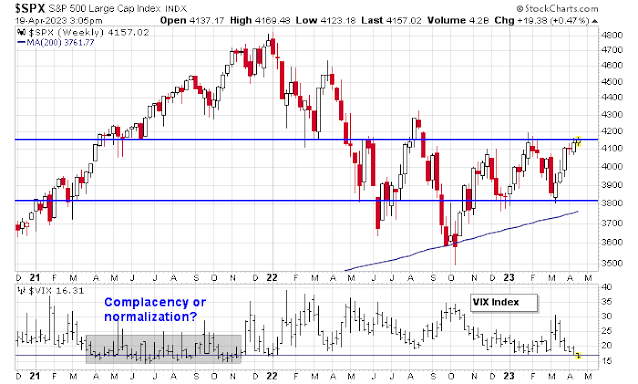

Mid-week market update: I am publishing this note slightly early today as I have an appointment just after the market close and the prices on the charts will not be today’s closing prices. As the S&P 500 struggles with overhead resistance, I would like to offer some words of warning for equity bulls. The VIX Index has returned to levels not seen since November 2021, before the market topped out. Is that a sign of complacency, or normalization?

As a reminder, November 2021 was just before the onset of the omicron variant, and the retirement of the transitory language by the Federal Reserve. While this doesn’t mean that the market will necessarily fall immediately, it does indicate a possible precarious backdrop and an accident waiting to happen.

As well, cross-asset volatility has dropped to a 14-month low.

Negative divergences

From a technical perspective, the S&P 500 is struggling with a resistance zone, but the 5-day RSI and NYSE McClellan Oscillator (NYMO) are exhibiting short-term negative divergences. Even though the percentage bullish and percent of S&P 500 above their 50 dma are positive in the same short-term time frame (dotted arrows), they are also showing negative divergences when compared to the peak in early February (solid arrows).

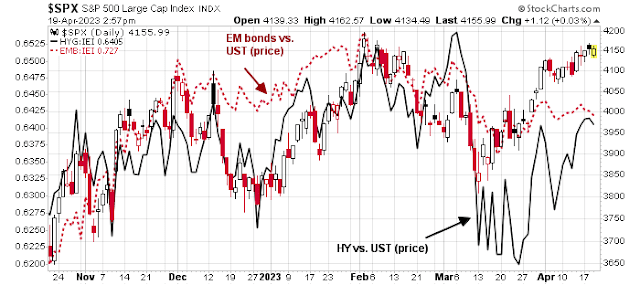

Similarly, equity risk appetite indicators are also exhibiting negative divergences.

So are credit market risk appetite indicators.

The debt ceiling landmine

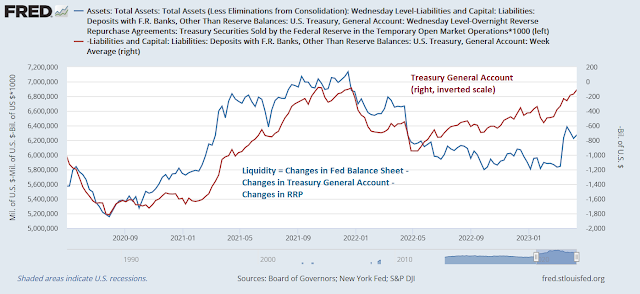

In addition, market anxiety over the debt ceiling is already rising as Treasury approaches its X date when it has exhausted its extraordinary measures.

Ironically, one of the extraordinary measures is supporting stock prices. That’s because Treasury is drawing down its account (TGA) at the Fed – sort of like taking cash out of your bank and spending it. This has the effect of injecting liquidity into the financial system, which supports the price of risky assets.

The vast majority of respondents of the BoA Fund Manager Survey expects that the debt ceiling will eventually be resolved, and that is certainly the market consensus. Once the debt ceiling is lifted, the US government will start to borrow again. Debt issuance will have the effect of soaking up liquidity. Moreover, the U.S. Treasury will undoubtedly try to build up its TGA balance, which also withdraws liquidity from the system. These measures will create headwinds for stock prices.

Don’t expect a crash

Putting it all together none of my analysis means that the market is about to crash. It’s only been about a month since the failure at Silicon Valley Bank sparked a banking crisis. Stock prices have rebounded strongly, but the market suffered considerable technical damage from that mini-panic. Expect a period of sideways choppiness and consolidation before stocks can sustainably rally (see Assessing the technical damage).

Fortunately, regional bank stocks, which was at the epicentre of the panic, are holding support and exhibiting a series positive RSI divergences, which is a positive sign.

Sometime in March (don’t remember the exact date) I had suggested to watch TSLA and the Semi-Conductor Index to show signs that the market was being affected by recession fears. Today, TSLA is 34 points lower from the high after reporting earnings. SMH is being held up NVDA. I would watch it for the other shoe to drop. It is just a matter of time in my opinion.

In the interest of full disclosure I do trade the stocks and direction (long or short) in my postings.

FYI:

TSMC, the leading chipmaker for the likes of Apple and Nvidia, has warned that a weaker than expected recovery in China has hit demand for its semiconductors. The Taiwanese chipmaker cut its forecast for the semiconductor market this year, excluding memory, to a mid-single-digit percentage decline. FT