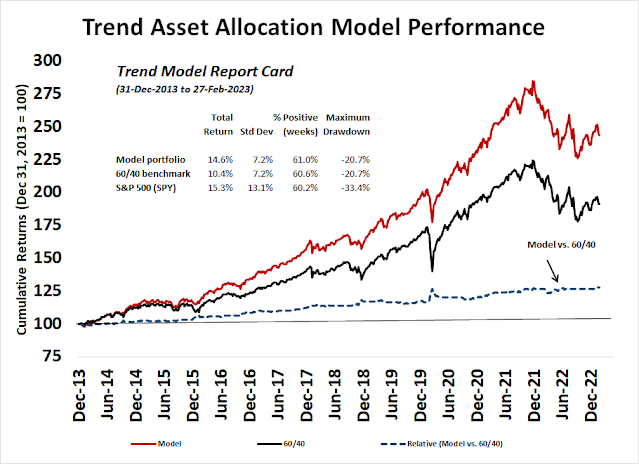

Preface: Explaining our market timing models

- Ultimate market timing model: Sell equities

- Trend Model signal: Neutral

- Trading model: Neutral

Update schedule: I generally update model readings on my site on weekends. I am also on Twitter at @humblestudent and on Mastodon at @humblestudent@toot.community. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

About that breadth thrust

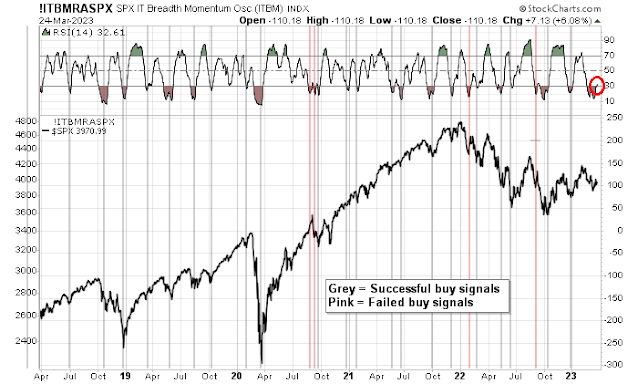

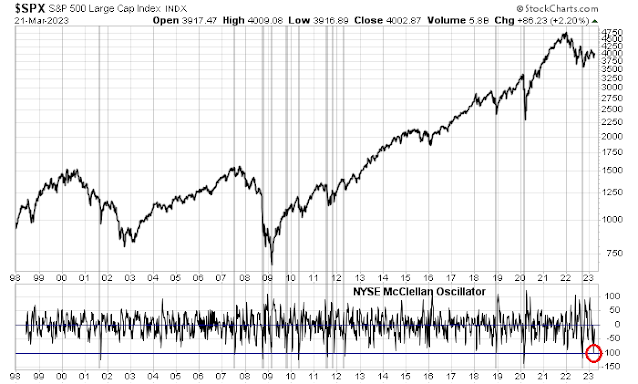

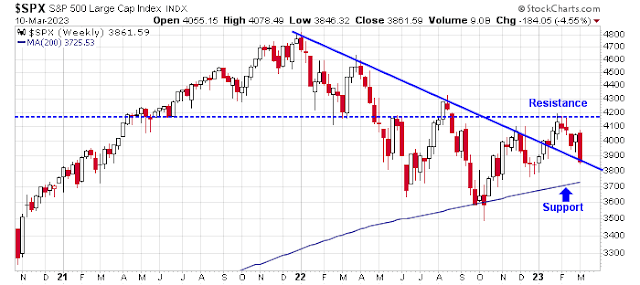

I have had several discussions with investors over the meaning of the recent Zweig Breadth Thrust (see Interpreting the Zweig Breadth Thrust Buy Signal). A ZBT is a rare condition that occurs when the market moves from an oversold to an overbought condition within 10 trading days. There have been seven out-of-sample signals since Marty Zweig wrote his book, Winning on Wall Street. The stock market was higher a year later in every instance, though it did pause and pull back on two occasions, which occurred against Fed tightening cycles. I think that the latest signal will resolve in a pullback.

What’s a Breadth Thrust?

