Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “

Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post,

Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

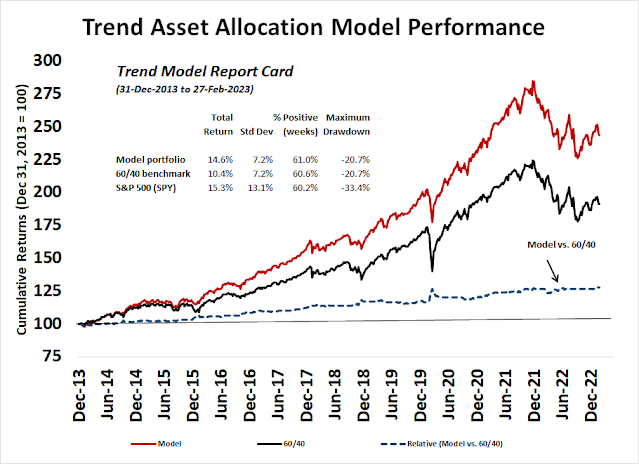

The

Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found

here.

My inner trader uses a

trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don’t buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts is updated weekly

here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities

- Trend Model signal: Bullish

- Trading model: Bullish

Update schedule: I generally update model readings on my site on weekends. I am also on Twitter at @humblestudent and on Mastodon at @humblestudent@toot.community. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

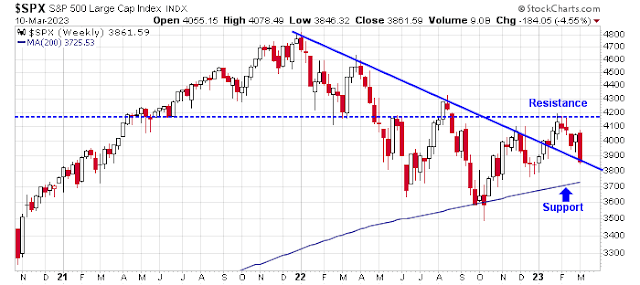

Breaks at key support

A week ago, I wrote that I was bullish on the equity outlook, but the S&P 500 appeared to be extended short-term and the Powell testimony and Jobs Report could be sources of volatility (see China: Global bullish catalyst?). I was right on the volatility as Powell sounded a hawkish tone and the SVB crisis didn’t help matters. The S&P 500 violated its key support levels at the 50 dma and 200 dma. In addition, the equal-weighted S&P 500, the mid-cap S&P 400, and the small-cap Russell 2000 all blew through the bottom of descending channels.

Is this the End? Here are the bull and bear cases.

Bull case

In response to Powell’s remarks, Fed Funds futures is now discounting a 50 basis point move at the March 20 FOMC meeting and a terminal rate of 550-575 basis points. The 2-year Treasury yield spike above 5%, which is a high for this cycle before pulling back. These conditions should be very challenging for stock prices, but the S&P 500 only fell -3.1% from Friday to Thursday, which is the day before the Jobs Report. Is that all the Fed can do to dent the stock market?

Meanwhile equity risk appetite indicators are exhibiting positive divergences.

From a long-term perspective, the analysis of the 50 and 200 dma of the equity call/put ratio shows that sentiment is recovering from an excessively condition. The crossover of the 50 and 200 dma is a constructive sign that signals the start of a new bull leg in stocks.

The bear case

Here is the bear case. The Fed’s hawkish tone put a bid under the USD, which has been inversely correlated to equity prices. The USD Index has been range bound but it may be about to stage a major technical breakout, which would be negative for risk appetite.

Stock prices may also be facing headwinds from liquidity conditions. Fed liquidity is showing a negative correlation to the S&P 500. The lack of liquidity is a potential a headwind for the bulls, though the sudden banking crisis could compel the Fed to inject funds into the banking system.

From a technical perspective, the NYSE McClellan Summation Index (NYSI) is recycling from an overbought condition, but the stochastic hasn’t reached an oversold reading yet, which suggests further downside potential in the next few weeks.

