I’ve been trying to make sense of the blowout January Jobs Report. BLS reported a Nonfarm Payroll gain of 517,000, which was an off-the-charts surprise compared to market expectations of 185,000. Whenever large surprises occur, it makes me think that the report represents a data blip.

For some perspective, the 517,000 gain represents an enormous surge in the seasonally adjusted NFP report (blue). The non-seasonally adjusted figure (red) shows that January usually sees large layoffs, and job losses were lower than normal.

Here are the bull and bear cases for employment and the labor market.

The bull case

Some signs of improvement can be seen in the more volatile household survey. The establishment survey (blue) is the headline jobs figure that is the main focus. The household survey (red) is a smaller sample survey and the results are more volatile. Nevertheless, the household survey showed signs of improvement in December, which continued into January. By that metric, the January upside blowout shouldn’t have been a major surprise.

In addition, initial jobless claims (blue) have been trending down, which is an indication of labor market strength. On the other hand, continuing claims have been edging up. In other words, people are losing jobs at a slower pace, but those who lost jobs are encountering more difficulty finding new ones.

Some of the raw data shows a mixed picture. The non-seasonally adjusted establishment survey (blue) shows fewer job losses compared to the last two instances in January. However, the non-seasonally adjusted household survey (red) shows more job losses compared to January 2022 but more job losses compared to January 2021. This suggests that either there is a problem with the seasonality adjustment, a data blip with the volatile household survey data, or a weather-related issue that’s affecting employment.

New Deal democrat argued that the level of January layoffs was extraordinarily low and the odds of a downdraft in February employment is high.

In conclusion, here’s what we have: in a very tight labor market, in the aggregate employers were reluctant to lay off seasonal hires in January, electing to keep them on payroll. This translated into blockbuster job gains on a seasonal basis. But we have to wait for February’s report to see whether this is a sign of renewed strength in the jobs market, or whether employers have less need to hire new workers as a result. In other words, will January’s strength continue in a month where actual hiring, not layoffs, are expected.

The bear case

The bear case depends on trends. Even though headline employment gains were strong in January, compensation gains have been soft and they haven’t kept pace with job gains. The employment cost index (blue) is released quarterly and includes both wages and benefits. ECI gains have been decelerating. Similarly, the average hourly earnings for nonsupervisory employees (red), which is less distorted by year-end bonuses of management workers, have also seen the rate of change plunge.

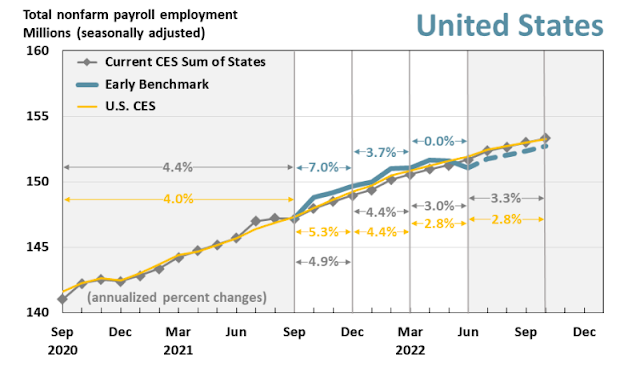

In addition, the Philadelphia Fed published a

study showing Q2 job gains were only 10,500 compared to 1.1 million reported by the establishment survey. The study was based on Quarterly Census of Employment and Wages (QCEW) data of unemployment insurance premiums of workers. The survey is very comprehensive and covers virtually all employers that pay insurance premiums, compared to the sampling technique used by the establishment and household job surveys.

Unfortunately, QCEW data is not reported on a timely basis and the latest report we have is Q2. Nevertheless, the Philadelphia Fed study leads to the conclusion that investors should put more weight on the household survey (red line, December 2021 = 100), which shows flat jobs growth for most of 2022, with a re-acceleration that began in December even as the establishment survey (blue line) raced ahead.

What does this all mean? My base case calls for a downward reversion in future job reports. If the household survey is right, employment was flat for most of 2022, though it revived late in the year. It also means that the labor market is not as tight as the Fed believes, though we will have to wait until February to see how much momentum there is in job gains.

Cam, we hear of massive layoffs, esp in tech. Does that ever coincide with a new bull market?

See thread https://twitter.com/SamRo/status/1619036663233056768

Thx.

Interesting, makes one wonder why what gets media attention is the firings.

Don’t tell J Pow

November and December were revised up. How does the three month average compare to prior three months?