The main event last week for US investors was the FOMC decision. As expected, the Fed raised rates by a quarter-point and underlined that “ongoing increases in the target range will be appropriate”. Powell went on to clarify that “ongoing increases” translated to a “couple” of rate hikes, which would put the terminal rate at 5.00% to 5.25%, a level that was just above market expectations. He went on to signal that the Fed does not expect to cut rates this year. Moreover, he stressed, “We will stay the course until the job is done”.

Those statements appeared hawkish, until he allowed, “We can now say for the first time that the disinflationary process has started”. In addition, he characterized financial conditions as tight when it was obvious that markets had been taking on a risk-on tone since October.

As a consequence, the Fed’s hawkish warnings fell on deaf ears. Asset prices went into a risk-on mode in response to Powell’s statements during the press conference. The market consensus terminal rate stayed at just below 5% and expectations of rate cuts at the end of 2023 changed from one to two. It took a strong surprise from the January Jobs Report to push the terminal rate above 5%, though easing expectations was pushed forward into mid-year.

To be sure, inflationary pressures are softening in a constructive way, but the risk of transitory disinflation is rising.

Inflation is decelerating

Powell was correct in observing that the “disinflationary process has started”. Inflation rates, however they’re measured, have been decelerating since mid-2022.

Goods inflation has been falling as supply chain bottlenecks normalized. This effect is can be seen in the slump in manufacturing indicators such as PMI and ISM, though the service side of the economy has been much more robust. Powell made several references to the “services ex-shelter” components, which are mainly linked to the labor market and wages, of inflation that are worrisome. Even then, compensation pressure, as measured by the Employment Cost Index and Average Hourly Earnings for nonsupervisory workers (which largely excludes bonuses), has been trending down.

On the other hand, leading indicators of employment such as temporary jobs and the quits/layoffs rate have also been noisy. They had been falling until the positive shock seen in the January Jobs Report, which saw a rebound in temporary employment.

In addition,

Variant Perception pointed out that consumer expectations of inflation are falling fast.

A dove in hawk’s clothing?

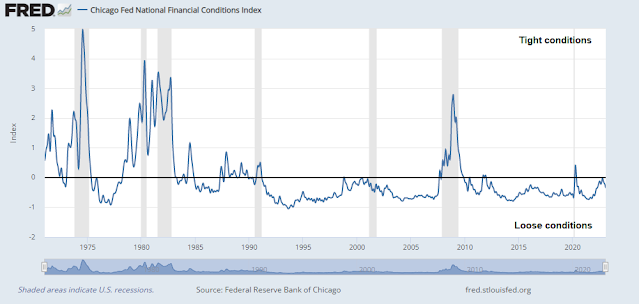

There was some surprise and confusion when Powell characterized financial conditions as tightening very significantly in the last 12 months. It was an opportunity for the Fed Chair to push back against the risk-on rally that began in October, but he declined.

Powell’s comments are consistent with a recent

Lael Brainard speech given on January 19, 2023. The Fed appears to interpret financial conditions indices differently when real rates are rising significantly. This was an important signal that the Fed is prepared to allow the stock and credit markets to rip.

Financial conditions have tightened considerably over the last year as the Federal Reserve and foreign central banks have tightened policy. Real yields have risen significantly across the curve over the past year: 2-year yields on Treasury Inflation-Protected Securities (TIPS) have risen more than 4-1/2 percentage points to 2.1 percent, and 10-year TIPS yields have risen more than 2-1/4 percentage points to 1.2 percent. Short-term real interest rates have moved into decidedly positive territory. Mortgage rates have doubled.

From a technical internals perspective, market leadership had been signaling a cyclical rebound since the rally off the October lows. Cyclical industries, with the exception of oil and gas, have been outperforming. Even transportation, which had been the laggards, joined the party.

The China reopening boost

The cyclical rebound theme is also evident in the China reopening narrative.

Chris Williamson, Chief Economist at S&P Global Markit Intelligence, observed that “Global factory downturn shows signs of easing as China re-opens”.