As well, different versions of the Advance-Decline Line are breaking below support, which is an ominous near-term development. Market breadth has sustained considerable technical damage. Unless stock prices can immediately reverse those losses, they may need a period of basing before they can rally higher.

The verdict

What’s the verdict? The S&P 500 has been consolidating sideways since it staged an upside breakout through a falling trend line in January. The upside breakout was constructive for stock prices, but until the consolidation period resolves itself either to the upside or the downside, it’s difficult to be definitive about direction. While I am constructive on stock prices, some caution needs to be warranted here.

Tactically, the market is poised for a relief rally. Three of the four components of my Bottom Spotting Model have flashed buy signals. The VIX Index has spiked above its upper Bollinger Band, which is an oversold market reading, the NYSE McClellan Oscillator is oversold, and TRIN spiked above 2 on Thursday, indicating price-insensitive selling, which is a characteristic of a margin clerk driven liquidation. Only the term structure of the VIX Index hasn’t inverted on a closing basis, though it did invert several times during the day on Friday.

Subscribers received an alert Friday that my inner trader had initiated a long position in the S&P 500 and he had bought into the panic. The usual disclaimers apply to my trading positions.

I would like to add a note about the disclosure of my trading account after discussions with some readers. I disclose the direction of my trading exposure to indicate any potential conflicts. I use leveraged ETFs because the account is a tax-deferred account that does not allow margin trading and my degree of exposure is a relatively small percentage of the account. It emphatically does not represent an endorsement that you should follow my use of these products to trade their own account. Leverage ETFs have a known decay problem that don’t make the suitable for anything other than short-term trading. You have to determine and be responsible for your own risk tolerance and pain thresholds. Your own mileage will and should vary.

The headline volatility event next week will be the CPI report. The FOMC meeting will be in the following week on March 20. Brace for further choppiness.

Disclosure: Long SPXL

Hey Cam, I hope all is well with your eye.

The USD Index could be making a H&S, neckline at around 101.

Lots of talk about Pigs and Pythons, how the pandemic stimulus is still working it’s way through the economy. Joe Sixpack may have spent it by now, but whomever he spent the money to has it now, or whomever whomever spent it to. They talk about taking on debt as a creation of money, ok I get that, but all the stem checks did not go to paying off debt and destroying money, or at least not permanently as CC debt is heading back up.

What’s more, fiscal deficits…isn’t there something about if the federal gov’t runs a deficit the population runs a surplus…I don’t have it quite right because I think it also includes trade balance, but even our huge trade deficit is nothing compared to fiscal spending deficits.

Isn’t that adding sausage to the Pig?

Wow! Here’s an idea, the gov’t goes austerity, stops spraying money into the economy, the $ goes up, and unfortunately the market tanks.

In WW2, we had similar levels of gov’t spending and debt, only the public did not get the money, we *exported* bullets, tanks, planes etc to the war zones.

Now, is the gov’t going to run a balanced budget?

This pandemic stimulus has a name attached, but in reality it is simply fiscal stimulus, how is that different from SS and Medicare spending in it’s final impact? Does it matter where the money in your bank account comes from?

When did the US get seriously on the gov’t deficit path? Late 70s early 80s? Certainly after 2000. What has the market done? It’s gone up. Some major drawdowns on the way, but since the GFC the budget deficits have accelerated, as has the market. Is gov’t deficit spending a secular tailwind for the markets because spending won’t stop, and unless we get taxed to death the money stays somewhere and it isn’t all going to China.

We won’t get a period of depressed prices that goes on for a decade because of all this money from the gov’t that will continue and likely increase.

We have had rates this high before, look at the 90s. So Jay Pow can raise them more, but this will affect gov’t interest burdens, so they will have to spend even more.