I have found that too many investors regard technical indicators and their buy and sell signals as black boxes. To address that issue, let’s consider the investment theme behind a breadth thrust. A breadth thrust involves the following conditions:

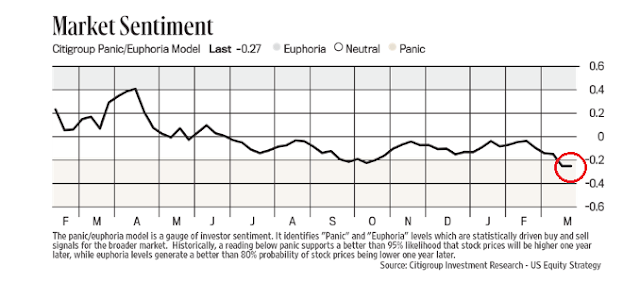

- Usually an oversold market where sentiment becomes washed out.

- A sudden violent market recovery and buying stampede with broad participation.

- The momentum from the buying stampede eventually pushes prices higher and usually marks the start of a new bull phase.

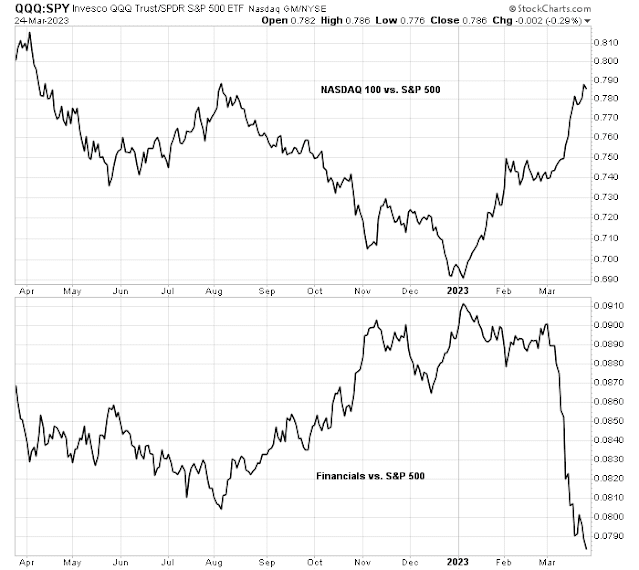

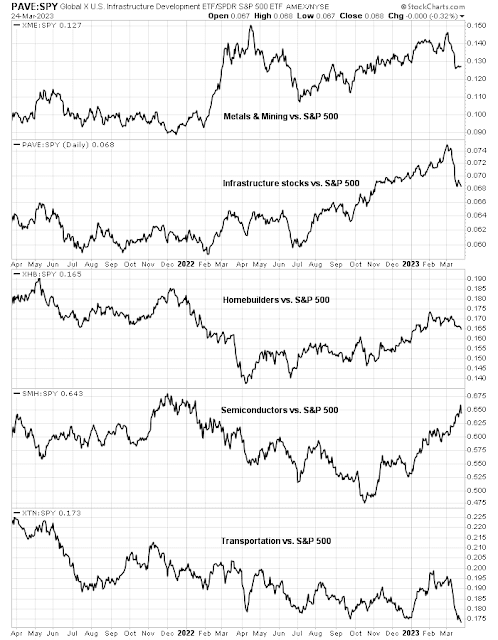

