In response to the recent financial turmoil, Fed Funds futures is discounting a 25 bps hike at next week’s FOMC meeting, followed by a brief peak and rapid rate cuts for the rest of the year.

Are those market expectations realistic? How will the Fed navigate between the Scylla of inflation and Charybdis of financial stability and recession?

Anatomy of a banking crisis

The responses to the collapses of Silicon Valley Bank and Signature Bank were swift and clear. The response has three legs, as outlined by this

joint press release from the Fed, Treasury, and FDIC.

First, the FDIC invoked the systemic risk exception to protect all deposits of the troubled banks. On the other hand, shareholders and bond holders had to take their lumps. This allows the deposit insurance fund to cover any gap between the funds obtained from the problem bank’s assets.The deposit insurance fund was refilled with a bank levy and therefore there is no cost to taxpayers.

As well, the Fed reduced haircuts on collateral offered at the discount window, making it an easier way for banks to obtain funding from the Fed in the event of deposit withdrawals. More importantly, the Fed and the Treasury used their 13-3 emergency authority to create a new bank funding facility called Bank Term Funding Program (BTFP). The BTFP allows the Fed to lends against Treasuries and Agencies for a year, a longer term than the discount window, at par, which is a generous term as the market usually prices such securities at a discount to par.

Just when the authorities thought banking jitters were over, the Saudi National Bank, which is the largest shareholder of the too-big-to-fail Credit Suisse, announced that it would not inject any more capital into the troubled Swiss institution. The announcement sparked another risk-off stampede in European banks. At the height of the panic, the one-year CDS of Credit Suisse was trading at levels last seen in Greek banks at the height of the Greek Crisis. The crisis stabilized when the Swiss National Bank, Switzerland’s central bank, said that it would step in and provide support to Credit Suisse “if necessary”. Finma, the Swiss financial regulator, also issued a statement certifying that Credit Suisse “meets the higher capital and liquidity requirements applicable to systemically important banks”.

Still, the financial contagion wasn’t over. In the US, First Republic Bank fell victim to deposit flight. The panic briefly paused when a consortium of 11 banks agreed to deposit $30 billion for First Republic for at least 120 days.

The worst of the storm may have passed. From a technical perspective, the KBW Regional Banking Index found some footing at a long-term support zone).

The inflation problem

That’s not the whole story. The fragility of the banking system makes the Fed’s price stability mandate far more complicated. Inflation is still too high and the Fed needs to bring it back down to its 2% target.

The latest CPI report presented a good news, bad news story on inflation. Core CPI came in ahead of expectations. As the accompanying chart shows, goods inflation has been decelerating sharply but most of the strength has been in services (blue bars).

New Deal democrat argued that “Properly measured, consumer prices have been in deflation since last June “. He highlighted the lagging nature of Owners’ Equivalent Rent (OER), the major component of shelter CPI, as house prices tend to lead OER by 12 months or more. After making all the adjustments, NDD concluded:

If we substitute the FHFA house price index for OER, headline CPI would have been down -1.4% as of December (since that is when the reported FHFA data ends).

That’s the good news. The bad news is goods disinflation is abating. Excessive inventory has been worked off. Inventory/sales ratios have normalized after the COVID Crash and retailers are not as compelled to offer large discounts to sell their goods. As well, used auto prices, as measured by the Manheim Used Vehicle Index, has risen for three consecutive months.

Even more problematic is the tight labor market. The Atlanta Fed’s wage growth tracker shows a welcome deceleration in wage growth, but readings are still too high at 6.1%.

Further analysis beneath the hood shows signs of a tight labor market. Job switcher salary increases are strongly outpacing the raises of job stayers, indicating strong worker bargaining power.

The Fed’s reaction function

The key question for investors is, “What will the Fed’s reaction function be under the current conditions?”

Notwithstanding the fed’s dual mandate of price stability and full employment, the main reason that central banks were created was to ensure financial stability. It rose to the task admirably in this instance. The price was a dramatic pivot in market expectations of monetary easing. Market expectations of a series of rate cuts this year is simply unrealistic in the face of elevated and persistent inflationary pressures.

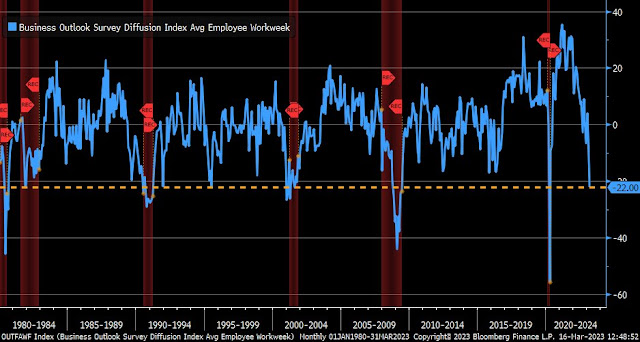

On the other hand, the latest Philadelphia Fed survey is pointing to a slowing economy. The Fed may be tightening into a recession. The average workweek plunged in March.

