Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “

Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post,

Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The

Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found

here.

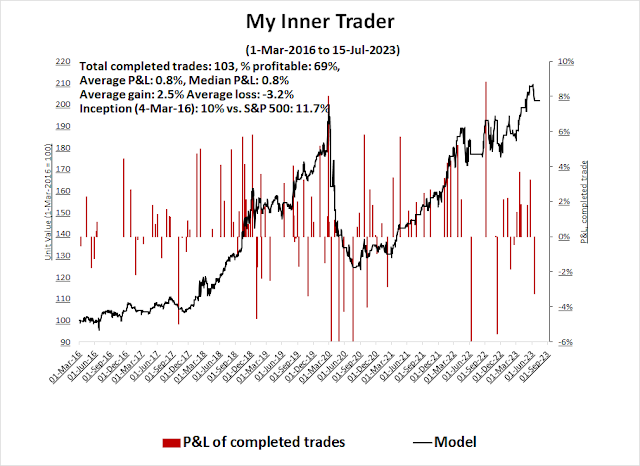

My inner trader uses a

trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don’t buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts is updated weekly

here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities (Upgrade)

- Trend Model signal: Bullish (Upgrade)

- Trading model: Neutral (Last changed from “bearish” on 15-Jun-2023)*

Update schedule: I generally update model readings on my site on weekends. I am also on Twitter at @humblestudent and on Mastodon at @humblestudent@toot.community. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

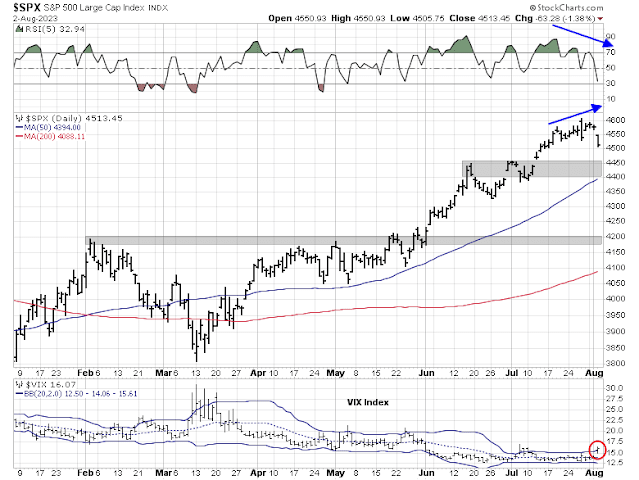

A likely buy signal ahead

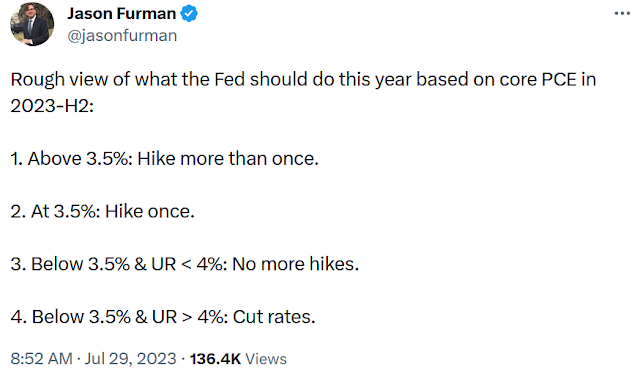

Regular readers know that I apply the monthly MACD crossover as a way of determining long-term buy signals. The model works this way:

- Buy when the monthly MACD histogram changes from negative to positive.

- Sell the market exhibits a negative 14-month RSI divergence.

The month isn’t over yet, but when this model is applied to the broadly based NYSE Composite, it is on the verge of a buy signal, with the caveat that it’s never a good idea to front-run model readings. Significant market strength on Monday, which is the month-end, could tip the model reading into buy territory. Otherwise, the model should flash a buy signal in August barring a major pullback.

This model has performed well on an out-of-sample basis. It was timely in flashing a sell signal in late 2018. It bought back into the market in 2019 and sold just as the market topped in early 2020. It turned bullish again in late 2020 and became bearish in early 2022.

The history of past buy signals has usually indicated relatively long-lived bull runs with only minor drawdown risk.

A Trend Model upgrade

Independent of the MACD crossover model, the Trend Asset Allocation Model has finally turned bullish after staying at a neutral reading since March. As a reminder, the Trend Model has been running on an out-of-sample basis since December 2013. A hypothetical strategy of over or under-weighting equities by 20% against a 60/40 benchmark using out-of-sample signals would have yielded almost equity-like returns with 60/40 like risk. The Ultimate Market Timing Model has also flipped to bullish as a result of the risk-on signal from the Trend Model.

