It was the best of times. It was the worst of times. The S&P 500 (SPX) remains in a well-defined uptrend, but the NASDAQ 100 (NDX), which represents large-cap growth, violated an uptrend that stretches back to the GFC. The relative performance of the NASDAQ 100 to the S&P 500 shows a similar trend break that’s somewhat reminiscent of the Tech Bubble top of 2000. Moreover, the recent relative performance of speculative growth stocks, as measured by ARK Investment ETF (ARKK), is similar to the post-2000 Bubble bust.

Growth poised for a recovery?

Is this the bottom for growth stocks? The dark line in the lower panel depicts the relative performance of the NDX to the SPX, normalized to the price action in the last 12 months. The shaded regions show periods when the NDX has been oversold relative to SPX and reached an area of relative support. With the exception of the 2000-2002, relative oversold periods at relative support have been good times to buy NDX for superior relative performance.

NDX is now recycling off oversold. Does this mean that the worst is over for growth stocks?

This time is different

History doesn’t repeat itself but rhymes. Not all growth stock bubbles are the same. At the 2000 top, the NASDAQ 100 was full of companies with unprofitable companies with insane valuations. Fast forward to 2023, large-cap growth stocks are mostly profitable, cash generative, and have strong competitive positions. By contrast, the performance of speculative growth stocks as proxied by ARK Investment ETF (ARKK) far more resembles the behavior of growth stocks in the post-bubble bust of 2000-2002.

To be sure, large-cap growth is richly valued and have come to represent about 40% of S&P 500 weight. Consider, for example, that the S&P 500 trades at a forward P/E premium of 3-4 points compared to the mid-cap S&P 400 and small-cap S&P 600. Moreover, the history of forward P/E by market cap shows that the large-cap premium wasn’t evident until 2020, the onset of the pandemic.

A question of leadership

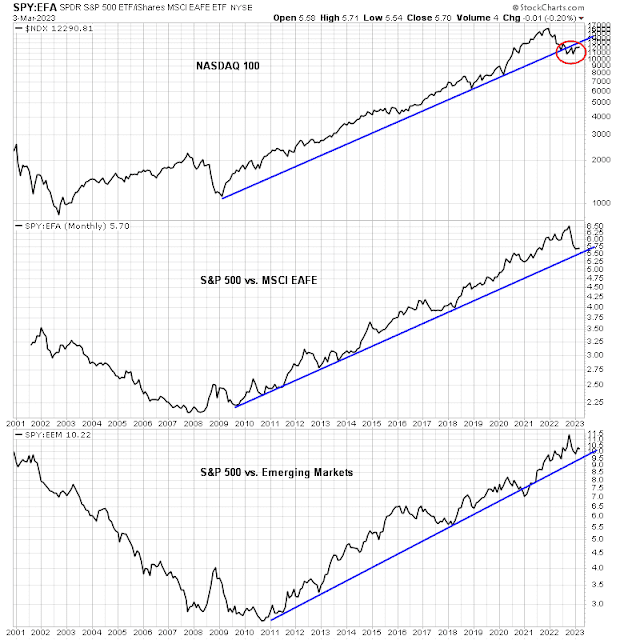

The dominance of FANG+ large-cap growth in the S&P 500 begs another question. US equities have been leading non-US since the GFC. Much of the outperformance is attributable to the superior fundamentals and earnings growth from FANG+ names. Now that the NASDAQ 100 has violated its uptrend, can US equities continue to lead?

US equities also trade at a considerable premium forward P/E to the rest of the world. Unlike the P/E history of US forward P/E by market cap, the US valuation premium had been relatively modest until about 2016, when it began to widen against the rest of the world.

The question of future market leadership can be distilled as, “Are the FANG+ stocks gone ex-growth in their earnings outlook?”

On one hand, the recent scramble over natural language AI is a sign that competitive barriers are crumbling, as evidenced by investor concerns over the AI threat to Google in search. Facebook’s uneven pivot to the Megaverse is another example that the growth trajectory for social media may be decelerating. Netflix’s initiatives to limit password sharing is another sign that the company is reaching the limits of subscriber growth. By contrast, Apple’s research initiatives for non-invasive blood glucose monitoring opens up an enormous medical device opportunity for the Apple Watch.

In all likelihood, faltering large-cap growth is putting US global equity leadership on borrowed time. Investors should keep an eye on the evolution of relative performance. Should the S&P 500 violated any relative uptrend compared to either EAFE or EM, it will be a definitive signal to decisively rotate into non-US equities for better performance in the next cycle.

Publication note: I am scheduled for a cataract operation on my eye Monday. There will be no mid-week market update as I expect to be out for the week. I will try to publish at least an abbreviated note next weekend, but that will be dependent on the progress of my recovery.

Cam: All the best for a speedy recovery from your eye surgery.

Yes, best wishes

Cam,

Good luck with the surgery on Monday. Get well soon.