There were some questions raised about the investability of China last year as regulatory uncertainty rose amidst some market turmoil. Fast forward to today, The MSCI Asia Pacific Index rose 20% from its October low and technically entered a new bull market. Enthusiasm is rising on the prospect of China’s abandonment of its zero COVID policy and reopening its economy.

Emotions can run to extremes. Now that many investors are bulled up again, it’s time to revisit the China investable question.

Evaluating the reopening trade

The term “investable” has many meanings. For traders, the question is tactical. Should you buy or fade the reopening trade? For long-term investors, the question is whether China represents an investment opportunity in light of its structural challenges and risks.

Let’s begin with the tactical question by evaluating the reopening trade. From a technical perspective, the rally in MSCI China has indeed been impressive. From a factor perspective, however, MSCI China has exhibited a strong and persistent negative correlation to the USD. While correlation isn’t causation, it does beg the question of how much the rally in Chinese equities is attributable to USD weakness.

From a fundamental perspective, the issue is the sustainability of the rally.

- When will a sustained recovery in services spending begin?

- How high will the recovery be compared to pre-pandemic levels?

- How long will it last?

- Will we see a second wave of infections after the Lunar New Year travel period that cripples economic activity? There have been horror stories about the latest COVID wave has overwhelmed the healthcare system (as examples, see reports from the BBC, New York Times, and The Economist).

There has been much excitement as certain industries surged as beneficiaries of the reopening trade, such as travel. A top-down analysis of the relative performance of major sectors leads to a more sobering conclusion.

Here are my main takeaways:

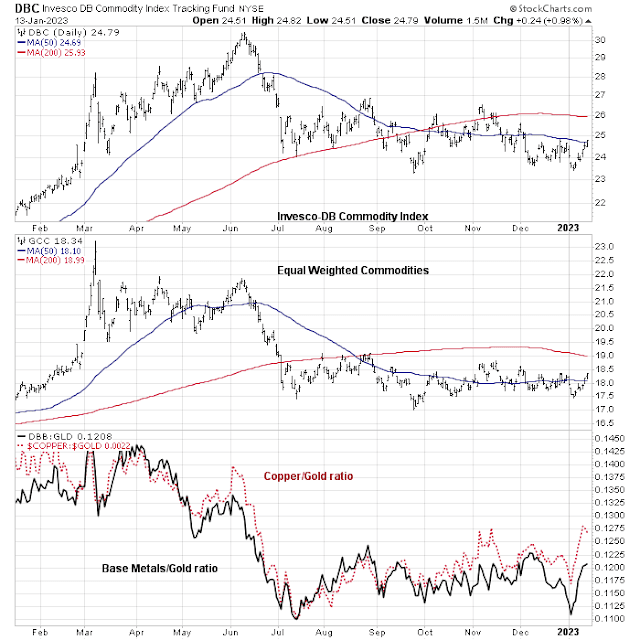

Materials: If China’s reopening is truly sustainable, material stocks should show up as the leadership as commodity demand would surge. Instead, these stocks have been underperforming since the October bottom. This is confirmed by the sideways performance of major commodity indices and the cyclically sensitive copper/gold and base metals/gold ratios.

Consumer: If the China reopening is a success, shouldn’t consumer stocks be going bonkers? There are doubt about the success of the reopening trade. CNBC reported that “China’s big consumer market isn’t rebounding to pre-pandemic levels just yet”, Instead, consumer stocks have only been market performers.

Real Estate and Financials: One of China’s long-term challenges is the resolution of its debt-induced property bubble. Beijing recently relaxed its “three red lines” criteria, which was designed to rein in rampant property speculation. To be sure, the rescue measures haven’t been interpreted as a bailout of troubled real estate developers, but as a way of culling the herd and supporting the stronger developers, and paving the way for greater industry consolidation. Real estate stocks have rebounded strongly off the October lows, but their relative performance is exhibiting a sideways pattern. The financial sector, which would bear the brunt of any collapse in real estate, has been a market performer. I interpret this as a sign of possible stabilization, but the long-term challenge of the real estate debt overhang hasn’t been resolved.