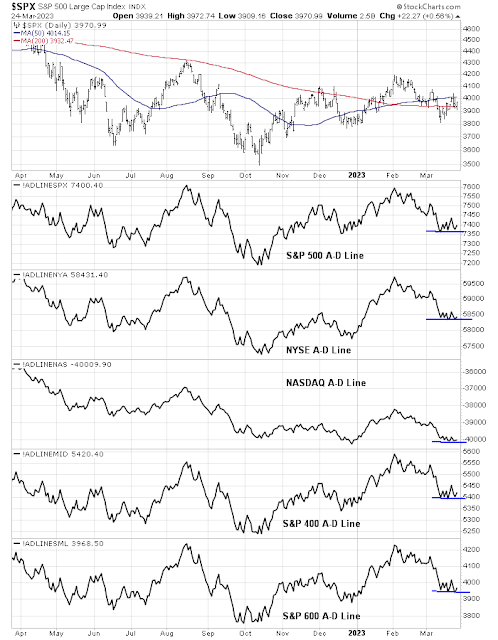

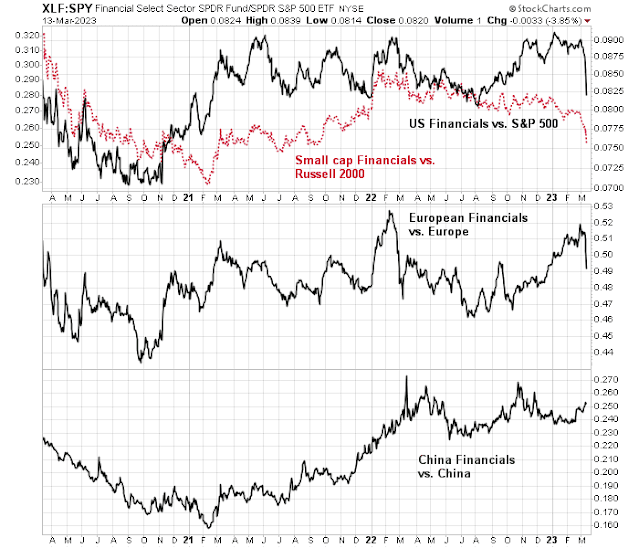

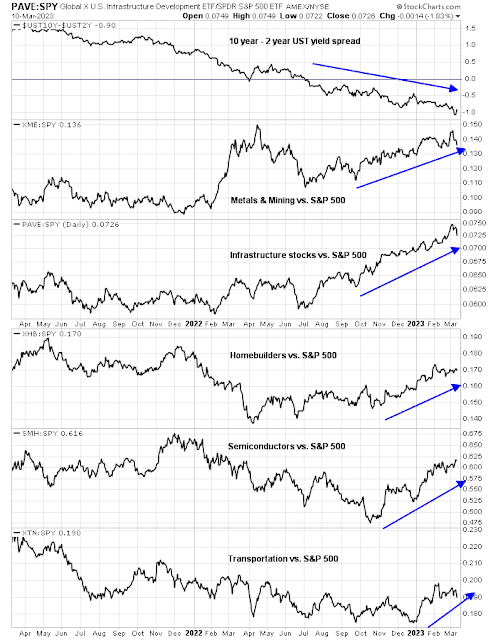

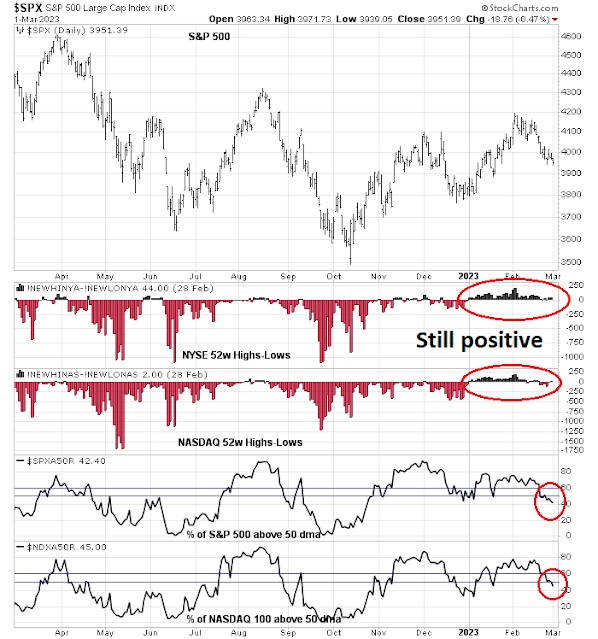

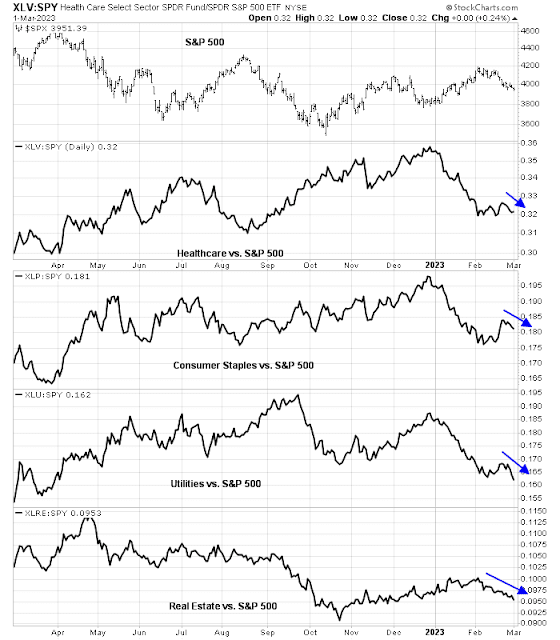

Let’s apply those three criteria to the current ZBT buy signal. Arguably, the recent banking crisis jitters created an oversold and washed-out sentiment. But broad participation? The accompanying chart shows the relative performance of the five sectors in the S&P 500 by weight. The sectors comprise over 70% of index weight. Technology was the sole market leader. The other four were either flat or lagged the market. Broad participation doesn’t look like this.