So my take is that even if we have an absolutely scary crash like 2008/2009 that the bounce will be breathtaking should that happen, but I think rates at some point will abate which will give the markets a boost. Gov’t spending will continue until the $ is truly beat up. Look up how Weimar Germany’s stock market performed, as well as Zimbabwe during it’s hyper inflation.

It’s all about fiat, and since 1971, the gov’t has not been restrained like it was in say the 30s when the money was US money backed by gold. So I think we need to keep an eye on deficits, and I doubt they will stop before 2024. After jan 2025 maybe, but I doubt it, the voters want the money…..this is a bit like 3rd generation of super wealthy families that spend it all.

If you google fed deficits and the S&P is interesting….1974 it was less than 500 billion, now it is 80 times higher, the S&P is about 60 times higher. The S&P was 1600 before the GFC and the FED deficit was around 10 trillion, now it is about 30 trillion and the S&P peaked at 4800 which is 3 times 1600….curious huh?

You are right. Most of the return is from credit expansion. The real growth of econ contributes only a very small portion. This has been stated in many published articles not too long ago. First, people were concerned. And then people stopped worrying and decided to join the money game en masse because only the price pays. And equity is the best inflation hedge, bar none. Dr. Strangelove will love the market and stopped worrying.

SVB fiasco is part of the symptoms of the gigantic globalized money game today. There is no money managers left from late 70s and early 80s, except perhaps Buffet/Munger and a very small number of others. Do not be surprised that other banks and funds suffer from the same incompetence. But no worry, our gov will make the whole thing whole again. Totally risk free for the money game, the modus operandi of our gov.

Well, at least the management lost their jobs and the shareholder equity was wiped out. They didn’t get away scot-free.

I wish that the FDIC will claw back the profits on shares sold by the management over the last few weeks (under the guide of 10b).

The rise in S&P500 over the last decade can also be attributed to the profit-making juggernauts of the mega-companies (Google, Microsoft, FB, Apple, Amazon, etc.). Most of the rise in S&P500 probably comes from these tech behemoths.

Absent those, I wonder if S&P500 would have outshone the rise in deficits and debt.

2y yield topped out. Credit condition contracts bigly. Rate hike cycle is over. Bank runs, the best psychology weapon, will do the job for the Fed. Looking for inflation to come down fast and furious. If the Fed doesn’t stopped here they will enjoy seeing hundreds of banks, who are already suffering from massive unrealized loss in their bond portfolio and potentially forced to realize the loss, fail from coast to coast. Something these geniuses who have cushy jobs all their lives in bureaucracy and academia are incapable of envisioning. Name one Fed regime who you think has done a decent job of steadily guiding our economy with sound money policy.

=> Bank runs, the best psychology weapon, will do the job for the Fed. Looking for inflation to come down fast and furious.

Are you expecting the run on SVB and others to decelerate or inhibit economic activities?

Well said! I agree wholeheartedly.

The cushy jobs in academia and bureaucracy likely leads to group think and an inability to stand out of the crowd. Far easier to fail in a group than to stand out alone even though you’re right.

The question is what were the Wall Street analysts doing? Many were urging to buy SVB as recently as a few weeks ago. If you invest in financials and banks, you must be be aware of $600bn in unrealized losses that are unlikely to be made whole as the Fed Fund rates are unlikely to be in the vicinity of 0% anytime soon (unless Powell’s rate hikes have already done enough economic damage to cause an incoming crash in a few quarters).

Now, I can understand the start-ups don’t have the time or skills to perform due diligence of this nature, but what about the VC funds proving them the capital?

And, don’t even get me started on the Fed. They should know who owns the Treasuries and how much losses have been accrued since the peak?

The Fed seems to be creating peaks and valleys in the financial assets. Average investors are left holding the bags while the Wall Street makes off on commissions and fees like a bandit.

Yeh, someone like Jimmy Bullard, who never bothers with a small dose of logical thinking. Every time he opens his mouth he cements further his case of being one of the biggest idiots. People like him think they on some sort of standup comedy tour. Publicity and engagement fee are more important than striving for real policy.