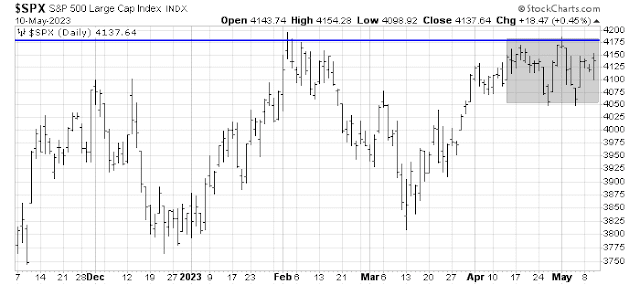

Mid-week market update: The S&P 500 remains mired in a trading range, and neither the bulls nor the bears can gain the upper hand.

Here are the bullish and bearish reasons why the market can’t break out of that range.

Bull case

Part of the bull case rests on excessively bearish sentiment. The Barron’s Big Money survey of U.S. institutional investors shows a crowded short reading, which is contrarian bullish.

As well, consider hedge fund positioning. Discretionary funds (dark blue line) are also in a crowded short, but systematic (light green line) funds, which are mainly the trend followers, have been buying the market and they are roughly neutral. Any bullish catalyst could spark a FOMO buying stampede.

While excessively bearish sentiment can put a floor on stock prices, an unexpected bullish factor has appeared – insiders. Insiders have been tactically very good at timing short-term market bottoms in the past year, and the latest readings show net insider buying, which is a buy signal.

In the short run, regional banking shares can’t seem to stabilize themselves, indicating that the slow motion banking crisis remains a problem in the eyes of investors. The KBW Regional Banking Index violated a long-term support zone, with no Fibonacci retracement support underneath the index. The only hope that bulls can hope for is the group holds relative support at the 2020 lows (bottom panel).

So where does that leave us?The market stuck in a tug-of-war between the bulls and bears with neither side gaining the upper hand. I believe that the odds are starting to favor an upside breakout of resistance at about 4180 in the coming weeks, sparked by a positive surprise such as a debt ceiling deal, followed by a blowout top and bearish collapse.

My inner investor is neutrally positioned at about the equity and bond weights specified by his investment policy statement. My inner trader is tactically long the S&P 500. He will evaluate his position should the S&P 500 test resistance at 4180. The usual disclaimers apply to my trading positions.

I would like to add a note about the disclosure of my trading account after discussions with some readers. I disclose the direction of my trading exposure to indicate any potential conflicts. I use leveraged ETFs because the account is a tax-deferred account that does not allow margin trading and my degree of exposure is a relatively small percentage of the account. It emphatically does not represent an endorsement that you should follow my use of these products to trade their own account. Leverage ETFs have a known decay problem that don’t make the suitable for anything other than short-term trading. You have to determine and be responsible for your own risk tolerance and pain thresholds. Your own mileage will and should vary.

Disclosure: Long SPXL

Rather than trying to make an educated guess which way the market will breakout of this trading zone I am looking for “tells”. Historically when the market is held up by a few stocks it is not good sign of strength. Today, the Nasdaq way out performed the various other indices. Dow Jones, which represents the old line companies (except for apple) is the weakest. We need to see a break in one of the leaders before the trend changes. I am yet leaning to NVDA because the Semi-Conductor Index is weak. In the mean time I have just about stopped trading. This is chop city and one can lose a lot of money as the market goes back and forth.

NVDA is also the top holding of all those robotics/AI ETFs. These ETFs are in strong uptrend, e.g. BOTZ. Many areas of the Market are also in nice uptrend. A generic example: XLK, and many individual names.

Debt ceiling agreement would not exactly be a surprise, no deal would and then lookout below! I think the bank problems get worse each day and odds are something will break.

Copper is not that strong either.

How much of the floor is shorts covering?

Will they be able to push the shorts enough to get an upside breakout before it all goes to hell? I dunno, but yes it is annoying to see it moving your way and then reversing.

A case can be made for a rising wedge from the Oct lows, it would target approx 3000 which is a number bandied about by some. If price breaks 4000 decisively then that would be breaking out of that pattern.