ratio of high beta to low volatility stocks is an indicator of risk appetite, and it fell below a key relative support line even as the market made new highs. So did different version of the Advance-Decline Line.

Credit market risk appetite, as measured by the relative performance of high yield (junk) bonds and leverage loans, are also not buying into the new stock market highs.

What’s holding up the market?

In light of all these dire warnings, it’s natural to be cautious about the market outlook. But why is the market defying gravity?

The answer is easy when you look under the surface and analyze the relative performance of the top five index sectors. Big Tech sectors, namely technology, consumer discretionary (AMZN), and communication services make up nearly half of index weight, and Big Tech has been extremely strong on a relative basis. It is difficult to see how the stock market could decline without Big Tech weakness.

Some of the leadership can be explained by the dominance of the megacap growth stocks. Take Apple as an example. The market cap of Apple now matches the entire market cap of the Russell 2000 small cap index. The stock broke up through a rising channel last week, which could either be the sign of a blowoff top, or signs of further market strength. Until leading stocks like Apple weaken, the bulls will retain control of the tape.

Big Tech dominance can also be seen on an equal weighted basis, which minimizes the contribution of heavyweight FANG+ stocks. The equal-weighted analysis of the relative performance of the top five sectors also shows that the Big Tech sectors are in relative uptrends.

The analysis of the relative performance of large and small cap technology stocks does show some cracks in the phalanx of tech leadership. The relative performance of small cap technology (green line, top panel) peaked out in April and rolled over even as large cap tech roared upwards. In addition, the relative performance of small cap to large cap tech (green line, bottom panel) mirrors the relative performance of small cap to large cap stocks, indicating that the size effect is more important that the sector effect.

The bulls last stand?

In light of this analysis, it is no wonder why the bulls’ phalanx is holding ground, just like the Greeks at the Pass of Thermopylae. For readers who are unfamiliar with the Battle of Thermopylae, a small Greek force held off an enormous Persian army at the Pass of Thermopylae, which was a very narrow passage, for three days. For two days, Persians sent wave after wave of soldiers at the Greek defenders in the narrow passage, and the assaulting force all returned bloodied. On the third day, the Persians found a narrow path around the pass and encircled the Greeks.

Historical analogies only go so far. What will crack these stubborn bulls? Watch for the answer in the leadership of the NASDAQ 100, and semiconductor stocks. The bears are not going to take control of the tape as long as the relative performance of these stocks are holding up.

For a study in contrasts, here is the percentage of stocks in the S&P 500 above their 5 dma. This indicator has breached a short-term uptrend and should be a bearish warning for traders.

Here is the same indicator for the NASDAQ 100. The uptrend remains intact. Are these conditions short-term bullish or bearish in light of Big Tech market dominance?

In conclusion, investors with intermediate and long term time horizons should be cautious about the stock market outlook, but it is unclear what bearish catalyst will reverse the market advance. Short-term traders, on the other hand, can give the bull case the benefit of the doubt, as long as the NASDAQ and semiconductor bull trends are holding up.

Disclosure: Long TQQQ

Ultimate market timing model: Sell equities

Trend Model signal: Neutral

Trading model: Bullish

So, the above “sell equities” indicates getting to a 60:40 ratio (“Neutral”), based on your definitions?

https://humblestudentofthemarkets.com/trend-model-report-card/

It depends on your time horizon.

Ultimate Timing Model: Long-term model with signals every few years. It will be very slow in getting in and out of the market. It only has a buy or sell signal, no hold.

Trend Model: Intermediate term model with signals several times a year. Quicker, and with buy, hold, and sell signals.

The Trend Model is on a hold signal, the Ultimate Timing Model is still on a sell.

Post after post that Cam has been writing has shown a very scary picture of the inner workings of the market. The Naz bull is eerily reminiscent of Year 2000, despite the differences. Differences not withstanding, there are enormous similarities between year 2000 and 2020 (The Robinhood mania, small traders being overtly confident, the bubble in the Housing market, extremely low short positioning, loss making stocks making a run to ATHs, Mr. Buffett holding significant cash, Gold rallying to ATH, US treasuries, close to ATHs, and Dollar value crashing, the bifurcated, K shaped economy/global markets etc.).

It may be a risky move, but the pain trade here is to be long TQQQ, because this is the only thing working. As Cam pointed out earlier, we may be looking at the next and last leg down in Financials, as the Naz rallies to absurd highs.

