Mid-week market update: The stock market surged last week in reaction to the soft CPI reading. It got better news this week when PPI came in lower than expected. As well, China unveiled a 16-point package to try and stabilize its cratering property market and softened some of its Zero COVID policies. Berkshire Hathaway unveiled a new long position in TSMC, which light a fire under semiconductor stocks, though Micron’s warning this morning unwound some of the rally.

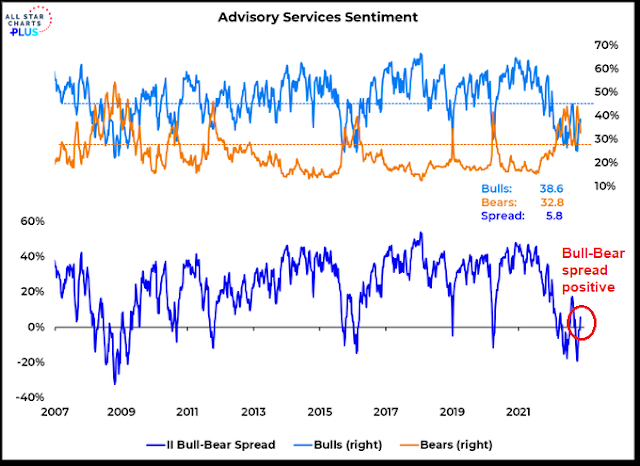

As a consequence, the Investors Intelligence survey showed that the bull-bear spread turned positive. Increasingly, I am seeing discussions about positioning for a year-end rally.

Should you jump on the year-end rally bandwagon?

A year of the Grinch

While the year-end rally is becoming the consensus view, I beg to differ. Beneath the hood, signs of technical deterioration are appearing that are causing some concern. 2022 is likely to be a year of the Grinch for equity investors, instead of Santa Claus.

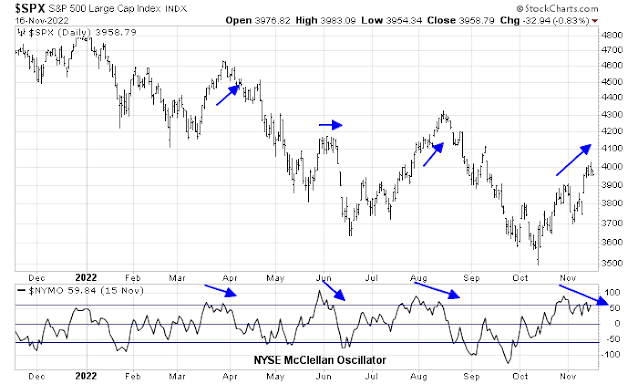

Despite all of the good news, the S&P 500 is struggling to overcome resistance at the 4000 level. Should it stage an upside breakout, the next major resistance level is at about 4120 at the falling trend line resistance.

The NYSE McClellan Oscillator (NYMO) is exhibiting a negative divergence while overbought. While this is not a precise market timing indicator, it is nevertheless an ominous development.

The NYSE McClellan Summation Index (NYSI) recycled from an extreme oversold condition of under -1000. Past rallies have usually taken NYSI back to positive – and it’s nearly there. The one exception was the bear market rally of 2008 when NYSI rose to -200 before weakening. The current reading is above the -200 minimum level, indicating that stock prices could fall at any time during this bear market rally.

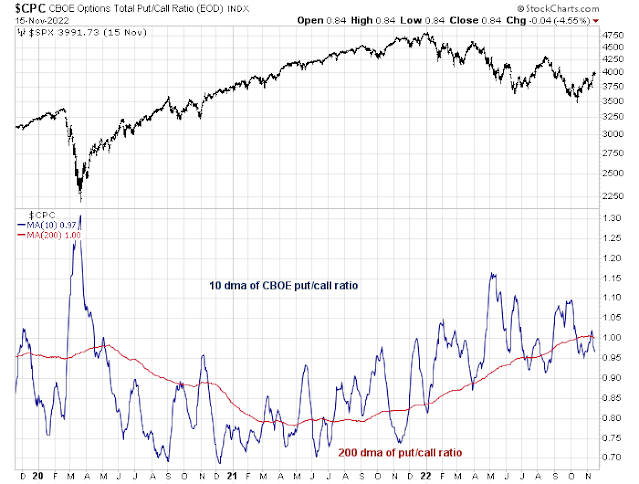

The 10 dma of the CBOE put/call ratio has fallen to levels that indicate complacency is setting in, which is contrarian bearish.