Internet: Where’s the leadership? The only constructive relative performance chart is the Chinese internet sector, which has been making a saucer-shaped relative bottom against the market. Even then, these consumer-related plays have not achieved a definitive relative breakout despite the news that the regulatory squeeze on tech companies is ending.

At a regional level, the relative rebound in China and Hong Kong has begun to fade and the relative performance of other Asian equity markets is still exhibiting sideways relative performance patterns.

In short, relative performance analysis is signaling a very fragile China reopening and its sustainability is questionable. A recent Project Syndicate essay went as far as characterizing China as the “sick man of Asia”:

While China’s exit from its zero-COVID policy was never going to be easy, it was widely viewed as necessary to reinvigorate the beleaguered economy. But the speed with which the government has abandoned three years of tight restrictions has left the country’s health-care system – and its economy – reeling.

According to former German Foreign Minister and Vice Chancellor Joschka Fischer, the zero-COVID policy was always “fatally flawed,” as it “required a suspension of the social contract between the [Communist Party of China] and the people.” Chinese President Xi Jinping “wanted to use the pandemic to demonstrate the superiority of the Chinese system over the declining West,” but, with GDP growth slowing sharply, ended up demonstrating the system’s fragility.

China’s situation may get worse before it gets better. As Northwestern University’s Nancy Qian notes, “key features of China’s social and economic structure make it especially difficult for ordinary households to grapple with the virus.” So, while “there is little doubt that returning to normalcy is the right direction for China, the days and weeks ahead are going to be exceedingly difficult and full of sorrows.”

Moreover, as Columbia University’s Shang-Jin Wei observes, there is no guarantee that China’s economy will “bounce back” after the zero-COVID exit. “China must contend with several challenges, including declining confidence among firms and households about their future incomes in the short run, insufficient productivity growth in the medium run, and an unfavorable demographic transition in the long run.”

Yale’s Stephen S. Roach highlights a major barrier to confronting these challenges: Xi’s “increased emphasis on security, power, and control undermines productivity at a time when China needs it the most.” As a result, what was until recently “the world’s greatest growth story” is now in jeopardy.

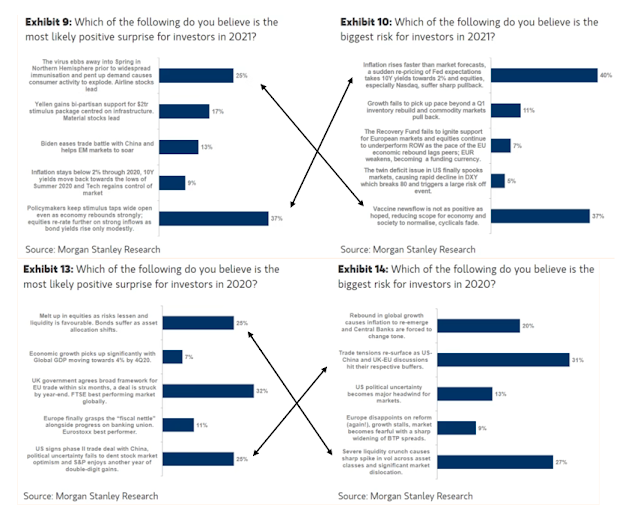

An FT Alphaville post showed that expectations may be too high for the China reopening trade. Morgan Stanley conducts an annual survey of the top risks and opportunities for the coming year at its Global Insights conference. In most years, the major opportunities cited by respondents are balanced by the same factor as a major risk. Here are some examples from 2020 and 2021.

This year is different. While the second highest opportunity focusing on inflation is balanced by the top risk cited by respondents, the risks of the top opportunity, which is the China reopening trade, is nowhere to be seen. Institutional investors appear to have thrown caution to the wind and gone all-in on the China reopening narrative, which is potentially contrarian bearish.