The new orders component of the survey also skidded to recessionary levels.

The ECB, which is only tasked with only fighting inflation, responded last week with a dovish rate hike. Its benchmark rate rose the widely expected 50 bps, but it withdrew forward guidance on the future trajectory of interest rates. Its statement walked a tightrope between price stability and financial stability.

Inflation is projected to remain too high for too long…The Governing Council is monitoring current market tensions closely and stands ready to respond as necessary…The new ECB staff macroeconomic projections were finalised in early March before the recent emergence of financial market tensions

Will the Fed follow a similar path? The Fed hates to surprise markets, and, if I had to guess, it would raise rates by the expected 25 bps. But that leaves a lot of wiggle room for other actions to address the problems of price stability and financial stability. My base case scenario calls for the Fed to:

- Repeat the mantra that inflation is too high and the Fed is committed to its 2% target.

- Correct market expectations of rapid rate cuts in 2023 with a higher for longer message. All eyes will be on the Summary of Economic Projections (SEP), or “dot plot”, for the likely trajectory of interest rates. Also keep an eye on changes in projected GDP growth as a signal of whether the Fed expects a recession.

- A possible temporary suspension of the shrinkage of its balance sheet, or quantitative tightening,

as a way of ensuring there is plentiful liquidity for the banking

system and underline that it stands ready to provide additional support as needed.

How will the market react? Will it focus on the higher for longer message, which is equity bearish, or the Fed’s readiness to provide ample liquidity to the market as evidence of a Powell Put? Moreover, does the Fed revise its GDP growth projections in the face of the signs of a slowdown?

Stay tuned.

Good post.

If one thinks of the two monsters to slay in terms of ‘time’, financial stability is , imo, a short term challenge for which the Fed has the tools and the willingness to use them as demonstrated last week. Leaving aside CS which has had issues for ever, the liquidity crisis is easier to manage. The issue is not of credit quality but of duration which time itself will help heal.

The inflation is still the six headed snake monster and Fed’s tools are not sophisticated. The market is not giving high probabilities to rate cuts either.

The financial panic has forced banks to re-examine their lending standards and make fewer good quality loans. The high interest rates have made many projects harder to justify. The results will be contraction in economic activity and higher odds of recession sooner than later.

My take on it is the regional banks. If deposits in the systemically important banks are 100% guaranteed, then who will leave more than 250k in the smaller banks unless they too are covered, otherwise expect a lot of stress in 1000s of banks as people pull money out. If all banks are covered then this is worse moral hazard than ever because no bank would be responsible for depositors’ money. Why bother with bank reserves?

What happened during the housing bubble when banks could package their lousy mortgages and get them off their books? Well this will be like “who needs books?”

It is understandable that central banks wish to avoid problems in the economy, but every time they push things back I think it will just get worse.

Once the gold window was closed, congress could spend and spend and we would just print more. Does anyone think that removing responsibility for the deposits in the banks will turn out any better?

This could make equities go higher. It also shines a light on how serious the government is….they folded, not how we expected but by neutralizing the consequences of raising rates for the banks.

In an economy that is 70% service and in debt, higher rates will crush things and when rates come down it is not a sure thing that people will go back to old spending habits.

Well maybe they will change the rules to bail out those 600 zombies in the Russell 3000, who knows.

Interesting times.

Cam,

The FinTwit is drowning in rumors of the coming liquidity to the markets as the Fed/Govt attempt to save the regional banks from bank runs. Of course, this will result in a lot of liquidity to the system.

Any idea on the size of this liquidity and its impact on Bitcoin and gold/silver?

1. Looking for gold to double as first level. Target time is 3 years (perhaps sooner) as the coming money creation will accelerate. Silver is not a good hedge. BTC is an unknown.

2. Commercial RE might get into real trouble. This is the negative feedback loop affecting regional banks most. Lots of new housing projects will be delayed or even cancelled because they are mainly financed by regional banks. So expect chaos in housing markets. Watch home builders and material suppliers price action to confirm the market repricing soon.

Ingjiunn,

Thanks for your response. I agree gold is going higher. Silver and possibly Bitcoin (based on reaction last week) are heading north as well.

I think Powell will likely retract from his tightening campaign in coming weeks and months. Pause hikes and QT, and even supply liquidity to the markets. Fore now, they need to save the banks and the financial plumbing. So, commercial R/E, housing, and related stocks will get a lease on their lives for a few more months.

At some point later this year, he’ll again need to face persistent inflation because of all this QE over the past few years. If the Banking stabilizes, Powell may resume his hiking and QT campaign. That’ll destroy the Commercial R/E and housing, and probably push the economy into a ditch.

Wow! Most of this article went over my head. How can banks increase their uninsured bank deposits on their own? Banks spend a lot of marketing dollars to attract deposits.

https://www.barrons.com/articles/sbv-fed-qe-banking-crisis-22175ec0?mod=read_next

Would appreciate if someone can post a Reader Digest’s condensed version of this article. It seems important enough.

One needs a subscription to rad it!!

Cut-and-paste the URL here

http://archive.is