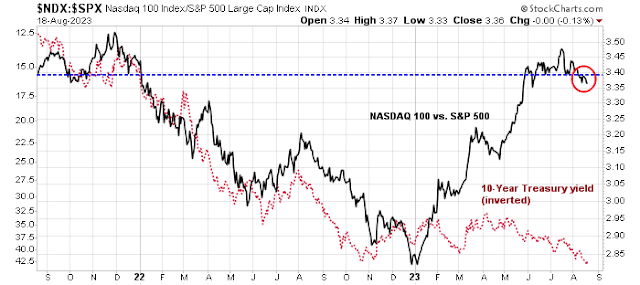

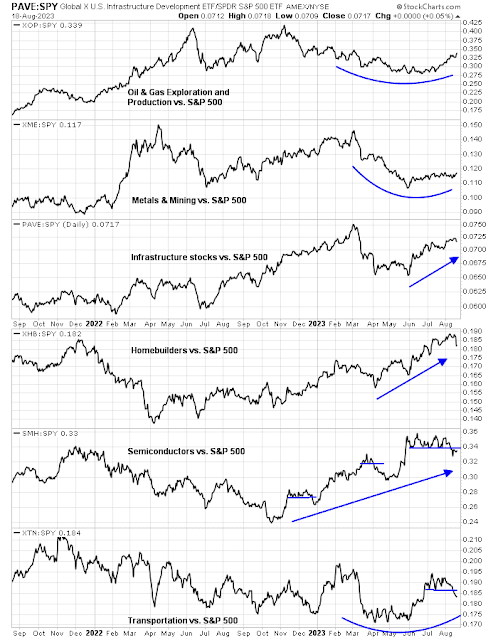

As for the internals of the Trend Model, here are some constructive signs that I would highlight. First, market leadership is broadening out after megacap technology stocks began to falter.

The relative performance of most cyclical industries is turning up, which is the equity market’s signal that a soft landing is ahead.

Commodity prices are showing signs of recovery. More importantly, industrial commodity prices are turning up, which are signals of probable global cyclical strength.

Across the Atlantic, the Euro STOXX 50 has broken out to a new high. The UK’s FTSE 100 is holding above both its 50 and 200 dma.

Short-term cautious

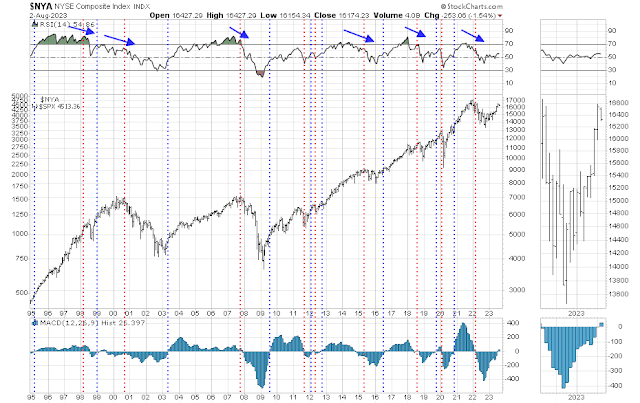

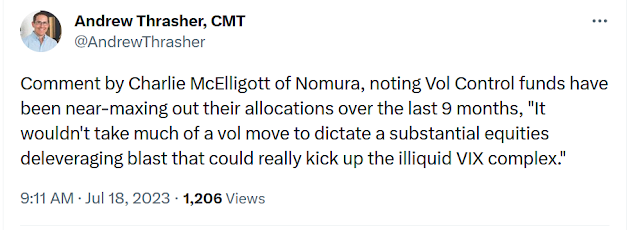

While the intermediate trend appears bullish, stock prices can pull back 5–10% at any time in the short term. The market is technically extended and sentiment is extremely frothy.

Even though breadth has begun to broaden, readings are still not confirming the strength in the S&P 500. To be sure, the S&P 500 has made a new recovery high, but the equal-weighted S&P 500, the md-cap S&P 400 and the small-cap Russell 2000 are struggling below key resistance levels.

Sentiment also looks a little giddy. ETF flows indicate a FOMO buying stampede. While this is not an immediate actionable sell signal, it is nevertheless an indication that the market can pull back at any time.

The National Association of Active Investment Managers (NAAIM) conducts a weekly survey of RIAs who manage individual investors’ funds. The replies allow for extreme opinions, from levered short, exposure of less than -100%, to levered long. The latest results show an average NAAIM Exposure of 100%, or a levered long.

The survey also discloses the minimum, maximum, first, middle and bottom quartile exposures. The latest readings show a minimum exposure of 31%. In other words, the most bearish respondent is bullish, and this is the third consecutive week that the minimum exposure has been positive. An analysis of the history of NAAIM data shows only four instances of three consecutive positive readings, which is too small a sample size. However, a study of two consecutive positive readings showed 21 instances of two consecutive positive readings. The average one-week forward S&P 500 return in those cases was -0.2%, compared to 0.2% in all instances. The four-week forward return was -0.3%, compared to 0.5% in all cases.

