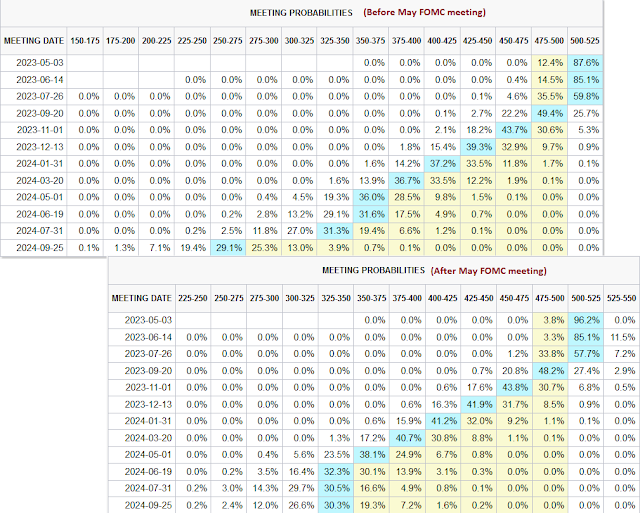

Mid-week market update: As expected, The Fed raised rates by a quarter-point and hinted that it will pause rate hikes at the next meeting, but underlined its conviction that it will not cut this year. Fed Funds expectations are largely unchanged after the meeting. The market is expecting a pause and cuts later this year.

The gulf between the market’s expectations and the Fed’s messaging isn’t closing. As we proceed into summer and early fall, every meeting that the Fed doesn’t cut and maintains its higher for longer narrative will amount to a tightening of expectations for the market. And that’s not equity bullish.

Why the Fed will or won’t pivot

Former Fed economist

Claudia Sahm recently explained the three reasons why the Fed won’t pivot to rate cuts this year:

No one wants to be Arthur Burns.

Current Fed officials experienced the 1970s and early 1980s firsthand.

Inflation is persistent and won’t slow fast enough to declare victory this year.

Here is the one reason why the Fed might cut. A recession that highlights the Fed’s dual mandate of price stability, which it is mainly focused on today, and full employment (and financial stability).

While the disconnect between the fixed income market and the Fed’s message is problematic, the disconnect that the stock market has with the macro picture is even worse. The bond market is discounting a recession that forces the Fed to cut rates later this year. The stock market is discounting a soft landing. Under a soft landing scenario, meaningful rate cuts are unrealistic. If rates were to fall and there is a recessionary hard landing, the economic contraction will put downward pressure on sales and margins, which is bearish for stock prices.

In effect, stock market bulls are wrong either way. If there is a soft landing, rates will stay high and P/E ratios, which are already historically elevated, will have little room for expansion. By contrast, the equity bull case under a hard landing that’s attributable to falling rates is equivalent to dancing on your front lawn as your house burns down because you got to collect on your insurance.

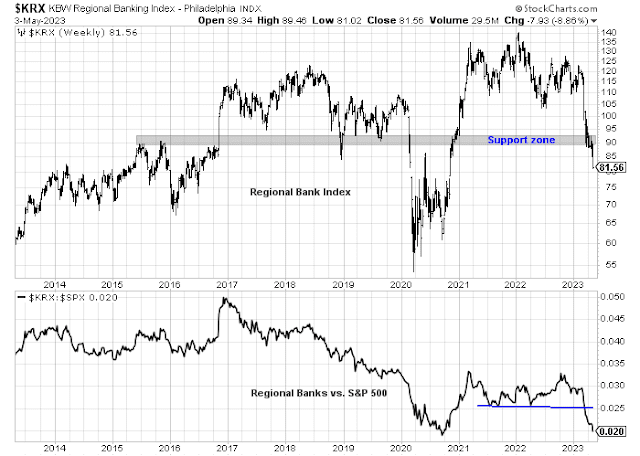

Banking crisis not over

When SVB collapse, I wrote that one of the pre-conditions for a resumption of the bull phase is stabilization in regional bank stocks. On the day that JPMorgan bought First Republic Bank, the KBW violated a long-term support level and regional banking shares are continuing to weaken. While the Fed has made noises about supplying liquidity to the system to ensure banking stability, regional banks have not found a bottom yet.

Much depends on the perception of Fed policy. That’s because banks, in general, are borrowing short and lending long. The persistent inversion of the yield curve is hurting bank profitability, large or small.

My inner trader is maintaining is short position in the S&P 500. The usual disclaimers about my trading positions apply.

I would like to add a note about the disclosure of my trading account after discussions with some readers. I disclose the direction of my trading exposure to indicate any potential conflicts. I use leveraged ETFs because the account is a tax-deferred account that does not allow margin trading and my degree of exposure is a relatively small percentage of the account. It emphatically does not represent an endorsement that you should follow my use of these products to trade their own account. Leverage ETFs have a known decay problem that don’t make the suitable for anything other than short-term trading. You have to determine and be responsible for your own risk tolerance and pain thresholds. Your own mileage will and should vary.

Disclosure: Long SPXU

DO ‘THEY” RING A BELL AT THE TOP?

I had two “tells” that were supposed to help me trade the short side aggressively. One was Tesla which has broken down (207 to 166) and the other is the Semi-Conductor Index – SMH. I would watch the poster child stock which is showing the excess and exuberance – NVDA. In my opinion when it breaks the trend should be down on an intermediate basis.

I felt that Chair Powell’s presser was more hawkish than dovish. He pretty much quashed the notion of rate cuts for now and sees the two issues of bank stress and inflation as more or less separate.

More bearish now than before the decision and added to SPXU.

One has to love old fashioned sayings, some are classic for a reason, that being the wisdom they have.

“Actions speak louder than words”. Of course he will speak hawkish, he wants to fight inflation, whether he will succeed or not is another matter. At this point if he even coos like a dove, things will go nuts. But what will they do when something makes broken noises? They will pivot because it’s going to save us lol.

What bothers me is the bearish sentiment. Gold on the other hand everyone says to buy, well almost everyone. Today it took out the recent high at 2063 but has made a long upper shadow which with all the bullish sentiment makes me think of a near term top.

I have a put call on SPXS, but I confess I have no clue where the market will be next week, next month, next year. How they will get past the refinancing of loans for zombie corporations is beyond me…suspend mark to market, Fed backstopping, I dunno.