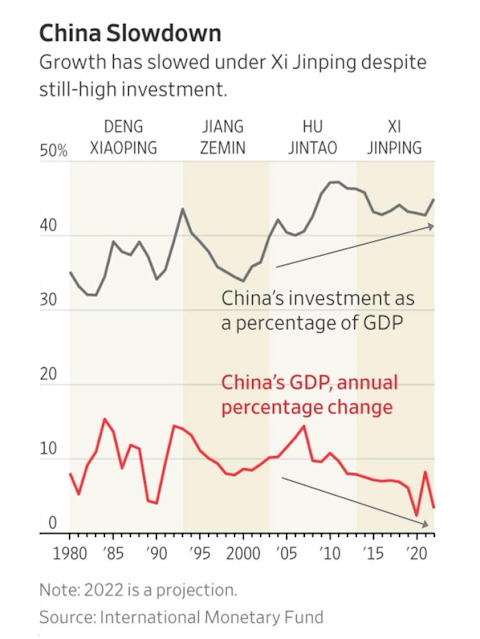

Long-term challenges

Longer term, China faces several challenges. The main economic problem is the sustainability of its growth model. China has been growing through debt-fueled infrastructure investment. Since 2000, even though investment as a percentage of GDP has been strong, GDP growth has been decelerating. Beijing recognizes this problem and it has been trying to pivot away from investment to household spending as a source of growth.

My analysis of sector relative performance shows that the real estate sector, which is the primary beneficiary of infrastructure-fueled growth, has stabilized. This is a positive first step as it reduces the tail-risk of a disorderly unwind of property-related debt. However, the market performance of consumer stocks, which should be strong beneficiaries of the reopening trade, has been stagnant. Moreover, it is not signaling a sustainable shift from infrastructure to household spending-driven growth.

Another challenge is the decoupling question in light of the growth of bipartisan animosity against China in Washington. Long-time China watcher Patrick Chovanec recently provocatively asked, “Do we want China to fail? Is that our policy now?” He later amended and elaborated with:

Past US policy was to encourage constructive economic reform in China and to mitigate the prospect of economic instability there. Is US policy now to retard China’s development and aggravate economic instability there?

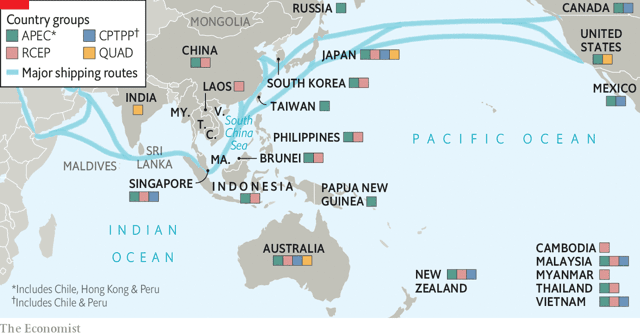

It certainly seems to be headed in that direction. The recent Biden Administration’s initiative to deny China access to advanced semiconductor technology is designed to cripple China’s development. The Economist published an article that argued that economic and military alliances are forming in the Indo-Pacific to counter Chinese aggression.

The world is divided into three major trade blocs of roughly equal sizes. A concerted effort to retard Chinese development would have seismic implications for the global growth outlook.

Lastly, no discussion of China would be complete without addressing the tail-risk of a war over Taiwan. Despite the frequent sorties by Chinese military aircraft toward Taiwanese airspace, the immediate risk of a conflict is relatively low. Longer term, however, the risk is growing. The Center for Strategic & International Studies (CSIS) recently conducted a series of wargames of the Chinese invasion of Taiwan.

CSIS developed a wargame for a Chinese amphibious invasion of Taiwan and ran it 24 times. In most scenarios, the United States/Taiwan/Japan defeated a conventional amphibious invasion by China and maintained an autonomous Taiwan. However, this defense came at high cost. The United States and its allies lost dozens of ships, hundreds of aircraft, and tens of thousands of servicemembers. Taiwan saw its economy devastated. Further, the high losses damaged the U.S. global position for many years. China also lost heavily, and failure to occupy Taiwan might destabilize Chinese Communist Party rule. Victory is therefore not enough. The United States needs to strengthen deterrence immediately.

