Preface: Explaining our market timing models

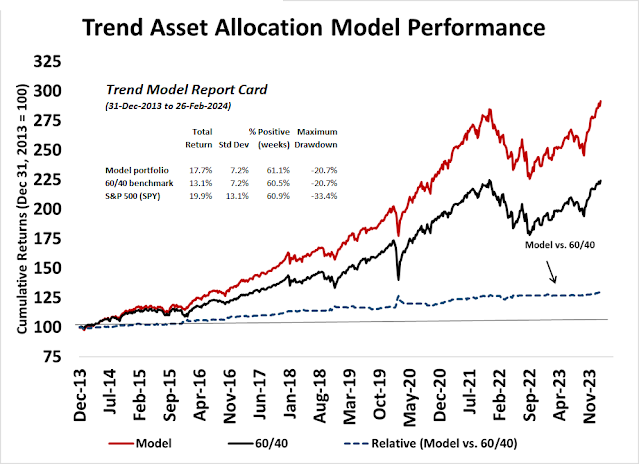

My inner trader uses a trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don’t buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts is updated weekly here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)

- Trend Model signal: Bullish (Last changed from “neutral” on 28-Jul-2023)

- Trading model: Bearish (Last changed from “neutral” on 15-Mar-2024)

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

Is the decline over?

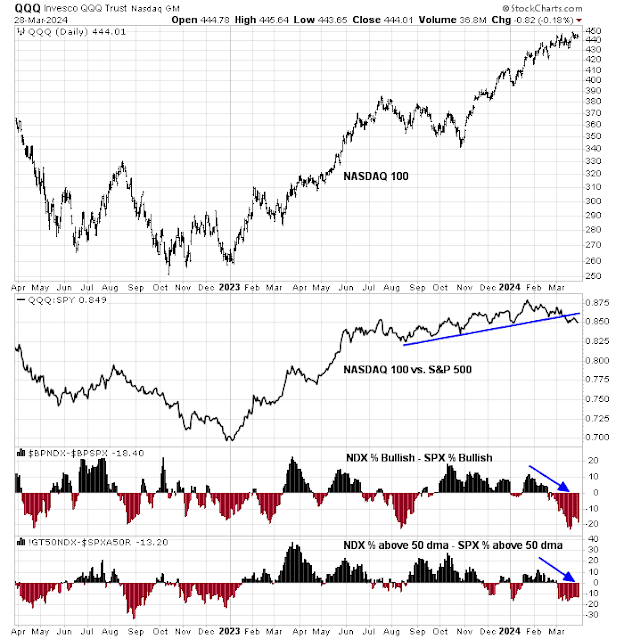

The bulls have lost control

Make no mistake about it, the bulls have lost control of the tape and a decline has begun. Breadth, as measured by NYSE and NASDAQ 52-week highs-lows, has turned negative. In the past, such declines haven’t ended until a crescendo of negative breadth was seen.

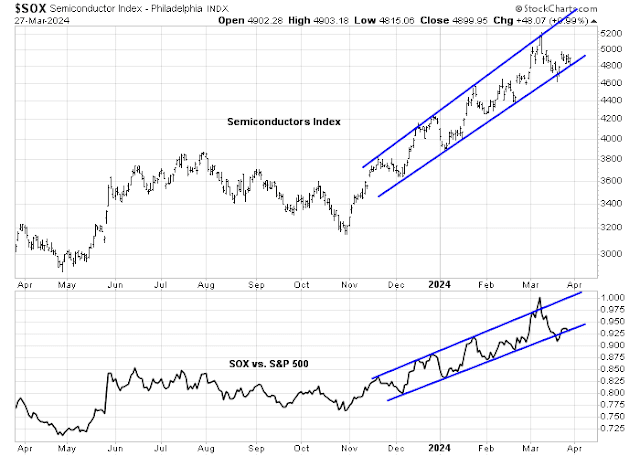

Another sign of a trend break can be found in the technical condition of semiconductor stocks, which are bellwethers of AI-related investment theme. The Semiconductor Index has violated the rising trend lines on both an absolute and relative basis.

While the semiconductors may represent growth stocks, which have been weakening, an equally worrisome development is relative weakness in some deep value stocks. Regional banks, which have been beset by commercial real estate problems, violated a relative support level last week. Weakness in both extreme growth and value names is a warning of further downside in the overall market.

Fearful enough?

While anything can happen, sentiment models may not be panicked to call for an intermediate-term bottom.

