Mid-week market update: There is an adage on Wall Street, “Bulls, make money, bears make money, hogs just get slaughtered.” I issued a tactical buy signal to subscribers on the weekend based on my usually reliable S&P 500 Intermediate-Term Breadth Momentum Oscillator (ITBM). ITBM flashed a buy signal as of the close on Friday when its 14-day RSI recycled from oversold to neutral.

Now that the stock market is rallying, how greedy should you be? One guideline to consider is, after an ITBM buy signal, the percentage of S&P 500 above their 20 dma generally reaches at least 60%, if not more, before the rally peters out. (Note one-day data delay on % above 20 dma).

Still range-bound

This will be a relatively brief note as the technical structure of the stock market is mainly unchanged since my last update on the weekend. The S&P 500 is still range-bound. Support can be found at the falling trend line at about 3800. Initial upside resistance is at about 4080, with secondary resistance at about 4150.

Before you get too bullish, let’s takeone step at a time. The daily chart of the S&P 500 shows that the index is just testing its 50 dma level, and there is a resistance zone just above the 50 dma. Net NYSE highs-lows have barely turned positive. While that is constructive, it’s no reason to throw caution to the wind and get all bulled up. Tactically, long exit triggers to consider are 1) percentage of S&P 500 above their 20 dma above 60% (almost), or 2) the VIX Index reaches to bottom ot its Bollinger Band (not yet).

Inflation will set the tone

Keep in mind that we will see the report of February PCE, which is the Fed’s preferred inflation metric, Friday morning and the report will be a potential source of volatility and it will set the tone for the market next week.

The Cleveland Fed’s Inflation Nowcast tool is in line with consensus cover PCE expectations of 0.4% month/month and 4.7% year/year.

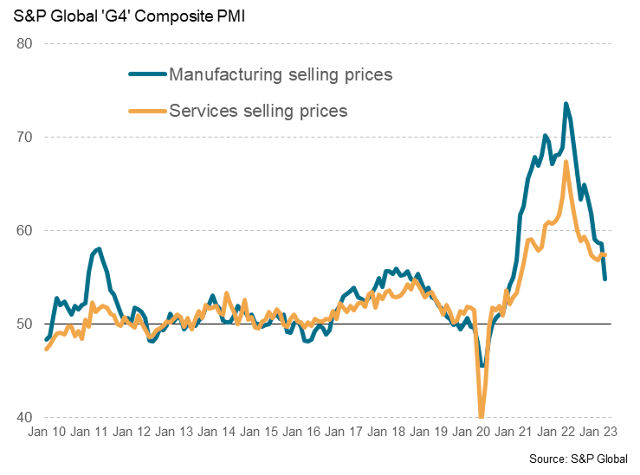

S&P Global (formerly IHS Markit) reported that G4 goods inflation has been falling, but services inflation, which is a metric that the Fed is watching closely, was stubbornly strong in March.

My inner trader remains tactically long the S&P 500, but he is inclined to either reduce or exit his position tomorrow (Thursday) ahead of the PCE report, especially if the market exhibits any bullish follow-through. The usual disclaimers apply to my trading positions.

I would like to add a note about the disclosure of my trading account after discussions with some readers. I disclose the direction of my trading exposure to indicate any potential conflicts. I use leveraged ETFs because the account is a tax-deferred account that does not allow margin trading and my degree of exposure is a relatively small percentage of the account. It emphatically does not represent an endorsement that you should follow my use of these products to trade their own account. Leverage ETFs have a known decay problem that don’t make the suitable for anything other than short-term trading. You have to determine and be responsible for your own risk tolerance and pain thresholds. Your own mileage will and should vary.

Disclosure: Long SPXL

The adage has merit. Hogs likely over leverage, or ignore position size wisdom. But the opinions of many are based on outcomes, so if I buy a stock at 1 and sell at 10 and it goes to 100 they will say I sold too early, if at 10 I hold it and it goes back to 1, then I held it too long. I doubt that when Soros made 1 billion in a day on the pound that he was careful about position size . Buying and selling in tranches is a good idea but the greedy little demon in our heads can interfere. I think the important thing to remember is that there are and will be many many setups in the market. Greed begets fear. What is it that one fears that makes one greedy?

Many traders will sell part of a position and book profits and let the winners run. Another time honored technique is “trail stops”. Trail stops are not perfect, and can be subject to whipsaws. Personally, I use Technical analysis, again not perfect, but has saved me many times. Cam has excellent TA.

The Banking crisis has almost certainly baked a recession. The only issue outstanding is it enough to keep the Federal Reserve from tightening further. If we are in for a hard landing than the Nasdaq is way ahead of itself. My ‘tell’ this time around is TSLA. If it drags in this rally, I would be confident that things are not going to be easy and will trade it from the short side.

Friday should be interesting one way or the other.