The wargames were conducted under the assumption that Taiwanese military forces would initially oppose the Chinese landings vigorously, which could be questionable. CSIS also reported on Pentagon classified wargames, which had more dire results:

The DOD has done much internal wargaming on a U.S.-China conflict, but the results are classified, with only a few details leaking out. These details hint at heavy casualties and unfavorable outcomes….Michele Flournoy, former undersecretary of defense for policy, similarly stated, “The Pentagon’s own war games reportedly show that current force plans would leave the military unable to deter and defeat Chinese aggression in the future.” Another report noted that a “secret wargame” showed that the United States could prevail in the conflict with China, but at the risk of causing nuclear escalation.

Regarding another wargame, General John E. Hyten, then-vice chairman of the Joint Chiefs of Staff, said, “[The U.S. warfighting concept] failed miserably. An aggressive China team that had been studying the United States for the last 20 years just ran rings around us.” This happened, at least in part, because “the blue team lost access to its networks almost immediately.” Unclear was what sort of cyberattack caused this loss of capability or what the China team did to “run circles” around the U.S. team.

Investment conclusions

I began this publication with the rhetoric question, “How investable is China?” A short-term analysis of the leadership internals of the reopening trade shows little conviction that the reopening will succeed. Neither the cyclically sensitive materials sector nor the consumer sector is showing any signs of leadership. The only signs of possible leadership are the technology and internet stocks, which is inconsistent with the reopening investment theme.

Longer-term, it is a positive that recent easing initiatives have stabilized the real estate and finance sector. However, the challenges of the debt overhang from infrastructure led growth remains and a pivot to consumer-led spending growth is not evident. As well, China faces an economic development obstacle of global decoupling, and geopolitical risk of conflict in the South China Sea. This is a recipe for a slow growth environment with rising risks. Long-term investors in China are likely to face subpar returns coupled with high volatility.

“China faces an economic development obstacle of global decoupling”

Good article. Thanks. China is seen by the rest of the world with wary eyes, anti democratic and engaged in subversion of international law and order. She is also seen as an untrustworthy business partner, engaged in systematic theft of Intellectual Property. The world has seen similar movie before, IMHO, starting with Germany and Japan in 2nd WW, Russia currently and China and North Korea on the same trajectory. Along the way, the world also saw non-state actors like perpetrators and supporters of 9/11, who were also defeated. The world has now woken up to the Chinese threat and will act to marginalize China, protect their own Intellectual property, reduce dependance on Chinese supply chains and take proactive steps to increase military spending in South China Sea. You also made an excellent point about rapidly aging Chinese demographics (an article a few years ago) that will be a huge, non-productive burden on China. Japan is facing similar demographic issues, China may get there in short order.

As far as Chinese superiority, well, the evidence speaks for itself, when it comes to Chinese vaccines. Truth be told, China seems to be fairly advanced in Science and technology, but still wasn’t able to deliver on Chinese developed vaccines.

Cam, wondering your thoughts on the Deemer breadth thrust that was triggered over the past few days. Apparently a Whaley thrust was triggered as well. The Deemer thrust has had an excellent LT track record. All of my indicators are screaming sell right now but by definition they generally do during breadth thrusts as Deemer points out below.

“The stock market generated Breakaway Momentum today for the 25th time since 1945: walterdeemer.com/bam.htm. This is a genuine breadth thrust. It means (IMHO) we’re in a bull market. How long it lasts, and how far it carries, is something we will know only in the fullness of time.

Just as a reminder: It takes unusually-powerful breadth over a ten-day period to generate Breakaway Momentum. Which means, by definition, the market is always overbought from a short-term standpoint when Breakaway Momentum is generated.”

The last time this flashed was June 2020.

I’ll have more detailed analysis tomorrow.

I respectively beg to differ having nailed the low and championed the China investment since.