A short covering rally

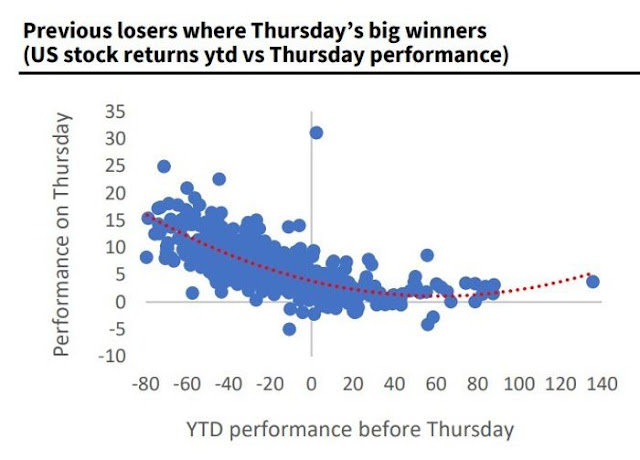

The violent price surge off the CPI report can mainly be attributable to short covering. SocGen found that last Thursday’s big winners have been the worst losers in 2022.

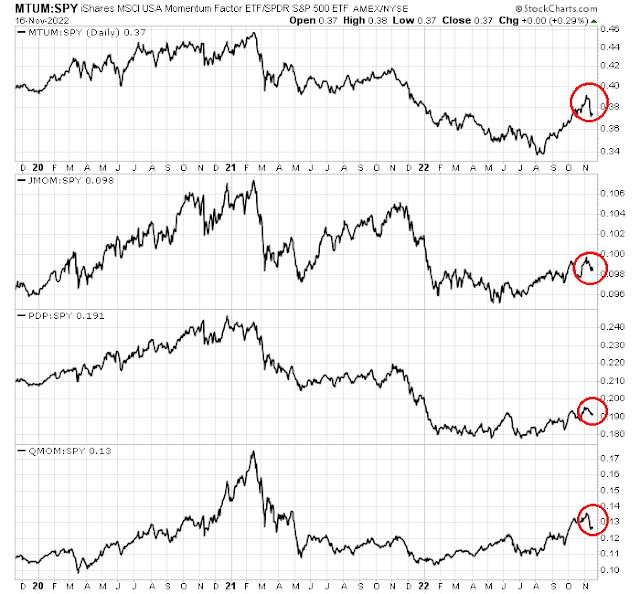

In addition, anecdotal evidence indicates that a number of long/short equity hedge fund strategies were recently shut down. This necessitated a massive bout of short covering, as evidenced by the reversal in all flavors of the price momentum factor. In order for the rally to continue, the bulls need to exhibit further momentum. In this context, the failure of the S&P 500 at 4000 is disappointing.

Seasonality headwinds?

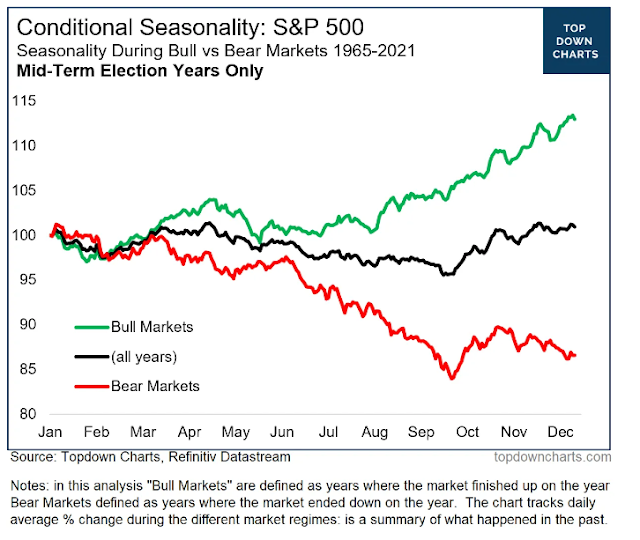

Investors are probably familiar with the analysis of mid-term election year seasonality, which states that the stock market tends to enjoy a bullish tailwind into year-end. Callum Thomas at

TopDown Charts analyzed mid-term election year seasonality by bull and bear markets and found that the S&P 500 tends to decline into year-end during bear markets.

