Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “

Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post,

Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The

Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found

here.

My inner trader uses a

trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don’t buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts is updated weekly

here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Sell equities (Last changed from “buy” on 26-Mar-2023)

- Trend Model signal: Neutral (Last changed from “bullish” on 17-Mar-2023)

- Trading model: Bearish (Last changed from “neutral” on 02-Jun-2023)

Update schedule: I generally update model readings on my site on weekends. I am also on Twitter at @humblestudent and on Mastodon at @humblestudent@toot.community. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

A quick trip around the world

Now that the U.S. debt ceiling drama is over, it’s time to take a quick trip around the world to review the state of global equity leadership.

The relative performance of different major regions against the MSCI All-Country World Index (ACWI) shows a surge in the U.S. market. Europe has pulled back and Japan is steadily advancing against ACWI. Within emerging markets, heavyweight China is weak and EM ex-China is steady against ACWI.

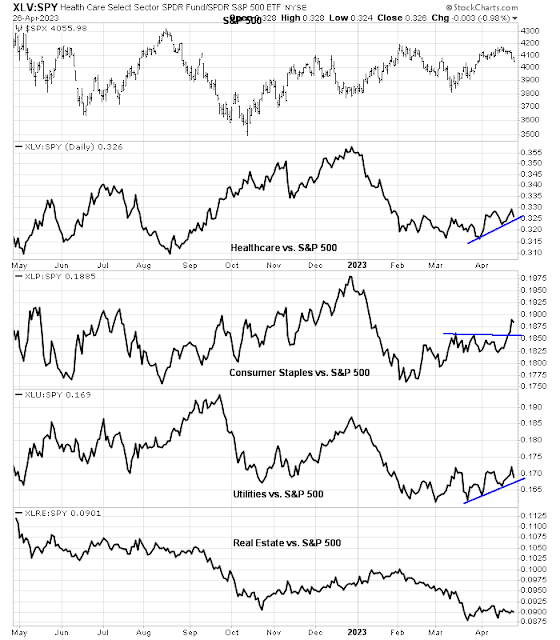

Fragile U.S. leadership

Even though the U.S. equity market has rallied strongly, its leadership can only be characterized as fragile. The U.S. market has been held up by a handful of AI-related stocks.

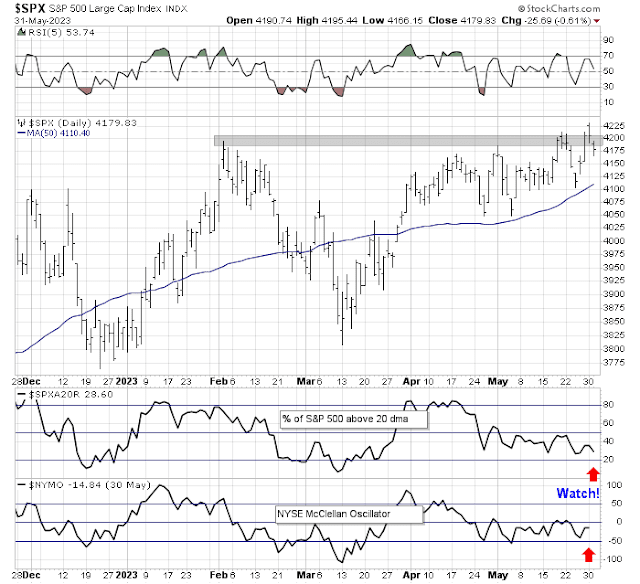

Even as the S&P 500 broke out through the 4180-4200 resistance zone, breadth and momentum indicators are flashing negative divergences.

Analysis from John Authers shows that technology outperformance against the S&P 500 sparked by the AI frenzy is comparable to the NASDAQ Bubble of the late 1990s. If this is truly the start of another bubble, it has the potential to go much further.

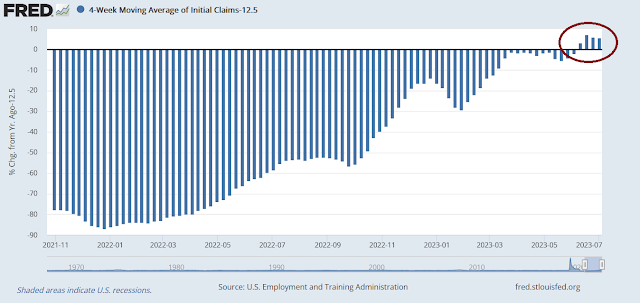

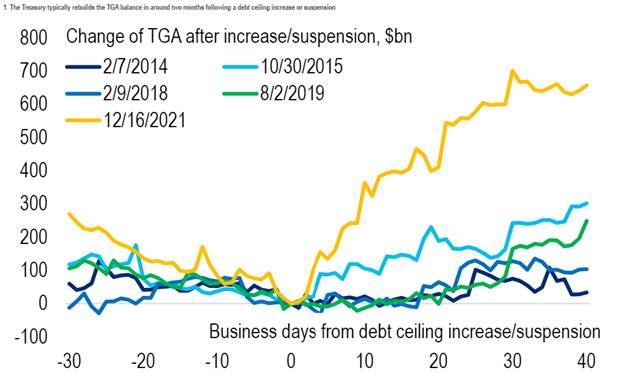

Tactically, the lifting of the debt ceiling will be a catalyst for the U.S. Treasury by borrowing to reverse its drawdown of the Treasury General Account, which is its “checking account” at the Fed. This will drain liquidity from the financial system. The net effect could amount to quantitative tightening on steroids. The open question is whether the Fed will act to cushion the effects of the liquidity drain after seeing the effects of the recent regional banking crisis.

