Mid-week market update: It’s always difficult to make tactical trading calls on FOMC meeting day. The S&P 500 approached the latest meeting with the 5-day RSI near overbought territory. The experience in 2022 of overbought or near overbought conditions on meeting days (March and July, n=2) has seen stock prices continue to advance. Can it continue? Do the bulls have anything left in the tank for their charge?

Low expectations

Market psychology coming into the meeting was tactically cautious. The short-term term structure of the VIX is deeply inverted (bottom panel), indicating fear.

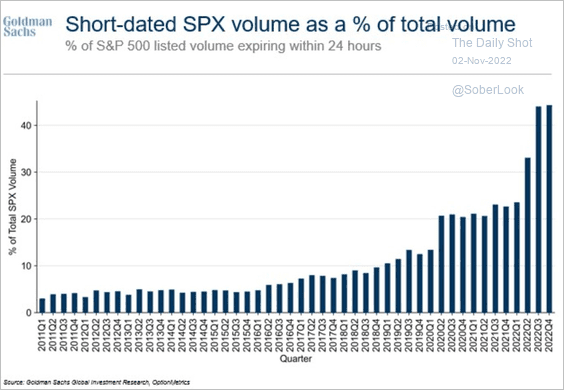

Short-term dated option volume has been surging, which makes the short-term term structure of 9-day to 1-month VIX more relevant in determining option sentiment.

As well, inverse leveraged ETF activity has also exploded, which is contrarian bullish.

Is the rally done?

Strictly from a technical perspective, the S&P 500 traced out an inverse head and shoulders pattern. The index pulled back below the breakout level. The 14-day RSI hadn’t reached an overbought condition, which is the level where the last rally failed. On the other hand, the percentage of S&P 500 above their 20 dma neared the 90% level, which is an overbought extreme and defined the last tactical top.

It could be argued that the latest rally still has some momentum. The NYSE McClellan Summation Index (NYSI) rallied off an extremely oversold condition of -1000. If history is any guide, rallies haven’t stalled until NYSI turned positive. The lowest level this indicator reached before a rally ended was -200 in 2008, which is far from the current reading of -575.

On the other hand, the 5 dma of the percentage of S&P 500 bullish on P&F also reached an oversold extreme, and it recovered to approach the minimum level of 67% when rallies stalled.

So where does that leave us? The market is nearing a number of key “take profit” technical tripwires with the prospect of high volatility in the coming week. Investors are facing a series of event risks with binary outcomes in the coming days in the form of the October Jobs Report on Friday, mid-term elections next Tuesday, and the CPI report next Thursday. Despite today’s downdraft, Fed Funds expectations were largely unchange as a result of the FOMC announcement.

Subscribers received an email alert yesterday that my trading model had turned neutral and my inner trader had taken profits in his long S&P 500 positions. While anything can happen and there could be some further upside in the major equity indices, prudence dictates that risk reduction is in order.

Nice move jogging to the sidelines at Tuesday’s high ahead of the bear blitz today.

I think it would take an extraordinary event to catalyze a year-end rally from here – even if the catalyst turns out to be a sharp decline to attractive valuations.

FOMC day followed the usual pattern of a sharp reversal of the initial reaction during the press conference, but while the cyclical rally has taken a beating today, the Dow is still well off the lows as the Nasdaq failed to recover even the 50-day average. Mike Wilson and others argue that the market may be unwilling to price in a recession as long as the labor market is still showing this kind of strength. This may be unfortunate for tech investors and probably real estate, that the economy is showing this kind of resilience in the light of Fed tightening. Interestingly XLE:XLK is nearing the upper boundary of a downward channel on the monthly chart as it did in June 2014. Short energy, long tech has been the defining trade since the 2008 financial crisis and it is showing signs of a reversal, but if the channel holds, there could be a sharp reversal for XLE in the months to come. We may have to see weakness in the labor market for the latter option to play out, but that may still be 2-3 months away (this is what the strategists are saying) Personally I believe that the real wekness is going to show up as next earnings seasons approaches.

Price catching up to market breadth reversal. This market breadth model continued to do a good job of predicting price movement due to breadth which saw it called for a short Fed day 14:45 at ES 3868.75 and it is likely to reverse with a sufficient breadth thrust here at Fed +1, 15 minute chart of SPX futures ES. This should be encouraging for the bulls because market breadth by this measure has not dropped as much as price has but it is still early as this may just be an attempt to gap fill.

https://i.imgur.com/79OC8KG.png

Short term market breadth was basically flat since noon ET and the bulls had no chance of making any gains and this breadth reversal model did not flip to the long side which is just as well if one look at the long term prospect of a breadth reversal – it is pretty slim right now on the weekly chart (notice the bold red line overlaying the SPX trending strongly to the downside – that is the cumulative NYSE 52 week high – lows, weekly chart). There is a strong correlation between this cumulative line and Fed action, but that is another subject all together.

https://i.imgur.com/y7ECLPT.png

More often than not, short term market breadth reversal model can spot short term price trends as this model reversed to buy at 01:15 ET Friday AM at ES 3736.50 and stayed with the 08:30 ET chop and stayed long. The % NYSE stock above 50 day MA has now regained the same level as the open of Fed day and is rising rapidly.

https://i.imgur.com/LTzRIpe.png

Despite what some who’d said Friday’s action being un-tradable or unknowable – it was not. It followed the entry-above-VWAP trades and exited when the VWAP ATR profit targets were reached. It is rare to have 3 VWAP trades in one day but that was what happened in bear market rallies with interspersed profit taking. These long only trades added up to be > +1.5% but were manageable. Friday being a VWAP day is in contrast to the previous two days which were not VWAP candidates.

https://i.imgur.com/hiSCx9O.png

The simple message is „just sell tech and buy something else“ but that may be too simplistic.

Is it the right time to buy something else? Or should we wait? My question refers to the investment portfolio