An unusual anomaly arose during the latest banking crisis when a long-standing historical relationship broke apart. When bank stocks skidded in response to the problems that first appeared at Silicon Valley Bank, the 2-year Treasury yield fell dramatically, indicating a rush for the safety of Treasury assets. What was unusual this time was the weakness in the USD. The greenback has rallied during past financial scares and crises as investors piled into the safety of the USD and Treasury paper. This time, Treasuries did reflect a flight to safety, but not the USD. As the USD has been inversely correlated to the S&P 500, and the dollar can’t advance even with the macro tailwind of a banking crisis, what does this mean for asset returns?

The long-term picture

Let’s start with the long-term view. The 20-year chart of the USD shows that it has retreated to test a support zone that stretches back to 2015. If it were to break support – the next support level can be found at just under 90 – it would spark a secular bear phase and the dollar could face considerable downside potential compared to current levels.

What would a break of support mean for asset prices in the next market cycle? While correlation isn’t causation, the relative performance of the S&P 500 against MSCI EAFE has been highly correlated to the USD Index. Will dollar weakness mean better relative returns for non-U.S. equities?

To be sure, the relative forward P/E valuation of different regions argue against U.S. equities.

If the USD were to fall into a secular bear phase, one asset that is likely to benefit is gold, which has historically been inversely correlated to the dollar. Gold prices staged an upside breakout from a multi-year base in 2020. If the greenback were to weaken further here, it would represent further tailwinds for the yellow metal.

The measured upside on a monthly point and figure chart of gold is $2,779, though that represents a multi-year target and it’s unlikely to be reached in the immediate future.

A cyclical Warning

One word of warning. There is one negatively correlated asset to the USD that is flashing a cyclical warning. In addition to gold, commodity prices have also been historically inversely correlated to the dollar. But the two assets started to diverge in mid-2021.

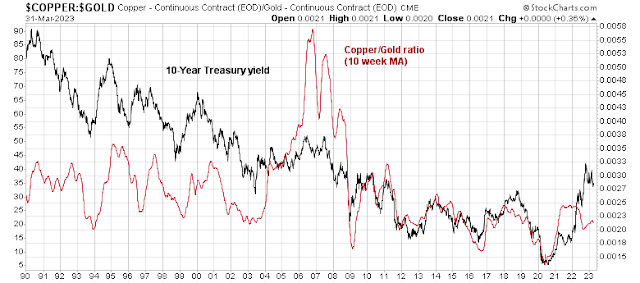

I attribute this to a sign of global cyclical weakness. The decline in the cyclically sensitive copper/gold and base metals/gold ratios is a sign of economic weakness. Economic weakness is also foreshadowing a reduction in risk appetite, as measured by the stock/bond ratio.

A similar relationship can be found between the copper/gold ratio and the 10-year Treasury yield. Weakness in cyclical indicators like copper/gold point to lower bond yields and a probable recession ahead.

In conclusion, the USD Index is on the verge of breaking long-term support. If it does, it would have multiple implications for asset class returns:

- Bullish: Non-U.S. compared to U.S. equities.

- Bullish: Gold.

- Bearish: Near-term economic outlook. Commodity prices are sounding a warning that a recession is likely ahead, which would be bullish for Treasuries and bearish for cyclically sensitive assets like commodities.

Excellent narrative. Thanks.

“Near-term economic outlook. Commodity prices are sounding a warning that a recession is likely ahead, which would be bullish for Treasuries and bearish for cyclically sensitive assets like commodities”.

Sure, the short end of the curve should rally if there is near term uncertainty in the US (led by a recession, budget battle looming around June, banks that are waving a yellow flag etc.).

What would be the implication for the long end of the yield curve? Would the entire yield curve decline if the short end were to rally?

You are likely like me watching the bank ETFs not rallying much after plunging 25% overnight. They are staying down as the rest of the market is rising and ignoring their downfall. This feels very weird and makes me expect markets to fall. That is my experience of previous bank crises talking. Every bank crisis has accompanied a bear market in stocks. All the literature says they are the lifeblood of the economy. But this banking fiasco is different.

I constantly refer to the quote taped to my computer, “We can’t rely on precedent when everything is unprecedented.”

The cause of the current bank crisis is unprecedented. I read a great background article on how this evolved. First, when COVID hit in 2020, the Treasury mailed out helicopter money to everyone. The economy was shut down making spending it difficult so it ended up in bank accounts instantly ballooning cash in banks. Nobody was borrowing so the banks bought government bonds to earn a bit on this ocean of cash. Another wave of helicopter money hit with Biden’s gift to citizens.