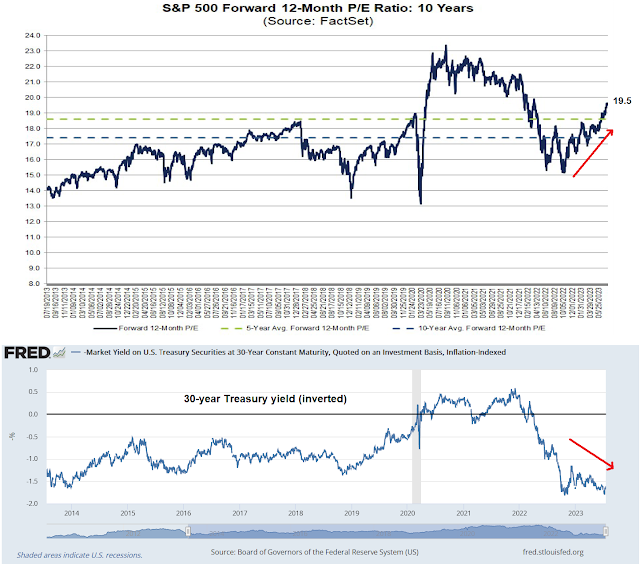

The reports from Q2 earnings season were mixed. With 51% of the S&P 500 reported, the EPS expectations beat rate is above the 5-year average but the sales beat rate is below. One constructive development is the resumption of upward revisions in forward 12-month EPS estimates.

As a consequence of the mixed beat rates, the price response to positive EPS surprises have been wobbly.

In conclusion, my Trend Asset Allocation Model has turned bullish, which is a signal for long-term investors to raise their equity allocations. However, the short-term outlook is less certain and the market can correct at any time.

From a big picture perspective, hers’s how I reconcile bullish and bearish outlooks in different time frames. The percentage of S&P 500 stocks above their 200 dma has risen strongly to above the 75% level (top panel, red line), which is a sign of positive price momentum. But momentum isn’t strong enough to take the indicator to over 90%, which is a “good overbought” condition that was a signal of sustained market advances in the past. This “in between” level of between 75% and 90% has shown a hit-and-miss record. The market has continued to rise at times and shown choppy in a sideways patterns during other periods.

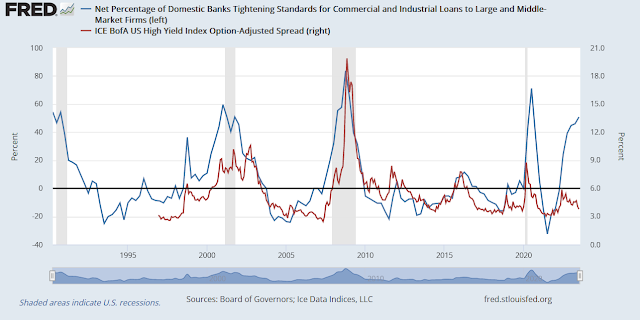

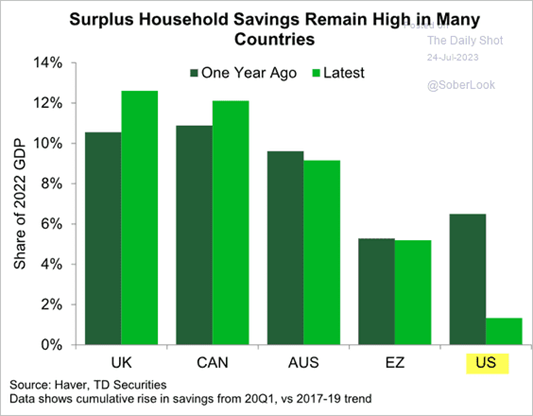

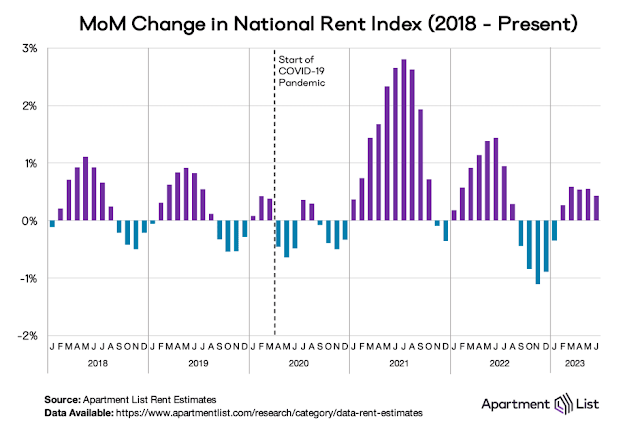

I conclude from this analysis that the intermediate-term risk/reward is bullish for equity prices, but not so bullish to signal a hyper-aggressive posture. If history is any guide, stock prices should rise steadily from current levels. While garden variety 5-10% corrections are to be expected, the tail-risk of a drawdown of over 20% is greatly diminished. Nevertheless, investors should be aware of the key risks of a credit event should the economy weaken into recession, stagflation risk should the Fed fail to bring inflation under control, and decoupling risk if Sino-American relations deteriorate further in the 2024 election year.

My inner investor is beginning to shift his equity allocation from a neutral to an overweight position. My inner trader is on the sidelines. The market is too overbought and extended to take action without a downside break. He’s waiting for the proverbial fat pitch to take a position.