Despite significant strength and moment, the timing of this peak is also quite scary. With political day of reckoning, we may be looking at some significant stock market turbulence in Q4 2020.

Here is a preview what is under the calm geopolitical surface (see the video).

https://news.yahoo.com/trump-supporters-anti-racism-protesters-020217713.html?guccounter=1&guce_referrer=aHR0cHM6Ly93d3cuZ29vZ2xlLmNvbS8&guce_referrer_sig=AQAAAIR1MvspaojBNhg885mZm1YNMQPlQ4IDbEAd5Zy50uXVyrDBnI31WSJgdm_PvtGmCilw0kNN0XVK6cakWunHHszX8UZNmyet-NztjacqhXIRXo0n2t8HowIPm4r6n2ejzXgnaWSb5tcR7nOkknjSd8ksV_xaM3BA4khrm9_B5eqc

I have speculated that there may be electoral chaos after November, especially if the election is close. One or both sides will claim it was stolen from them, the results will wind up in the courts, and there will be protests and counter protests all over the country.

We are just getting a preview now.

Spot on.

“The ratio of high beta to low volatility stocks is an indicator of risk appetite, and it fell below a key relative support line even as the market made new highs. So did different version of the Advance-Decline Line”.

Cam, please see the graphs below the above;

In these graphs, the NYSE AD volume has a blue line that takes one back all the way to March/April time frame. Is it possible to reconstruct the other three graphs and blue lines with the same time frame? Thanks.

I don’t understand the question. The charts are all shown with the same time frames.

The top three blue lines are drawn with the same time frame (starting end June/July), the fourth one with a different time frame (starting between March and April time frame).

Is it possible to redraw the top three graphs, starting March/April as start point)?

The conclusions may be the same regardless.

Please see my e mail to you. . Thanks.

D.V., people don’t really take the election seriously until after Labor Day. My opinion is that Biden doesn’t hold up. Of course, there will be October surprises and possibly a big one in September. I wouldn’t worry about what’s going to happen November 3rd for another month.

Thanks, Wally.

The NASDAQ Composite is 2500 stocks with the top 100 having over 95% of the market cap. So an equal weight Composite is a small cap index similar to the Russell 2000. Cam, if you are using the advance/decline line for the Composite rather than the 100, you may be seeing small cap speculation changes not the top 100 changes. Just a thought.

Here is how the tech rally could end badly right away – China/US trade war going to a brawl.

Some experts think the extreme sanctions by the Trump administration against Huawei recently will be a turning point in the trade war. It is a Pearl Harbor event. They have effectively bankrupted the company by restricting access to key chips, not just American made but any chip made anywhere in the world using any American technology. A company found selling them restricted chips will be forbidden to sell their products into the US market. This could be everything from the Huawei’s phone components to the camera or screen.

They were expected to announce a powerful new 5G model in a few weeks and won’t even have enough chips in inventory to even cover Chinese demand let alone the world.

Huawei is a Chinese technology global champion. They have 600 million global phone users. It would be like a foreign country bankrupting Apple. In fact, China could very well damage Apple in retaliation. Apple sold 7 million of their 41 million (17%) iPhones in China last quarter. By comparison, Huawei sold 36 million. Likely Chinese government disruptions of Apple’s manufacturing assembly and other supply chain issues would cripple the now $2 Trillion market cap Apple at least temporarily if the Chinese took a hard stance. Apple doesn’t have a 5G phone and it is preparing a blockbuster introduction of one later this year. Will a nasty, dogfight trade war spoil this?

Maybe China will wait for the November election and hope a new administration will be different. Huawei can survive on its inventory of chips and Chinese government support.

I can’t envision China standing by and watching their tech champion fall to this attack.

At the least of it, Chinese consumers might just turn their backs on US products especially Apple’s. It seems the anti-globalization movement everywhere is morphing into consumer nationalism which hurts global brands.

Ken

China should be welcome to leave the global chip supply and develop their own. Other countries (Japan, South Korea, Taiwan, Singapore etc.) have tried and failed.

The American magic is importing immigrants, giving them money to power research, and eventually green cards. China is welcome to do so, and then some.

Ultimately, demographics is against China, as Cam has written about, many moons ago (pun intended, Lol).

I hear you and agree. Just talking stock markets.

