Preface: Explaining our market timing models

- Ultimate market timing model: Sell equities

- Trend Model signal: Neutral

- Trading model: Bullish

Update schedule: I generally update model readings on my site on weekends. I am also on Twitter at @humblestudent and on Mastodon at @humblestudent@toot.community. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

Sell in May?

The big picture

Let’s begin by stepping back and analyzing the “big four” factors used by Fama and French to explain equity returns, namely price momentum, quality, size, and value and growth. The accompanying chart shows the returns of these four factors in the last 10 years. Here are the main takeaways:

- Price momentum peaked in early 2021 and has been falling ever since.

- Quality troughed in 2022 and began to rise in a choppy manner.

- Returns to size (small caps) dropped sharply in 2023 as large caps outperformed.

- Value bottomed against growth in early 2022, but fell in 2023 as FANG+ recovered.

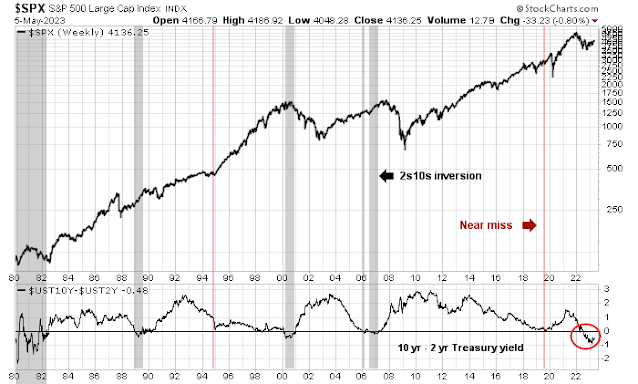

The past behaviour of the 2s10s yield curve is instructive from a top-down perspective. While an inverted yield curve does serve as a warning, the S&P 500 tended to top out when the yield curve began to steepen after an inversion event.

The recent banking regional banking crisis is an equally concerning market signal. Past instances of violations of relative support for bank stocks have marked major market tops, especially if bank relative performance is plummeting as it is today.

Narrow leadership

A comparison of the S&P 500, which is float-weighted, the equal-weighted S&P 500, the mid-cap S&P 400, and the small-cap Russell 2000 shows how leadership has become concentrated in the largest stocks. All of the other indices are weaker than the S&P 500 at a key support level last week.

The week ahead

While we are cautious about the intermediate-term outlook, the tactical picture turned bullish. Two of the four components of my bottom spotting model have flashed buy signals. The VIX Index closed above its upper Bollinger Band and the NYSE McClellan Oscillator fell below -50, both of which indicate oversold conditions. In the past, two or more simultaneous buy signals from the bottom spotting model components have tended to mark entry points for the S&P 500 on the long side with strong risk/reward ratios.

According to FactSet, the results from Q1 earnings season have been very strong. With 85% of the S&P 500 having reported results, 79% of companies beat EPS expectations compared to a 5-year average of 77%, and 75% of companies beat sales expectations, compared to a 5-year average of 69%. Consequently, forward 12-month EPS estimates have been rising.

Keep an eye on the regional banking stocks, which have become the focus of the latest pullback scare. The bears will point out that the KBW Regional Banking Index violated a long-term support zone and blew past an important Fibonacci support retracement level with no support in sight (top panel). The bulls’ only hope is the group finds footing at or near relative support (bottom panel). Until these stocks find their footing, the path of least resistance for the market will be down.

While the short-term buy signal from the Bottom Spotting Model is tactically constructive, the bulls shouldn’t overstay their welcome. The S&P 500 bounced off short-term support last Thursday while exhibiting a positive RSI divergence, but it’s still in a trading range. Expect stiff resistance at about 4180,

I would like to add a note about the disclosure of my trading account after discussions with some readers. I disclose the direction of my trading exposure to indicate any potential conflicts. I use leveraged ETFs because the account is a tax-deferred account that does not allow margin trading and my degree of exposure is a relatively small percentage of the account. It emphatically does not represent an endorsement that you should follow my use of these products to trade their own account. Leverage ETFs have a known decay problem that don’t make the suitable for anything other than short-term trading. You have to determine and be responsible for your own risk tolerance and pain thresholds. Your own mileage will and should vary

I worry about the regional banks. They are stuck with long term assets and short term liabilities. Nothing they can do about that. It makes me think of how much easier it is to go into debt than it is to pay debt off. I think the same applies to rates, it’s much easier to lower them than to raise them. If things get bad, what will they do? I get making bonds valued at par, but what about commercial real estate, mortgage loans?

When money can be moved out of banks with a click can contagion spread like wildfire? They can always lend the banks 50 trillion interest free to make them solvent until the dust settles, but this only would lay the ground for more moral hazard.

Economy is definitely slowing. One Walmart store I regularly go to for medication and hygiene products saw dramatic slowdown in customer traffic. I usually come in at 9pm on Saturdays. It is routinely packed. What I saw last month is sparse traffic. I befriended a few workers there and they told me my observation is valid. Let’s see what WMT will say on earnings report the week after next.

Commercial RE is definitely a problem. In 2009, at the depths of GFC repercussion I bought a machine shop in the old downtown SJ nearing old KNTV station location at a bargain price. The area had been zoned for industrial use ever since SJ became a city. It has had car shops, machine shops, canaries, etc. I converted my shop into a hybrid lab for R&D purpose, and really enjoyed working there and with friends around. A few years ago Google decided to construct an 80-acre complex in downtown SJ dubbed Google West. They were buying properties left and right to clear that space. They contacted me several times for a purchase. And suddenly I was informed early this year that they are not buying my shop space anymore because their pet project is now on hold indefinitely. Now that area becomes an eye ore since the initial work has started a year ago and stopped late last year. But I am happy with my shop still. In early 2000s Cisco announced they will expand big time in the Coyote Valley area of SJ. Cisco today has one third of the market cap back then. Coyote Valley is still undeveloped and very beautiful. But there is one entity coming and with a fat wallet. That is Mormon Church. They have a project to establish a mega church in SJ. Coyote Valley is the only place with that much space. Don’t know how to make of this grand church, but I can imagine Google going the same fate as Cisco. Cisco is today a legacy tech company with stable rev and dividend and that’s it. Google might be worse off because their rev is basically ads.

So follow Hemingway. It goes slowly and then suddenly.

Why in this scenery the Trend Model hasn’t been downgraded from neutral?

The Trend Model inputs are purely price based. THe market is stuck in a trading range. Why should it turn bearish?