Historically, changes in liquidity have been closely correlated with stock prices. The forecast liquidity drain could be the spark for a risk-off period with U.S. equities at the epicenter. Another intermediate-term headwind is contained in the debt ceiling bill, as the spending cuts contained to the bill amount to a greater fiscal drag on the economy.

Constructive Asia

The relative performance of major Asian markets shows a mixed bag. China-related markets of China and Hong Kong are underperforming ACWI. Japan is on the verge of a relative breakout from a long base and could be a source of leadership should it show further strength. Taiwan and Korea have ticked up, but the strength is attributable to the AI frenzy in the U.S. that has sent semiconductor stocks surging. India is flat against ACWI.

The market took a fright when Chinese Manufacturing PMI shrank for a second straight month in May from 49.2 to 48.8, though Non-Manufacturing PMI remained in expansion territory despite dropping from 56.4 to 54.5. However, Caixin Manufacturing PMI, which measures a sample of smaller firms, unexpectedly rose from 49.5 to 50.9, indicating expansion.

A look beneath the surface of sector leadership shows that the industrial economy is in good shape. The primary tool for our analysis is the Relative Rotation Graph, or RRG chart, which is a way of depicting the changes in leadership in different groups, such as sectors, countries or regions, or market factors. The charts are organized into four quadrants. The typical group rotation pattern occurs in a clockwise fashion. Leading groups (top right) deteriorate to weakening groups (bottom right), which then rotate to lagging groups (bottom left), which change to improving groups (top left), and finally completes the cycle by improving to leading groups (top right) again.

The RRG chart of China sectors shows some surprising results. The top right leading quadrant consists of energy, financials, industrials and utilities. The presence of cyclical sectors such as energy and industrials are signals of strength not weakness as indicated by official Manufacturing PMI.

The Chinese technology sector deserves a special mention. We had suggested that the actions taken at the recent G7 meeting were a signal of a deepening rift between China and the West (see

How the G7 meeting exposes the risks for 2024).

Since the publication of that report, relations between China and the U.S. and Europe have deteriorated. China declined an American proposal for U.S. Defense Secretary Austin to meet with his Chinese counterpart Li Shangfu at the Shangri-La Dialogue security forum in Singapore.

In addition, China has sanctioned Micron Technology and barred its semiconductor components for national security reasons. Even though Western powers raised concerns about how to de-risk their economies from Chinese influence for security reasons, China has rejected the “de-risk” language and perceived initiatives as the ban on the export of advanced semiconductor manufacturing equipment to China as a way of hobbling Chinese technological advancement. Instead, Beijing has labeled de-risking initiative as a decoupling effort and encouraged the development of semiconductor technology to catch up with the West as a matter of industrial policy.

In the past, China has gone through several industrial policy cycles. The story is the same. Beijing exhorts its economy to invest in industry X. Local cadres rush to foster start-ups in that industry, which creates a boom in the stocks involved in industry X and eventually over-investment and white elephants. The latest semiconductor development imperative is likely to end the same way, but with a difference. This time, foreigners may not be able to benefit from the boom phase as semiconductors will be deemed to be sensitive and not open to foreign investment.

A buying opportunity in Europe

Turning to Europe, which had been the global leadership. The Euro STOXX 50 staged an upside relative breakout in early 2023. While it has pulled back, it remains above the breakout level, which is constructive. Several countries also remain above their relative breakout levels, which we interpret as a buying opportunity. As European exports are sensitive to Chinese growth, and our analysis of Chinese growth internals are constructive, I believe the current pause in European strength should be bought.

In conclusion, here are the takeaways from our quick trip around the world:

- U.S. equities have surged, but the leadership is narrow and may not be sustainable. Treasury will be borrowing extensively after the debt ceiling is lifted and drain liquidity from the financial system, which will create headwinds for equities.

- Japan appears to be on the verge of a relative breakout that could see it become a global leader.

- The apparent weakness in China may not be as dire as the headlines indicate.

- Europe has pulled back, but it remains the global leaders and should be bought.

The week ahead

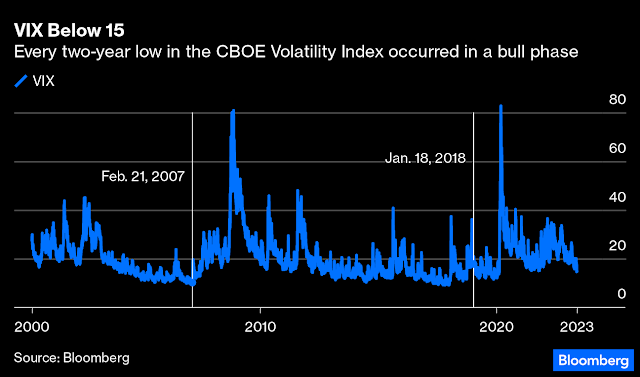

Looking to the week ahead, current market conditions are starting to look like the blow-off top scenario that I outlined three weeks ago (see How the market could break out to a blow-off top). Subscribers received an email alert on Friday that my inner trader had initiated a short position in the S&P 500. In addition to the intermediate-term headwinds from the TGA reset, the VIX Index had fallen below its lower Bollinger Band, which is usually a sign of a short-term top.

The usual disclaimers apply to my trading positions.

I would like to add a note about the disclosure of my trading account after discussions with some readers. I disclose the direction of my trading exposure to indicate any potential conflicts. I use leveraged ETFs because the account is a tax-deferred account that does not allow margin trading and my degree of exposure is a relatively small percentage of the account. It emphatically does not represent an endorsement that you should follow my use of these products to trade their own account. Leverage ETFs have a known decay problem that don’t make the suitable for anything other than short-term trading. You have to determine and be responsible for your own risk tolerance and pain thresholds. Your own mileage will and should vary.

Disclosure: Long SPXU