I say comparing China subindexes to the the World Index should be done on a “Leading-Edge Momentum” basis from the low point in November when Chinese government policy changed unexpectedly to VERY business friendly with regards to real estate, social media and Covid policies. The MSCI China chart shows the index going up to 64 from 35 or up 80%. The CHIQ Consumer Index did about 5% ‘relatively’ better (42 from 40). So in other words it went up the 80% of the China index plus a bit. I would not call that a sluggish consumer print that shows the reopening is stumbling.

So the quote, “relative performance analysis is signaling a very fragile China reopening and its sustainability is questionable. A recent Project Syndicate essay went as far as characterizing China as the “sick man of Asia”” to me is wrong, totally wrong and out of date by a couple of important months. YES, I agree that at the November low before all the reforms, China was a VERY sick puppy heading for the crapper to be avoided but after it in started a multi-year bull market. And by the way, it had one of my Tactical Factor TWISTs at the low.

Let’s look at Covid. Expert health agencies now believe 92% of Beijing residence have now had Covid and 100% will have had it by month end. 70% had it in December already. The new media portrays the pandemic in China as a very long wave of economic havoc. But it isn’t. A friend of mine got Covid recently and was relatively mildly ill for a week and has a bit of a manageable, lingering cough. That tells me that Beijing residents are quite able to quickly get back to work and go out to buy consumer products. Look at World Cup soccer and NFL stadiums full of unmasked folks that have left Covid behind. I don’t want to minimize the tragedy of loved ones dying. I’m just looking at China’s business and stock market outlooks.

In measuring the fact from the charts that Chinese Indexes are just back to June levels, I say that means there is still huge upside. In June, the outlook was terrible with failed policies heading for an economic brick wall. Now, since November we have started dramatic, business friendly policies heading for a great future. I like the fact that we are still at June stock prices. The US by contrast is heading for a recession of some unknown depth with a possible brick wall ahead with the GOP debt ceiling debate. As of today, the Chinese index and the S&P 500 have had the same performance since the beginning of 2022. Of course, China dipped far lower. But truly, which has the more favorable outlook for 2023?

Chinese and Asian junk bonds keep going up sharply which is the best indicator of corporate improving health.

Looking at GDP growth and saying China is in a lower range does not say anything about their future stock market performance. The US went decades of 3-5% growth and their stock market went on decades of robust stock prices. China had 10% economic growth and went nowhere. Forget that statistics as a stock market forecaster.

As far as war risk, Xi and Biden are getting downright very cozy and Xi is smoothing relations with others. The new Chinese economic initiative need global trade. Other countries need cheap Chinese goods to send inflation lower. Win-win for better relations.

Yes, the world is splitting into three pieces for investment. They may proceed at a different pace or even in a different direction. I want to analyze them separately and as objectively as I can given my ‘home biases’.

Media coverage and US government propaganda will continually paint China in a bad light since there is an America-first global competition mindset happening. I’m just trying to make money for my clients through that media fog.

My conclusion continues to be China first, Europe second (EAFE too) and America third (growth bubble needing another year to unwind). Canada is way back given its real estate crashing likely causing near-future economic problems.

I agree with Cam’s great analysis 90% of the time. This is the other 10%.

Great analysis and timing, as always, Ken. Could you remind us again how a twist is calculated and in this case: was it MSCI China vs MSCI ACWI? Thanks in advance!

Regarding TWISTs: I run two momentum indexes on a given index such as MSCI China or S&P 500. one is high momentum and the other low.

I calculate the daily average movement between the two momentum indexes. For illustration let’s say China has an average of 0.5%. On TWIST day, the spread goes statistically much higher. The low momentum index with all the dogs shoots up while the high momentum is more stable. The spread might be 4% with low momentum up 5% in that day and high momentum only up 1%. That is significant and marks an ending of a downtrend if the low isn’t violated.

On November 9, 2020, Vaccine Day announcement the low momentum went up 11% and high momentum went DOWN 1% all on the same day. High momentum was filled with stay at home big winners while low momentum had the Value stocks that took over leadership in the following bull market.

Hope that answers the question

Ken, are these high momentum indices something you make yourself or something found online?