The moral of this story is, “Beware the facile analysis of seasonality”. The weakness during bear markets makes sense, as stock prices will be pressured by tax-loss selling as December approaches.

In conclusion, don’t be fooled by the talk of a year-end rally. The market rally is poised to stall in the near future. Even though I don’t have an actionable sell signal for traders, investors should stay cautious.

Totally agree with the analysis but there is CHINA.

It has set up perfectly for my Tactical Factor strategy.

1) Market must be down (was down over 30%)

2) Market must have TWIST (Big TWIST in China 300 AND Hong Kong indexes)

3) High Yield debt must keep on rallying strongly (take a look at KYHB)

4) there must be a narrative around government or Central Bank stimulus. (Multipoint plans for Covid reopening and Real Estate supports)

Check, check, check, check.

Oh yes, one more item – “I don’t want to do it.”

But of course, I do it because I ask myself, “If you do all this research and you don’t act, why the hell are you doing it?”

Also on my “Leading Edge Momentum Rankings” China and regional countries (Taiwan, Singapore, Japan, Australia) are leaders with all Chinese related subindexes (CHIQ, KWEB)

News out of the G19 on China wanting to smooth relations is another positive.

Note also the metal commodity prices are strong.

French and German indices have also – unlike their US counterparts – recaptured their 200-day MA and accelerated away from it to the upside. What I found noteworthy is the outperformance of CAC & DAX vs the Nikkei and ASX for instance. Thanks so much for sharing!

I think the US markets also want to go higher. The S&P500 is likely heading to the 200dma near 4080.

As China reopens in the coming months, it will provide a tailwind to global markets. It is not just the French and German market, even the Polish market (EPOL) is touching the 200dma. Maybe the investors sense the beginning of the end of the Russia-Ukraine war. That will put some downward pressure on oil (offset by the Chinese demand), fertilizers, and grains prices and inflation.

I read an interesting article about an 11 million person city in China that the government is using as a test case for reopening. They closed testing centers even.

Amazingly (from a Western viewpoint) Chinese citizens remain being ultra cautious without being forced. There are extremely few people on subways and everyone is masked with restaurants empty. The lockdowns created a real fear of the virus. They trust their government’s caution unlike so many in ‘free’ countries.

We in the west think that the population was itching to be liberated and afterwards the COVID will then spread like wildfire. But no, any Covid surge in China will be minimized surprisingly for us in the WEST.

SPX is holding support where it should above 3905 (previous pivot high in Oct) level. The down component of the volatility is at a minimal -0.38 level which showed sellers are not motivated to selling which could change of course. When a trader takes a short position, ideally this level should be dropping <-20 which SPX last saw on 11/07/22. With a low level of down volatility, there is a higher probability of continuation of the up trend, as back in 08/09/22.

https://i.imgur.com/YqgesNv.png

Sorry, didn’t mean to reply to this post; should have started a new post but good point about Asia. Japan with a population of 40% of US had only 47,000 Covid fatality, vs > 1.05 million for the US.

This AM

*BULLARD: RATES NEED TO BE INCREASED FURTHER TO CURB INFLATION

*BULLARD CITES POLICY RULES SUGGESTING RATES OF BETWEEN 5%-7%

No doubt someone got a hold of his speech. It is something they have to say, but whether it is what the Fed will do in Dec is another question.

The market is calling the Fed’s bluff. The Fed wants to jawbone the market down but after an initial spike down, it just drifts back up.

Someone posted a good chart that SPX uptrend channel breaks are not breaking this time around – this may have something to do with the 11/10/22 peaked CPI & strength on strength rally as prices are less likely to break as much as before even as the $CPCE put call ratio approached +5.5 SD (standard deviation) record level. In the past 25 years all 4 prior cases of +5.5 SD put/call tops had lead to average of +8% in 1 month and avg +13% in 3 months, but 2 of those cases, one in 2001 and another in early 2008 saw significant bear markets after the initial gains.

https://twitter.com/FrankCappelleri/status/1593673978241077249

NautilusCap on extreme put call ratios and subsequent returns:

https://twitter.com/NautilusCap/status/1593435078528491522