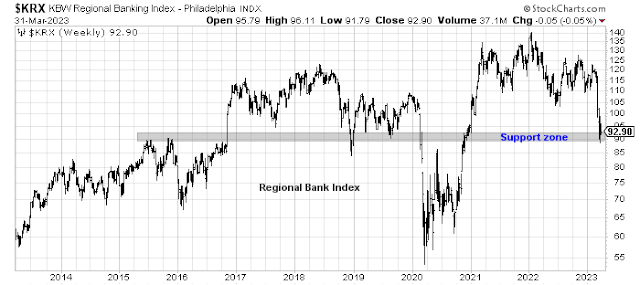

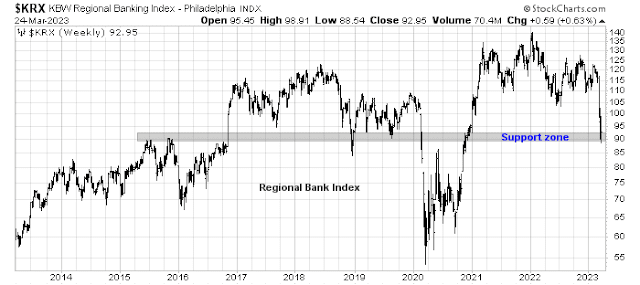

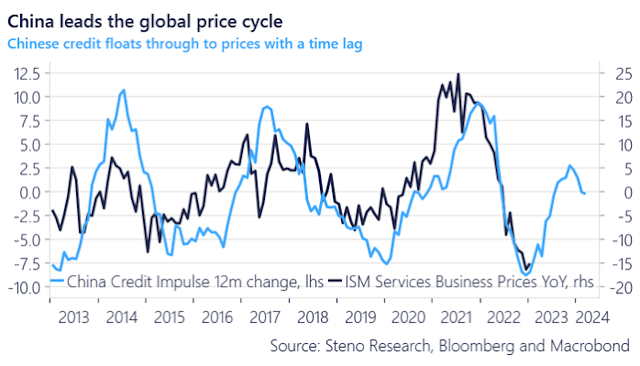

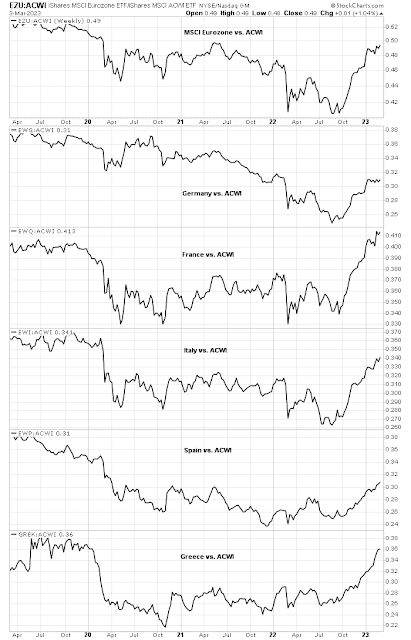

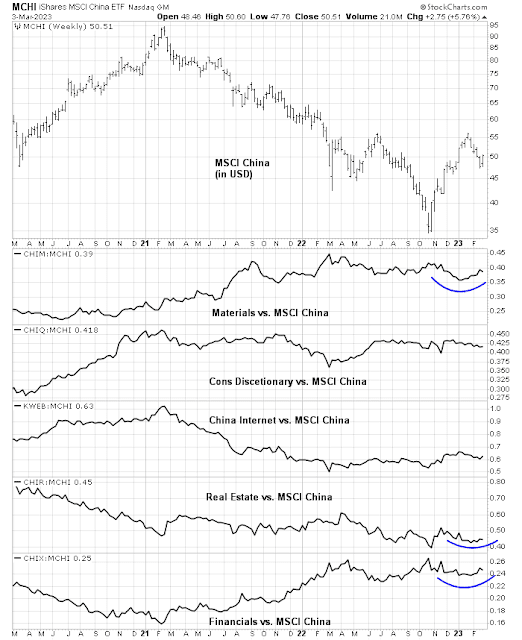

Breadth thrust signals aren’t perfect. Technical analyst Walter Deemer highlighted the simultaneous combination of a Whaley Breadth Thrust and Breakaway Momentum in mid-January. The buying stampede was sparked by the bullish prospect of China re-opening its economy after a reversal of its zero-COVID policy. While the S&P 500 did rally shortly after the two signals, it pulled back after investor disillusionment with the China re-opening trade. Similarly, the latest ZBT signal was sparked by a recovery off the banking crisis low, but the KBW Regional Banking Index has since retreated to test its previous lows, which is not a good sign.