Indeed, China’s Manufacturing and Non-Manufacturing PMIs have rebounded.

Hopes of a China reopening rebound can be seen in the relative performance of the Chinese materials sector.

A review of the relative performance of the stock markets of China and her major Asian trading partners shows that while the China and Hong Kong markets have pulled back after an initial surge, the performance of semiconductor-sensitive Korean and Taiwan markets are in relative uptrends, and the mining sensitive Australian market has staged a relative breakout and pullback.

In short, the combination of excitement over China’s reopening and the dovish pivot by the Fed is sparking a risk-on rally in risky assets. My Trend Asset Allocation Model turned bullish last week. The performance of my model portfolio based on the real-time signals of this model that varies asset allocation by 20% over/under a 60% S&P 500 and 40% 7-10 Year Treasuries has been excellent (see

link for full discussion of methodology). The model portfolio is ahead of the benchmark for all 1, 3, 5 year time horizons and since inception in December 2013. In addition, it is exhibiting equity-like returns with 60/40 balanced fund like risk.

Key risks: Heads I win, tails you lose

There are two key risks to the China reopening narrative: Its failure and its success.

What if the China reopening trade fizzles? While the hopes for a cyclical rebound is evident in equity market action, there is little confirmation from the commodity markets. Commodity prices, regardless of how they’re measured, have been moving sideways and are not showing the same risk-on pattern seen in equity markets. Similarly, the cyclically sensitive copper/gold and base metals/gold ratios are also range-bound and are not exhibiting signs of surges in demand.

What if the reopening scenario succeeds?

Bloomberg Economics modeled the effects of a successful China reopening and forecasts that China’s GDP will accelerate from 3% to 5.8% in 2023. It could also elevate global CPI to the 5% level in Q2, which would complicate the Fed’s plans to pause rate hikes.

Instead of cutting rates, the Fed would interpret this as transitory disinflation and respond by raising rates. Such an inflationary resurgence would be an unwelcome surprise for risky assets. The closest analogy is the double-dip recession of 1980-82. The Fed had tightened in early 1980 and the yield curve had become deeply inverted. The inversion reversed itself in mid-1980, but the Fed began to tighten again in July and sent the economy into a second recession. During that period, the stock market rallied for eight months in 1980, topped, and went into a prolonged bear market for almost two years.

The moral of this story is, be careful what you wish for. The disinflation you see today may be transitory and you will pay for it later in the year. Powell has made it clear that he wants to avoid the Volcker era when the Fed was forced to raise rates to very painful levels to control inflation and inflation expectations. He would prefer to err on the side of overtightening and remedy with rate cuts in the case of a slowdown rather than undertighten and allow inflation to run out of control.

Powell, whose previous career was in finance, summarized the difference between the jobs of Fed officials and market participants during the

post-FOMC press conference.

It’s our job to restore price stability and achieve 2% inflation. Market participants have a very different job… It’s a great job. In fact, I did that job for years, in one form or another. But we have to deliver.

It’s a message that all market participants should keep in mind.

The Chinese economy is very likely to be moribund going forward. The activities have shifted to India/Southeast Asia and some back to the US/Mexico.

If historical numbers hold that Oct ’22 is the market bottom, the economic downturn in US would bottom at about Apr. Although the Jan ’23 job report is a big beat, the compensation increase is actually lower that that of Dec ’22. So a good combination of more people working but wage pressure receding.

Global CB liquidity has reverted to around neutral, form big negative of last year, mainly due to BOJ and PBOC.

Technically the important marginal players of L/S hedgies are at vey low positions. If the markets continue to go up, it will force these hedgies into reluctant players and pushing markets much higher. We have seen the ARKK types of holdings bursting upward these days.

A bit confused how to reconcile the “Bullish” (upgrade) in the Ultimate market timing (long term) with the assessment that Fed is going keep rates higher and for longer regardless what markets (not) priced in at the moment.

If I interpret correctly, how does the long term ultimate market timing can turn bullish together with the medium trending following?