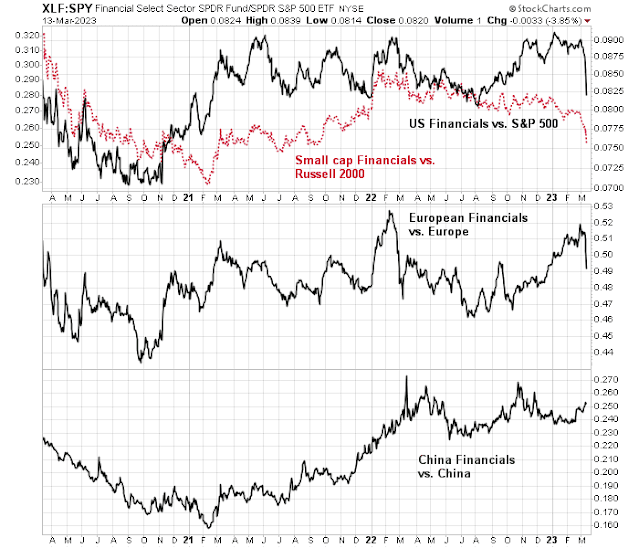

I know that financial stocks are more than just banks, they include financial conglomerates like American Express, broker-dealers, life and property and casualty insurers, and so on. But mark this day. This will be a financial panic to tell your grandchildren about. As the chart shows, the technical damage to the sector is considerable.

Contagion effects

The contagion effect can also be seen in small caps, which dropped along with large cap financials.

European financial stocks also skidded in sympathy. The good news is China is marching to its own drumbeat.

The dog that did not bark

Financial panics follow a well-known script. A crisis erupts. Investors rush for safe havens. Fiscal and monetary authorities step in to stabilize the situation.

Here’s what’s the same. Investors did rush for the safety of Treasury assets. The 2-year Treasury yield fell to 4.02% from over 5% last week. The Fed and Treasury Department played their part. It was fortunate that the crisis occurred within the banking system, which is within the Fed’s purview (unlike the Lehman Crisis which occurred within broker-dealers that the Fed couldn’t rescue). A solution was found and the Fed flooded the system with liquidity, as evidenced by the rally in crypto-currency prices.

Here’s what’s different this time. The rush into Treasury assets was not accompanied by a stampede into the USD. In fact, the USD weakened. Moreover, jitters were felt in Europe, even though there was no clear evidence that any European banks were in trouble at all.

These are some “dog that did not bark” observations. Why did the USD weaken? If the European banking is under stress, why did EURUSD rally?

Historically, the USD has been inversely correlated with the S&P 500. These conditions lead me to believe that the panic is only temporary and the authorities have the situation under control. Animal spirits overwhelm rationality and a positive divergence is occurring between stocks and the USD.

In conclusion, this is a classic bank panic. The authorities have done their part and the damage should be contained. All financial markets except for stocks have behaved according to script. The stock market should bottom and rally from these levels.

Disclosure: Long SPXL

Hi Cam, could it be that investors are losing confidence in the Fed’s ability to contain inflation via higher rates (now that higher rates have started breaking stuff), and selling USD as a result? It will be interesting to see on Thursday what stomach the ECB has for higher rates given the stress among European banks today.

The USD could simply be weak as investors don’t expect the Fed Funds rates to rise to the same levels (6%?) as before. Gold, silver, and crypto – all went up. So did Euro.

Having said that, I don’t think anyone, including Fed, knows the appropriate level of FFR to implement a sufficiently restrictive policy.

Powell mentioned the word ‘disinflation’ like 18 times at the last FOMC, and totally flipped at the Congressional testimony after seeing the strong Jan CPI reading. I don’t have any confidence in what they are doing. Just taking a shot in the dark, I presume.

Hi Cam, what you are hoping for is rational and intellectual behavior from investors and money managers. Something to keep in mind is when investors panic rational behavior is in short supply. That is how you have a selling climax and crashes like 1987.

I would not call all clear at this point. If the CPI is hot and no further cracks show up, Fed would likely raise another 25 bps. Inflation is the bigger problem and important to tackle.

Question is also what affect it has on consumer psyche and behavior. It could slow the economy further. A recession is just as likely now as before.

The stability of the financial system is of course critical and more important than the inflation. It is entirely possible that Powell has already raised interest rate to a level (and probably more) that’ll bring the inflation down in coming quarters. Remember, it takes anywhere from 1 to 2 years for the real economy to see the effects of the monetary policy. Pausing the rate hikes here and ensuring the system remains stable won’t hurt anyone.

Moreover, the banks will exercise more caution now before lending their money out and tightening the financial conditions – helping the Fed out.

Having said that, Powell could still raise the rates by 25bps to prop up the credibility of the Fed. The SF Fed was asleep on the wheels while SVB was squandering the bank’s assets. The Fed should have also known the effects of higher rates on long-term bonds and damage it could cause to the B/S of the banks.

I believe this facility is available only to the two banks that failed (I could be wrong). The implicit put extends to others as well.

The mismatch of asset and liability duration was the main issue. Fed has been literally banging the drums about it’s intentions. So, it’s a failure of the management and not the Fed(the regulators should have been aware of it).

Barney Frank has been cashing a paycheck from Signature Bank since 2015!!

Will a marginal increase of 25 bps cause systemic risk? I don’t think so. The credibility of the Fed is at stake as well.

If the risks are so great, cut rates and flood the markets with liquidity. Fight inflation another day!

“the Fed flooded the system with liquidity, as evidenced by the rally in crypto-currency prices.”

Cam –

Great observation. Banks can now approach the Fed and use their devalued assets (e.g., long-term Treasuries) and borrow against the full value of those.

Is that the sole source of the liquidity? Will that be sufficient to power the rally in stocks and crypto?

https://www.schwab.com/learn/story/bank-turmoil-what-does-it-mean-fed-policy

Good article. Here are some excerpts…

In addition to its dual mandate to keep inflation in check and to promote full employment, the Fed has a third unwritten mandate: to maintain financial stability. In times of stress, financial stability concerns often trump the other two mandates. Consequently, we believe the Fed may pause its rate-hiking cycle, or make smaller rate increases, until the outlook is clear.

Financial conditions had already begun to tighten in recent months and the recent volatility will only make that worse. Banks already have been tightening lending standards and raising interest rates on loans, making credit for businesses and households less available and more costly.

…expectations are now for a peak rate of 4.75% to 5%, suggesting just one more rate hike of 25 basis points and then rate cuts in the second half of the year.

this backstop does not apply to all banks, just those specifically named by the FDIC.

Hi Cam,

I am not sure I understand the base for your bullish narrative here. The rates just suffered a heart attack, and FF futures dropped close to 200bp in just 2 days, which signals pretty large stress is about to happen for the economy.

Now, are you equity bullish because:

a) Bond market got it all wrong and there will be no stress for the economy, so let’s enjoy the lower rates while it lasts,

b) Bond market is right, but it doesn’t matter … equity market will still go up due to lower rates and higher liquidity in the system,

c) or is it something else?

Thanks for your explanation.