Other analysts have analyzed breadth thrusts and arrived at similar conclusions. Tom McClellan analyzed the history of ZBT buy signals all the way back to 1928 and concluded that they only had about a 50-50 chance of success, though he defined failures as the market not immediately rising to new highs.

Brett Steenbarger quantified the short-term effects of breadth thrust and he was not impressed.

I went back to 2006 and identified all market occasions in which more than 90% of SPX stocks were above their 3, 5, and 10-day moving averages at the same time. Interestingly, out of well over 4,000 market days, this only occurred on 42 occasions. Over the next five trading sessions, the market was down by an average of -.26%, compared with a gain of +.18% for the remainder of the sample. No particular edge here, even going out 20 days. Returns over a next 20-day period were volatile, with 17 of the 42 occasions rising or falling by over 5%.

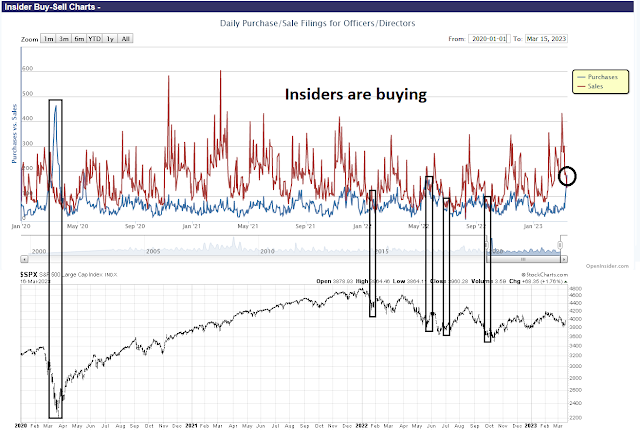

Not Bearish

My skepticism of the effectiveness of the latest ZBT doesn’t mean that we are outright bearish on stock prices. Rob Anderson at Ned Davis Research pointed out that the Coppock Curve flashed a buy signal for the S&P 500 at the end of March by turning up.

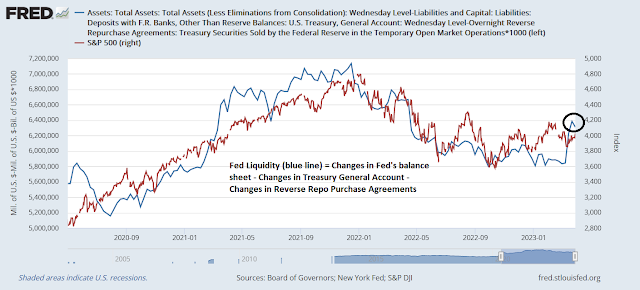

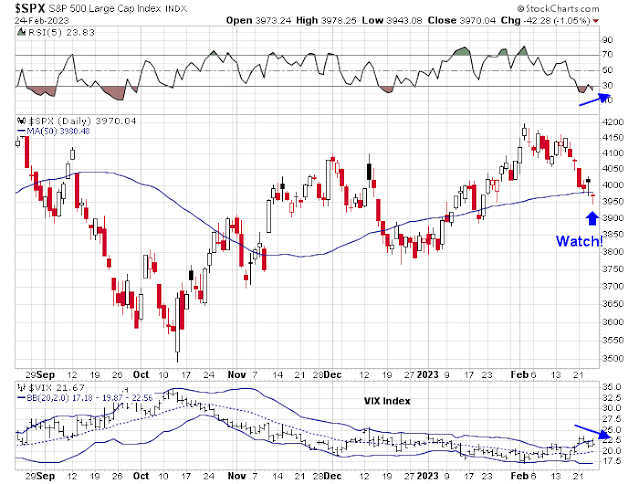

As the Fed drains liquidity from the banking system, regional bank stocks struggled to hold their long-term support. Coincidence?