All of the bonds the banks bought went underwater as government bond yield rose and their prices plunged. The is bad for banks but manageable as long as depositors left their cash in accounts. But high short term rates have clients buying high yielding short term instruments and drawing down their bank accounts.

All this to say, for the first time in history, the banking crisis was NOT about a recession hitting bank customers who then default on their loan payments. It was only about huge, unprecedented shifts in government fiscal and monetary policy.

The banking industry will be saddled with higher costs going forward and this makes their current performance very logical.

The rise in the rest of the market makes sense when investors are realizing the bank stock crash doesn’t indicate an economic crash. Plus we have interest rates falling because investors are misunderstanding the situation is different from past bank crashes.

Powell says that credit tightening will weigh on the economy and recession indicators have uniformly risen to almost a 100% chance of a recession soon. This might not happen, once again because this is all new. The recession alert indicators are based on long history. Time are now unprecedented.

In reality, the measures taken to liquify the banking system have released HUGE amounts of possible lending power. The new rescue policy says Fed will take any bank’s heavily discounted bonds owned as collateral at face value, not market value and give a bank cash. At first, this might only be used to replenish deposits leaving a bank but it could be used above that need to grant more loans that have a higher profit than the government bond interest.

The US economy was not in recession when the Fed policy banking crisis hit. The huge drop in interest rates accompanying it will stimulate the economy making it harder to keep inflation down.

The Fed shouldn’t be pausing until there is real weakness in the economy. If they misinterpret the banking crisis and stop the fight on inflation too early, it will set inflation on a long-term higher trajectory.

The stock market reaction when looked at this way is not weird. It’s totally logical.

All the cross currents in the market makes one head spin. There has been a flight to quality stocks, the usual suspects: AAPL, MSFT, NVDA etc.. I read somewhere that these 5 stocks have carried the indexes higher while the more broadly based indexes are dragging.

What we know is that in most cases trends persist. As of now gold is in an uptrend and dollar is in the early stages of breaking down. Extending the thought process forward: if gold is a refuge against a weak dollar and inflation, than inflation is going to persist.

That is the reason I suggested gold in an earlier posting.

Looking ahead, my personal feeling is that we are definitely going to have a recession. The question is the depth and severity. As a trader I look for market based stocks or indexes to confirm my bias. So, if we are going to have a recession, Tesla and the Semi-Conductor Index (SMH) should breakdown soon or show signs of weakness.

Thank You Ken for posting your detailed analysis. I find them well reasoned and informative.

Bank runs now is not a concern anymore after Fed and treasury backstopped the deposit. In the process Fed created a decent amount of money out of thin air.

Meanwhile as of this week money market fund has USD$5.1T and counting. It is overwhelmingly in T-bills at IR at least 4.5%. So another large sum of money has to be created to pay the yield.

After all of this more regulations are to be piled on banks, and banks themselves have reduced dramatically C&I loans, not expanding them. Last week numbers of C&I loans (this is banks’ bread and butter) have plunged at a speed never seen before. This definitely will lower GDP. So banks now are not investable because they can make money on both fronts.

But there are other factors currently affecting economy in a big way most people are not paying attention to but all corporates and big money have started their moves: mainly generative AI and their incorporation into our economy.

Immediate investment implications: gold up, dollar down, IR down, big tech up. Nvidia has a chance to become a very very big cap company.

Does the recent stock market reaction make you think we are in “winter” still?

Is it hubris or plain stupidity. Congress has abandoned fiscal restraint for decades, opting to paper over the deficits. Solvency of the sovereign is considered a non issue. Of course the rest of the world will send their resources and products to us for our paper.

The Fed also thinks it can do whatever and handle all the consequences.

Maybe I’m too hard on the Fed because they have to react in large part to conditions created by congress.

Oh, and now if you oppose us you can’t use our money. As if nobody noticed that.

If the dollar devalues which makes sense given the trade deficits and continued fiscal deficits, then real things like gold and commodities should eventually go up. Admittedly in a recession consumption drops and so prices of the related commodities go down, but America is no longer the global engine it was, so if the recession is not global there could be a bid for commodities ex-USA. The question of course is “what happens to profits?”

We all wish to avoid holding equities during the trip down the elevator shaft, but it is instructive to look at a 50 year chart of the S&P. Can you see that historic drop in 1987? Moral of the last sentence is “If you get caught off guard and you have stock of well run companies and the market is down 50%, don’t sell, the worst is over. Selling at the bottom is a classic mistake.” The really hard part is knowing to get out when it is only down 10%, which is basically impossible for most of us and this leaves us with risk management which emotionally is less gratifying than winning while over leveraged, but far safer.

Cam, what do you think are the implications of the vast expansion of the rrp by Money Market Funds besides the hoovering of deposits? If you have some good references or reads to recommend that would be great.