Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “

Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post,

Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The

Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found

here.

My inner trader uses a

trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don’t buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts is updated weekly

here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities

- Trend Model signal: Bullish

- Trading model: Bullish

Update schedule: I generally update model readings on my site on weekends. I am also on Twitter at @humblestudent and on Mastodon at @humblestudent@toot.community. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

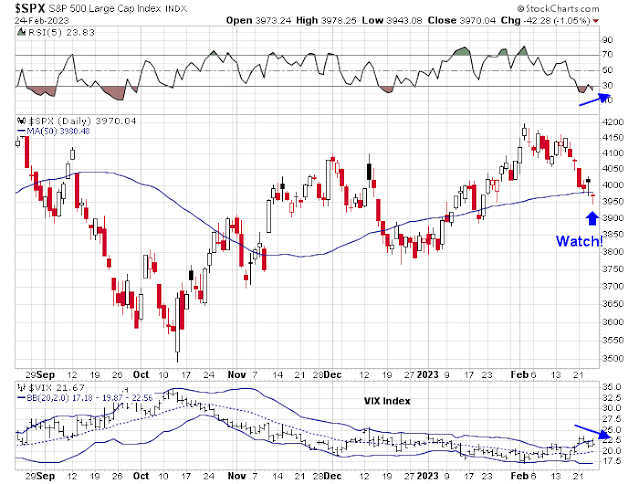

Testing key support

As the S&P 500 tests critical support level, as defined by the falling trend line, it’s technical decision time for both bulls and bears. While a rally off support levels is the more likely outcome, a break of support opens the door to considerable downside risk to the 200 wma at about 3715. On the other hand, a relief rally is likely to be capped at resistance at about 4180.

The bull and bear cases

Here are the bull and bear cases. The bull case consists mainly of an oversold condition. While oversold markets can become more oversold, the NYSE McClellan Oscillator had already become very stretched to the downside. Markets usually don’t crash from such levels.

From a longer term perspective, the price momentum factor, as measured in different ways, is turning up. These readings are consistent with conditions seen in the last two major market bottoms.

On the other hand, both the equal-weighted S&P 500, the S&P 400, and the Russell 2000 have broken support, indicating overall weakness beneath the hood.

Different versions of the Advance-Decline Line have all violated their uptrends, which is a signal that the bulls have lost control of the tape. Even if you aren’t bearish, this argues for a period of sideways consolidation and choppiness.

The China wildcard

I have pointed out before that it’s impossible to make a call on risk appetite if you don’t pay attention to the China re-opening narrative. The report card on the China re-opening trade contains both good news and bad news.

The bad news is the market is losing faith in the trade. The relative performance of the Chinese equity market and her major Asian trading partners shows that, with the exception of Japan, all the other markets have violated key relative uptrends. At the very least, a period of sideways consolidation will be necessary before regional markets can consistently outperform again.

On the other hand, the analysis of sector relative performance within China tells a more constructive story. Consumer stocks are still lagging. Consumer discretionary and internet, which consist of consumer sensitive companies like Alibaba and Tencent, are in minor relative downtrends. By contrast, the cyclically sensitive materials sector has turned up. So have the highly leveraged real estate stocks and the real estate sensitive financials, which reflect Beijing’s initiatives to support the property sector.

While these developments are constructive for the Chinese re-opening trade, a possible tail risk has appeared. In a more ominous development, China and Russia affirmed their deep ties, with Beijing’s top diplomat describing the relationship as “solid as a mountain” during talks in Moscow. The

WSJ reported that “US Considers Release of Intelligence on China’s Potential Arms Transfer to Russia”. Nothing has been decided, but Secretary of State Blinken stated that China is almost certainly supplying non-lethal dual-use goods. If China were to take the next step and provide weapons in support of the Russo-Ukraine war, it risks sanctions from Europe and the US, who are its major customers, and reverse any positive effects of the re-opening trade for investors in a catastrophic manner.

The week ahead

Looking to the week ahead, the S&P 500 is testing its 50 dma while exhibiting positive divergences on its 5-day RSI and VIX Index, which has recycled below its upper Bollinger Band after spike above. I interpret these as tactical buy signals.

The odds favor a relief rally of unknown duration and magnitude. The usually reliable S&P 500 Intermediate Term Breadth Momentum Oscillator (ITBM) is oversold on its 14-day RSI, which is a bullish setup. The buy signal will be triggered when the ITBM RSI recycles from oversold to neutral.

From strictly a technical perspective, investors and traders should make a directional call based on how the market behaves after the relief rally. My inner trader remains positioned bullishly. The usual disclaimers apply to my trading positions.

I would like to add a note about the disclosure of my trading account after discussions with some readers. I disclose the direction of my trading exposure to indicate any potential conflicts. I use leveraged ETFs because the account is a tax-deferred account that does not allow margin trading and my degree of exposure is a relatively small percentage of the account. It emphatically does not represent an endorsement that you should follow my use of these products to trade their own account. Leverage ETFs have a known decay problem that don’t make the suitable for anything other than short-term trading. You have to determine and be responsible for your own risk tolerance and pain thresholds. Your own mileage will and should vary.

Disclosure: Long SPXL

The toughest nut to crack right now is the surge of a full one percent in Fed Funds Futures December 2023 since the blowout jobs report at the beginning of the month. The December 2024 contract went up a bit more than the December 2023. This means both that rates are higher now and longer.

No getting around it, this increases the risk by quite a bit.

Also, at the same time, the European bank rate also went to new highs for year end 2023 and 2024.

If all bond market rates rise throughout maturities by anywhere close to one percent, markets will be in big trouble.

A possible bright point is that many economists are thinking January statistics were distorted by unreliable seasonal adjustments and that February and March will unwind that. So we could have surprising good jobs (weaker) and inflation numbers (lower) in a few weeks.

Maybe markets will take the interest rate news in stride thinking that we are simply in the last phase of the rate hikes and look across to the other side when rates will fall. Wishful thinking for sure.

Fed is driving this train. It may speed up , slow down or cruise depending on the data but for now the destination is certain. Bond market has come to terms with it mostly but equities have not. Equities have a double burden: higher discount rates and lower earnings to contend with.

It’s possible for equities to look past the valley but only if liquidity is ample.

My humble opinion.