The AAII sentiment readings were taken earlier in the week before fears of an Iran-Israeli war rattled the markets. The Fear & Greed Index, which is updated in real-time, is only in the neutral zone after retreating from an excessively bullish condition.

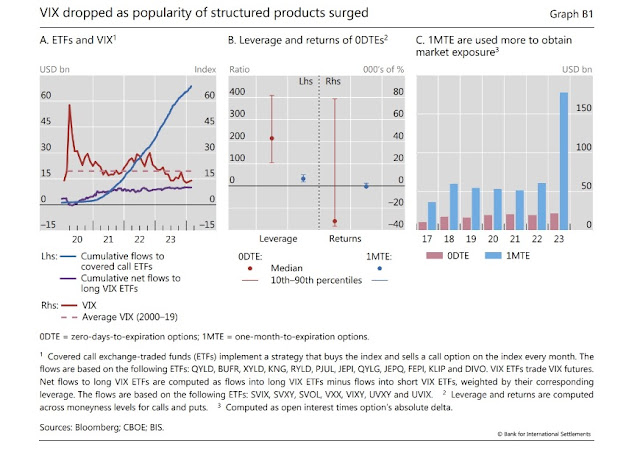

The Topdown Charts analysis of leveraged ETF trading as a sign of sentiment tells a similar story of a retreat from excessive bullishness, but readings are not bearish enough to be contrarian bullish.

Nearing a bottom

That said, technical indicators are nearing extreme oversold conditions consistent with a tactical bottom. The Zweig Breadth Thrust Indicator reached an oversold level, which tends to be signals short-term bottoms, though the signals can be slightly early. There were 17 such signals in the last three years, and the market continued to decline for a few days after the initial signal in seven instances.

Three of the five components of my Bottom Spotting Model flashed buy signals on Friday. Historically, two or more simultaneous buy signals have been good indicators of short-term bottoms. Similar to the ZBT Indicator, this model has a tendency to be slightly early and I would look for the actual bottom early in the coming week. The three buy signals are:

- The VIX spiking above its upper Bollinger Band, indicating an oversold condition;

- The NYSE McClellan Oscillator falling below -50, another oversold condition; and

- TRIN spiking above 2, which is a sign of price-insensitive selling, which is indicative of risk manager induced selling.

Fade the inflation scare

Last week’s market weakness was first sparked by a stronger-than-expected CPI report which resolved in upside cup and handle breakouts in Treasury yields across the entire yield curve. As well, market expectations of the first Fed rate cut were pushed out from June to September. Higher yields will undoubtedly create some headwinds for stock prices.

I am inclined to fade the inflation fears. Barring an all-out Middle East War that spikes oil prices for a prolonged period of time, the economy is not about to experience a 1970s-style runaway inflation. The one-year change in oil prices is barely positive at 3.5%.

The Atlanta Fed’s Wage Growth Tracker shows that wage growth has decelerated to 4.7%. While that figure is well above the Fed’s 2% inflation target, the trajectory of labour market compensation does not point to a 1970s-style wage growth spiral.

Much of the elevated inflation readings in CPI can be attributed to shelter and owners’ equivalent rent (OER). CPI would be below the Fed’s 2% target if we were to substitute real-time estimate of rent for OER.

As earnings estimates are still rising, the economic environment is steady growth with uneven disinflationary progress toward the Fed’s 2% target. This should be bullish for stock prices, though bond prices would depend on how inflation evolves in the coming months.

Lastly, the IMF recently published a note warning about slowing global productivity. The U.S. appears to be one of the few exceptions, experiencing above-trend productivity growth. What’s not to like?

In conclusion, my analysis of market internals concludes that the decline is nearly done. Sentiment is not sufficiently panicked to be contrarian bullish. Technical conditions are oversold but can become more oversold. I interpret these conditions as a stock market that’s undergoing final flush before an intermediate-term bottom is formed. I believe any pullback should be temporary and shallow in nature. The macro backdrop is long-term equity bullish.

I would like to add a note about the disclosure of my trading account after discussions with some readers. I disclose the direction of my trading exposure to indicate any potential conflicts. I use leveraged ETFs because the account is a tax-deferred account that does not allow margin trading and my degree of exposure is a relatively small percentage of the account. It emphatically does not represent an endorsement that you should follow my use of these products to trade their own account. Leverage ETFs have a known decay problem that don’t make the suitable for anything other than short-term trading. You have to determine and be responsible for your own risk tolerance and pain thresholds. Your own mileage will and should vary.