Ken

Unfortunately, when one talks about stocks and investments, politics enters the conversation as it has significant impact on investments.

That said, I appreciate your sharing your insights and especially your feedback from Jim Stack, another venerable analyst.

I stumbled upon this debate about China between two very polite, but diametrically opposed thinkers recently. It was organised by an Australian libertarian think tank**…quite interesting viewpoints raised.

John Mearsheimer

(John Mearsheimer is the leading proponent of a branch of neorealist theory in international relations called offensive neorealism which maintains that states are not satisfied with a given amount of power, but seek hegemony for security.) https://military.wikia.org/wiki/John_Mearsheimer

Versus

Kishore Mahbubani

(The Foreign Policy Association Medal was awarded to him in New York in June 2004 with the following opening words in the citation: “A gifted diplomat, a student of history and philosophy, a provocative writer and an intuitive thinker”. Mahbubani was selected as one of Foreign Policy Top 100 Global Thinkers in 2010 and 2011 and one of Prospects top 50 world thinkers in 2014.) https://en.wikipedia.org/wiki/Kishore_Mahbubani

https://www.youtube.com/watch?v=ZnkC7GXmLdo

**https://en.wikipedia.org/wiki/Centre_for_Independent_Studies

_________

On the other end of the spectrum.

If you really want a fright, old John Piger serves it up pretty fiery (as in: “…The Coming War on China is John Pilger’s most recent film – his 60th documentary and arguably his most prescient. Completed in the month Donald Trump was elected US President, the film investigates the manufacture of a ‘threat’ and the beckoning of a nuclear confrontation…” )

http://johnpilger.com/videos/the-coming-war-on-china-english-subtitles-

“Dead or alive, they all had cast a good vote.” A good historical story to remind us there always exists traitors and those who would defraud the vote, even in 1864.

https://www.chron.com/news/article/Mail-in-ballots-were-part-of-a-plot-to-deny-15507606.php

Hi Wally.

My wife and I checked on-line our voter registration (in CA) last week and discovered the permanent mail in box was checked. We specifically wanted to vote in person and we did not check the permanent mail in box. There was no way to change as the system would not allow it. I guess the State of CA determined it is too dangerous to vote in person and have taken steps to ensure our safety. What a bunch of wonderful people.

Mark

The state knows better than you!

Mark, its a tough decision. I definitely don’t think the states should be mailing out ballots to people who haven’t requested them. That said, I’ve usually used the absentee ballot method because I’m a senior and qualify to do that but I’ve often wondered if my vote ever made it there or maybe was disqualified because of my scribble signature. This year the Texas Gov. has added an extra week to early voting so I’m going to do that. I’ll have my mask and my 3M sealed glasses on. LOL

‘The level of job openings in accommodation and food services is three times the 2009 level.’

https://blogs.uoregon.edu/timduyfedwatch/2020/08/24/monday-morning-notes-8-24-20/

“There is $1 trillion stashed away in the U.S., and it just might save the economy. It’s enough to either boost consumer spending by at least $78 billion dollars a month over the next year or supercharge growth if confidence soon turns higher….

Continuing on the theme that maybe the recovery will be more rapid than expected by the conventional wisdom”

– Professor Tim Duy

On the Thermopylae analogy, the few days delay in the Persian army’s advance allowed Athens to evacuate. Big tech and the semis are giving investors time to de-risk or hedge.

Right on, Chuck – that has to be the slickest comment I’ve read all day.

Cam has his mojo back!

Closing my SPXU flyer for a -3% loss.

I hope Cam has this figured out. I feel bad about you putting on that SPXU position after my comment last week.

But Cam’s Sunday newsletter was so negative that I thought about closing some of my long large cap position this morning even though I’m still sitting at just 15% long. Some day soon, I would like to feel comfortable about increasing that to a more normal size.

It was only 1000 shares, Wally. I’m happy to donate $250 if it helps to improve our read on the markets.

I think Chuck nailed it with his earlier comment. This is not the time to go all in – this is an opportunity to scale back, maybe way back.

https://www.marketwatch.com/story/the-stock-market-is-rich-but-may-be-at-a-far-more-reasonable-valuation-level-than-traditional-measures-suggest-11598295650?mod=mw_latestnews

When analysts start trotting out measures like this one, it may be a sign that things have gotten out of hand.