Mid-week market update: I thought that I would publish an early mid-week market update in light of the shortened US Thanksgiving trading week. As the S&P 500 consolidates in a narrow range between 3900 and 4000, things are breaking beneath the surface.

Let’s begin the analysis at the extreme risk part of the market. As the crypto world teeters, Bitcoin is weakening, Coinbase shares (COIN) have broken support, and the Bitcoin to Greyscale Bitcoin Trust (GBTC) ratio erode, indicating a widening NAV discount.

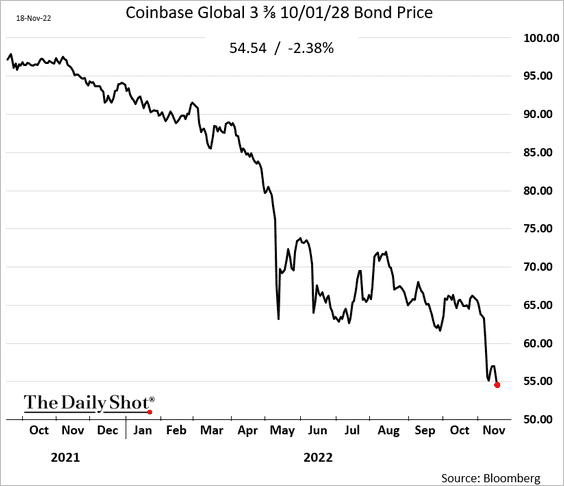

I haven’t conducted a full analysis of Coinbase, but consider the market’s signals on the company. Its debt is trading at nearly 50c on the dollar. If the entire edifice were to collapse, will the common shareholders receive anything in liquidation?

Then we have the cult favorite, Tesla. TSLA broke neckline support on a head and shoulders formation on the monthly chart. The measured downside objective is *gasp* about $20.

Another warning can be found in the relative performance of defensive sectors. Even as the S&P 500 rallied off the October bottom, defensive sectors were all in relative uptrends during that period.

Finally, the VIX Index just breached the bottom of its Bollinger Band, which is usually an indication of an overbought stock market. Past occurrences have foreshadowed market stalls in the last six months.

I recognize that Thanksgiving Week is normally thought of as a period of positive seasonality for stock prices. But analysis from Jeff Hirsch shows that the seasonality win rate on Tuesday and Wednesday has been positive, upside potential was been relatively weak.

In the short run, the key trigger for market direction may be the release of the FOMC minutes tomorrow. Stay cautious.

Disclosure: Long SPXU

Does anyone know the cost of mining bitcoin…not the all in costs, just the electricity. If the electricial cost is greater than the price of a coin, how long before the miners quit? I get it that the cost varies in locale, but this puts a danger zone at a certain price level.

Silver miners for example can keep mining at 10$ because the operational cost is around 5$, so they just deplete the mine and stockholders get shafted. But bitcoin miners have to pay their bills, they can’t just pay the electricity after 10 years, the feedback is fast.

What happens to bitcoin if the miners quit? What am I missing?

Bitcoin’s Next Headwind: Struggling Crypto Miners

https://www.barrons.com/articles/crypto-miners-bitcoin-prices-51656447948?mod=Searchresults

From the article, the average cost of production for a miner is about $15,000 per coin.

Note many miners have cash or bitcoins on their balance sheets. That may carry them through for some time.

https://www.barrons.com/articles/bitcoin-price-mining-stocks-buy-51639081798?mod=Searchresults

From the article: Riot Blockchain (RIOT) has a mining cost of $13,000, estimates Brendler, while Marathon Digital Holdings (MARA) is around $7,000 to $8,000.

Thx

Another thing is wealth and debt.

A lot of so called wealth is illusory. If I have 1000 shares of amazon, it is 93k, today, but if amazon is 20 in 3 months, it’s 20k…same shares, different wealth…so a lot of wealth is at the margin as FTX showed us so well.

Debt does not do that, it sticks, it can be paid off, defaulted by bankruptcy or inflation.

This is why debt is the one to worry about, and also consider what will be done about it. Paying it off at the federal level, does anyone see that?

So how much of this fight inflation is just smoke and mirrors? So they crash the market and economy….everyone will want something else…so then they can let inflation run against the non monetary deflationary forces and just print.

Sure, the market is defensive and the VIX low but that doesn’t mean it could not rally. After a while in a bear market, everyone has the recency bias of the last trendline that broke or the last Fed speak while they should be looking for regime change in market behavior. There are specific rules for looking for such changes, perhaps this chart will help, looking purely at price behavior the dots are painted in real time on the daily. It has occurred many times in the past after market bottoms, in Apr 2020 and Apr 2009, to name a few. In 2020 this lead to the recovery rally blow off top on June 9, 2020, pulled back and then continuation.

https://i.imgur.com/ZWRhzo5.png

Another change to watch for is how the market behaves with high $CPCE put call vol ratio. In a bear market rally, high put buying and call selling leads to sharp market declines but at a certain point when market stops selling into bear market rallies, higher CPCE periods no longer leads to price declines. We began to see this in the last 25 days since 10/28/22 and prior to that we last saw on 4/9/20 and 4/20/20 coming out of the 2020 pandemic lows. All these point to hints that this rally could continue which doesn’t mean there would be no pull backs, but the likelihood is higher prices.

One of the driving force behind the 2022 equities decline has been attributed to the strong dollar. If one applies the same type of price analysis of $DXY as it was done above for the $SPX, what would one see? Could the bottom be spotted and could the top be predicted? Probably yes. The yellow represent strength in price rallies and the large magenta weakness in falling prices, small pink dots showed short term market tops. All painted real time in daily chart.

Once weakness in the face of falling prices occurred (large magenta), the bulls will not return until a more durable bottom is found.

https://i.imgur.com/uq5F869.png

Finally, what should one do with long bonds (TLT)? That is the elephant in the room because it has wrecked the portfolios in this bear market for a lot of investors. Investors, especially some foreigners because they don’t see any other choices, kept buying and it kept dropping – but the end to the bond bears may be near. Using the same type of analysis as the above two charts, we saw some bottoming in the spring of 2021 but every attempt at rallies was slapped down and by 01/04/22 it was a full blown sell off – masses of sell on sell action (large magenta). TLT tried to do a bear market rally in June through 08/01/22 but the strength rally was rejected the next day on 08/02/22 and the sell off repeated.

Finally by 11/16/22 which was only one week ago Wednesday, we saw a strength rally (yellow) that wasn’t rejected by short term highs which is very constructive and price gapped up today. All of this was brought about by the CPI report which also caused TLT to do a large gap up. It is an empirical observation that long bonds generally rally 10 days after the CPI peaked and this time it seems to follow the other observations.

https://i.imgur.com/g3KB6NM.png

So what is score?

SPX = +

DXY = —

TLT = +

All of that point to a stock rally and a long bond rally purely on price analysis. Looking at the Z-score, both instruments are in the over bought area and may need a breather before further upside.

Tom McClellan has a blog out suggesting that what is seen in the front month treasury is explained as buy exhaustion as seen in his proprietary corporate bond A/D indicator and that treasurys is likely to reverse in price. It is sometimes true that we see exhaustion in treasurys but there are also continuations, often after decreases in CPI and after peaked CPI, that is why there is empirical observation that treasurys tend to rally 10 days after peak CPI.