Same thing with factors, can we find them online?

As far as Europe goes, I have to admit the news is pretty bad, only can it get worse?

My impression is we have a global sovereign debt crisis developing, and how that resolves other than inflation I don’t know. Global austerity for 20 years? Not gonna happen.

I construct them. The factors can be found as ETFs. RPG = Growth VLUE = Value SPLV = Low Vol IWM = Small cap.

There are different ETFs in each category that are useable.

thanks a lot, now I remember what relative movements were part of the twists!

Thx Ken

I agree with Ken on Europe.

The recovery in the China junk bond is mainly attributable to government easing measures on the property sector. Interpret that in any way you like.

The relative return analysis of Chinese sectors against MSCI China is not telling the story of a cyclical recovery, other than maybe KWEB, which is not very confidence inspiring.

While Ken and I disagree I believe his risk control techniques shouldn’t get him into too much trouble. If he is wrong his methodology should stop him out before everything unravels.

True, if Leading Edge Momentum turns sour on China, I am out.

I think the disagreement could be a matter of time frame.

Many younger Chinese just got their inheritances early, that’s bound to stimulate some demands short to mid term (after funeral costs). Longer term it is unclear to me as an investor in the west due to geopolitics.

I would trade China, but not have the bulk of my investments there. It is less free than the western world.

How are the Russians who have their assets frozen doing? I think that it’s possible for western assets to be treated similarly, or is it only us who do these things.

Jack Ma said something a while back, how is he doing these days?

China provides cheap labor, and in return has a huge trade surplus which it invests, but without that surplus how will it fare? It is predicated on continuing cheap labor…with decoupling and robotics, will that last forever? The debt and real estate situation is something that bothers me, how can it end well.

I don’t know what makes an innovator innovate, it is a combination of intelligence, creativity, opportunity, stubbornness to keep trying this whatever it is that they are creating…we can’t make them, teach them, they are born. This is the problem with centrally run economies I think because the innovators get stifled (I could be wrong on that).

If Chinese nationals are trying to get money out of China, why should I put mine there?

The Chinese people are hard working, wish for a better life, intelligent, but this Orwellian society is not one I trust.

Maybe I’m too paranoid.

One thing that gets me is the narrative and confirmation bias.

You read about buying high because it can go higher in the sense of quality is not cheap. Or buying bargains on the way to zero is a bad idea. Losers buy losers is the mantra.

But then there is the opposite narrative, the dogs of the dow, buying hated industries, and picking up bargains because the baby got tossed out with the bathwater.

So, in the end the outcome justifies the means.

I simply cannot accept that.

Find a method based on momentum or fundamentals, but be objective. The narratives are misleading.

I for example cannot wrap my head around the cost of financing the federal deficit if rates stay high, but maybe they will just print more and markets will just go higher. Perhaps equities will be treated like hard assets (the value ones anyways) because this fiat failure is inevitable (or is it?).

What did we learn from the reaction to the lockdowns? The government spewed out huge stimulus, not out of compassion but in my opinion to prevent huge unrest.

So what will happen next time?

Does anyone know an easy way out of debt?

In the short run, printing is less painful, especially for those who wish to stay in power. In the long run, if things really are broken then terrible times lie ahead whether one chooses austerity now, or printing. My bias is that printing is almost inevitable.

Where will that money go?

So maybe the market is front running the Fed. The timing of the pivot not so important as the belief it will eventually show up big time . Ask congress if they have a choice between being tossed out of office or having inflation. Which will they pick?

China had a major policy reversal from zero COVID to totally open society. It was something the people in China wanted as well. So, there will be challenges in the near term as the country goes through this transition. Arguably, the economy will be better off with the new policy. The party leadership will support the transition in variety of ways, not yet known.

The consumption and travel sectors are going to benefit initially.

One does not have to invest in China per se. I am trading from the long side in consumer.

Other areas that are of interest to me are Vietnam, India, Indonesia, Thailand. Mexico as well.

I am more in agreement with Ken on China.