The performance of balanced funds has become especially challenging in 2022. In most recessionary equity bear markets, falling stock prices were offset by rising bond prices or falling bond yields. The fixed income component of a balanced fund portfolio has usually acted as a counterweight to equities.

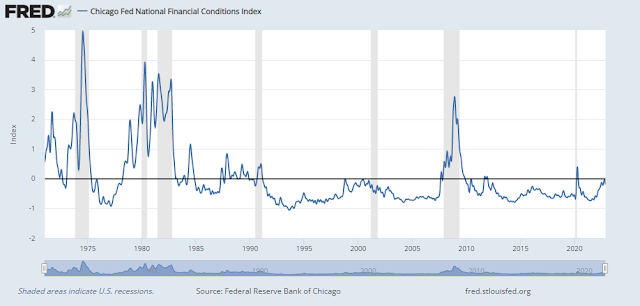

Not so in 2022. You would have to go back to the double-dip recession of 1980-1982 to see a prolonged period of positive correlation between stock and bond prices. That era was characterized by the hawkish Volcker Fed, which was determined to keep raising rates in order to squeeze inflationary expectations out of the economy. Fast forward to 2022, the Powell Fed appears to be on a similar path. What does that mean for investors?

Here are the challenges for stock, bond and balanced fund investors as we peer into 2023.

50 doesn’t mean an easy Fed

The October CPI and PPI reports were welcome news for investors. Both came in lower than expectated and the soft CPI report sparked a risk-on melt-up. In addition,

Jason Furman had previously observed that the shelter component of CPI is a lagging indicator. When he swapped spot rents instead of the BLS shelter metric, he found that core CPI with spot rents rose at a 2.8% annual rate over the last three months, compared to a 5.8% for actual core CPI.

Before everyone gets too excited, a parade of Fed speakers cautioned that while the October CPI print was a welcome development, it wasn’t enough to move the needle on monetary policy. Moreover, while Fed speakers were telegraphing that a 50 bps increase in the Fed Funds rate is likely at the December FOMC meeting, a slower pace of rate hike doesn’t translate to an easier policy. The terminal rate will remain the same.

I cannot emphasize enough that one report does not make a trend. It is way too early to conclude that inflation is headed sustainably down. In 2021, monthly core CPI inflation fell during the summer—it fell from 0.9 percent in April 2021 to 0.2 percent in August 2021 before accelerating back to 0.6 percent and 0.5 percent in October and November of that year. More recently, monthly core CPI inflation fell from 0.7 percent in June 2022 to 0.3 percent in July, only to rebound to 0.6 percent the next two months. We’ve seen this movie before, so it is too early to know if it will have a different ending this time.

Waller cautioned that monetary policy “is barely in restrictive territory today” and while he supports a 50 bps hike at the next meeting, it doesn’t mean that the Fed is pivoting to an easier monetary policy.

I am going to take a considerable risk here and employ an airplane simile to illustrate how I think of our past policy actions and where we are going. When an airplane is taking off, the pilot fires the engines as much as possible to get off the ground. The goal is to get to cruising altitude quickly, so the initial ascent is steep. But as the plane gets closer to cruising altitude, the pilot slows the rate of ascent, while continuing to climb. The final cruising altitude will depend on many factors, most notably details about the weather. Turbulence may force you to a higher or lower altitude, but you adjust as you go to have a smooth ride.

St. Louis Fed President James Bullard went further when he discussed what he considered to be a “sufficiently restrictive” policy rate in a recent

presentation. Using a different range of assumptions, Bullard projected a range of 5-7% for the Fed Funds rate using the Taylor Rule. To be sure, Bullard’s projections can be regarded as an outlier as most Fed speakers have discussed a Fed Funds terminal of about 5%, which is roughly current market expectations. Bullard’s analysis nevertheless an indication that the Fed could far more hawkish than what is being priced in.

In short, the Fed recognizes that it is tightening into a recession, much like the Volcker Fed did nearly 40 years ago. The 2s10s yield curve is deeply inverted and it hasn’t been this inverted since 1981 during the Volcker tight money era. The Powell Fed’s fear is stopping tightening too soon and in so doing spark a more persistent level of inflation. It is signaling that it is willing to assume the risk of a recession in order to get inflation under control.

The challenge for equity investors

Here is the challenge for equity investors. The last time the 10-year Treasury yield was at similar levels was 2008-2009, which was a recessionary period. The forward P/E fell as low as 10, but a more realistic range was 12-16. The S&P 500 is currently trading at a forward P/E of 17.2, which is slightly above that historical range.

