Mid-week market update: The stock market reacted with a risk-on tone to the FOMC decision. The S&P 500 has staged an upside breakout through the 4100 level. While I am cautiously intermediate-term bullish, be warned that the initial reaction to FOMC decisions are often reversed the following day.

Keep in mind that this is a weekly chart. The week isn’t over.

Be prepared for consolidation

Investors are faced with a data-rich week this week, each of which is a potential source of volatility. In the US, we have seen softer than expected consumer confidence, a deceleration, and missed expectations in the Employment Cost Index, constructive conditions from the JOLTS report, inasmuch as the quit/layoffs rate is falling and the ratio has led NFP employment. The main event was the FOMC decision.

In addition, META reported earnings after the close today, with AAPL, AMZN, and GOOGL tomorrow. As well, there is the January Employment Report print Friday morning. In Europe, we have seen a mixed picture in the eurozone inflation reports, with CPI softer than expected by core HICP coming hot. Investors will also see the ECB and BoE rate decisions tomorrow.

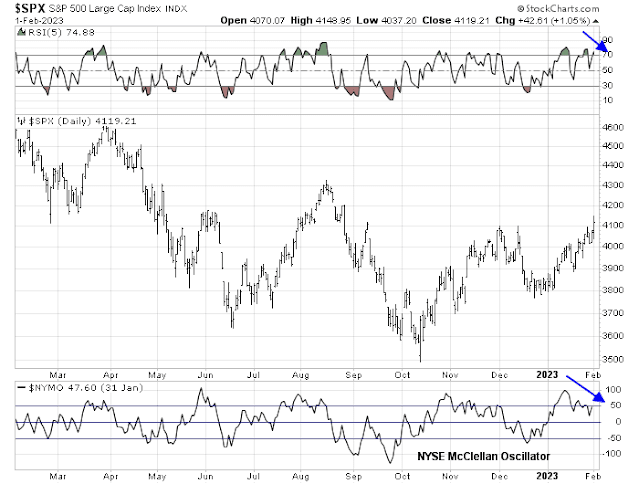

While the data has mainly been risk positive so far, keep in mind that they can’t be relied upon to stay that way and the market is overbought while exhibiting negative divergences.

In other words, be prepared for a period of consolidation after the upside breakout through the falling trend line.

Fedspeak risk

During the post-FOMC press conference, Fed Chair Powell acknowledged that most inflation and labor market indicators are softening, which is constructive development. But he also tried very hard to push back against the notion that the Fed is going to pivot to a less hawkish path in the near future. In particular, the statement about ongoing increases (plural) is a hint that the Fed intends to raise the Fed Funds rate to above 5%, which is higher than current market expectations.

The Committee anticipates that ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time.

If the Fed is dissatisfied with the exuberance of the market reaction, watch for Fed speakers in the coming days to reinforce the notion of a higher-than-expected terminal rate and a low probability of rate cuts later this year.

To be sure, today’s upside breakouts were confirmed by other indices, which is a positive sign. However, the advance may be extended. While I am not inclined to be short, I would also caution against chasing the rally. Wait for a pullback before buying.