I don’t comment about individual stocks very often, but I came upon this chart. It has been steadily rising for the last few years and it has been quietly beating its sector peers. Could this be the next Amazon or Apple?

Relative strength study

My conclusion is based on a study I did in 2012. I found that investors should buy the relative strength winners when the market is in a bull trend, as defined by the Trend Asset Allocation Model.

During the Tech Bubble, the leadership were the TMT (Tech-Media-Telecom) stocks. After the bubble burst, it was real estate – until it wasn’t. Every bull cycle has its market darlings.

Intrigued? The mystery chart turns out to be LVMH, the luxury goods maker (all charts are in USD). I was inspired to look at it after a Ones and Tooze podcast which revealed that LVMH’s CEO Bernard Arnault had pushed Elon Musk aside to be the world’s wealthiest man.

As Elon Musk’s fortune dwindles to a mere $190 billion, a new oligarch has been crowned the richest person in the world: Bernard Arnault of France. On the episode this week, Cameron and Adam discuss how Arnault made his money and what his empire tells us about his home country.

If this is the start of a new bull cycle, LVMH is a strong candidate to be the next market darling. I have made the case before for Europe becoming the next market leader. The leadership of LVMH is supportive of that case.

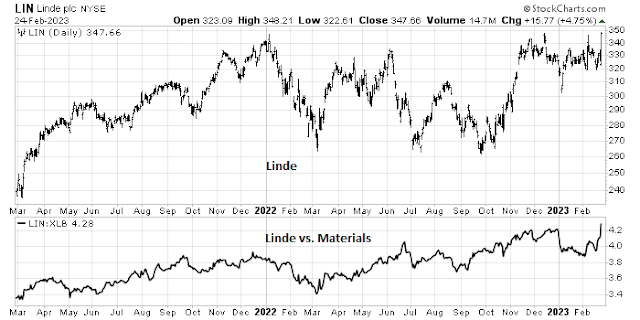

Here are some other large cap European stocks that could be leadership candidates. Linde, which is an industrial gas and engineering company. The stock achieved a relative breakout (bottom panel) but it’s testing resistance on the absolute (USD) price chart (top panel).

Allianz could be intriguing as European financial stocks have begun a recovery.

Here is the sector ETF EUFN.

Bottom line. When US investors think about the new leadership, think outside the box and think about Europe.

Interesting idea. Curious what is driving this stock up?

It’s not really in the traditional Value sector (financials, industrials, materials,…)

It’s the next growth name. In the past it’s been banks, real estate, to biotech. Luxury goods has been a secular winner for companies selling to wealthy Chinese consumers.

Thank you. Some US-based affordable luxury names ($TPR, $CPRI) haven’t being too well.

I guess the wealthy Chinese consumers go for the real luxury. I wonder if they are staying away from the US products as well given the elevated tensions between the two countries.