More worrisome is the downside potential in forward EPS estimates. A recession is on the way, but the earnings recession is only just starting. Estimates typically fall 15-20% in a recession, but they are only down -3.8% on a peak-to-trough basis. They fell about -20% during the COVID Crash.

The recent risk-on episode in reaction to the soft CPI print was ironically unhelpful to the intermediate outlook for stock prices. That’s because market rallies have the effect of causing the Fed to raise rates even further in order to tighten financial conditions.

Investment implications

In conclusion, equity prices look pricey by historical standards. Analysis from Absolute Strategy Research going back to 1910 shows that the bond/stock yield ratio is extremely stretched by historical standards. Investors will find better risk/reward in the bond market than the stock market.

The good news is that the inflection point may be just around the corner. Historically, peaks in the 30-year Treasury yield have either been coincident or led Fed pivots and equity market bottoms, though the lead times have been highly variable. As well, the positive correlation between stock and bond prices in 2022 should translate into a strong return recovery for balanced funds. The two-edged sword of positive asset price correlation works both ways.

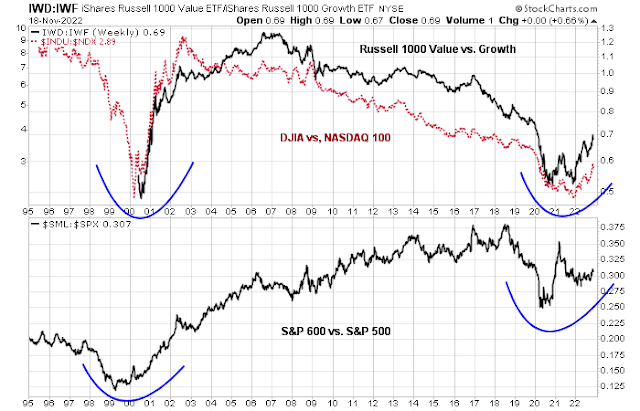

Investors who are compelled to be exposed to US equities by mandate may wish to consider small-cap stocks, whose forward P/E valuations are far more compelling than the S&P 500.

Market leadership appears to be undergoing a long-term shift which should see a prolonged period of better relative performance for value stocks and small-caps.

Cam/ People are seeing the ghosts of financial repression appearing, meaning inflation will not be as hard fought as they lead us to believe. The trend of your post is gloomy, yet at the end it appears that the market may move soon. In that case what is the downside potential and why be short? Study of net new highs suggests that Friday may well have been the day the bear market ended. Help me out here, spell your expectations out a bit more clearly.

I will explain my short-term tactical outlook in tomorrow’s publication

Bonds seem to have the better risk/ reward profile for the next while but it is hard to get excited about 10 year bond yields just over 3% and longs at 3.2%, in Canada at least. 5 year GICs at 5% seem like a better bet but of course are locked in. Long corporates at just over 5% are more enticing but will be vulnerable to spread widening in a recession as credit risk increases. My recent allocation has been to GICs and good quality perpetual preferred shares yielding about 6.5% or 8.5% on an interest equivalent basis due to favourable tax treatment.

This time is different. At least in the last 100 years.

What is different is the debt.

In WW2 there was a huge debt of course, but this followed the depression, people were used to not having much, and waiting for things, then came the war.

But now this debt has been rising for 40 years, it’s not exogenous like in the 40s, we have brought it on ourselves to avoid pain of some kind. The dollar is not backed by gold like it was back then.

So maybe the metrics of old are no longer as valid.

They say the sweet spot for the markets is when inflation runs at 2%, maybe that’s no longer true, maybe it is 3 or 4%.

The Fed pivot works until it no longer works, the federal gov’t running deficits won’t stop because if they stop they are out of office. You could say that the moral hazard is with us the voters because we won’t vote for someone who will cut back on entitlements, the military and all the other services, so we will keep electing those who offer a “free lunch”. So I think inflation is going to be entrenched unless robotics or some techno-breakthrough happens. Back in the 80s, 90s and on we had the opening up of China which reduced the costs of doing things and communications allowed this comparable advantage to manifest.

Globalization has helped to reduce inflation but not only is there a move away from it but the wage differentials are becoming less.

So, who knows? Maybe inflation will run at 4 % and companies will manage to keep the earnings margin and equities will be an inflation hedge, so long as they have value in their products.

Well said. Thanks