Mid-week market update: The Zweig Breadth Thrust buy signal is a rare price momentum signal that’s been triggered only six times since Marty Zweig wrote the book that outlined his signal. The stock market has risen every time 12 months after the buy signals. It requires the Zweig Breath Thrust Indicator (ZBT) to rise from an oversold to an overbought condition within 10 trading days, which is indeed an rare occurrence.

While the ZBT buy signal is extremely rare, the ZBT Indicator can serve as a useful short-term trading indicator when it is oversold. In the past, this has served to indicate favorable risk-reward long entry points, which seems to be the situation today.

Tactical bottom signals

In addition, two of the four components of my Bottom Spotting Model have flashed buy signals. The VIX Index has spiked above its upper Bollinger Band, and the NYSE McClellan Oscillator is oversold. In the past, two or more simultaneous buy signals have also been decent long entry points.

Reasons to be cautious

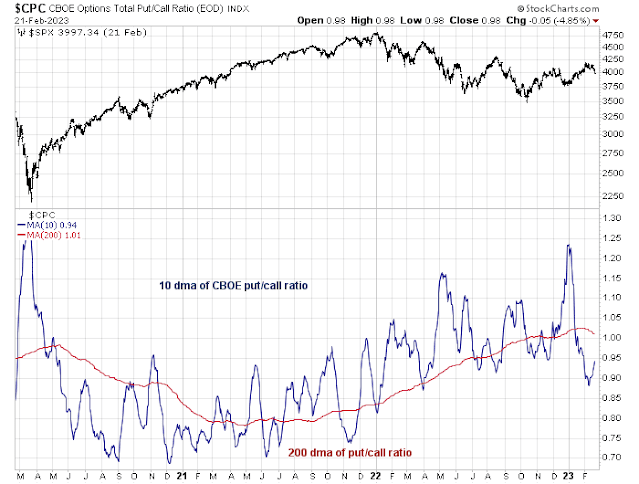

Even though the equity market may be due for a bounce, I have some doubts as to whether the current circumstances represent a durable bottom. Option sentiment, as represented by the 10 dma of the put/call ratio, isn’t fearful yet.

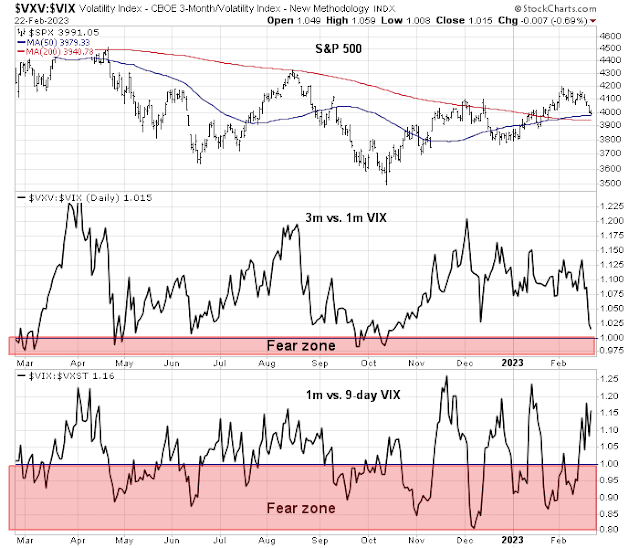

As well, while the term structure of the VIX is exhibiting some signs of rising anxiety, it isn’t showing signs of panic either.

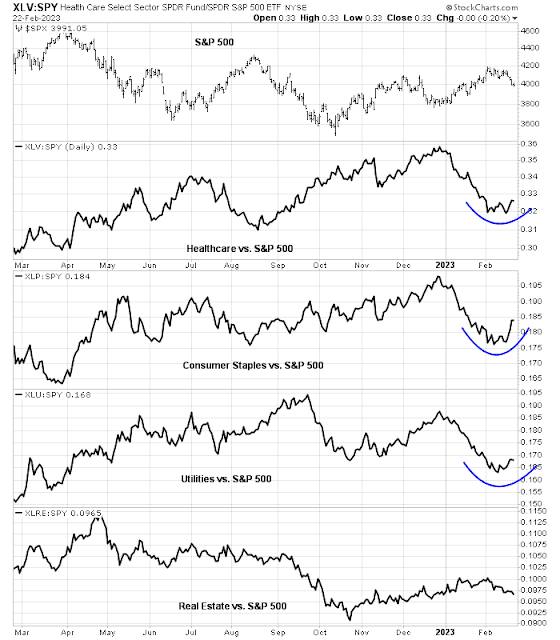

The relative performance of defensive sectors are starting to bottom and they are trying to turn up, which is an ominous sign for the bulls. Investors need to keep an eye on how these sectors perform in the coming days.

What to watch

Here is what I am watching. The S&P 500 is short-term oversold on a number of key indicators. The 5-day RSI is oversold, the percentage of S&P 500 above their 20 dma is near or at oversold territory, the index is at the bottom of its Bollinger Band and it’s testing its 50 dma.

In all likelihood, we are going to see only a 2-4 day bounce, but watch for the re-test after the relief rally. In the past, durable bottoms have been signaled by positive divergences shown by the 5-day RSI and the percentage of stocks above their 20 dma.

Subscribers received an alert that my trading account had tactically entered a long position in the S&P 500. The usual disclaimers apply to my trading positions.

I would like to add a note about the disclosure of my trading account after discussions with some readers. I disclose the direction of my trading exposure to indicate any potential conflicts. I use leveraged ETFs because the account is a tax-deferred account that does not allow margin trading and my degree of exposure is a relatively small percentage of the account. It emphatically does not represent an endorsement that you should follow my use of these products to trade their own account. Leverage ETFs have a known decay problem that don’t make the suitable for anything other than short-term trading. You have to determine and be responsible for your own risk tolerance and pain thresholds. Your own mileage will and should vary.

Disclosure: Long SPXL

Cam, there is reference to watch for the re-test. Re-test of what level?

Thanks